Bookkeeping for Busy Bees: Simple Strategies to Stay on Top of Your Finances

Keeping up with bookkeeping can feel overwhelming to entrepreneurs and business owners who are often on the go. Simple accounting bookkeeping procedures can help you keep correct financial records, make sure that invoices and payments are made on time, and keep an eye on your cash flow without taking up too much of your time. We’ll go over useful advice including using accounting software to automate repetitive activities, scheduling regular time for financial inspections, and methodically keeping track of revenues and expenses. These time-saving techniques also assist in preventing costly mistakes and helping make wise financial decisions.

Effective money management becomes difficult in the middle of this chaos. Nonetheless, preserving financial stability and guaranteeing business expansion depends on you keeping up with your accounting bookkeeping..

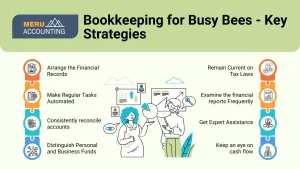

Arrange the Financial Records.

Effective accounting bookkeeping starts with maintaining the organization of your financial information. Financial administration can be complicated and mistakes can be made in disorganized records.

- Establish a methodical filing system for bank statements, invoices, and receipts.

- Scan papers with digital tools and store them digitally.

- To prevent backlogs, update and examine your records on a regular basis.

Benefits:

You’ll save time, feel less stressed, and have all the information you need at your fingertips with an ordered system.

Make Regular Tasks Automated

By decreasing errors and requiring less manual labor, automation makes bookkeeping easier. Bookkeeping services guarantee that regular chores are carried out effectively and reliably.

- Payroll, spending monitoring, and invoicing can all be automated with accounting software.

- To sync transactions with your bookkeeping software, set up automatic bank feeds.

- Make use of the remainder functions, or payment due dates and financial deadlines.

Benefits:

Automation frees up your time, allowing you to focus on more strategic aspects of your business.

Consistently reconcile accounts

Making sure your bank statements and financial records match is ensured by regular reconciliation. It ensures the precision of your bookkeeping and helps identify irregularities.

- Plan reconciliations for each month to ensure that your records and bank statements match.

- Look into any differences right away and fix them.

- Utilize the reconciliation tools found in the majority of accounting programs.

Benefits:

Accuracy is maintained through regular reconciliation, which keeps minor mistakes from growing into significant problems.

Distinguish Personal and Business Funds

Combining personal and business funds makes accounting bookkeeping more difficult and increases the risk of financial reporting errors.

- Establish a separate bank account solely for your business.

- Assign separate credit cards to business expenses and personal expenses.

- Keep track of every transaction in the appropriate account.

Benefits:

Keeping your finances different assures transparency and clarity in your financial records and makes bookkeeping easier.

Keep an eye on cash flow

Tracking cash flow is crucial for understanding the financial well-being of your company. Making well-informed decisions and future planning are aided by bookkeeping services.

- Generate regular cash flow statements to monitor financial liquidity.

- Monitor your income and expenditures to identify trends and patterns.

- Establish cash flow goals and track your progress toward them.

Benefits:

A company that manages its cash flow well will have adequate liquidity to pay its debts.

Get Expert Assistance

Accuracy and compliance are ensured by the knowledge and experience that professional bookkeeping services provide to your financial management.

- Hire an accounting company or qualified bookkeeper.

- Seek out experts with a track record in your field.

- To save money and have more freedom, use virtual bookkeeping services.

Benefits:

Hiring a professional service improves the caliber of your bookkeeping and offers insightful information about your financial situation.

Examine the financial reports Frequently

Reviewing financial data on a regular basis facilitates problem-solving, performance tracking, and strategic decision-making.

- Evaluate critical metrics and measure them against your goals.

- Create monthly financial reports featuring cash flow analyses, balance sheets, and profit and loss statements.

- Your business strategy might be guided by the insights found in reports.

Benefits:

Frequent reviews let you make proactive decisions and keep you updated on the financial health of your company.

Remain Current on Tax Laws

Following tax laws guarantees compliance and keeps fines from occurring. Bookkeeping services also help optimize tax benefits.

- Keep up with any changes to the tax regulations that affect your company.

- Ensure your tax returns are supported by precise and thorough documentation.

- Consult with a tax professional for guidance and strategic planning.

Benefits:

Maintaining compliance with tax laws prevents legal issues and ensures your business maximizes available tax benefits.

Conclusion

The success of any business depends on its capacity to maintain precise accounting records. Busy business owners can effectively manage their finances and maintain their financial health by putting these easy methods into practice. Meru Accounting can help you simplify your financial management by providing expert bookkeeping services. Our skilled staff makes sure that all of the reporting is accurate, compliant, and informative so you can concentrate on expanding your company. To find out how we can help with your bookkeeping needs, get in touch with us right now.

FAQs

- How can business owners stay on top of bookkeeping?

Keep records arranged, check reports often, and use tools to save time. These steps reduce errors and keep money matters clear. - What tasks in bookkeeping can be automated?

You can automate payroll, billing, and expense tracking. This cuts manual work and helps avoid common mistakes. - Why should business and personal funds be kept apart?

Mixing both causes confusion and leads to wrong reports. Separate accounts make tracking and filing much easier. - How often should you match your books with bank records?

Check them once a month. It helps find mistakes early and keeps your books accurate. - Why is cash flow tracking important in bookkeeping?

It shows if you can cover costs and plan ahead. Watching cash flow helps you avoid money gaps. - When is it smart to get help with bookkeeping?

If you feel lost or busy, a bookkeeping expert can save time and fix errors. They also help with rules and reports. - What financial reports should be checked each month?

Review profit and loss, cash flow, and balance sheet. These show income, costs, and what your business owns. - How does proper bookkeeping help with tax rules?

It keeps your records correct and on time. You stay clear of fines and make the most of tax options.