Home » How do I maintain accounting for marketing agencies?

How Do I Maintain Accounting for Marketing Agencies?

Running a marketing agency takes skill, time, and strong control over your money. You need to track income, costs, and taxes. Accounting for marketing agencies helps you stay on budget, avoid errors, and plan for growth. If you set up the right system from the start, you can focus more on clients and less on numbers. With the right accounting setup, marketing agencies can keep finances clear, reduce stress, and make smarter business choices. Proper records also build trust with clients and support long-term growth.

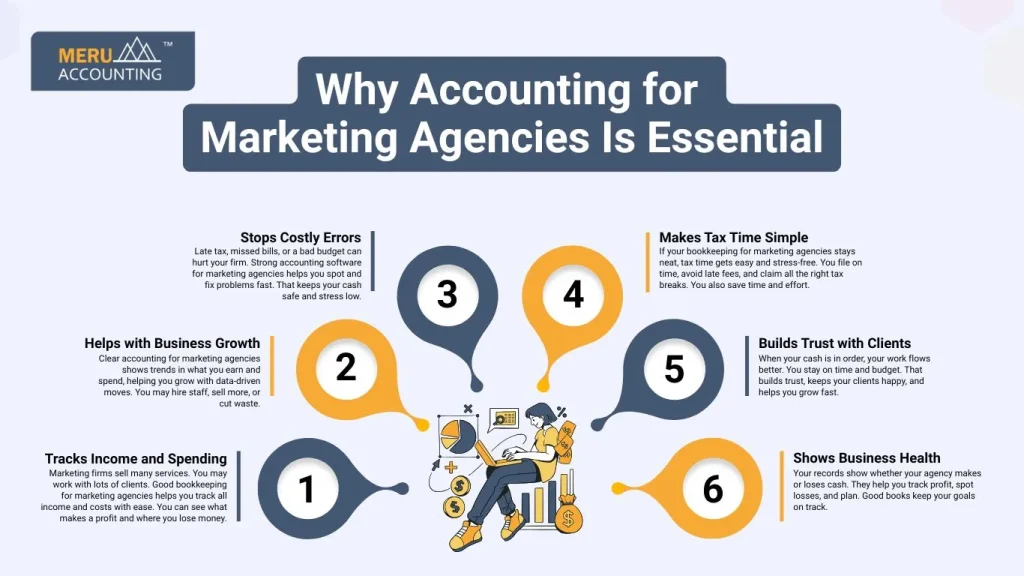

Why Accounting for Marketing Agencies Is Essential

Good records help your agency run smoothly and earn more. They give you a clear view of your cash and help you make smart moves.

Tracks Income and Spending

Marketing firms sell many services. You may work with lots of clients. Good bookkeeping for marketing agencies helps you track all income and costs with ease. You can see what makes a profit and where you lose money.

Helps with Business Growth

Clear accounting for marketing agencies shows trends in what you earn and spend, helping you grow with data-driven moves. You may hire staff, sell more, or cut waste.

Stops Costly Errors

Late tax, missed bills, or a bad budget can hurt your firm. Strong accounting software for marketing agencies helps you spot and fix problems fast. That keeps your cash safe and stress low.

Makes Tax Time Simple

If your bookkeeping for marketing agencies stays neat, tax time gets easy and stress-free. You file on time, avoid late fees, and claim all the right tax breaks. You also save time and effort.

Builds Trust with Clients

When your cash is in order, your work flows better. You stay on time and budget. That builds trust, keeps your clients happy, and helps you grow fast.

Shows Business Health

Your records show whether your agency makes or loses cash. They help you track profit, spot losses, and plan. Good books keep your goals on track.

Strong accounting for marketing agencies gives you control, supports growth, and builds a clear path to long-term success.

Bookkeeping for Marketing Agencies: What You Need to Know

Bookkeeping for marketing agencies means keeping daily records in order. It helps you track cash, stay legal, and plan for the future.

Record Every Transaction

Log all money in and out. Note the date, sum, and cause in a clear sheet. This builds a true cash trail and keeps small slips from turning into big losses.

Store Receipts and Invoices

With accounting software for marketing agencies, you can store digital copies of receipts and invoices with ease. This is helpful during audits and tax season, and also helps you verify transactions and back up your financial reports.

Match Bank Records Often

Check your bank slips against your books. Spot errors or gaps right away. A monthly check keeps your records clear and true.

Separate Personal and Work Funds

Use one account for work and one for self. Mixing the two can cause stress and tax issues. A clear split keeps your books neat and fair.

Track Time and Costs by Project

Assign time and money spent to specific clients or campaigns. This helps identify which projects are most profitable, so you can adjust pricing or focus on better services.

Keep Books Updated Weekly

Don’t wait until the month ends. Update your books every week to spot issues early, stay informed, and avoid a pile of work building up over time.

Key Features to Look for in Accounting Software for Marketing Agencies

The right accounting software for marketing agencies saves time and cuts errors. It helps you manage books faster and with less stress. You stay organized and make better money decisions every day.

Easy to Use Tools

Good software should be easy for non-accountants. Look for clear dashboards, user-friendly layouts, and helpful tips that make everyday tasks simpler and quicker.

Project-Based Tracking

Choose tools that link income and costs to specific projects. This helps you monitor client budgets, avoid overspending, and boost profits with real data.

Built-In Invoicing

Automated invoicing features reduce manual work. These tools help you send bills on time, follow up on unpaid ones, and track money you are owed.

Cloud-Based Access

Cloud tools let your team access data from anywhere. This is perfect for remote agencies, allowing real-time updates and seamless collaboration with your accountant.

Expense Auto-Tracking

Software with bank feed integration helps pull in expenses automatically. This reduces human error, saves time, and ensures nothing slips through the cracks.

Tax Ready Reports

Choose tools that generate reports for taxes. These help you file taxes faster, avoid fines, and show clean records to authorities if needed.

How to Track Cash Flow and Manage Expenses Effectively

Cash flow is vital for your agency. With accounting for marketing agencies, you can monitor cash inflow and outflow easily, helping to avoid gaps and maintain smooth operations.

Set Up a Cash Flow Sheet

Use a spreadsheet or software to list all income and costs. Break it down by month. This shows what you earn, what you spend, and how much cash you have in hand.

Track Recurring Costs

List fixed costs like tools, wages, rent, and ads. These don’t change much month to month. Tracking them helps you plan well and avoid cash flow gaps or delays.

Watch Client Payments

Late payments hurt your budget. Track each invoice, send reminders, and charge late fees if needed. On-time payments help you keep a steady and safe cash flow.

Offer Online Payments

Let clients pay online using secure gateways. This cuts down wait time and excuses. It also makes the payment process smooth and quick for both you and the client.

Limit Unplanned Costs

Stick to your set budget each month. Don’t spend on new items unless urgent. This helps you avoid stress, save more, and build good habits with money.

Keep a Safety Fund

Save a small part of your income each month. This fund helps during slow periods or when clients pay late. It keeps your agency safe and running without stress.

Invoicing and Payroll Tips for Marketing Agencies

Billing clients and paying your team are key parts of your agency. Keep these tasks simple and on time. It helps avoid delays, builds trust, and keeps your team happy.

Send Invoices Fast

Send invoices right after each project or phase ends. Use simple templates and clear due dates. Quick billing helps you get paid faster and keeps your cash flow strong.

Use Simple Templates

Each invoice should list what work was done, the price, and the due date. A clear layout avoids confusion and helps clients pay without delay or questions.

Track Who Has Paid

Use tools or reminders to check who paid and who didn’t. Mark invoices as paid, unpaid, or overdue. It keeps your follow-ups sharp and your income steady.

Automate Recurring Invoices

For repeat jobs, use tools that send bills each month. This saves you time and cuts errors. It also helps clients pay on time without reminders.

Handle Freelancer Pay Separately

If you hire freelancers, track their hours, pay, and work dates. Keep their invoices and contracts in one place. This avoids mix-ups during tax time or audits.

Use Payroll Tools

Payroll tools help with staff pay, tax, and super. They cut errors and save time. Paying your team on time also builds trust and keeps them loyal.

Common Tax Deductions for Marketing Agencies

If you run a marketing firm, many of your costs can be tax write-offs. Know what counts and keep the right proof.

Office Rent and Bills

Rent, electricity, internet, and phone bills for your workspace are all deductible. Track these monthly, and store bills as proof for tax time.

Marketing Tools and Software

Subscriptions to tools like SEO software, analytics, and accounting software for marketing agencies are usually deductible. Keep invoices to support these claims.

Freelancer and Staff Pay

Payments to contractors and employee salaries can be claimed. Maintain payment records, tax filings, and contracts to stay in line with legal rules.

Business Travel and Meals

Travel and meals for work are often deductible within limits. Log details like dates, reasons, and costs. Save all related receipts for your records.

Training and Courses

Online courses or workshops that help you grow professionally can be claimed. These are business expenses that improve your agency’s performance.

Ad Spend and Promotion

Spending on digital ads, printed material, or event promotions often qualifies. Save receipts and ad platform reports to support your deductions.

Reports That Help You Grow Your Marketing Agency

Regular reports show financial health. Applying accounting techniques for marketing agencies here ensures the reports are accurate and actionable.

Monthly Profit and Loss

This shows how much you earned versus spent. Use it monthly to track profits, spot issues, and make key changes to your business model.

Cash Flow Statement

This helps you see when and where money enters or leaves. It keeps you informed so you never run out of money at the wrong time.

Balance Sheet

A balance sheet lists assets, debts, and equity. It shows your agency’s total value and helps lenders or investors judge your business’s health.

Project Budget Reports

Track budget vs. actual costs for each campaign. This helps improve quotes, manage time, and adjust future budgets based on past data.

Client Revenue Report

Rank your clients by revenue earned. Focus on the best ones, reduce time spent on low-value clients, and optimize your service mix.

Expense Breakdown

Break down your total spending into categories. It highlights where money is wasted and what areas need tighter control.

At Meru Accounting, we know your business is creative, fast, and full of moving parts. We help you focus on your clients while we handle the numbers. We specialise in accounting for marketing agencies and understand the unique challenges creative businesses face. Our team helps you manage money with ease and accuracy. Our team offers specialised bookkeeping for marketing agencies. Our service keeps your records accurate, tax-ready, and always compliant with local laws.

FAQs

- What type of accounting is best for marketing agencies?

Marketing agencies benefit most from accrual accounting. It tracks income and expenses when earned or incurred, not just when paid, giving you a clearer financial picture.

- Do I need separate accounts for each client?

No, but you should track income and expenses by project or client. Most accounting software for marketing agencies lets you tag each transaction, so you can keep everything organised and easy to review.

- Can freelancers be included in payroll?

No, freelancers are not part of regular payroll. Track them separately under contractor expenses. This helps during tax time and keeps records clean.

- How often should I update my books?

Weekly updates are best. This helps you spot issues early, manage cash better, and avoid year-end stress. Bookkeeping for marketing agencies works best when it’s regular.

- Is cloud-based software safe for financial data?

Yes, if you use trusted platforms with encryption and secure logins. Cloud accounting software for marketing agencies also allows real-time updates from anywhere.

- What tax deductions can I claim?

You can claim ad spend, office rent, internet bills, software, freelancer pay, and travel costs. Keep all receipts and talk to a tax expert for full advice.