All About Receivables Management and Its Importance in Sustaining Business Growth

Receivables management plays a key role in keeping a business strong and safe. It is the process of tracking and collecting payments from clients for goods or services sold on credit. A good system makes sure that firms get their dues on time, keep cash flow steady, and cut the risk of unpaid bills. Without clear control, even a firm with good sales may face stress from late or missed pay.

For growing firms, accounts receivable management is more than just collecting dues. It builds trust, cuts risk, and adds long-term strength. Strong receivable control helps cover daily costs, fund new plans, and keep work smooth. In short, receivables management is the base of sound money plans and a key driver of growth.

What is receivable management?

Receivable management, also known as accounts receivable, refers to the amount due by the customer for the sale of goods on credit. It means the company has given the credit facility to its customer for a period the pay the amount. It represents the right of the company to receive the amount due from the customer after the completion of the credit period.

From an accounting viewpoint, the customer who has purchased goods on credit is known as a sundry debtor. The accounts receivable are shown under the head of current assets in the balance sheet.

Since many companies sell on credit and have a considerable amount of receivables, there are various complexities in AR. Thus, it becomes quite important to collect the receivables on time, making receivables management a vital part of financial planning. They are also the source of working capital for the business.

Receivables process

Managing accounts receivable includes the following process:

- The first and foremost thing is to check the credibility of the customer before lending the goods or services on credit. The terms and conditions of the credit sale must be reviewed.

- Draft credit policy for the customer regarding credit terms and conditions, time, payment method, etc.

- Generate an invoice to the customer with all details and agree on the terms with the customer.

- Monitoring of any delay or possibility of non-payment from the customer is a vital part of managing receivables.

- Minimize the risk of bad debt of the receivable outstanding and continue to build the customer relationship.

- Timely addressing the grievances of the customer.

- Reducing the receivables by the amount of the payment received from the customer.

Key Goals of Managing Receivables

1. Improve Cash Flow

The top goal of receivables management is to keep cash moving in on time. Strong flow of funds helps the business stay secure.

2. Cut Bad Debts

By tracking receivables well, a company cuts the risk of unpaid bills. This saves money and keeps profits safe.

3. Support Growth Plans

With cash coming in on time, a firm can invest, hire staff, and expand with ease.

4. Build Client Trust

Clear and fair credit terms build trust. Good ties with clients lead to more sales and long deals.

5. Keep Work Smooth

Steady cash from receivables makes it easy to pay staff, suppliers, and daily costs. This keeps the business running with no breaks.

Benefits of receivables management

- Effective receivables management provides numerous benefits to the business and shows the value of managing receivables with care. Grab the following benefits of accounts receivable:

- Strengthen the liquidity position of the firm.

- Deploy proper control over cash and other sources of working capital.

- Establish a friendly and cordial business relationship with a customer.

- Boost sales volume.

- Improve the profitability of the business.

- Reduced the risk of bad debt.

- Help in addressing the gap between credit sales and receipt of payment from the customer.

- Customer satisfaction is achieved by handling their complaints on time.

How Receivables Management Sustains Business Growth

Reliable Funds

Steady payments create funds for growth. Firms can invest in sales, tech, and staff when cash flow stays strong.

A smooth flow of cash means firms do not need to rely much on debt.

Investor Confidence

A sound receivable plan makes investors trust the firm. A steady record shows that the firm has strong money control.

This trust makes it easy to bring in more funds and partners.

Faster Scaling

Firms can grow staff, goods, or services with no pause. Good cash flow helps them reach new clients and markets with ease.

Strong funds give the power to act fast on new chances.

Reduced Risks

Tight receivable checks lower the risk of debt. It guards the firm from cash gaps and stress in growth.

Less risk means the firm can face hard times with ease.

Focus on Strategy

When receivables are in check, leaders can plan with ease. Time saved from chasing dues is spent on key goals.

This focus helps the firm build long-term plans with care.

Stronger Client Ties

Clear bills and due dates build trust with clients. This cuts disputes and brings repeat work.

Happy clients often give more work and share good word of mouth.

Better Credit Score

Good receivable care lifts a firm’s credit score. It helps get bank loans and fair vendor terms.

Banks see the firm as low risk and offer good rates.

Higher Profits

Less delay and low bad debt save more cash. Firms can use the gain for growth and new plans.

More profit means more scope to grow and stay ahead of rivals.

Steps for Effective Receivables Management

1. Set a Clear Credit Policy

Make rules before giving credit to clients. State payment terms in a simple and clear way.

2. Send Quick and Accurate Invoices

Issue invoices right after a sale. Keep them clear, correct, and easy to read.

3. Follow Up Regularly

Check unpaid bills on a set schedule. Send polite reminders before and after due dates.

4. Offer Flexible Payment Options

Give clients many ways to pay. Easy options lead to faster payments.

5. Track Accounts Receivable

Review reports often to catch late payers. Take quick steps to collect dues.

6. Use Technology Tools

Use software to send auto reminders and track bills. Tech makes the job faster and error-free.

7. Build Strong Client Bonds

Stay polite and fair in talks with clients. Good ties lead to trust and quicker pay.

Why Is Accounts Receivable Important?

1. Indicator of Business Health

Accounts receivable shows how strong a business is. When clients pay on time, it proves the company is stable and trusted by banks, lenders, and investors.

2. Builds Customer Trust

Giving clients credit builds trust. When you offer fair payment terms, customers feel valued and keep working with you.

3. Keeps Cash Flow Steady

A good accounts receivable system stops cash gaps. It makes sure the company has money to pay bills, staff, and daily costs.

4. Helps Growth and Expansion

When receivables are collected on time, a business can invest in new projects, hire more staff, and grow faster.

5. Reduces Risk of Loss

If receivables are not tracked, the business may lose cash. Strong control lowers the chance of late pay, bad debts, and loss.

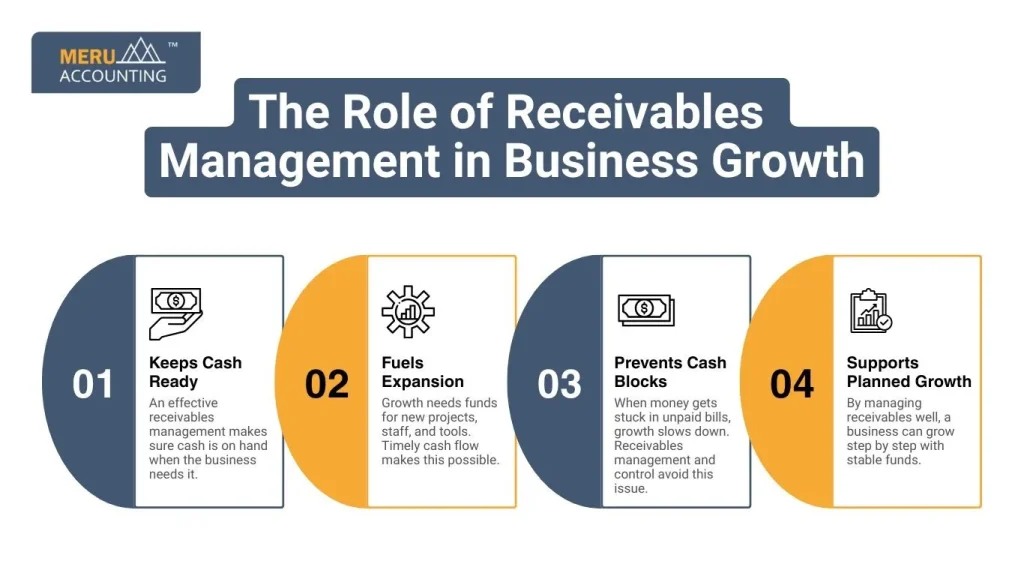

The Role of Receivables Management in Business Growth

1. Keeps Cash Ready

An effective receivables management makes sure cash is on hand when the business needs it.

2. Fuels Expansion

Growth needs funds for new projects, staff, and tools. Timely cash flow makes this possible.

3. Prevents Cash Blocks

When money gets stuck in unpaid bills, growth slows down. Receivables management and control avoid this issue.

4. Supports Planned Growth

By managing receivables well, a business can grow step by step with stable funds.

Accounts Receivable vs Accounts Payable

Aspect | Accounts Receivable (AR) | Accounts Payable (AP) |

Definition | Money owed to the business by customers. | Money the business owes to suppliers. |

Nature | Asset (amount to be received). | Liability (amount to be paid). |

Cash Flow Impact | Increases cash inflow when collected. | Decreases cash outflow when settled. |

Financial Stability | Must be managed to ensure timely collection. | Must be managed to avoid late payment issues. |

Receivables Management In Different Sectors

Reliable Funds

Steady payments create funds for growth. Firms can invest in sales, tech, and staff when cash flow stays strong.

A smooth flow of cash means firms do not need to rely much on debt.

Investor Confidence

A sound receivable plan makes investors trust the firm. A steady record shows that the firm has strong money control.

This trust makes it easy to bring in more funds and partners.

Faster Scaling

Firms can grow staff, goods, or services with no pause. Good cash flow helps them reach new clients and markets with ease.

Strong funds give the power to act fast on new chances.

Reduced Risks

Tight receivable checks lower the risk of debt. It guards the firm from cash gaps and stress in growth.

Less risk means the firm can face hard times with ease.

Focus on Strategy

When receivables are in check, leaders can plan with ease. Time saved from chasing dues is spent on key goals.

This focus helps the firm build long-term plans with care.

Stronger Client Ties

Clear bills and due dates build trust with clients. This cuts disputes and brings repeat work.

Happy clients often give more work and share good word of mouth.

Better Credit Score

Good receivable care lifts a firm’s credit score. It helps get bank loans and fair vendor terms.

Banks see the firm as low risk and offer good rates.

Higher Profits

Less delay and low bad debt save more cash. Firms can use the gain for growth and new plans.

More profit means more scope to grow and stay ahead of rivals.

Receivables management is more than tracking payments. It is a way to drive and sustain growth. Strong accounts receivable practices bring cash flow stability, cut risks, and free funds for expansion. By managing receivables well, both small and large firms can focus on growth without cash stress.

At Meru Accounting, we help firms manage receivables with ease. Our team ensures quick invoicing, clear tracking, and smooth collections. With our skills, firms can boost cash flow, lower risk, and build growth with full trust.

FAQs

- What is receivables management?

It is the process of tracking and collecting money owed by customers. - Why are accounts receivable important?

They show how much money a business is yet to collect, which affects cash flow. - What happens if receivables are not managed?

It can cause cash shortages and slow down business growth. - How can small businesses improve their management of receivables?

By using accounting software, clear policies, and regular reminders. - What tools help in receivables management?

QuickBooks, Zoho Books, and Xero are common tools. - Can outsourcing help with accounts receivable?

Yes, outsourcing reduces workload and improves collections. - How does receivables management affect growth?

It ensures cash flow, reduces risks, and provides funds for expansion.