What Are the Best Practices for Integrating Amazon Bookkeeping with Overall Business Financials?

Integrating Amazon bookkeeping with your overall business financials is essential for maintaining a streamlined accounting system and ensuring your business’s financial health. Amazon sellers manage many transactions, including sales, fees, shipping, and taxes, which can quickly become complex. By following best practices for Amazon bookkeeping, you can simplify your financial processes, keep accurate records, and make better business decisions. Using Amazon bookkeeping software also enhances efficiency, making it easier to track and manage every aspect of your business’s financials.

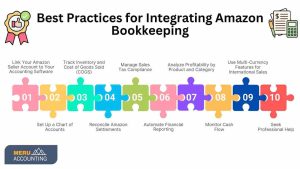

Best Practices for Integrating Amazon Bookkeeping

1. Link Your Amazon Seller Account to Your Accounting Software

- One of the first steps is connecting your Amazon seller account to your accounting software, such as QuickBooks or Xero. Amazon bookkeeping software often supports seamless integration, automatically importing sales data, fees, shipping charges, and other transactions into your accounting system. This reduces manual data entry and minimizes errors, ensuring that your financial records are up-to-date and accurate.

2. Set Up a Chart of Accounts

- A properly structured chart of accounts is crucial for organizing your financial data. For Amazon bookkeeping, create specific categories for your Amazon-related transactions. These categories may include sales revenue, Amazon fees, shipping costs, and inventory expenses. A clear chart of accounts makes it easier to monitor the financial performance of your Amazon business and understand where your money is going.

3. Track Inventory and Cost of Goods Sold (COGS)

- Tracking your inventory and calculating the cost of goods sold (COGS) is essential for understanding your profitability. Amazon bookkeeping software can help you monitor inventory levels, track purchases, and calculate COGS accurately. This practice allows you to manage stock effectively and avoid over- or under-stocking, which can affect both sales and expenses.

4. Reconcile Amazon Settlements

- Regular reconciliation of Amazon settlements with your bank deposits is a must. By comparing the amounts in your Amazon seller account to your bank statements, you can ensure that all transactions have been recorded correctly. This process also helps you spot any discrepancies or missing payments, keeping your financial records accurate.

5. Manage Sales Tax Compliance

- Sales tax compliance can be challenging for Amazon sellers, especially if you sell in multiple states. Amazon bookkeeping software can simplify this by tracking sales tax for different regions and ensuring that you charge the correct rates. Setting up the correct sales tax settings in your software helps you stay compliant with tax laws and avoid penalties.

6. Automate Financial Reporting

- Automating your financial reporting is another key practice. Most Amazon bookkeeping software allows you to generate detailed financial reports like profit and loss statements, balance sheets, and cash flow statements. These reports provide a comprehensive overview of your business’s financial health and help you make informed decisions.

7. Analyze Profitability by Product and Category

- Amazon bookkeeping also helps you perform profitability analysis by product and category. By understanding which items generate the most revenue and which have higher costs, you can adjust your pricing strategies, discontinue underperforming products, and optimize your product mix for better profitability.

8. Monitor Cash Flow

- Monitoring your cash flow is critical for ensuring that your business has enough funds to cover expenses and invest in growth. With Amazon bookkeeping software, you can track cash flow in real-time, helping you stay on top of your financial situation and plan for future investments.

9. Use Multi-Currency Features for International Sales

- If your Amazon business involves international sales, multi-currency features in your bookkeeping software are essential. These features allow you to handle transactions in various currencies, manage exchange rate fluctuations, and accurately report your international income and expenses.

10. Seek Professional Help

- Lastly, consider seeking help from a professional accountant or bookkeeper who specializes in e-commerce. They can provide guidance on best practices, ensure your books are accurate, and help you comply with tax laws and regulations.

Conclusion

By following these best practices, you can streamline your Amazon bookkeeping processes and ensure your overall business financials remain organized and accurate. If you’re looking for expert assistance, Meru Accounting offers specialized services for e-commerce businesses, helping you integrate Amazon bookkeeping with your finances seamlessly. Using Amazon bookkeeping software and following these strategies will ensure that your business runs smoothly and stays compliant with financial regulations.

FAQs

- How can I connect my Amazon seller account to accounting software?

Use software like Xero or QuickBooks. These tools sync with your Amazon seller account. They pull sales, fees, shipping, and tax data. This removes manual entries and reduces mistakes. It keeps your Amazon bookkeeping simple and correct. - What chart of accounts works best for Amazon bookkeeping?

Create clear categories in your chart of accounts. Use separate sections for sales, Amazon fees, shipping costs, and inventory. This setup helps track spending and income better. It also makes Amazon bookkeeping easier to review and update. - Why should Amazon sellers track inventory and cost of goods sold?

Tracking inventory helps avoid overstock or missed sales. COGS shows how much each sale costs you. This keeps your profit numbers correct. Good Amazon bookkeeping software tracks both and shows clear stock levels. - How do I reconcile Amazon settlements with bank deposits?

Check your Amazon settlement report. Match each amount with the deposit in your bank. Record any fee or charge that applies. This keeps your Amazon bookkeeping clean and your cash numbers right. - How do Amazon sellers handle sales tax compliance?

Use Amazon bookkeeping software with built-in tax tracking. It shows taxes by state or country. Set the right rules in your software. This helps charge the correct rate and keeps you compliant with tax laws. - Can I automate financial reporting in Amazon bookkeeping?

Yes. Most tools create reports like profit and loss, cash flow, and balance sheets. These update as new data arrives. They save time and help you check your Amazon business performance without delay. - How do I check product or category profit in Amazon bookkeeping?

Use your software to track each item or group. See which products sell most and which cost more. Use this to change prices, drop weak items, or add stronger ones. This improves Amazon bookkeeping and profit tracking. - Why do Amazon sellers need multi-currency features?

If you sell outside your home country, use software with multi-currency tools. It tracks exchange rates and foreign payments. This keeps your Amazon bookkeeping correct across all sales regions.