How Does Automated Amazon Bookkeeping Software Save Time and Reduce Errors?

Automated Amazon bookkeeping software streamlines the complex task of managing eCommerce finances by automating key processes like transaction tracking, sales tax calculations, and expense categorization. This technology saves valuable time by eliminating manual data entry and ensuring real-time updates of financial records.

By reducing human error, it enhances accuracy in financial reporting, helping businesses stay compliant and make data-driven decisions. With automated bookkeeping, Amazon sellers can focus on growing their business while leaving the accounting tasks to the software.

Table of Contents

- Introduction to Automated Amazon Bookkeeping

- How can you Reduce Errors and Save Hours by using Automated Amazon Bookkeeping Software?

- Conclusion

- Frequently asked Questions (FAQs)

- Summary

Introduction to Automated Amazon Bookkeeping

Automated Amazon bookkeeping software is designed to simplify and optimize the financial management of eCommerce businesses on Amazon. It automates the tracking of sales, inventory, expenses, and taxes, ensuring accurate and timely financial reporting.

This software eliminates the need for manual data entry, significantly reducing the risk of errors while saving valuable time. By integrating seamlessly with Amazon seller accounts and other financial platforms, automated bookkeeping helps sellers focus on growing their business, knowing their finances are managed efficiently and accurately.

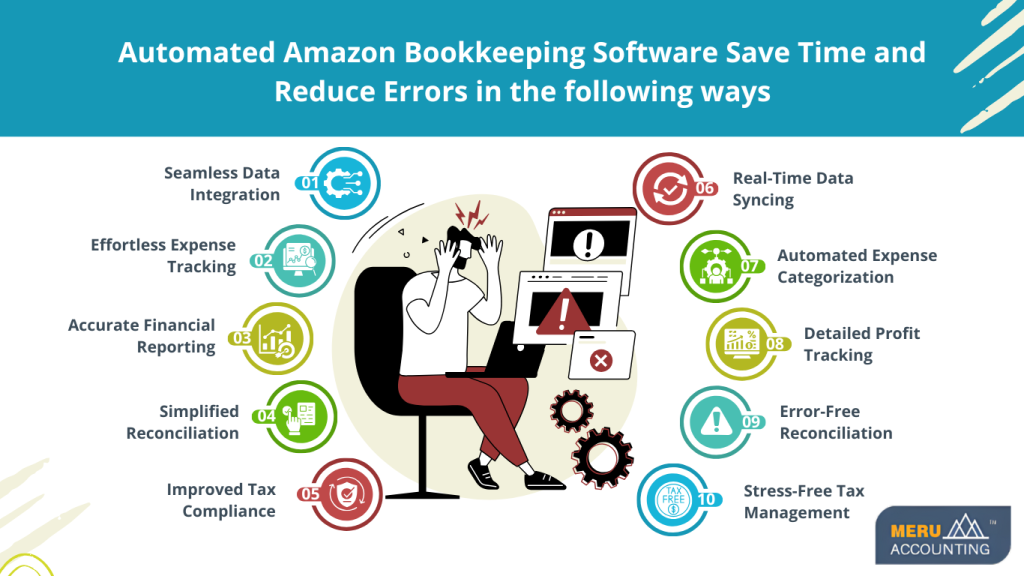

Automated Amazon Bookkeeping Software Save Time and Reduce Errors In the Following ways

Seamless Data Integration

With Amazon bookkeeping software, you can automatically sync your Amazon seller account to import sales, fees, refunds, and other transactions. This eliminates the need for manual data entry, minimizing errors and ensuring that your financial records are up-to-date.

Effortless Expense Tracking

Automated Amazon bookkeeping categorizes expenses like shipping costs, advertising spend, and inventory purchases. This makes it easy to keep track of where your money is going, helping you maintain an organized financial overview.

Accurate Financial Reporting

Generate detailed profit and loss statements with Amazon bookkeeping software. These reports provide insights into your business’s financial performance, helping you identify trends and make better decisions.

Simplified Reconciliation

Reconciliation becomes faster and more accurate with Amazon bookkeeping automation. The software matches your transactions with bank and payment records, flagging inconsistencies so you can address them without hassle.

Improved Tax Compliance

Using Amazon bookkeeping software ensures your tax records are accurate and complete. It tracks sales tax, organizes deductible expenses, and helps you prepare for tax filings efficiently, reducing the risk of costly errors.

Real-Time Data Syncing

Amazon bookkeeping software automatically imports transactions from your Amazon account, including sales, refunds, and fees.

Automated Expense Categorization

Expenses such as shipping, storage, and advertising are automatically categorized by Amazon bookkeeping tools. This feature keeps your accounts organized and ready for tax preparation.

Detailed Profit Tracking

Stay on top of your business performance with detailed reports generated by Amazon bookkeeping software. These reports help you understand your profit margins and identify areas for improvement.

Error-Free Reconciliation

Reconcile your Amazon payouts with your bank accounts seamlessly using automated Amazon bookkeeping tools. The software matches transactions and flags discrepancies, ensuring your records are accurate.

Stress-Free Tax Management

With Amazon bookkeeping software, tracking deductible expenses and calculating sales tax becomes effortless. This ensures your tax filings are precise and reduces the risk of penalties.

Conclusion

Automated bookkeeping is essential for Amazon sellers looking to streamline their financial processes, reduce errors, and save valuable time. By integrating seamlessly with Amazon Seller Central and tracking sales, fees, and expenses in real time, it ensures accurate financial records.

Meru Accounting offers expert support, tailored solutions, and customized reporting to help sellers manage their finances efficiently. With automated bookkeeping, sellers can focus on scaling their business, stay tax-compliant, and improve cash flow management. Embracing automation allows Amazon sellers to optimize operations and ensure long-term financial success.

Frequently asked Questions (FAQs)

What is automated bookkeeping, and how does it help Amazon sellers?

Automated bookkeeping is the use of software to manage financial data, including transactions, expenses, and reports. For Amazon sellers, it streamlines processes like tracking sales, fees, and inventory costs, saving time and reducing errors.

Why should Amazon sellers choose Meru Accounting for automated bookkeeping?

Meru Accounting specializes in providing customized bookkeeping solutions tailored to Amazon businesses. With advanced tools and expertise, they ensure accurate financial management, helping sellers focus on scaling their business.

What reports can automated bookkeeping generate for Amazon sellers?

Automated bookkeeping tools generate detailed reports like profit and loss statements, expense breakdowns, cash flow summaries, and product profitability analyses. Meru Accounting provides customized reporting to meet specific business needs.

What is the cost of outsourcing automated bookkeeping to Meru Accounting ?

The cost depends on the complexity and size of your Amazon business. Meru Accounting offers flexible pricing plans tailored to your needs, ensuring a cost-effective solution that delivers value and efficiency.

Will automated bookkeeping handle multiple currencies for international Amazon sellers?

Yes, automated bookkeeping tools can manage multiple currencies and conversion rates, ensuring accurate financial reporting for international Amazon sellers.

How does Meru Accounting help with inventory tracking for Amazon sellers?

Meru Accounting integrates automated bookkeeping software with inventory management tools, providing real-time updates on stock levels, cost of goods sold, and profit margins. This helps sellers optimize their inventory management and track expenses accurately.

Can I track my Amazon advertising expenses with automated bookkeeping?

Yes, automated bookkeeping software tracks Amazon advertising expenses and integrates them into your financial reports. Meru Accounting ensures these costs are properly categorized, helping you monitor ROI on your ad campaigns.