Home » How Intuit Bookkeeping Can Help You Avoid Costly Financial Mistakes

How Intuit Bookkeeping Experts Can Help You Avoid Costly Financial Mistakes

Managing business finances is not always simple. Mistakes in bookkeeping can lead to fines, cash flow issues, or even business failure. Intuit bookkeeping experts become valuable in such situations. They help you keep your finances in order and avoid costly errors. With Intuit tools and support for bookkeeping, you gain control and guidance to help your business grow.

Accurate financial records are vital for the growth and stability of any company. Even small errors can lead to major losses. Intuit bookkeeping services provide a complete solution to help businesses avoid expensive mistakes. In this blog, we will show how Intuit bookkeeping experts boost accuracy, speed up tasks, and give you a live view of your business finances. With smart tools and a simple layout, they help cut repeat work, follow rules, and keep records clean.

This reduces errors and saves time that can be used for more useful work. Intuit bookkeeping services can bring accuracy and speed. If you want to avoid heavy financial mistakes, learn to use the right tools and expert support to stay on the right side of the law.

What Are Intuit Bookkeeping Services?

Intuit bookkeeping services are software-based solutions designed to help small business owners manage their financial records efficiently.

Intuit bookkeeping experts provide a simple and easy-to-use system. You can track income, expenses, invoices, and payments in one place. This helps you stay on top of your business’s financial health.

They support key tasks like logging income, tracking costs, sending invoices, and making reports. Their tools work well with QuickBooks and other Intuit products. This gives you better control and a full view of your business finances.

Common Financial Mistakes Businesses Make

Missing or Late Tax Payments

Late tax filing or missed payments can cause fines and added interest. It may also harm your business name.

Incorrect Data Entry

Small errors in records can lead to wrong choices. Manual entries are hard to check and may cause big issues later.

Not Separating Business and Personal Finances

Mixing work and personal costs leads to confusion. It can also bring tax troubles or legal risks.

Untracked Cash Flow

If you don’t track cash flow, you may overspend or run out of funds. This slows growth and affects vendor ties.

Failing to Reconcile Accounts

If bank and book records don’t match, fraud or missed deals may go unseen. This also skews your reports.

No Budgeting or Planning

Spending without a budget leads to poor use of money. Without a plan, it’s hard to see future costs or set profit goals.

How Intuit Bookkeeping Experts Support Accurate Financial Management

Precise Accounting Documents

Bookkeeping with Intuit ensures each financial transaction is recorded with care. With up-to-date and correct records, your reports stay clean, and your choices stay smart. Good books mean good business moves.

Improved Compliance

Following tax laws and rules is key. Bookkeeping with Intuit helps your firm meet all financial laws and filing needs. This lowers the risk of fines or audits and keeps your books clean and ready.

Better Money Control

When your data is on time and right, you can plan well. Intuit bookkeeping experts give the numbers you need to track cash flow, set a smart budget, and map out your growth. Good planning starts with good numbers.

Saves Time and Resources

Letting Intuit bookkeeping experts handle your books means your team can focus on what matters most—your work. This saves both time and cost. You get more time for sales, service, and building your brand.

Fewer Errors in Records

Manual work often leads to big mistakes. Bookkeeping with Intuit uses smart tools to lower errors. With fewer slips in your records, your books stay safe, and your reports stay right.

Real-Time Financial Info

With Intuit tools, you can track your money in real time. This means you can spot issues fast, act quickly, and make better calls. You get a full, live view of your money at any time.

Cost Savings for Your Business

By keeping your records clean and your systems smooth, bookkeeping with Intuit helps cut waste. You spend less time fixing past mistakes and more time doing work that earns. In short, you save money while boosting control.

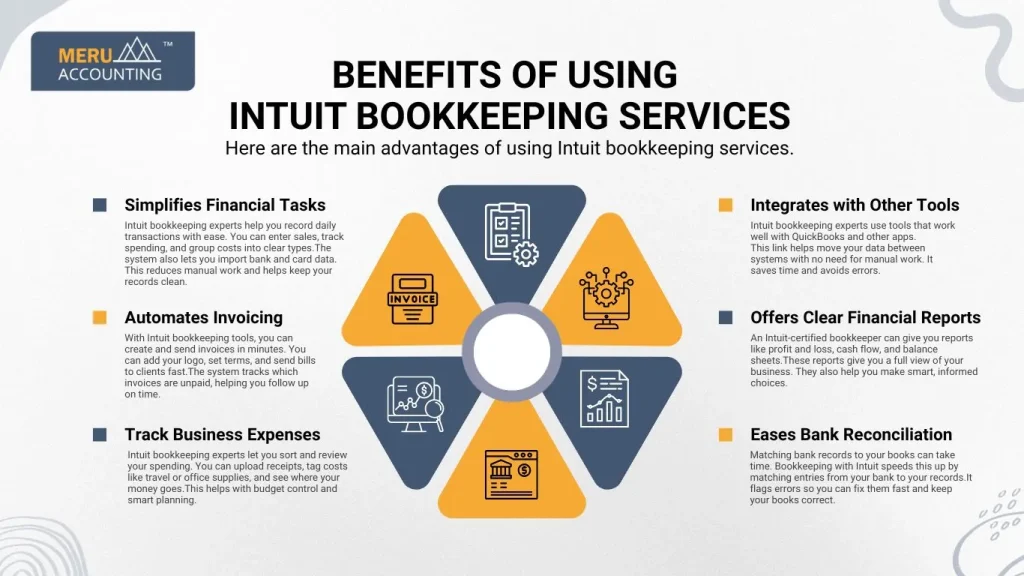

Benefits of Using Intuit Bookkeeping Services

Here are the main advantages of using Intuit bookkeeping services:

Simplifies Financial Tasks

Intuit bookkeeping experts help you record daily transactions with ease. You can enter sales, track spending, and group costs into clear types. The system also lets you import bank and card data. This reduces manual work and helps keep your records clean.

Automates Invoicing

With Intuit bookkeeping tools, you can create and send invoices in minutes. You can add your logo, set terms, and send bills to clients fast. The system tracks which invoices are unpaid, helping you follow up on time.

Track Business Expenses

Intuit bookkeeping experts let you sort and review your spending. You can upload receipts, tag costs like travel or office supplies, and see where your money goes. This helps with budget control and smart planning.

Eases Bank Reconciliation

Matching bank records to your books can take time. Bookkeeping with Intuit speeds this up by matching entries from your bank to your records. It flags errors so you can fix them fast and keep your books correct.

Offers Clear Financial Reports

An Intuit-certified bookkeeper can give you reports like profit and loss, cash flow, and balance sheets.

These reports give you a full view of your business. They also help you make smart, informed choices.

Integrates with Other Tools

Intuit bookkeeping experts use tools that work well with QuickBooks and other apps.

This link helps move your data between systems with no need for manual work. It saves time and avoids errors.

Provides Cloud Access and Security

With Intuit bookkeeping services, you can log in from any device, anywhere.

It’s cloud-based, so your data stays safe and backed up. It also uses top security tools to keep your info safe.

Scales with Your Business

Bookkeeping with Intuit works for all business sizes.

Whether you are a solo owner or running a growing firm, it adjusts to fit your needs.

As you grow, you can add more users and features with ease.

Strong Customer Support and Learning

Intuit bookkeeping services come with full support.

You get access to guides, videos, forums, and live help. This is great for both new users and professionals.

Features of Intuit Bookkeeping That Matter Most

Bank Sync

Intuit bookkeeping experts help you connect your bank accounts. The system pulls in transactions each day to keep your records up to date.

Receipt Capture

You can take photos of receipts using your phone and match them to related expenses for quick, clear tracking.

Easy-to-Use Dashboard

The dashboard has a clean and simple design. It lets you see key data at a glance without the need to dig deep.

Mobile Access

You can use the system on your phone, tablet, or desktop. This makes it easy to check reports or send invoices from anywhere.

Customizable Reports

You can create reports the way you want. Filter them by date, category, or client for better insight.

Role-Based Access

Give each team member the right access level. This helps protect private data while allowing teamwork.

Who Should Use Intuit Bookkeeping Experts?

Small business owners

They can stay on top of their finances without hiring a full-time bookkeeper.

Freelancers and self-employed workers

They can manage income, spending, and taxes in a clear and simple way.

Startups

They can build strong habits for money tracking right from day one.

Growing companies

They can scale their systems and teams without losing sight of their money flow.

How to Start Using Bookkeeping with Intuit Tools

Getting started with bookkeeping with Intuit is simple. Whether you’re new to keeping books or switching from another system, follow these easy steps to begin managing your money the smart way.

Sign Up for an Intuit or QuickBooks Account

Go to the Intuit or QuickBooks site and create your account. Enter your email, pick a strong password, and share basic business info.

Pick a Plan That Fits Your Needs

Intuit bookkeeping services offer multiple plans. Choose one based on your business size, whether solo or growing.

Link Your Bank and Credit Cards

Connect your accounts so that bookkeeping with Intuit can pull real-time data automatically.

Set Up Invoices, Tax, and Business Settings

Add your logo, set tax rates, and adjust tools to your firm’s needs.

Use Reports to Track Business Health

Run cash flow, profit, and balance reports to guide smart decisions.

Add Your Team or Accountant

Grant proper access to your bookkeeper or team members for efficient collaboration.

Tips to Make the Most of Intuit Bookkeeping Experts

Check the Dashboard Each Week

View sales, bills, and trends weekly for better awareness.

Use the Mobile App to Stay on Top

Track and manage finances from your phone or tablet.

Set Up Reports on a Schedule

Automate the delivery of key reports like P&L and cash flow.

Use Tags and Groups for Better Insight

Sort data for smarter planning and tax prep.

Get Help from Intuit Experts

Don’t hesitate to ask for expert help as early fixes prevent costly issues.

Why Choose Intuit Bookkeeping Over Other Tools?

Trusted Name – Backed by Intuit

Known worldwide, Intuit offers trusted performance and safety.

Seamless Sync with QuickBooks

Easily integrates for smooth workflows and synced data.

Easy to Use, Accurate by Design

Simple for beginners, powerful for pros, built to prevent errors.

Fits Any Business Size

Scalable solutions that grow with you.

Help Is Always Available

Access guides, experts, and live chat for instant help.

Comparison: Manual vs. Intuit Bookkeeping Services

Feature | Manual Bookkeeping | Intuit Bookkeeping Services |

Data Entry | Manual | Automated |

Error Rate | High | Low |

Time Investment | High | Low |

Real-Time Insights | No | Yes |

Tax Prep | Difficult | Easy |

Scalability | Limited | High |

Mobile Access | No | Yes |

Get the most from Intuit bookkeeping with Meru Accounting. Our team uses Intuit tools to give you fast, clear, and correct records. We help your business stay on track, follow the rules, and avoid costly mistakes. With Meru Accounting, managing your finances is simple, so you can focus on growth. Let us handle your books and reach your goals with ease. Work with Meru Accounting today to see how our Intuit bookkeeping services can help your success.

FAQs

- How do Intuit bookkeeping experts prevent financial mistakes?

They track and update all data in real time, keeping your records correct and avoiding losses. - What are the main benefits of Intuit bookkeeping services?

They save time, lower costs, improve recordkeeping, and help with smart planning. They also ensure tax and financial rules are followed. - Why is real-time tracking useful?

It gives a live view of your accounts, so you can act fast and solve issues early. - How do Intuit bookkeeping experts help control money?

They provide accurate, current data to guide budgets, cash flow, and spending decisions. - Why are Intuit bookkeeping services more reliable than manual work?

Automation cuts errors. The tools find and fix problems quickly to keep your records clean. - How do Intuit bookkeeping services save time and money?

They automate routine tasks, reduce staff workload, cut costs, and free time for business growth. - Can Intuit bookkeeping services ensure tax compliance?

Yes. They track income and expenses accurately, follow tax rules, and reduce the risk of fines.