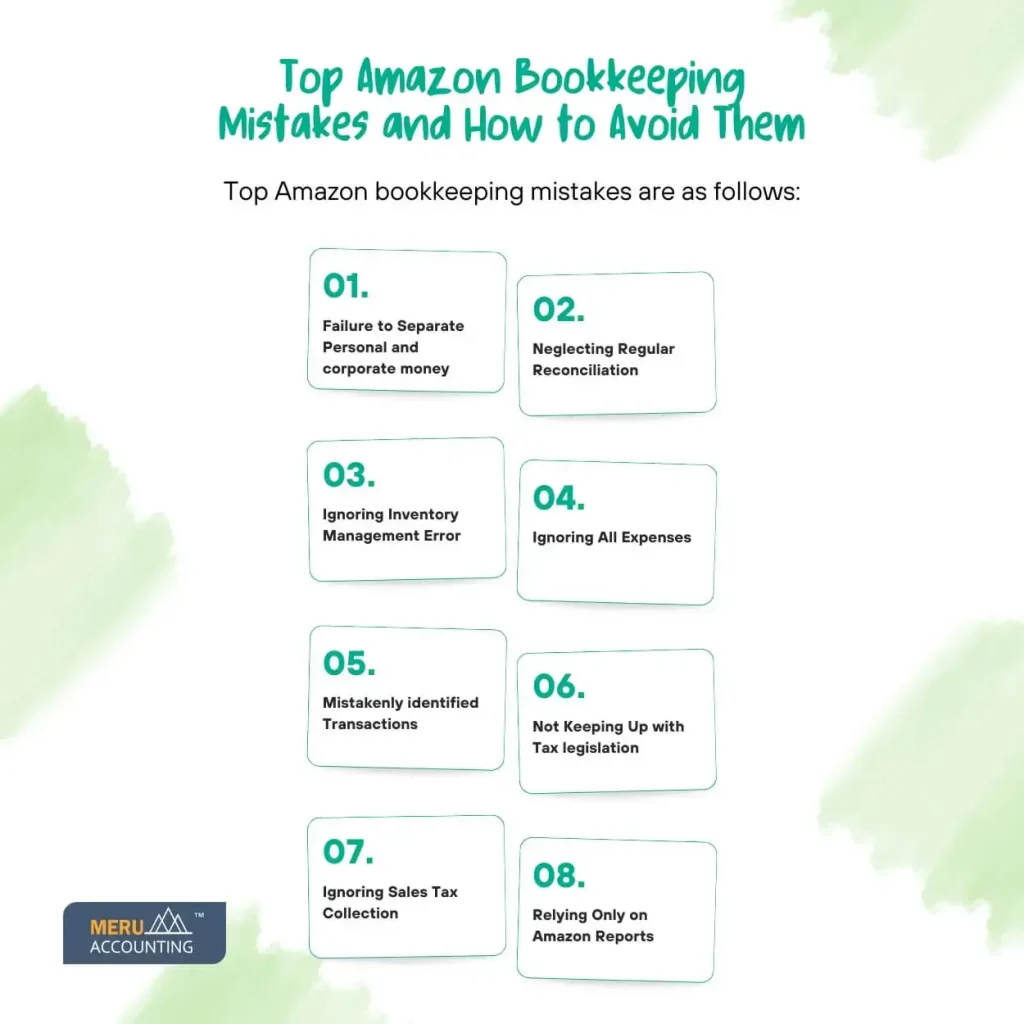

Top Amazon Bookkeeping Mistakes and How to Avoid Them

For Amazon sellers to secure continued business growth and financial stability, accurate bookkeeping is essential. Common bookkeeping errors, however, can affect progress and result in financial hazards. We will list the most common bookkeeping errors made by Amazon sellers in this blog and offer practical solutions to help you prevent them. These mistakes can lead to missed income and compliance problems. They can range from failing to properly track spending and overlooking sales tax responsibilities to improperly handling inventory costs and account reconciliation. We’ll go over useful advice for utilizing accounting software, maintaining accurate financial records, and putting up a strong bookkeeping system. Amazon sellers can increase their profitability, strengthen their financial management, and steer clear of expensive blunders by tackling these typical hazards.

Keeping accurate books on Amazon is crucial to running an online store on the marketplace. Sellers frequently undervalue the significance of precise bookkeeping, which can result in disparities in finances and problems with compliance. Making use of Amazon bookkeeping software may guarantee accuracy and expedite the procedure. This blog will discuss frequent bookkeeping errors made by Amazon sellers and provide helpful advice on how to avoid them.

Failure to Separate Personal and corporate money:

- Mistake: A common mistake made by Amazon sellers is to combine their personal and corporate money, which can result in unclear financial statements.

- Solution: Get a credit card and bank account specifically for business use. This division guarantees accurate financial records for your Amazon business and streamlines bookkeeping.

Neglecting Regular Reconciliation

- Mistake: Sellers frequently make the mistake of failing to reconcile their accounts on a regular basis, which leaves errors and discrepancies undetected.

- Solution: The answer is to plan routine reconciliations between your credit card and bank statements and your Amazon transactions. This procedure can be automated and error rates can be decreased by using Amazon bookkeeping software.

Ignoring Inventory Management

- Mistake: Inaccurate financial records and stock anomalies might result from poor inventory management.

- Solution: Connect your bookkeeping software with a reliable inventory management system. Keep track of expenses, sales, and inventory levels to keep accurate financial records.

Ignoring All Expenses

- Mistake: A lot of sellers fail to account for small costs, which can mount up and have an impact on profitability.

- Solution: Keep a record of every business expense, regardless of size. Utilize Amazon bookkeeping software to precisely classify and record each expense.

Mistakenly identified Transactions

- Mistake: Mistakes in transaction classification might result in erroneous tax returns and financial statements.

- Solution: Learn about appropriate accounting classifications and classify transactions in a consistent manner. To reduce errors, use bookkeeping software from Amazon that has automated classification features.

Not Keeping Up with Tax legislation

- Mistake: Penalties and non-compliance may arise from a failure to stay current with tax legislation.

- Solution: Keep up with tax regulations that affect your Amazon firm. Utilize tax compliance tools in your bookkeeping software to make sure you adhere to all legal obligations.

Ignoring Sales Tax Collection

- Mistake: Some vendors fail to gather and send in sales tax, which might result in monetary and legal problems.

- Solution: Recognize your sales tax responsibilities and make sure you collect and send in the appropriate amount. Sales tax reporting and computations can be automated with the use of Amazon bookkeeping software.

Relying Only on Amazon Reports

- Mistake: Financial records that are not comprehensive may result from relying solely on Amazon’s financial reports.

- Solution: To combine all financial information from several sources, use Amazon bookkeeping software. This method offers a thorough understanding of the financial situation of your company.

Conclusion

For the profitability of your online store, maintaining accurate Amazon bookkeeping is essential. Your financial management can be greatly enhanced by avoiding typical errors including failing to keep personal and corporate finances separate, skipping frequent reconciliation, and not paying attention to inventory management. By using Amazon bookkeeping software, you can maintain accuracy, expedite procedures, and remain in compliance with tax laws.

For Amazon merchants, Meru Accounting provides professional bookkeeping services. To effectively manage your finances, our staff can assist you in putting best practices into practice, avoiding typical pitfalls, and using the appropriate tools. To find out how we can help your Amazon business be financially stable, get in touch with us right now.