Benefits of Using Drake Tax Software to Prepare a Tax Return

Preparing taxes can be stressful for both individuals and professionals. The process needs accuracy, speed, and compliance with tax laws. Drake Tax Software is a top pick for accountants, CPAs, and tax preparers. This software helps to manage tax returns in a smooth and simple way. It combines powerful tools with an easy-to-use design, making tax filing less of a burden.

What is Drake Software?

Preparing tax returns is a difficult task that requires extensive knowledge and technical know-how to manage tasks such as filing for returns, managing payroll and transactions, and attending to clients.

Drake Software provides an accessible, user-friendly, and professional interface to make tax returns, speed up the filing of tax returns, and improve productivity to aid professionals in preparing tax returns and accelerate the pace of their work.

The services provided by Drake Software sequentially enhance customer value for professionals and build up their practice.

Role of Drake Software in Tax Preparation

1. Simplifying Tax Filing

Drake Tax Software makes tax filing less stressful by guiding users through each step. It organizes forms, checks for errors, and ensures all required data is entered.

2. Helping Accountants and CPAs Work Faster

The software reduces manual work for accountants. It allows them to complete more returns in less time, which means more clients served in a season.

3. Improving Accuracy in Returns

Mistakes in tax filing can be costly. Drake’s error-check system spots missing or wrong entries before you submit.

4. Supporting Different Tax Needs

It works for individuals, small businesses, corporations, and non-profits. This makes it useful for firms that serve many client types.

5. Enabling Remote and In-Office Work

Drake can be used on a desktop or in the cloud. This lets accountants work from home or the office with the same data.

6. Staying Compliant with Tax Laws

The software updates often to follow IRS rules, keeping your filings up to date and compliant.

Features and Working Mechanisms of Drake Tax Software

User-Friendly Navigation and Calculation Tools

Drake Tax Software makes preparing returns simple with a clean menu layout and smooth navigation. You can quickly review returns before filing or e-filing. Built-in error alerts highlight calculation mistakes, while calculation notes, tips, and reminders help improve filing accuracy.

Tax Planning and Analytics

Professionals can plan client returns, compare tax data across years, manage separate filings, and file schedules with ease. Tools like LookBack, LinkBacks, and DoubleCheck verify data, reference prior-year entries, and ensure accuracy. Multi-Office Manager allows you to track workflow and analyze performance.

Streamlined Data Entry

Flexible forms reduce keystrokes and let you choose your preferred input method. You can define and lock fields, access research tools, browse tax resources, and use the built-in knowledge base for technical support.

Importing and Exporting

Save time by importing prior-year data, W-2s, Schedule D, Form 8615, K-1, trial balances, and other reports. Export professional reports for clients to maintain a polished presentation.

Drake Documents Integration

Securely store tax forms, returns, client records, and other documents in a digital filing system. You can set default descriptions, watermark scanned files, and create fillable PDF tax returns for easy storage.

Quick Estimator and Loan Tools

Easily generate fee estimates, customize billing statements, and calculate refunds. The amortization schedule feature helps clients determine loan payments and track interest.

E-Signature and E-File

Eliminate manual paperwork with digital signatures and e-filing. E-signatures are secure, tamper-proof, and legally bound to documents. Clients can approve consent forms and file state returns online.

Secure Data Storage

All sensitive information is protected with strong encryption, ensuring compliance with privacy and IRS standards.

Cloud-Based Access and Multi-User Collaboration

Work from anywhere with the cloud version, keeping files secure and synced. Multiple users can collaborate on returns in real time without losing track of changes.

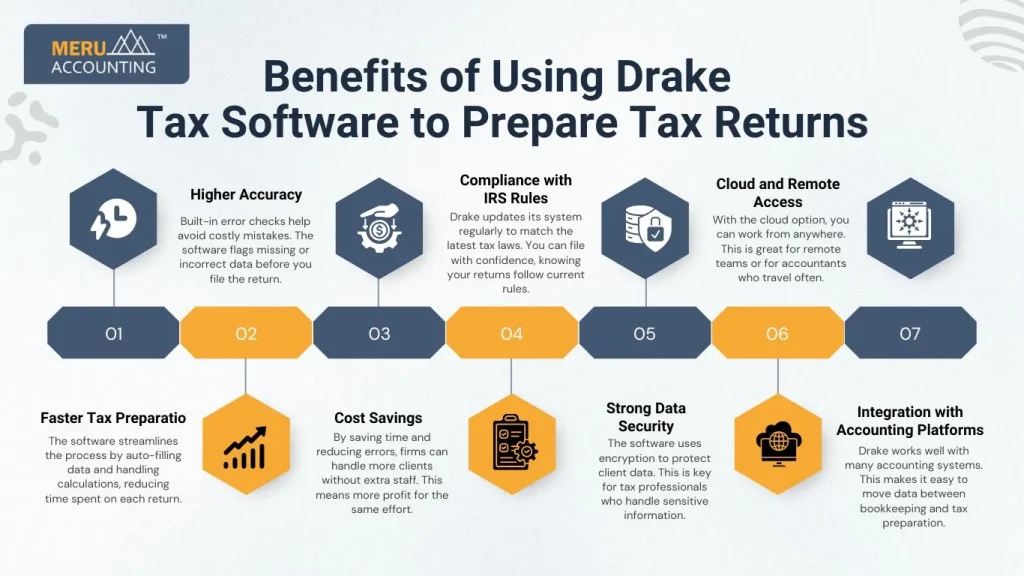

Benefits of Using Drake Tax Software to Prepare Tax Returns

1. Faster Tax Preparation

The software streamlines the process by auto-filling data and handling calculations, reducing time spent on each return.

2. Higher Accuracy

Built-in error checks help avoid costly mistakes. The software flags missing or incorrect data before you file the return.

3. Cost Savings

By saving time and reducing errors, firms can handle more clients without extra staff. This means more profit for the same effort.

4. Compliance with IRS Rules

Drake updates its system regularly to match the latest tax laws. You can file with confidence, knowing your returns follow current rules.

5. Strong Data Security

The software uses encryption to protect client data. This is key for tax professionals who handle sensitive information.

6. Cloud and Remote Access

With the cloud option, you can work from anywhere. This is great for remote teams or for accountants who travel often.

7. Integration with Accounting Platforms

Drake works well with many accounting systems. This makes it easy to move data between bookkeeping and tax preparation.

When people think of tax software, they often focus on how it helps accountants. But one of the biggest advantages of Drake Software is the way it improves the client’s experience. Happy clients mean more referrals, repeat business, and a stronger reputation for tax professionals.

How Drake Tax Software Improves the Client Experience

When you think of tax software, you may see it as a tool for the accountant. But Drake Tax Software also helps the client in many ways. A happy client is more likely to come back and to tell others about your work.

1. Fast Turnaround

Clients want their taxes done on time. Drake helps you work fast with auto-fill and smart forms. This means you can give the client their tax report much sooner.

2. Clean, Clear Reports

Clients like to see a tax report they can read with ease. Drake gives neat, clear files that show key points. This helps the client know what is in their return without stress.

3. Fewer Mistakes

No one likes to fix a tax file after it is sent. Drake checks for small and big errors as you work. This means the client can trust the end file you give them.

4. Safe Data

Clients need to know their data is safe. Drake uses strong locks on files and only lets the right people in. This helps keep trust high and risk low.

5. Work From Anywhere

With Drake’s cloud, you can serve the client even if they are far away. They can send you docs online, and you can send the tax file back the same way.

6. Better Follow-Up

Drake keeps client files in one spot. This means you can find them fast for a check-up or next year’s return.

By making work fast, clear, and safe, Drake Tax Software helps you serve clients better. This makes the client happy, builds trust, and keeps them coming back year after year.

Case Studies and Real-World Applications

1. Boosting Efficiency in a Small CPA Firm

A small CPA firm switched to Drake Software and cut preparation time by 40%, allowing them to serve more clients in peak season.

2. Helping a Solo Preparer Work Across States

A freelance tax preparer used the cloud version to serve clients from multiple states without leaving their home office.

3. Scaling Operations for a Large Firm

A large firm integrated Drake with its accounting systems, handling hundreds of returns per week with fewer staff hours.

4. Improving Accuracy in Non-Profit Filings

A non-profit organization reduced filing errors and avoided penalties by using Drake’s built-in compliance checks.

5. Reducing Costs for a Startup Accounting Firm

A new firm chose Drake for its affordable pricing and automation, allowing them to compete with larger firms.

6. Managing Complex Corporate Returns

A corporate accountant used Drake’s automation tools to handle multi-entity returns without delays.

At Meru Accounting, we use Drake Tax to give quick, safe, and accurate tax preparation. Our team knows how to get the best from its strong tools, so each return is done with care. We help people, small firms, and big firms file taxes with no stress. By mixing our skills with the speed of Drake, we save you time, cut flaws, and keep you in line with IRS rules.

FAQs

- What is Drake Tax used for?

It is used to make and file tax returns. It helps tax pros, CPAs, and firms work quick and with more ease. - Is Drake Tax easy to use for new users?

Yes. It has a clean look and plain menus. New users can learn it fast. - Can Drake Tax do both personal and business returns?

Yes. It works for both. You can file for people, small firms, and big firms. - Does Drake Tax update for new tax laws?

Yes. It updates a lot to match the latest IRS rules. This helps you stay in line. - Is my client’s data safe in Drake Tax?

Yes. It uses strong locks and tools to keep all data safe from harm. - Can I use Drake Tax in the cloud?

Yes. A cloud type is there. You can work from any place with web access. - How much does Drake Tax cost?

The cost will depend on the type and tools you pick. It is known to be low in cost when you match it with most tax tools.