Exploring the Benefits of Virtual Bookkeeping Services for Your Business

Bookkeeping may seem simple, but without virtual bookkeeping services, it’s easy to make costly errors. Many times, errors and delays happen due to less-qualified and less-experienced in-house staff. This is a common issue in companies of all sizes. It’s seen more in small businesses across the USA, where hiring skilled bookkeepers at a low cost is hard. That’s why outsourcing to virtual bookkeeping services is a better choice. It ensures better records and improves the quality of your finances.

Proper bookkeeping helps make good decisions. With expert help, your records stay clean, and your reports become reliable.

In the USA, there are many remote bookkeeping companies offering quality services. But you cannot select just any provider. For the best results, you must consider a few key points when choosing remote bookkeeping services. A reliable provider of virtual accounting services can improve your financial system and support business growth. In this blog, we will explain what is virtual bookkeeping, how it works, and the many benefits it brings to your business.

What is Virtual Bookkeeping?

Virtual bookkeeping means keeping financial records from a remote place. A bookkeeper works online, not in your office, and uses tools to track and manage your business’s money flow.

How It Works

- You send your data using a secure site.

- The bookkeeper logs in and updates your books.

- They use tools like QuickBooks, Xero, or Zoho Books.

- This is one of the benefits of virtual bookkeeping; it helps you manage your books without an in-house team.

Which Factors to Consider While Looking for Remote Bookkeeping Companies?

When you choose virtual bookkeeping services, it’s key to check the quality and experience of the provider. Let’s take a look at the key factors to consider:

1. Quality of Service

You need trained and experienced staff to handle the books. The company should know U.S. accounting rules and use them properly. They must follow all bookkeeping steps and give error-free work. This ensures your financial reports are easy to prepare and your cash flow stays clear.

2. Prompt Services

Time is crucial. The provider must not delay the work. Late bookkeeping leads to problems in tax filing, planning, and other tasks. Clear and fast communication is also needed. Tools like Zoom and Skype should be used to maintain smooth coordination.

3. Equipped with Technology

Bookkeeping needs the right tools. The firm should use cloud-based software that automates tasks and makes entries quick and precise. Software like QuickBooks, Xero, and Wave is often used. With this, your data stays safe and your team can access it anytime.

4. Data Security

Your business data is sensitive and needs full protection. Remote bookkeepers must have strong security policies. They should work on cloud-based platforms with daily backups, encryption, and access control.

5. Cost-Effective

Hiring in-house staff brings costs for training, salaries, space, and tools. Outsourcing cuts most of these. Virtual bookkeeping firms offer services at lower costs. This helps you get expert work without overspending.

These are key areas to focus on while outsourcing your bookkeeping work. The goal is to let your team focus on the core business, while experts handle the financial records. Since there are many providers, make sure to select the one that gives the best value.

How Do Virtual Bookkeeping Services Help Your Business?

Even though it’s routine, managing books through virtual bookkeeping services can save both time and effort. Small errors can lead to major issues. Mistakes in entries can affect your financial reports and decisions.

With virtual accounting services, skilled bookkeepers ensure fewer errors and better accuracy. But most businesses don’t have the time or staff to manage this well. This is where online bookkeeping services come in. They offer clean and precise records at a fair price while saving you time.

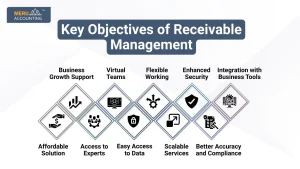

Key Benefits of Virtual Bookkeeping Services

1. Affordable Solution

Businesses always look to reduce costs. A full-time bookkeeper in the U.S. can cost between $43,980 and $55,450 per year. This also includes added costs like health benefits, bonuses, and overheads. But if you outsource, you only pay for what you use. That’s a clear saving.

2. Business Growth Support

If you’re a small business owner, you may only have one accountant to handle everything from entries to taxes. This can overload them. By outsourcing bookkeeping, your staff gets more time to focus on other areas like planning, tax saving, or investments.

3. Access to Experts

Many firms give the bookkeeping task to junior staff to cut costs. But this can lead to errors. While it saves money, it puts your records at risk. Hiring experienced pros can be costly. The best solution is to outsource to skilled virtual teams.

4. Virtual Teams

Yes, remote bookkeepers are often better. They handle many clients and are trained in several software tools. They bring speed and accuracy to the work.

5. Easy Access to Data

Every business needs access to its books. Online bookkeepers use cloud platforms, so you can check your records anytime, from anywhere.

6. Flexible Working

In-house bookkeepers usually work fixed hours. You must pay extra for overtime. But with virtual teams, you pay only for the hours worked. They are more flexible and meet deadlines better.

7. Scalable Services

As your business grows, your needs change. Virtual bookkeeping grows with you. You can add payroll, stock tracking, or support for other currencies. No need to hire or train new staff. The team shifts with your goals.

8. Better Accuracy and Compliance

One of the key benefits of virtual bookkeeping is the use of smart tools to reduce errors and boost accuracy. They follow top rules and build clear audit logs. This helps you meet tax rules and avoid fines.

9. Enhanced Security

Your data is kept in secure cloud systems. These use strong locks, backups, and strict rules.

Only approved people can view your data. This lowers the risk of theft or loss.

10. Integration with Business Tools

Most virtual bookkeeping services use apps that connect with tools like POS, CRM, and payment platforms. All your data is in one place. You save time and get updates in real time. This gives you a full view of your business.

What Are the Disadvantages of Virtual Bookkeeping Services?

While virtual bookkeeping has many benefits, there are a few points you should be aware of:

1. Data Security Concerns

Even with strong safety tools, there is always a slight risk of data leaks or theft. Your financial data is private, and any misuse can harm your business. Make sure the provider uses secure servers, strong passwords, daily backups, and data encryption to protect your records.

2. Managing Communication

You can’t meet your virtual bookkeeper face-to-face. Time zone gaps and busy hours can make it hard to talk when needed. This may lead to delays or errors. To fix this, set a clear plan for calls, updates, and how often you’ll talk.

3. Limited Real-Time Collaboration

An in-house team is often there when you need them. But with a remote bookkeeper, replies may not come right away. If you want real-time help or changes, this can slow things down. Set clear working hours and response times with the bookkeeper.

4. Lack of Business Context

A remote bookkeeper might not fully understand your daily work. They may miss key details about your process or industry. This can affect how they record or review your data. To solve this, share updates and give some training on how your business works.

What Are the Services Offered by Virtual Bookkeeping Companies?

Today, businesses realize how vital bookkeeping is. Small companies often cannot afford full-time staff or may not be happy with their current system. Outsourcing to a virtual team gives them a better way to manage records.

These virtual bookkeeping services are done by a third-party team from a remote site. They keep your books in good shape while your team focuses on the core business.

There are many service providers in this space. But you must select the right one to meet your needs.

Before you outsource, understand what you should expect. Here are some key services most virtual bookkeeping firms offer:

1. Accurate Transaction Recording

They track all business income and expenses in the correct accounts. This helps maintain clean books and avoids confusion later.

2. Compliance with Laws

A good bookkeeper knows the legal rules and tax policies. They ensure all tasks follow the law.

3. Industry-Based Services

Although the steps of bookkeeping are mostly the same, each industry has unique needs. Your provider should be able to adapt to your business type.

4. Financial Reporting

A big part of virtual accounting services is preparing reports like profit & loss, balance sheets, and cash flow summaries. These help you understand the financial state of your business.

5. Quick Responses

Delays in replying to questions or handling tasks can hurt your work. A good team gives timely updates and meets all deadlines.

6. High Accuracy

Mistakes can lead to wrong tax filings, wrong reports, and missed trends. Accuracy must be a top priority.

7. Cost Savings

One main reason to choose virtual services is to save money. By outsourcing, you reduce costs while getting expert-level service.

How to Find the Best Virtual Bookkeeping Services for Your Business?

Due to its value and cost savings, virtual bookkeeping services are now in high demand. More firms are moving online to manage their books. It offers ease, savings, and access to global talent. But with so many options, picking the right one is not easy.

If you’re looking to choose the right virtual accounting services, here are the key steps to help you find the best fit.

1. Know What You Need

Before choosing virtual accounting services, list what you need, like payroll, tax prep, or billing. Do you want help with payroll, billing, taxes, or just bank reconciliations? This will help you narrow down your options.

2. Check Experience and Skills

Only trust your business’s books with trained and skilled experts. Look for firms with a good history and proven results. Choose certified bookkeepers who know your industry.

3. Learn About the Tools Used

Different firms use different software. Make sure their tools work well with yours. Cloud-based software is the best, as it allows easy access and sharing.

4. Read Reviews and Ask for References

Check online reviews and ratings. You can also ask the firm to give contacts of other clients, and talk to them to learn about their experience.

5. Compare Prices

Prices vary. Don’t always choose the cheapest. Look at the quality and experience offered for the price. Balance cost with value.

6. See How They Communicate

Since all work is remote, strong communication is key. The firm must reply fast and keep you updated. Ask if they offer calls, chats, or emails.

How to Choose the Right Virtual Bookkeeping Service

1. Check Qualifications

- Look for certified bookkeepers or accountants.

- Ask about their experience in your industry.

2. Understand the Software

- Make sure they use cloud tools like QuickBooks or Xero.

- Ensure they support apps you already use.

3. Ask About Data Security

- Confirm they follow secure practices.

- Ask about backup and encryption.

4. Review the Cost

- Get a clear price breakdown.

- Avoid hidden fees or long contracts.

5. Look for Good Communication

- Choose a team that responds quickly.

- You should be able to reach them by email or phone.

Benefits of Virtual Bookkeeping Over Traditional Bookkeeping

Feature | Virtual Bookkeeping | Traditional Bookkeeping |

Location | Remote | Office-based |

Cost | Lower | Higher |

Flexibility | High | Low |

Real-Time Data | Yes | Often delayed |

Access to Experts | Global | Local |

Integration with Software | Easy | Limited |

Real Examples of Success

A Freelance Designer

- Switched to virtual bookkeeping.

- Saved 10 hours per month.

- Improved tax filing accuracy.

An Online Store

- Hired virtual accounting services.

- Integrated Shopify with QuickBooks.

- Gained real-time inventory and finance tracking.

A Startup Founder

- Avoided full-time hire.

- Used a virtual bookkeeper for reports, payroll, and taxes.

- Focused more on the product and the clients.

Virtual bookkeeping services offer more than just saving money. They give access to professional support, real-time data, and time-saving tools. Whether you are a small business or a growing startup, these services can keep your books clean and your stress low. Virtual bookkeeping is the best option for many small and mid-size businesses. It offers expert service, saves costs, and gives more time to grow your company.

Meru Accounting provides high-quality virtual bookkeeping starting at just $10/hour. Our team includes CPAs, Chartered Accountants, and trained staff who work with top tools like QuickBooks and Xero.

With Meru Accounting, your books stay error-free, reports stay on time, and your business stays ready for the future.

FAQs

- What is virtual bookkeeping?

It is bookkeeping done remotely using cloud software and digital tools. - How does a virtual bookkeeper work?

They access your data online, manage your books, and send reports regularly. - Are virtual accounting services secure?

Yes, they use encryption, firewalls, and secure servers. - Can I use virtual bookkeeping for a small business?

Yes, it’s ideal for small businesses due to its low cost and flexibility. - Which software is best for virtual bookkeeping?

QuickBooks, Xero, and Zoho Books are top choices. - How much do virtual bookkeeping services cost?

It depends on the service, but it’s usually cheaper than hiring full-time staff. - Can virtual bookkeeping handle taxes?

Yes, most services help with tax prep and coordination with tax experts.