What Services Do Receivables Management Services Include?

Managing your accounts receivable is vital for maintaining cash flow. Many businesses face late payments, unpaid invoices, and follow-up problems. That’s where receivables management services come in. These services help you collect payments on time and keep your business running smoothly.

In this blog, we will explain all the major accounts receivable management services. These services are simple but powerful tools to protect your money and save time.

What is Accounts Receivable Management?

Accounts receivable management means tracking money owed by customers. It includes sending invoices, giving payment reminders, and collecting dues. When done well, it helps keep your cash flow smooth and cuts down on bad debts.

It also covers setting credit terms, watching for late payments, and fixing billing issues. Good receivables management builds trust with clients and supports better money planning. Many firms now use tools to speed up tasks and reduce errors.

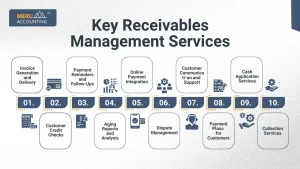

Key Receivables Management Services

Let’s look at the major services that help manage receivables effectively.

1. Invoice Generation and Delivery

- Creating accurate invoices is the first step.

- Invoices must include due dates, terms, and item details.

- Many receivables management services use automation tools.

- Invoices are sent by email or client portals for fast delivery.

2. Customer Credit Checks

- Not all clients should get credit.

- Before offering credit, check their credit history.

- This step reduces the risk of delayed payments.

- Accounts receivable management firms check client credit ratings.

3. Payment Reminders and Follow-Ups

- Many clients delay payments simply due to forgetfulness.

- Reminder emails or SMS help reduce late payments.

- Follow-up calls can also push for timely payments.

- This task is part of most receivables management services.

4. Aging Reports and Analysis

- Aging reports show how long invoices remain unpaid.

- It helps find slow-paying customers.

- Businesses can then take action faster.

- Accounts receivable management experts create these reports monthly.

5. Online Payment Integration

- Make payments easy for customers.

- Integrate online payment options like UPI, bank transfer, cards, etc.

- Quick and easy payment methods reduce delays.

- This is a key part of digital receivables management services.

6. Dispute Management

- Sometimes customers dispute the invoice.

- Handling disputes early keeps customers happy.

- These may include wrong amounts, missing items, or double billing.

- Accounts receivable management includes quick dispute resolution.

7. Customer Communication and Support

- Good communication is essential.

- Clear emails, follow-ups, and polite reminders build trust.

- Support teams handle customer concerns and payment-related queries.

- A good receivables management service always includes this.

8. Payment Plans for Customers

- Some customers want to pay in parts.

- You can set up installment plans.

- Helps in recovering large dues.

- This makes accounts receivable management more flexible.

9. Cash Application Services

- Matching incoming payments with invoices is called cash application.

- This helps maintain clean and updated books.

- Automation tools reduce errors in this process.

- Leading receivables management services offer automated cash application.

10. Collection Services

- For long overdue payments, third-party collections may help.

- These firms follow strict rules while collecting dues.

- They reduce your burden and increase the chance of recovery.

- Collection is an advanced part of accounts receivable management.

Best Practices in Accounts Receivable Management

Many firms miss basic but key steps in handling accounts receivable. Here are some best practices that help reduce risk and improve cash flow:

1. Avoid Giving Credit to Everyone

Always run a credit check before offering terms. Ask for ID and verify the buyer’s profile. If the client is risky, ask for upfront payment.

2. Get a Personal Guarantee

Ask business clients to sign a personal warranty. This builds trust and gives a legal hold if the payment is late.

3. Define Payment Terms First

Put payment terms in writing before you start work. Clear terms avoid delays and issues later.

4. Send Invoices on Time

Send bills right away. Late invoicing means late payments. Use tools that send invoices and follow-ups fast.

5. Offer Easy Payment Options

The simpler it is to pay, the faster you’ll get paid. Use online tools and give clients multiple options.

6. Track Payments Closely

Check accounts every day. Spot and report issues early to avoid bigger problems later.

7. Plan for Overdue Invoices

Have a set plan to deal with unpaid bills. Set rules for late fees, interest, or how and when to contact the client.

8. Follow Your Rules

Stick to your credit and collection rules. Treating each case the same builds fairness and reduces stress.

9. Watch Out for High-Risk Clients

Some clients may keep paying late. Cut risk by reducing their credit or asking for full advance payment.

Benefits of Receivables Management Services

Fewer Overdue Invoices

A structured plan with regular follow-ups ensures more bills are paid on time and fewer go past due.

Better Client Relationships

Clear billing builds trust. Clients value prompt, fair, and clear communication about money.

Faster Payment Cycles

With automation and live tracking, the time between sending a bill and getting paid is much shorter.

Lower Bad Debt Risk

By tracking client habits and checking credit reports, AR services help you spot risks early and avoid big losses.

24×7 Payment Tracking

Most providers offer real-time dashboards. You can track, review, and respond to issues anytime—even after hours.

Signs You Need AR Management Services

Lots of Unpaid Invoices

If unpaid bills are stacking up, it’s time to call for help. AR services can speed up recovery and improve cash flow.

Frequent Payment Chasing

When your team spends too much time chasing payments, it hurts other work. Let AR pros take over the follow-ups.

No Time to Track Payments

Busy days often mean missed due dates. AR systems handle alerts and follow-ups without manual work.

Cash Flow Gaps

Late payments can cause delays in paying staff or vendors. AR services help you get paid faster and keep things moving.

Billing and Bookkeeping Mistakes

Manual work often leads to slip-ups. AR experts help keep records right and up to date.

Tools Used in Receivables Management

- QuickBooks: Good for small to mid-sized firms.

- Xero: Easy-to-use and ideal for small firms.

- FreshBooks: Perfect for freelancers and service pros.

- Zoho Books: Budget-friendly with rich features.

- NetSuite: For large firms with more needs.

- SAP AR: Used by global and enterprise firms.

How to Pick a Good AR Partner

Know Their Industry Skills

Choose a team that knows your field. It makes a big difference.

Ask About Tools

Make sure their tools sync with your systems to cut down extra work.

Read Reviews

See what others say about their service quality and support.

Check Scalability and Support

Pick a partner who can grow with you and help when you need it.

Ensure Legal Safety and Data Care

The right provider will follow all laws and keep your data safe.

Why Use Accounts Receivable Management Services?

Accounts receivable (AR) management services help your business stay on top of customer payments. They help save time, speed up payments, and improve cash flow.

Reduce Payment Delays

Late payments can cause real problems. AR services send invoices on time and remind clients before due dates. This keeps money coming in and reduces payment delays.

Improve Cash Flow

Getting paid on time helps you pay bills, run your business, and plan for growth. Effective AR services help smooth out cash flow so you can avoid stress.

Save Time on Follow-Ups

Chasing unpaid bills eats up hours each week. AR teams handle this with smart tools and reminders, giving your staff time to focus on what matters most.

Cut Down on Billing Errors

Errors in bills slow down payments and hurt trust. These services use smart tools to make sure invoices are right and sent on time.

Focus on Growth

With AR in expert hands, you can focus on big goals like sales, new products, and better service instead of worrying about who hasn’t paid yet.

Dispute Resolution in Accounts Receivable

How to Handle a Wrong Debt Claim with Receivables Management Services

Good receivables management is key to strong accounting. If a client gets a wrong bill, it may lead to disputes. U.S. firms follow set steps to handle such cases well.

What Is a Dispute in Receivable Management?

A dispute happens when the invoice or billing has errors. If not fixed, it can slow down payments and affect the business’s cash flow. A clear method must be used to fix such errors.

Common Types of Disputes

- Quality Dispute

The product or service does not meet client needs. - Price Dispute

The price charged is not what was agreed. - Admin Dispute

Missing or wrong billing details. - Unbilled Goods

Items or services are billed incorrectly. - Double Billing

The client is charged twice for the same thing.

Steps to Resolve a Dispute

- Case Received

The analyst reviews the issue sent by accounts. - Prioritize and Track

A unique ID is assigned to each case to track progress. - Data Collection

Key records are pulled, like invoices, delivery proof, tax bills, etc. - Request Missing Info

If documents are missing, they are requested from the right person. - Solve the Case

Once all facts are clear, the case is closed via refund, collection, or write-off.

What If You Think Receivables Management Services Is a Scam?

Receivables Management Services (RMS) is a real collection firm. If you see their name on a credit report, take these steps:

- Check the Notice

Make sure the debt is real and the amount is right. - Ask for Proof

Request a debt validation letter. They must prove the debt is valid and that they have the right to collect. - Know Your Rights

If things seem off, talk to a lawyer or file a report with the FTC or the Consumer Protection Bureau.

Can You Settle a Debt with Receivables Management Services?

If you can’t pay in full, ask for a deal. But be careful:

- Don’t Pay Right Away

Only pay if you’re sure the debt is yours. - Read the Fine Print

Payment plans may come with extra fees or terms. - Never Share Bank Info

Avoid giving access to your bank account. - Get It in Writing

If you settle, get the terms in writing and keep a copy.

Managing accounts receivable is more than just sending invoices. It includes smart credit checks, strong follow-up, clear rules, and a solid plan for disputes. If needed, outsourcing to a skilled service can save time, cut stress, and help your business grow with better cash flow. At Meru Accounting, we provide smart receivables management services to help you get paid on time and cut late bills. Our team handles your accounts receivable management with clear bills, quick follow-ups, and easy tools. Let us manage your AR while you grow your firm.

FAQs

Q1. What are receivables management services?

They help firms track bills and get paid on time.

Q2. Why is accounts receivable management important?

It helps keep cash flow smooth and cuts bad debts.

Q3. Can small businesses use AR services?

Yes, they help small firms save time and get paid.

Q4. What tools are used for accounts receivable management?

Tools like QuickBooks, Zoho, Xero, and FreshBooks are used.

Q5. Is outsourcing AR management safe?

Yes, if the firm is trusted and keeps data safe.

Q6. What happens if customers don’t pay?

The AR team sends reminders or hires a collection firm.

Q7. Can AR services reduce overdue invoices?

Yes, they help by sending notes and calling clients.