How to Calculate Payroll Returns and Pay Payroll Tax Easily

Managing staff pay is key for every business. To stay compliant, you must pay your team on time and calculate payroll returns accurately while handling payroll tax with ease. If you make a mistake, you risk late fees, staff issues, or even audits. In this guide, we show you a clear way to work out payroll returns, pay your payroll tax, and keep your books neat.

Why Payroll Returns and Payroll Tax Matter

Payroll returns and payroll tax play a key role in any business. They make sure that staff pay and tax rules are met on time. When a firm files payroll returns, it shows wages paid, tax held back, and other staff costs. This helps the tax office check that rules are met.

Payroll tax is also a big part of staff pay. It funds key state and local needs such as health, roads, and schools. If a firm does not pay payroll tax correctly, it can face fines, late fees, and audits.

Good payroll work builds trust with staff and the tax office. It keeps your firm safe from risk and shows that you care about rules and fair pay. With clear payroll returns and taxes, a firm runs smoothly and stays free of legal stress.

What Happens if You Miss Payroll Returns?

Heavy Fines and Penalties

You may face big fines if you miss payroll returns. These costs can pile up fast and put pressure on your cash flow.

Risk of Audits and Legal Action

You could get audits or legal notices from tax bodies. This adds stress and takes time away from running your business.

Wrong or Missing Staff Tax Forms

Staff may not get the correct tax forms on time. This makes it hard for them to file their own taxes and causes frustration.

Damage to Business Trust

Errors can hurt your business’s trust. Both staff and clients may lose faith if payroll and tax work are not handled well.

Interest on Unpaid Taxes

Missing payroll tax payments often leads to added interest. The longer you wait, the more money you will owe.

Strain on Staff Morale

Late or wrong payroll returns may affect how staff feel about the company. Employees want to be sure their pay and tax records are correct.

Possible Loss of Business License

In some cases, not filing payroll returns can risk your license or rights to run the business. This can stop growth and harm your long-term goals.

Understanding Payroll Returns and Their Role

Payroll returns are a set of forms you file to show all pay details. They tell the government:

- How much do you pay your staff?

- How much tax did you take from their pay?

- What benefits did you give, like health or retirement plans?

- What part of the tax do you, as an employer, have to pay?.

These returns help you prove you follow the law. They also make it easy to check your accounts later.

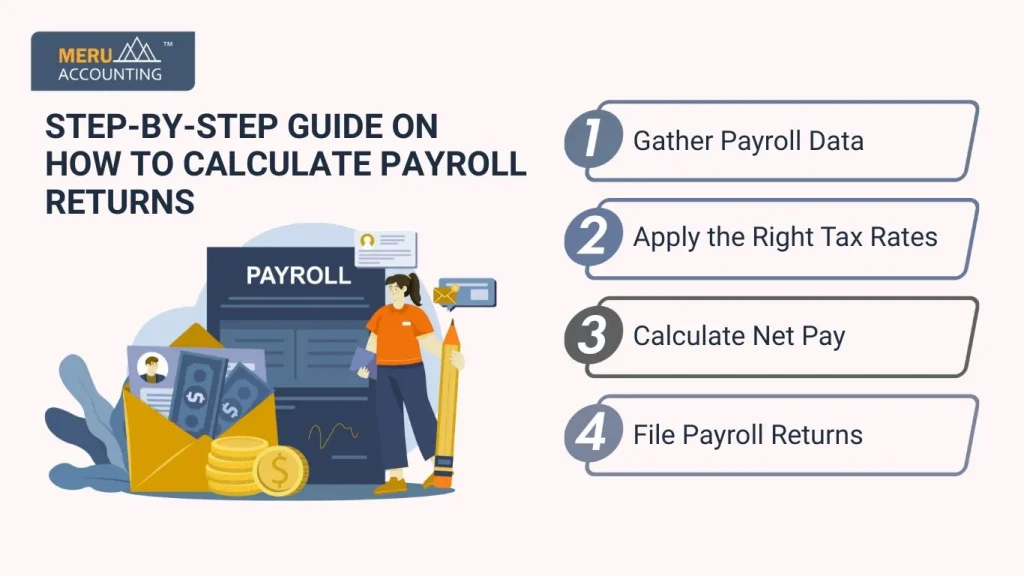

Step-by-Step Guide on How to Calculate Payroll Returns

Here’s a simple plan to keep payroll clear and correct:

Gather Payroll Data

- Collect all pay slips and time sheets.

- Note wages, bonuses, and benefits.

- Make sure details match with staff contracts.

Apply the Right Tax Rates

- Check federal, state, and local tax rates.

- Include employee and employer shares.

- Update rates if rules change to avoid mistakes.

Calculate Net Pay

- Gross pay – deductions – tax = net pay.

- Do this for each worker.

- Keep a record for reports.

File Payroll Returns

- Fill out the required forms for tax bodies.

- File them on time to avoid penalties.

- Use digital filing for speed and accuracy.

Follow these steps to calculate payroll returns easily and stay tax-compliant.

Which are the taxes to be considered before calculating the payroll returns?

Here are a few taxes that need to be calculated:

1. Social Security tax rate

The social security tax rate for each employee is 6.2%. For example, if the gross taxable wages of the employee are $1000, then the employee needs to pay $62 as tax. Further, these taxes have some criteria that exempt them from the payment of full taxes.

2. FICA tax

FICA tax is the employer and employee–paid tax for Medicare and Social Security. The employee and the employer both pay the matching contributions of the taxes. These taxes ultimately go towards Medicare and Social Security taxes.

3. Medicare taxes

The employee has to pay 1.45% taxes on the wages they earn under the Medicare tax rates. The employer must also pay 1.45% as the matching contributions. The Medicare taxable wages do not have a wage base limit; here, they need to pay 0.9% additional wages. The additional tax is based on the status of the filing.

Here are the criteria for filing:

- Single: $200,000

- Married filing jointly: $250,000

- Married filing separately: $125,000

4. Self-employment taxes

The self-employment tax is also called the Self-Employment Contributions Act (SECA) tax. It applies to those who earn on their own, not through a job. These taxes are charged when income is above the set limit. The limit is fixed as per rules and laws.

Common Mistakes to Avoid When Filing Payroll Returns

Even small mistakes can cost you money and time. Watch out for:

1. Wrong Employee Details

Wrong names, IDs, or payment info cause payroll returns to fail. Always check each employee’s details before filing to avoid rework.

2. Missing Tax Rate Changes

Tax rules change often. If you use old tax rates, you may overpay or underpay tax. Keep up with updates or ask a payroll expert for help.

3. Forgetting Bonuses or Overtime

Many businesses miss adding bonuses or extra hours to pay slips. This leads to wrong payroll tax figures and can trigger fines during audits.

4. Filing or Paying Late

Late payroll returns or tax payments cost you money in penalties. Use alerts or payroll tools to file on time, every time.

5. Poor Payroll Records

Messy records cause missing data and mistakes in reports. Keep files neat and updated to make tax filing smooth.

6. Wrong Employee Type

Mixing up employees and contractors causes reporting errors. Make sure you know how each worker is classified before filing payroll returns.

7. Skipping Payroll Checks

You must match payroll records with bank and tax statements. Skipping this step can leave errors hidden until it’s too late.

8. Outdated Payroll Software

Old or unused payroll software may give wrong results. Keep your payroll tools updated to meet tax laws and avoid mistakes.

By fixing these errors early, you can save time, money, and avoid tax troubles.

How to Pay Payroll Tax on Time Without Errors

Taxes can be tricky, but you can make it easy with these tips:

1. Set Up Automated Payroll Systems

Automation reduces manual work. It helps:

- Calculate tax deductions right away.

- Send payroll returns fast.

- Avoid late or missed payments.

2. Use Cloud Tools for Tax Calculations

Cloud tools help you:

- Store payroll data safely.

- Access reports anytime.

- Update tax rates quickly.

This helps you calculate payroll returns fast and manage tax in real time

3. Stay Compliant with Tax Rules

Tax laws change often. To avoid trouble:

- Check tax updates every few months.

- Keep staff data fresh and correct.

- Use trusted sources or experts for advice.

Best Practices to Simplify Payroll Returns and Payroll Tax Management

Doing payroll can be easy when you follow simple habits. These tips help you save time, avoid mistakes, and pay taxes on time.

Keep All Payroll Data in One Place

Store staff pay, hours, and tax data in one system. This stops mix-ups and makes report checks quick and simple.

Review Deductions Often

Tax cuts or staff perks can change. Check these often to make sure you take the right amounts from your pay.

Back Up Data Often

Payroll data is key for your business. Keep a safe copy often. It keeps your data safe if your system breaks or files get lost.

Use Simple Payroll Tools

Modern payroll tools are fast and easy to use. They cut errors and help you send tax forms on time.

Get Help From Experts

When you are not sure about tax or payroll rules, call an expert. They help you calculate payroll returns correctly and keep your business safe.

Stay Updated on Tax Rules

Tax laws can change each year. Learn new rules or use a tool that updates rates for you. This avoids fines and late fees.

At Meru Accounting, we know that payroll can be tough and time-consuming for business owners. Our team uses advanced cloud tools to manage payroll smoothly. We help you:

- Calculate payroll returns with full accuracy and zero delays.

- Generate clear payroll reports for better decision-making.

- Keep all payroll data secure and ready for audits.

FAQs

- What does calculating payroll returns mean?

It means working out wages, deductions, and taxes to prepare and file reports with tax bodies.

- Why is payroll tax important for my business?

It keeps you compliant with the law and ensures your staff’s taxes are paid correctly.

- Can software help with payroll returns?

Yes. Tools can track wages, deductions, and taxes fast, cutting errors and saving time.

- How often do I need to file payroll returns?

It depends on local rules. Many firms file monthly, some quarterly or yearly.