How to Resolve Problems While Checking Your Tax Refund Status?

Checking your income tax refund status is something most people do after filing their tax return. You expect to receive your money on time. But sometimes, you face issues while tracking your refund. You might see errors on the portal or face a delay in getting your money.

It’s normal to feel confused or stressed. But don’t worry. Most problems can be fixed with easy steps. This guide will show you the common issues people face while checking their income tax refund status and how to solve them. The content uses simple words so anyone can read and follow it with ease.

What Is an Income Tax Refund?

An income tax refund is money you get back when you have paid more tax than needed. It happens when your tax cuts or credits are more than your tax due. You get the refund in your bank account or by check. Most refunds are sent by the tax office in a few weeks.

This refund can come from extra tax taken from your pay, early tax paid, or tax credits you can claim. To get your refund fast, file your return right and on time. Keep all your tax papers safe, and use tax tools or a tax pro to help you get the most back.

Why You Should Check Your Income Tax Refund Status?

Keeping track of your income tax refund status is a smart step for better money planning. It helps you stay on top of updates, avoid wait times, and act fast if there’s a problem. Below are key reasons why this habit matters:

1. Stay in the Loop

By checking your refund status, you’ll know if your return was sent, is being looked at, or has been cleared. This keeps you in the loop at each step.

2. Avoid Hold-Ups

Refunds can get held up due to wrong or missing data. A quick check now and then helps you catch and fix such issues early.

3. Spot and Fix Errors

Mistakes like wrong bank info or unmatched details can slow things down. When you check the refund status, you get a chance to spot and fix those slips fast.

4. Plan Your Money

Knowing when your income tax refund will show up helps you plan your spend or savings with more ease. It keeps your cash flow on track.

Common Problems People Face While Checking Refund Status

1. Incorrect Personal Information

- You may enter the wrong Social Security Number (SSN), PAN, name, or date of birth.

- Even small errors can stop you from accessing your refund status.

- Double-check your details before entering them.

2. Return Not Yet Processed

- The system won’t show refund status until the return is processed.

- It may take a few days to weeks, depending on the mode of filing.

3. Website or App Errors

- The official refund tracking website may be down due to high traffic.

- You might face “system error” messages or slow loading issues.

4. Bank Account Mismatch

- If you entered the wrong account details, your income tax refund will fail.

- It could be returned to the department or sent to the wrong person.

5. Refund Already Sent But Not Received

- You may see “refund sent,” but your bank hasn’t received it yet.

- Sometimes banks take a few extra days to process deposits.

6. Identity Verification Delay

- If your identity is flagged, the tax department may hold your refund.

- You may need to verify your identity before refund is processed.

7. Tax Offset or Deductions

- If you owe government money (student loans, child support), your refund may be reduced.

- The department will send a notice explaining the deduction.

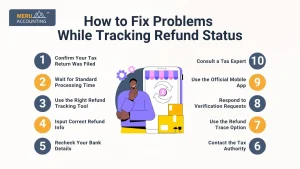

How to Fix Problems While Tracking Refund Status

1. Confirm Your Tax Return Was Filed

- Check your email or portal for filing confirmation.

- Make sure the tax return was accepted by the department.

2. Wait for Standard Processing Time

- E-filing refunds take about 7–21 days.

- Paper filing may take 4–6 weeks or longer.

- Don’t worry if it hasn’t been long since filing.

3. Use the Right Refund Tracking Tool

- Use the official IRS “Where’s My Refund?” tool (U.S.).

- In India, use the Income Tax Department’s refund status portal.

- Canada users can use CRA’s “My Account” service.

4. Input Correct Refund Info

- Enter SSN/PAN, filing status, and expected refund amount exactly.

- Be careful with spelling, numbers, and upper/lowercase.

5. Recheck Your Bank Details

- Log in to your tax portal to view the bank account number provided.

- If incorrect, you may need to wait for a check or reissue request.

6. Contact the Tax Authority

- Call after 21 days of e-filing if there’s no update.

- Be ready with your tax return copy and identification details.

7. Use the Refund Trace Option

- If refund is shown as sent but not received after 6 weeks, file a refund trace request.

- IRS and other tax departments have specific steps for this.

8. Respond to Verification Requests

- Sometimes tax authorities request more documents.

- Quickly respond to avoid refund delays.

9. Use the Official Mobile App

- Use apps like IRS2Go (U.S.) or your country’s official tax department app.

- These tools are faster and more user-friendly.

10. Consult a Tax Expert

- If things are too complex or stuck, hire a professional.

- They can speak with the department on your behalf and resolve the issue.

Additional Tips to Avoid Refund Delays in the Future

1. File Early

- Don’t wait for the last moment to file taxes.

- Early filers usually get refunds faster.

2. Use E-Filing Instead of Paper Filing

- E-filing is faster, safer, and easier to track.

- Refunds from e-filing reach you in less time.

3. Choose Direct Deposit

- Avoid paper checks by opting for direct deposit.

- It’s faster and more reliable.

4. Keep Your Details Updated

- Always provide the latest phone number, email, and bank info.

5. Review Your Return for Errors

- Before filing, check all entries carefully.

- Small errors can cause long delays in your income tax refund.

6. Keep a Copy of Your Tax Return

- Save a digital and printed copy for future reference.

7. Use Reliable Tax Software or Services

- Use trusted software or hire professionals for filing.

- This lowers the chance of mistakes.

Stages of Refund Status on Tracking Tools

Stage 1: Return Received

- The tax department has received your return.

- It’s under review.

Stage 2: Refund Approved

- Return is processed.

- Refund is confirmed and will be sent.

Stage 3: Refund Sent

- Refund has been issued.

- It should reflect in your bank account soon.

Expected Time for Refunds

Filing Type | Estimated Time |

E-file with direct deposit | 7–21 days |

E-file with paper check | 2–4 weeks |

Paper file with a check | 4–6 weeks or more |

International bank refund | It may take longer due to foreign transfer processes |

Why Does Your Tax Return Get Delayed?

You may face issues when checking your income tax refund. Several reasons can cause a delay. Here are some of the most common ones:

1. Wrong Details in the Tax Return

If your tax return has wrong facts — like a math mistake or wrong income — it can slow things down. The IRS checks these errors by hand, which adds time. A wrong entry or miscalculation means your income tax refund takes longer to reach you.

2. Missing Info on the Tax Return

A tax return with missing data also causes delays. If you leave out your Social Security number or forget to sign your return, the IRS will hold it. They will not move ahead until you fix these items. This means a late income tax refund.

3. Claiming Deductions You Can’t Take

If you ask for tax breaks that you don’t qualify for, your return gets flagged. The IRS will then review it in detail. This check makes the process take longer, and your income tax refund will be delayed.

4. Refund Used to Pay Past Debts

Your income tax refund may also get used to clear old debts. These include:

- Unpaid child support

- Federal student loans

- State taxes owed

If this happens, you won’t get your full refund, or may not get any at all.

What If the Refund Still Does Not Arrive?

- Contact the bank to confirm if funds were received or rejected.

- Use refund trace tools on the tax department portal.

- Check for deductions or government claims (called tax offsets).

- File a grievance or complaint if you face long delays.

- Submit a refund re-issue request through your login account.

It’s common to face small issues when checking your income tax refund status. Most of these problems can be fixed by entering the right information, waiting for the proper time, or contacting the tax department.

Always keep your return details safe, check status regularly, and don’t ignore error messages. If needed, take help from experts to avoid long delays and get your refund smoothly. Meru Accounting assists in accurate tax return filing. We help you avoid common errors that delay income tax refunds. We also offer refund tracking, query resolution, and support with tax authorities. With our team, you get peace of mind during the entire tax process.

FAQs

Q1. How can I check my income tax refund status?

You can check it through your tax department’s official website or mobile app.

Q2. Why does the portal say ‘No Information Available’?

This means your return is not yet processed, or the details are entered incorrectly.

Q3. How long does it take to get an income tax refund?

It usually takes 7–21 days for e-filed returns with direct deposit.

Q4. What should I do if I gave the wrong bank account number?

The refund will fail; you may need to update your info and request a re-issue.

Q5. Can I still track my refund if I filed manually?

Yes, but it takes longer. Use the same refund status tool after a few weeks.

Q6. Will I get a notice if my refund is reduced?

Yes, the tax department sends a notice if a tax offset is applied.

Q7. Can tax professionals help me get my refund faster?

They can help you file error-free returns and follow up on your behalf.