Home » How Bookkeeping Can Help Senior Citizens Streamline their Financial Tasks?

How Bookkeeping Services for Seniors Can Help Streamline Their Financial Tasks

Managing finances can get harder as we grow older. Bills, bank records, and taxes may feel confusing or stressful. That’s where bookkeeping for seniors comes into play. It brings comfort and ease to older adults who want to stay in control of their money. With the help of bookkeeping services for seniors, many financial burdens can be handled without stress. Seniors can enjoy their time, knowing their money matters are being looked after.

A personal bookkeeper for the elderly ensures that all the small, important financial tasks are done right and on time. When it comes to running a business, bookkeeping is key. But it’s not just for businesses. It’s also useful for individuals, solopreneurs, and even senior citizens.

For seniors living in the USA, managing money can get tough. Hiring a full-time employee to handle the books may not be ideal. That’s where bookkeeping services for seniors come in. These services can bring order, safety, and ease to handling money matters.

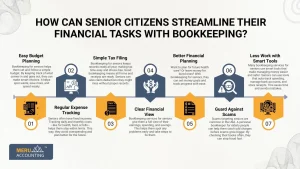

How can senior citizens streamline their financial tasks with bookkeeping?

1. Easy Budget Planning

Bookkeeping for seniors helps them set and follow a simple budget. By keeping track of what comes in and goes out, they can make smart choices. It helps spot waste, save more, and spend wisely.

2. Regular Expense Tracking

Seniors often have fixed incomes. Tracking daily and monthly costs—like for health, food, or bills—helps them stay within limits. This way, they avoid overspending and plan better for the future.

3. Simple Tax Filing

Bookkeeping for seniors keeps records ready all year, making tax time easy and stress-free. Good bookkeeping means all forms and receipts are ready. Seniors can also claim deductions they might miss without proper records.

4. Clear Financial View

Bookkeeping services for seniors give them a full view of their earnings, spending, and savings. This helps them spot any problems early and take steps to fix them.

5. Better Financial Planning

Want to plan for future health care? Or leave money for loved ones? With bookkeeping for seniors, they can set money goals and track progress with ease.

6. Guard Against Scams

Scams targeting seniors are common in the USA. A personal bookkeeper for elderly people can help them catch odd charges before scams grow bigger. By checking their books often, they can stop fraud fast.

7. Less Work with Smart Tools

Many bookkeeping services for seniors use smart tools that make managing money easier and safer. Seniors can use tools that auto-track spending, manage bank accounts, and store receipts. This saves time and avoids mistakes.

Why Are Bookkeeping Services Important for Seniors?

1. To Simplify Daily Financial Work

- Managing finances can feel like a full-time job.

- Bookkeeping for seniors keeps daily money matters clear and neat.

2. To Avoid Financial Mistakes

- Seniors may forget to pay bills or pay them twice.

- A personal bookkeeper for elderly clients can catch errors and prevent problems before they grow.

3. To Save Time and Energy

- Time is precious. Seniors don’t need to worry about paperwork.

- A personal bookkeeper for the elderly handles it for them.

4. To Prevent Fraud and Scams

- Older adults are common targets for scammers.

- Bookkeeping services for seniors help watch accounts and flag fraud early.

Benefits of Bookkeeping for Seniors

1. Peace of Mind

- With bookkeeping for seniors, they no longer have to worry about day-to-day finances.

2. Better Budget Control

- Helps stick to monthly budgets and avoid overspending.

3. Clear Financial Picture

- Bookkeeping services for seniors give a clear financial picture for both them and their family.

4. Improved Decision Making

- With help from a personal bookkeeper for elderly, choices become easier and more informed.

5. Freedom to Enjoy Life

- No need to deal with confusing numbers every day.

Who Can Benefit Most from These Services?

1. Elderly Living Alone

- They may not have daily support or help.

2. Couples with Health Issues

- One may be sick or forgetful, and the other may not be financially skilled.

3. Families Living Far Away

- Bookkeeping services for seniors help bridge the gap when loved ones live far away.

4. Seniors with Limited Computer Skills

- A personal bookkeeper for the elderly can handle everything offline.

What Makes a Good Bookkeeper for Seniors?

1. Trustworthy

- Must handle finances with honesty.

2. Patient and Kind

- Seniors may ask the same question twice or need slow explanations.

3. Well-Trained

- Should know financial tools and rules.

4. Good Communicator

- Able to explain things simply and clearly.

5. Flexible

- Should offer home visits, phone calls, or online chats.

Types of Bookkeeping Services Available

1. In-Person Bookkeeping

- A bookkeeper visits the senior’s home regularly.

2. Remote Bookkeeping

- Remote bookkeeping for seniors is handled online or by phone, making it simple and stress-free.

3. Family-Linked Bookkeeping

- A family member works with the bookkeeper to review reports.

4. Hybrid Services

- A mix of both remote and in-person help.

Tools and Technology Used in Bookkeeping

Bookkeeping for seniors is easier with the use of simple tools and modern technology. These tools help manage money matters with less stress and more ease. Below are some tools that are often used:

1. Simple Spreadsheets

Spreadsheets like Excel or Google Sheets are good for tracking income, spending, and due dates. They are easy to use and help keep clear, neat records.

2. Online Accounting Tools

Tools like QuickBooks, FreshBooks, and others give a full view of money coming in and going out. They are great for making reports and setting reminders.

3. Email Reminders

Emails can help remind seniors about bills, tax deadlines, or other dates. These alerts help stop late fees and missed payments.

4. Cloud Storage for Records

With tools like Google Drive or Dropbox, files can be stored online. This keeps records safe and easy to reach from any place.

5. Password-Protected Portals

These secure portals let seniors and their bookkeepers share files in a safe way. They help guard private details and make document sharing easy.

Technology Made Simple

Even if seniors are not good with tech, bookkeeping services for seniors can take care of these tools behind the scenes. These services keep the process smooth, safe, and simple for older adults.

How to Get Started with Bookkeeping Help

Getting started is simple if you take it step by step:

- Talk to the Senior First

Have a kind and open chat. Explain how this support can make their life easier and safer. - Check Local and Online Options

Many firms offer bookkeeping for seniors both in-person and through online services. - Set Up a Trial Period

Try the service for a month. See how it works for the senior and family. - Review Reports Together

Ask for regular financial updates. These should be in plain, simple words for easy understanding.

Questions to Ask Before Hiring a Bookkeeper

Before you choose someone, ask the right questions. It helps you find the best match for your loved one:

- How many senior clients have you worked with?

- Do you offer in-home visits or online help?

- What is your fee — hourly or monthly?

- Can you speak with family or caregivers if needed?

- Do you also handle tax work or filing?

These questions help you pick someone who meets your loved one’s needs and gives peace of mind.

Cost of Bookkeeping Services for Seniors

The price may change based on where you live and the tasks involved:

- Hourly fees: Most charge between $20 and $50 per hour.

- Monthly plans: These may range from $100 to $300, based on the type of help.

- Flexible pricing: Many offer custom plans just for seniors.

While it may seem like an extra cost, hiring a personal bookkeeper for elderly care brings peace of mind. It also helps prevent bigger and more costly financial problems down the line.

What Happens If Seniors Don’t Use Bookkeeping Help?

When seniors do not get help with their money tasks, they can face many problems. Without support, they may miss important steps or make mistakes. Here are some common issues that may arise:

1. Missed Bill Payments

Seniors may forget to pay rent, utility bills, or credit cards. This can lead to late fees or even a loss of service.

2. Bank Overdraft Charges

If they do not track spending, their account may go below zero. This can cause extra bank fees.

3. Tax Fines or Late Filing

Missing tax dates or filing with errors can lead to large fines from tax offices.

4. Untracked Medical Costs

Doctors, tests, and medicine can cost a lot. If these are not tracked, the senior may miss payments or run short of funds.

5. Risk of Fraud

Seniors who do not check their accounts often may become easy targets for scams or fraud.

6. Family Confusion in Emergencies

If the family needs to step in during a health crisis, they may not find clear records of money or bills.

Signs That Seniors Need Bookkeeping Help

It is important to notice early signs that a senior needs help with money. These signs show that support may be needed soon:

1. Forgetting to Pay Bills

If the senior keeps asking about paid bills or misses due dates, they may need help.

2. Losing Receipts or Bank Papers

If they keep misplacing money records, this may show memory issues or confusion.

3. Often Talking About Money Worries

If they talk often about stress or trouble with money, they may feel lost with tasks.

4. Signs of Memory Loss

If the senior forgets names, dates, or numbers often, they may need someone to handle finances.

5. Calls from Bill Collectors

If the senior gets letters or calls from collection agents, it may mean their bills are not being paid.

Bookkeeping for seniors is more than just numbers. It brings peace, safety, and order to their daily lives. A personal bookkeeper for the elderly helps manage bills, bank work, and taxes with care.

Whether it’s tracking monthly costs or sorting medical bills, bookkeeping services for seniors offer comfort and control. These services help seniors stay free from stress and enjoy their retirement years.

At Meru Accounting, we provide expert support tailored for seniors. Our team handles payments, keeps records clear, and updates families when needed. With our help, seniors gain peace of mind and financial ease.

FAQs

- What does bookkeeping for seniors include?

It includes bill payments, income tracking, tax help, and organizing expenses. - Are bookkeeping services for seniors expensive?

No, many services are affordable and offer monthly or hourly plans. - Can a personal bookkeeper for the elderly help with medical expenses?

Yes, they can track and record all health-related costs. - Is this service safe for seniors?

Yes, especially when handled by trusted professionals with experience. - Can family members be involved in the process?

Yes, they can receive reports or updates with the senior’s permission. - What if the senior doesn’t want help?

Start slow, explain benefits, and involve them in small steps. - Can these services be done remotely?

Yes, many bookkeeping services offer full remote support via phone or email.