Home » How Outsourced Bookkeeping for CPA work and its benefit.

How Outsourced Bookkeeping for CPAS Works and its Benefits

When Certified Public Accountants (CPAs) are busy, they may need help with bookkeeping. That’s where outsourced bookkeeping for CPAs comes in. It means a CPA can hire someone outside their office to handle the books. This helps save time and keeps things neat.

Outsource bookkeeping for CPAs is done by trained experts who know how to track money. It helps CPAs focus more on their big jobs, like giving tax help and money advice. Using bookkeeping services for CPAs makes the work easier, faster, and more correct. This is why many CPAs choose to outsource bookkeeping for CPAs to trusted teams. This means they hire trained bookkeepers from another company to help with the work. It saves time and makes the work easier.

What is Outsourced Bookkeeping for CPAs?

Outsourced bookkeeping for CPAs means hiring someone from outside the CPA’s office to help with keeping track of money. Instead of doing all the number work by themselves, CPAs can outsource bookkeeping for CPAs to a team that knows how to record income, bills, and payments. These teams give bookkeeping services for CPAs that are neat and on time. The CPA gives the papers, and the bookkeeper takes care of the rest. This helps CPAs get more free time and less stress while still getting correct records.

This kind of help is good because it gives CPAs more time. They do not have to do all the small jobs by themselves. Instead, they can focus on big things like helping clients or planning taxes.

How Does Outsourced Bookkeeping for CPAs Work?

Talk About Needs

The CPA firm and the outside team first have a talk. They make a list of all the jobs that the outsourced bookkeeping for the CPAs team will do. These can be things like checking the bank, sending invoices, making reports, or doing payroll. The CPA tells what is needed, and the bookkeepers listen and plan.

Choose Tools

Next, both teams choose the tools they will use. These tools are often bookkeeping software like QuickBooks or Xero. These tools help them do the work fast and right. The bookkeeping services for the CPA team and the CPA firm both get access, so they can see the same work at any time.

Share Data

Now, the CPA firm sends the client’s data to the outsourced bookkeeping for CPAs team. This means numbers like income, bills, or time sheets. They use safe, secure systems to make sure no one else can see the data.

Bookkeepers Start Work

Once they have the data, the bookkeepers begin. The outsourced bookkeeping for the CPAs team adds up numbers, checks them, and keeps good records. They make sure all the math is correct. They may do this daily, weekly, or monthly, whatever the CPA firm needs.

Review and Send Reports

The bookkeepers then make clear reports that show how much money came in and went out. They send these to the CPA firm. The CPA looks at the reports and uses them to help their clients make smart choices.

Stay in Touch

Both teams keep talking. This helps make sure all the work is done right. If something needs to change, they fix it fast. This teamwork makes the outsourced bookkeeping for CPAs smooth and strong.

By working this way, CPA firms save time, stay on top of tasks, and get clean records without doing all the work alone.

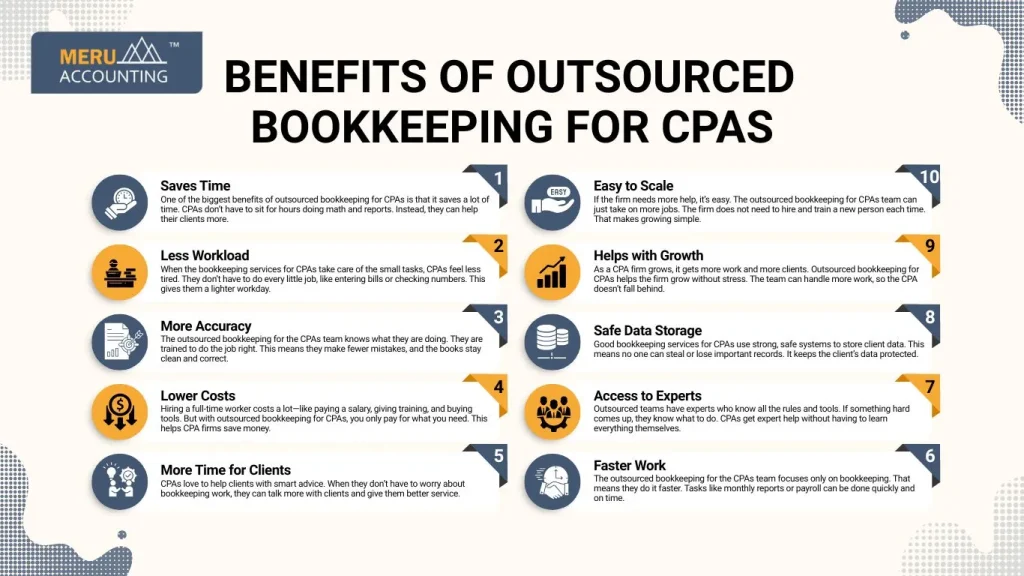

Benefits of Outsourced Bookkeeping for CPAs

There are many good reasons why CPA firms choose outsourced bookkeeping for CPAs. It makes their work life easier, better, and faster. Let’s look at how it helps:

Saves Time

One of the biggest benefits of outsourced bookkeeping for CPAs is that it saves a lot of time. CPAs don’t have to sit for hours doing math and reports. Instead, they can help their clients more.

Less Workload

When the bookkeeping services for CPAs take care of the small tasks, CPAs feel less tired. They don’t have to do every little job, like entering bills or checking numbers. This gives them a lighter workday.

More Accuracy

The outsourced bookkeeping for the CPAs team knows what they are doing. They are trained to do the job right. This means they make fewer mistakes, and the books stay clean and correct.

Lower Costs

Hiring a full-time worker costs a lot—like paying a salary, giving training, and buying tools. But with outsourced bookkeeping for CPAs, you only pay for what you need. This helps CPA firms save money.

More Time for Clients

CPAs love to help clients with smart advice. When they don’t have to worry about bookkeeping work, they can talk more with clients and give them better service.

Faster Work

The outsourced bookkeeping for the CPAs team focuses only on bookkeeping. That means they do it faster. Tasks like monthly reports or payroll can be done quickly and on time.

Access to Experts

Outsourced teams have experts who know all the rules and tools. If something hard comes up, they know what to do. CPAs get expert help without having to learn everything themselves.

Safe Data Storage

Good bookkeeping services for CPAs use strong, safe systems to store client data. This means no one can steal or lose important records. It keeps the client’s data protected.

Helps with Growth

As a CPA firm grows, it gets more work and more clients. Outsourced bookkeeping for CPAs helps the firm grow without stress. The team can handle more work, so the CPA doesn’t fall behind.

Easy to Scale

If the firm needs more help, it’s easy. The outsourced bookkeeping for CPAs team can just take on more jobs. The firm does not need to hire and train a new person each time. That makes growing simple.

How to Pick a Good Outsourced Bookkeeping Service

Choosing the right team for outsourced bookkeeping for CPAs is very important. You want people who understand your work and keep it safe. Here are some easy tips to help you choose the best one:

Check Experience

Pick a team that has worked with CPAs before. They should understand how CPA firms work and what kind of jobs they do. When the team has experience, they can do the work better and faster. This makes outsourcing bookkeeping for CPAs easier and smoother.

Look at Tools

Make sure they know how to use the same software you use. If your firm uses QuickBooks, Xero, or other tools, the team should be good at using them. Good bookkeeping services for CPAs are always ready to work with your systems.

Ask About Safety

It is very important to keep client data safe. Ask the outsourced bookkeeping for CPAs team how they protect your numbers and files. They should use strong passwords and secure systems. Keeping data safe helps your firm stay trusted.

Try a Small Job First

Do not give them a big job at first. Start with a small task to test them. If they do well, you can give them more work later. This is a smart way to use outsourced bookkeeping for CPAs without taking risks.

Check Prices

Ask how much they charge. Do they charge by the hour, by task, or monthly? Make sure their price fits your budget. The best bookkeeping services for CPAs should save you money, not add extra costs.

By using these steps, you can pick the right outsourced bookkeeping for the CPA team. A good team can make your work easier, faster, and safer.

Common Bookkeeping Services for CPAs

Bookkeeping services for CPAs help keep finances accurate and clear.

General Ledger

Record all business transactions in each accounting period carefully.

Keep accounts balanced to prevent mistakes and financial errors.

Accounts Payable & Receivable

Track invoices and payments for clients and vendors.

Ensure all bills and receipts are entered correctly daily.

Payroll

Process employee salaries and deductions each pay period.

Handle payroll taxes properly to avoid legal issues later.

Bank Reconciliation

Compare company records with bank statements every month.

Identify and correct errors quickly to stay accurate.

Tax Support

Prepare financial data to simplify the tax filing process.

Assist CPAs with reports needed for proper submission.

Financial Reports

Generate monthly, quarterly, and yearly financial statements clearly.

Provide insights to help with business decisions and growth planning.

Audit Help

Prepare accurate records for upcoming financial audits efficiently.

Support CPAs to maintain compliance and full transparency always.

Outsourced bookkeeping for CPAs is a smart way to make work easier. It saves time, lowers stress, and helps CPA firms grow. With trained teams, modern tools, and safe systems, CPAs can trust their bookkeeping to experts. Bookkeeping services for CPAs help the firm work better and grow faster.

If you are looking for a trusted team, Meru Accounting is a good choice. We offer expert outsourced bookkeeping for CPAs. We know what CPA firms need and help them stay ahead. With Meru Accounting, you get clean books, safe data, and more time to focus on your clients.

FAQs

- What types of jobs can be outsourced by CPAs?

CPAs can outsource data entry, bank work, invoicing, payroll, and report making. - Can small CPA firms also use outsourced bookkeeping?

Yes. Even small firms can get help from outside bookkeepers. - Will I lose control of my work if I outsource?

No. The CPA firm still controls everything. The outsourced team only helps. - How do I talk to the outsourced team?

You can use email, calls, or online tools. Many teams talk daily or weekly. - What if I don’t like the work?

You can stop the service or ask for changes. Most teams want to do a good job.