How do I choose an online bookkeeping service?

When choosing online bookkeeping services, focus on features like expense tracking and invoicing, ensuring they align with your business needs. Compare pricing plans for affordability and check for robust security measures to safeguard your financial data. Consider scalability to accommodate future growth, read customer reviews for user satisfaction, and evaluate customer support options. By weighing these factors, you can confidently select the best online bookkeeping service for your business.

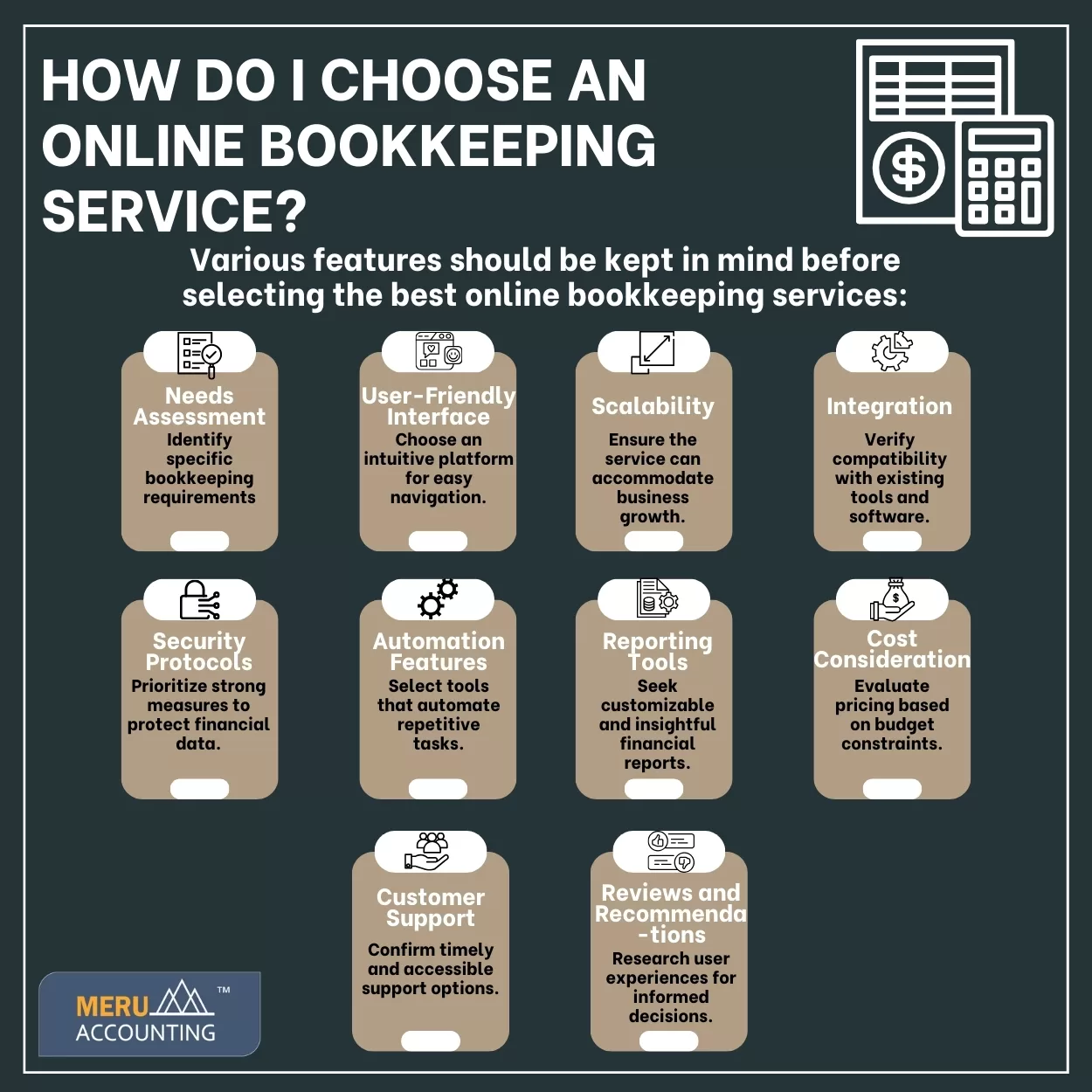

Various features should be kept in mind before selecting the best online bookkeeping services.

Define Your Needs

The first task is to clearly define the business’s bookkeeping needs. Include factors like the size of your business, the complexity of your financial transactions, and the specific features you require. Understanding your needs will guide you in selecting a service that aligns with your business requirements.

Ease of Use

Another important feature is User-Friendliness. Opt for an online bookkeeping service with an intuitive interface that you and your team can navigate effortlessly. A user-friendly platform can save time, reduce errors, and enhance overall efficiency in managing your finances.

Scalability

Choose online bookkeeping services that can grow with your business. Processes are streamlined and human data entry is reduced because of this integration. Ensure the bookkeeping service can accommodate increased transaction volumes and additional features as your business evolves.

Integration Capabilities

Efficient bookkeeping is about seamless integration with other tools your business uses. Look for a service that integrates well with your existing software and applications, such as invoicing tools, payment gateways, and tax software. Processes are streamlined and human data entry is reduced because of this integration.

Security Measures

Financial data is sensitive, and security is non-negotiable. Verify that the online bookkeeping service employs robust security measures, including encryption protocols, regular data backups, and compliance with industry standards.

Automation Features

Time is money, and automation can save plenty of both. Choose a service that offers automation features for repetitive tasks like expense categorization, invoice generation, and bank reconciliation. Automation reduces the risk of human error and frees up time for more strategic financial decision-making.

Reporting and Analysis Tools

Comprehensive reporting and analysis tools are invaluable for gaining insights into your business’s financial health. Ensure the bookkeeping service provides customizable and easy-to-understand reports that aid in budgeting, forecasting, and making informed financial decisions.

Cost Structure

Evaluate the pricing structure of different bookkeeping services. Some best online bookkeeping services charge a flat fee, while others may have tiered pricing based on transaction volume or additional features. Consider your budget and choose a service that offers the best value for your specific business needs.

Customer Support

Effective customer support is crucial, especially when dealing with financial matters. Verify the customer support channels’ responsiveness and availability and look for services that offer timely assistance through various channels such as chat, email, or phone.

Reviews and Recommendations

Before making a final decision, research reviews and seek recommendations from businesses similar to yours. Real-world experiences can provide valuable insights into the strengths and weaknesses of different bookkeeping services.

Conclusion:

Choosing the best online bookkeeping services is a strategic decision that can significantly impact your business’s financial management. By carefully considering your needs, assessing key features, and researching options, you can find the best online bookkeeping services. Meru Accounting’s bookkeeping services not only meet your current requirements but also align with your future business goals. Make the right choice, and empower your business with efficient and effective online bookkeeping.

FAQs

- What factors help choose the right online bookkeeping service?

Match service features with your business size, transaction load, and bookkeeping needs. - Why is ease of use important in online bookkeeping tools?

A simple layout helps your team work faster and make fewer mistakes. - How does integration improve online bookkeeping services?

It connects with tools like invoicing, tax software, and payment systems to cut manual work. - What security steps should bookkeeping services follow?

They must use strong encryption, regular backups, and follow data safety rules. - How does automation support online bookkeeping?

It handles tasks like invoice entry and bank matchups, saving time and reducing errors. - Why are reports and analysis tools useful in bookkeeping?

They give clear numbers for planning budgets and checking your business health. - What should I check in the cost structure of a bookkeeping service?

See if the price fits your budget and includes all the tools you need. - How do reviews help in selecting a bookkeeping service?

User feedback shows how the service works in real situations and daily use.