Home » Are There Any Legal Loopholes to Enhance Your Tax Preparations and Returns?

Top Legal Tax Loopholes to Simplify Filing and Maximize Returns

Paying taxes can be tough for small business owners and freelancers. But if you know the right legal tax loopholes, you can save money and boost your returns. In this blog, we’ll share real ways to improve your tax filing while staying within the law. We’ll also reveal some smart tax tips to help you grow your income.

Smart filing is not just about loopholes. One important Tax Preparation Secret is to plan early, keep clean records, and use the right tools. This helps you save time, cut stress, and stay ready when tax season comes.

Understanding Legal Tax Loopholes for Smarter Filing

No one likes to pay extra tax when they don’t have to. Legal loopholes help reduce your tax bill while staying within the law. They help you lower your tax bill while keeping everything within the law. You don’t have to bend rules or take risks. You just need to know what is allowed and use it wisely.

Why Knowing Legal Tax Loopholes Matters

Legal loopholes are like bonus tools. One Tax Preparation Secret is to spot them early. If you miss them, you lose money. If used wisely, you pay only what’s fair. This gives you more room to grow your business or invest.

Who Can Benefit from These Legal Loopholes?

Anyone who pays taxes can use them. Business owners, sole traders, or even part-time earners. These tips help all.

Many individuals also pay more tax simply because they don’t understand deductions or fail to keep records. Using these legal options can bring huge benefits.

What Are Legal Loopholes in Tax Systems?

A legal loophole is a gap in tax rules. It lets you save money by using smart ways to file. These are not tricks. They are written in tax laws. But many people miss them.

Are They Safe to Use?

Yes. As long as they follow the law. Legal tax loopholes are not tricks, but they are smart ways to lower costs.

Examples of Legal Loopholes

- Claiming home office space if you work from home

- Writing off business-related travel

- Using tax-free accounts for savings

- Prepaying expenses before year-end to get deductions

- Reporting losses to balance income

Tax experts always talk about these tools. They’re legal, easy to apply, and help reduce your burden.

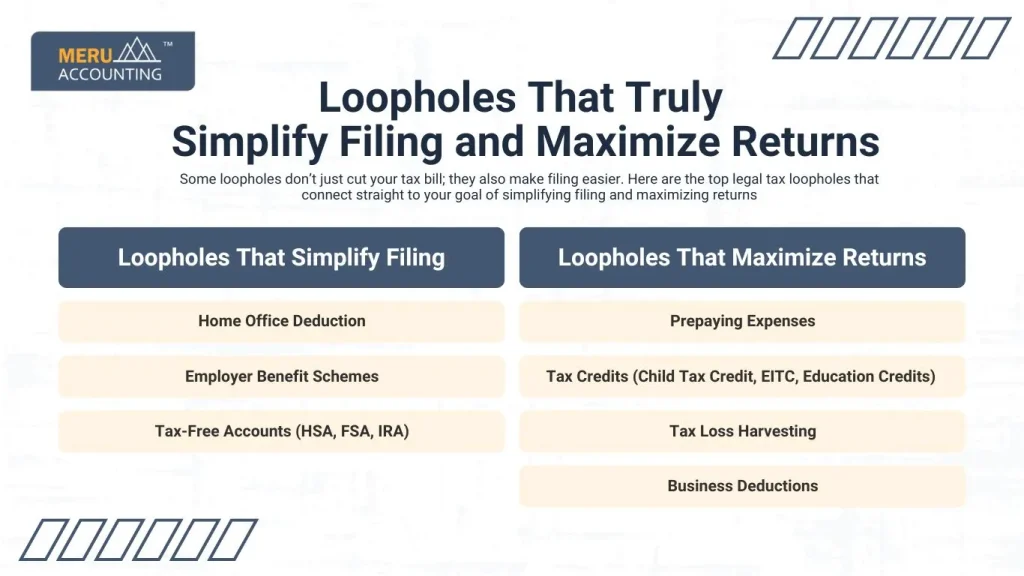

Loopholes That Truly Simplify Filing and Maximize Returns

Some loopholes don’t just cut your tax bill; they also make filing easier. Here are the top legal tax loopholes that connect straight to your goal of simplifying filing and maximizing returns:

Loopholes That Simplify Filing

- Home Office Deduction – If you work from home, you can claim part of rent, internet, and power. This is easy to apply once you track your bills.

- Employer Benefit Schemes – Plans like commuter savings or health benefits are handled by your employer. That means less paperwork for you.

- Tax-Free Accounts (HSA, FSA, IRA) – You just set them up once. Every year, your savings lower your tax without extra effort.

Loopholes That Maximize Returns

- Prepaying Expenses – Paying for supplies or services before year-end boosts deductions, giving you a higher refund.

- Tax Credits (Child Tax Credit, EITC, Education Credits) – These are dollar-for-dollar savings that increase your return, not just reduce income.

- Tax Loss Harvesting – Selling losing investments to balance gains helps you save thousands and still grow wealth.

- Business Deductions – Claiming travel, equipment, and supplies directly reduces taxable income, leaving more money in your pocket.

These are not tricks. They are legal loopholes in the tax code that both simplify the filing process and help maximize your returns.

The Hidden Value Behind Tax Preparation’s Secret

Good tax prep can uncover hidden gold. There are secrets in the process that help you reduce costs and boost your refund.

Tax Preparation Secret for Big Savings

Most people just fill out forms and file them. But the real tax preparation secret lies in smart planning, which helps you uncover every deduction you qualify for.

Knowing the timing of payments, understanding thresholds, and knowing which costs are fully deductible are all secrets professionals use.

Plan Early, Save More

Start your tax prep early. One Tax Preparation Secret is to track costs and check records on time. This ensures you claim all deductions you deserve.

Avoid a last-minute rush. Create a folder for all receipts, bills, and proof. That’s a small step with a big impact on savings.

What are the legal ways to enhance tax preparation and returns?

Here are some legal steps you can use to boost your tax results:

Maximize Credits and Deductions

Use all credits and cuts you qualify for. These may include home loan costs, gifts to charity, school fees, health spend, and work spend.

Contribute to Retirement Accounts

Add funds to plans like 401(k), IRA, or HSA. These cut taxable income and lower your tax bill.

Use Tax Loss Harvesting

If some of your stocks lose value, sell them and claim the loss. This loss can cut gains or reduce up to $3,000 of other income each year.

Maximize Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

When the contribution to these accounts is made, it is done with pre-tax dollars. This helps to reduce your taxable income, which can be mentioned during tax preparations.

Maximize FSAs and HSAs

Add funds to Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs). These use pre-tax dollars, which lowers your taxable income and eases tax filing.

Employer Benefit Plans

Review any benefits from your employer. Options may include commuter plans, spending accounts, or retirement plans supported by your workplace.

Business Expense Deductions

If you are self-employed or run a business, claim all valid work costs. These can include supplies, equipment, office use at home, or travel linked to business.

Claim Tax Credits

Check which tax credits apply to you. Common ones include the Child Tax Credit, Earned Income Tax Credit (EITC), and credits for education costs.

Manage Income and Deductions

Plan when to record income or costs. Shifting income to a later year or bringing costs forward may reduce your tax bill.

Tax-Efficient Investments

Choose options that lower taxes, such as municipal bonds or index funds. These let you build wealth while paying less in tax.

Professional Guidance

Seek advice from a tax expert. They can guide you through complex rules and help ensure you claim all benefits allowed by law.

Common Myths About Using Legal Tax Loopholes

Many fear using loopholes. But understanding the Tax Preparation Secret behind them shows these fears are myths.

They Are Not Allowed

That’s not true. Legal loopholes are written in the tax code. Many tax-saving options are supported by law.

Only Big Firms Can Use Them

No. Even freelancers and side hustlers can benefit. You just need to know your options.

It Will Trigger an Audit

Not if you have proof. Keep good records. File on time. Most audits are random, not linked to claims.

You Need a Tax Professional

Helpful, yes. But many loopholes can be used with good planning and tools.

Even a basic online system can guide you through many deductions.

Risks vs. Rewards: How to Use Tax Loopholes the Right Way

Legal loopholes come with pros and cons. You need to know both to use them the right way.

Risks

- Bad recordkeeping

- Misusing a rule

- Not staying updated on law changes

- Relying only on online forums or tips

Rewards

- Pay less tax

- Grow your refund

- Boost your business income

- More money for savings, growth, or investment

Using the right legal tax loopholes makes a major difference, but they must be handled with care.

How Tax Preparations Secretly Help in Audit-Proof Filing

A top tax preparation secret is to file with proof. This helps make audits quick and safe.

Keep Records in One Place

Use apps or folders. Save invoices, receipts, and logs. This helps if you ever face an audit.

Use Clear Categories

Split costs by use: work, home, car, tools. Clear records make deductions strong.

Match Bank Records

Match all claims with bank entries. It shows you’re honest. Auditors prefer clarity. You can even use cloud-based tools that link to bank feeds and auto-match your data.

By following these steps, you lower audit risks and get the full value of each tax preparation secret.

At Meru Accounting, we help you file better. Our team knows all the top legal tax loopholes and every tax preparation secret. We help you keep more of your hard-earned income. We don’t just fill forms. We find real legal loopholes that work for your business. Our tax advisors study updates, apply them to your case, and help cut your tax bill legally.

FAQs

- Are legal tax loopholes legal?

Yes, they are. Legal tax loopholes are allowed by law. These are legal ways to reduce your tax based on current tax rules.

- Can small businesses use tax loopholes?

Yes. Many legal loopholes also work for small businesses. You just need to know which ones fit your case.

- Do I need an accountant to use these loopholes?

No. You can use many loopholes on your own. But an accountant can help you find more and apply them the right way.

- What is a tax preparer’s secret?

A tax preparation secret is a smart method or step that helps lower your taxes. It could be early planning or tracking the right expenses.

- Can I claim home expenses as deductions?

Yes. If you work from home, you can claim a portion of rent, internet, electricity, and phone bills legally.