Tax Tips for Small Business Owners

Filing taxes can be a strenuous task at hand, and one of the most useful tax tips for small business owners is not to let it slip down their priority list. Although it is a responsibility that piles up and eventually knocks on the door of every business owner, it cannot be avoided.

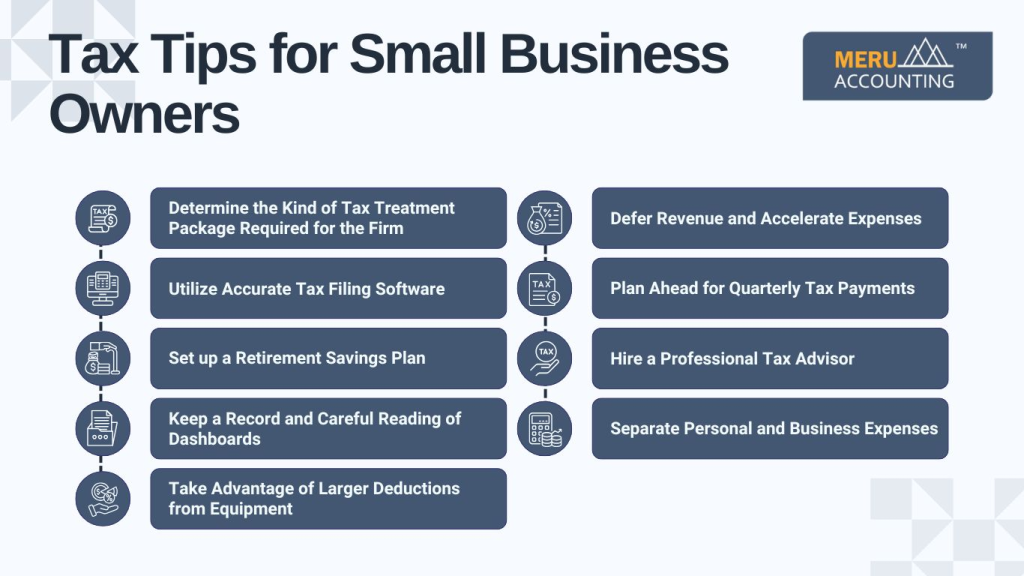

At the end of the tax year, small business owners are often looking for ways to minimize their tax liability and manage their finances better for the next tax year. Small business owners must familiarize themselves with their tax paperwork and procedures. These are some of the essential tax tips for small business owners to strengthen their tax preparation:

Determine the Kind of Tax Treatment Package Required for the Firm

There are different kinds of tax deductions that a company can claim from its qualified business income. The laws place limits on the amount of deduction for certain business services. It is important to know what kinds of services and tax treatment would qualify for the company’s needs. Proper planning helps in maximizing benefits while staying compliant with the tax code.

Utilize Accurate Tax Filing Software

Small business owners are often the worst hit if the tax filing software is not tailored to suit their specific needs. To protect their business from errors and loss of work, the company must opt for the best tax filing software. Therefore, small business owners should choose software that has backup filing options and offers a maximum-refund guarantee. This ensures the accuracy of the return and guarantees reimbursement of any fees or penalties that may be charged due to software errors.

Set up a Retirement Savings Plan

Beyond personal IRA contributions, small business owners have several options for employer-sponsored retirement savings plans and profit-sharing plans. A self-employed worker’s taxable income can also be reduced by contributing additional investments into a traditional retirement account. With any tax plan, contributions that the taxpayer makes for themselves and their employees can be tax-deductible. Small business owners can also qualify for a tax credit to help defray the costs of starting particular retirement plans.

Keep a Record and Careful Reading of Dashboards

Among the practical tax tips for small business owners, one is to keep tabs on receipts, as they reflect the financial dashboard of all expenses that the company incurs. Many of these receipts can qualify for tax deductions. These deductions depend on the business structure, as certain structures are eligible for specific types of deductions. Maintaining an organized record ensures that no potential deduction is overlooked.

Take Advantage of Larger Deductions from Equipment

Section 179 is one of the most valuable tax tips for small business owners, as it allows them to avoid tracking depreciation by treating equipment as a business expense. This equipment can be placed in service before the end of the year or preferably in the year it was purchased. This applies to both new as well as used equipment. Leveraging this section can significantly reduce taxable income for the business.

Defer Revenue and Accelerate Expenses

If a company uses a cash basis for tax purposes, profits may rise and look higher at the end of the year compared to the past year. In such cases, owners can defer revenue near the year-end as a way to cut taxable income. At the same time, if they expect more profit in the coming year, they can speed up their expenses or collections. This helps in balancing tax duties in an effective way.

Plan Ahead for Quarterly Tax Payments

Small business owners must pay estimated taxes four times a year. Missing these payments can bring fines and interest. By planning in advance and checking estimated income, businesses can spread tax dues across the year. This lowers the load during the main tax season and keeps cash flow steady.

Hire a Professional Tax Advisor

Tax laws are tough and often change. Having a tax advisor or an accountant can save small business owners from high-cost errors. A skilled expert ensures full compliance, finds more deductions, and gives custom plans to grow tax savings.

Separate Personal and Business Expenses

Mixing personal and business funds leads to mix-ups and missed deductions. Owners should keep a bank account and card that are only for the business. This habit not only makes record-keeping clear but also builds trust in case the tax office asks for an audit.

Importance of Tax Compliance

Following Rules

Tax compliance means following all tax rules and laws. It helps small business owners stay legal and stress-free.

Avoiding Penalties

It avoids legal trouble and heavy penalties. Following Tax Tips for Small Business Owners ensures you never pay extra fines.

Building Trust

It builds trust with banks, investors, and lenders. A compliant business is seen as reliable and safe to support.

Helping in Audits

Compliance records also help in future audits. When all papers are ready, audits become simple.

Supporting Growth

Small businesses that comply grow with ease. They focus on profit instead of dealing with penalties.

Access to Loans

Non-compliance can lead to blocked business loans. Banks prefer lending to businesses with clean tax records.

Investor Confidence

Investors often check tax compliance before funding. A good record shows the owner follows proper Tax Tips for Small Business Owners.

Business Stability

Following compliance shows a business is stable and reliable. It also builds a strong reputation in the market.

Common Tax Mistakes Small Business Owners Make

Mixing Finances

Using personal and business money together is risky. It creates confusion when filing taxes and can reduce deductions.

Filing Confusion

It makes the records unclear during tax filing. Tax Tips for Small Business Owners always suggest keeping separate accounts.

Missing Deadlines

Missing tax deadlines leads to fines and stress. Delays can also harm your business reputation.

Risk of Audits

Late filing increases the chances of an audit. Filing on time reduces unwanted attention from tax authorities.

Not Reporting All Income

Some owners forget small cash payments. Every payment counts and must be included for compliance.

Hiding Income Risks

Even small amounts must be reported to the IRS. Hiding income may bring strict penalties later.

Poor Record-Keeping

Lost receipts mean missed deductions. Keeping digital copies is one of the best Tax Tips for Small Business Owners.

Denied Claims

Without proof, tax claims may be denied. This reduces savings and increases tax owed.

Role of a Tax Professional

Beyond Filing

A tax professional does more than file returns. They guide you through all the steps of tax planning.

Future Planning

They help in planning for future years. Smart planning now reduces stress later.

Choosing Structure

They provide guidance on business structure for lower taxes. The right structure can save a lot of money.

Maximizing Benefits

They ensure owners use all credits and deductions. Following Tax Tips for Small Business Owners is easier with expert advice.

Saving Money

Many small businesses save more with expert help. A pro finds savings you might miss.

How Taxes Affect Cash Flow

Big Expense

Taxes are a big part of business expenses. Ignoring them can damage your budget.

Poor Planning

Poor planning may leave less money for growth. Smart Tax Tips for Small Business Owners suggest saving monthly.

Late Payments

Paying late adds interest and extra costs. This reduces funds for daily operations.

Saving Monthly

Saving monthly for taxes keeps cash flow stable. It also reduces stress during tax season.

Business Survival

Businesses with strong cash flow survive longer. Tax planning helps keep enough cash on hand.

Expansion Delays

Unexpected tax bills can delay expansion. Proper planning avoids sudden shocks.

Digital Tools for Small Business Taxes

Accounting Software

Tracks sales, expenses, and payroll. It gives small owners a full view of finances.

Reports and Filing

Produces reports for tax filing. This is one of the top Tax Tips for Small Business Owners for accuracy.

Expense Tracking Apps

Records daily spending through receipts. It makes recording easy and quick.

Error Reduction

Reduces manual data entry errors. Fewer errors mean better compliance.

Cloud-Based Tools

Store records online for easy access. You can log in from anywhere, anytime.

Team Collaboration

Useful for remote teams and tax pros. Everyone can work on one system.

Difference Between Tax Deductions and Tax Credits

Tax Deductions

Reduce taxable income. They lower the amount on which tax is calculated.

Deduction Examples

Example: office rent, travel costs, and supplies. These small costs add up to big savings.

Lower Taxable Income

Deductions lower the income level taxed. Many Tax Tips for Small Business Owners focus on deductions.

Tax Credits

Reduce actual tax owed, not just income. Credits directly cut the final tax bill.

Credit Examples

Example: energy credits, hiring credits, and education credits. These help small owners save more.

Smart Tax Strategy

This is one of the most important Tax Tips for Small Business Owners to remember.

Why Good Tax Planning Matters

Lowering Income

Tax planning lowers taxable income. This helps small owners pay less legally.

Reducing Stress

It reduces stress during filing season. Planning removes the last-minute rush.

Spending Clarity

It gives clarity on business spending. Owners know where money is going.

Avoiding Shocks

Planned businesses avoid sudden tax shocks. No surprise bills at year-end.

Growth Focus

It helps small owners focus on growth. Less tax worry means more time for business.

Correct Use

Planning ensures the correct use of deductions and credits. This is one of the smartest Tax Tips for Small Business Owners.

Smooth Cash Flow

It supports smooth cash flow management. Planned taxes mean better budgeting.

Audit Safety

Tax planning avoids surprises during audits. Proper records make audits stress-free.

Impact of Taxes on Business Growth

Investment Limits

High taxes reduce funds for investment. This slows down business development.

Tax Reliefs

Tax reliefs can support expansion plans. Owners must use all available benefits.

Freeing Cash

Correct deductions for free cash for new projects. More cash means faster scaling.

Investor Checks

Many investors check tax records before funding. Clean records attract more investors.

Reputation

Good tax habits build a strong reputation. Following Tax Tips for Small Business Owners builds trust.

Loan Trouble

Businesses with tax issues face trouble raising capital. Banks prefer safe borrowers.

Reinvestment

Tax savings can be reinvested in hiring or marketing. This supports long-term growth.

Long-Term Growth

Proper planning allows stable long-term growth. A tax-friendly plan helps in steady expansion.

Tax Benefits of Hiring Employees

Deductible Wages

Wages and salaries are deductible expenses. They reduce overall taxable income.

Job Credits

Some states give credits for creating new jobs. These reduce tax owed directly.

Training Claims

Training expenses may also be claimed. This supports both staff and business.

Employee Benefits

Employee benefits may reduce taxable income. Health insurance costs are often deductible.

Dual Advantage

Hiring staff supports both growth and tax savings. This is a win-win for owners.

Record Keeping

Good employment records make deductions easier. Clear proof avoids audit issues.

Special Credits

Some credits are available for hiring veterans or disabled staff. These are great Tax Tips for Small Business Owners.

Future of Small Business Taxes

Digital Filing

More governments promote digital tax filing. This trend will continue to grow.

Online Payments

Online payments will replace manual systems. It saves time and improves compliance.

Green Energy Credits

Tax credits may grow for green energy use. Small owners should explore these benefits.

Staying Updated

Small businesses must stay updated on reforms. Ignoring changes may cost money.

AI Tools

AI-based software will track deductions better. Smart tools will cut errors.

Startup Relief

Governments may give extra relief to startups. These credits support new businesses.

Global Rules

Global tax rules may affect international sellers. Exporters must watch cross-border laws.

Digital Readiness

Future Tax Tips for Small Business Owners will focus on digital readiness. Going digital is no longer optional.

Managing taxes does not need to be hard. With the right steps, small business owners can save money and avoid stress. Follow these tax tips for small business owners to stay ahead. Good planning today means peace of mind tomorrow.

At Meru Accounting, we help small business owners with smart tax steps. Our team handles bookkeeping, tax filing, and reports with care. We make sure all records are right, laws are met, and savings are high. With us on your side, you can grow your business while we manage the numbers. Partner with us for stress-free tax and accounting support.

FAQs

- What is the best way to lower taxes for small business owners?

Claim all legal costs and use tax credits. - Do I need a separate bank account for my business?

Yes, it keeps records clean and avoids tax trouble. - Can I deduct home office costs?

Yes, if the space is used only for work. - How often should I pay taxes as a small business owner?

Most owners pay tax four times each year. - Is hiring an accountant worth the cost?

Yes, they save more in taxes than their fee. - What happens if I miss a tax due date?

You may face fines, extra fees, or higher taxes. - Can tax software replace an accountant?

It helps, but hard cases still need an expert.