Which Type of Accounting Outsourcing Company Do You Need?

Money matters are very important for every business. To stay strong, a company must know how much it earns, spends, and saves. This is where accounting helps. But many small and big businesses do not want to hire full-time workers to do this. Instead, they ask for help from an accounting outsourcing company. These companies are outside your business, but they work like your own team. They help with keeping records, paying bills, managing tax papers, and more. This makes your work easier and helps you save time and money.

In this guide, we will learn what an accounting outsourcing company is, the different types of accounting consulting services, and how to choose the right one for your needs.

What is an Accounting Outsourcing Company?

An accounting outsourcing company is a team outside your business that helps with money work. Instead of hiring full-time staff, you let this company handle jobs like bookkeeping, payroll, and taxes. They are trained to do this work fast and with fewer mistakes. These companies use smart tools and software to keep your records safe and clear. This means you don’t have to worry about bills, tax forms, or reports. You can use your time to grow your business while they take care of the numbers.

They work online, so you don’t have to meet them in person. They give you reports, updates, and help any time you need it. This is very useful for people who run small businesses or have no time for accounting.

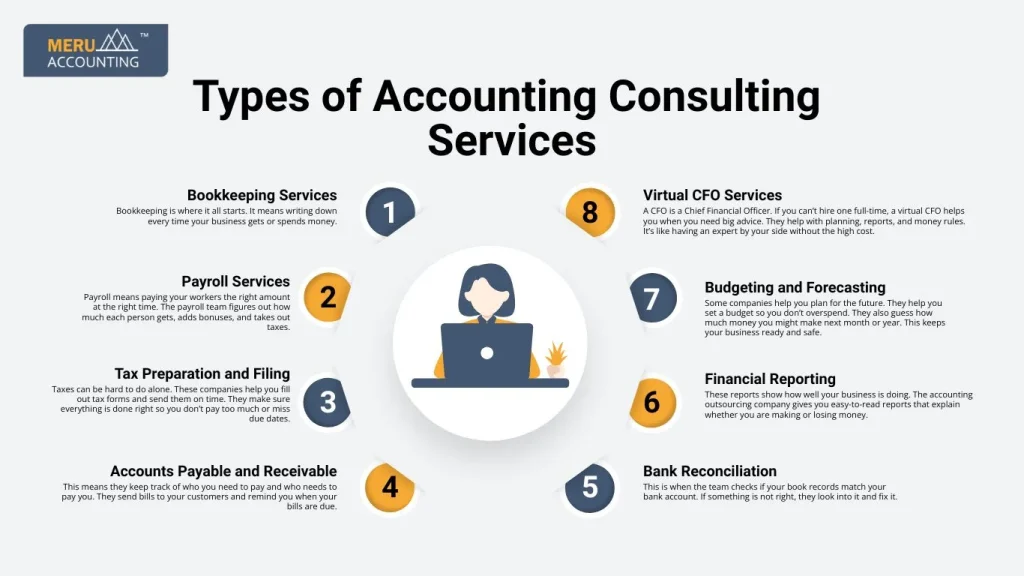

Types of Accounting Consulting Services

The different types of accounting consulting services. Not every business needs the same help, so it’s good to know what an accounting outsourcing company can offer. These services make money tasks easier and save you lots of time.

1. Bookkeeping Services

Bookkeeping is where it all starts. It means writing down every time your business gets or spends money. An accounting outsourcing company helps by keeping a list of all sales, bills, and payments. This keeps your records neat and clear. You’ll always know where your money is going.

2. Payroll Services

Payroll means paying your workers the right amount at the right time. The payroll team figures out how much each person gets, adds bonuses, and takes out taxes. They also give pay slips and make reports. This helps you pay your team without any worry.

3. Tax Preparation and Filing

Taxes can be hard to do alone. These companies help you fill out tax forms and send them on time. They make sure everything is done right so you don’t pay too much or miss due dates. This keeps your business safe from tax trouble.

4. Accounts Payable and Receivable

This means they keep track of who you need to pay and who needs to pay you. They send bills to your customers and remind you when your bills are due. That way, you stay on top of your money and don’t miss any payments.

5. Bank Reconciliation

This is when the team checks if your book records match your bank account. If something is not right, they look into it and fix it. This helps you avoid problems later and keeps your money records correct.

6. Financial Reporting

These reports show how well your business is doing. The accounting outsourcing company gives you easy-to-read reports that explain whether you are making or losing money. This helps you make smart business choices.

7. Budgeting and Forecasting

Some companies help you plan for the future. They help you set a budget so you don’t overspend. They also guess how much money you might make next month or year. This keeps your business ready and safe.

8. Virtual CFO Services

A CFO is a Chief Financial Officer. If you can’t hire one full-time, a virtual CFO helps you when you need big advice. They help with planning, reports, and money rules. It’s like having an expert by your side without the high cost.

Advantages of Hiring a Professional Accounting Outsourcing Company

Hiring an accounting outsourcing company gives many benefits:

1. Expert Guidance

Professional accountants manage your finances. They ensure accuracy and follow all rules.

2. Save Time

Outsourcing frees you from daily bookkeeping. You can focus on business growth and clients.

3. Lower Costs

No need to hire or train full-time staff. You pay only for the services you need.

4. Accurate Records

All financial records are precise and clear. Mistakes are reduced and compliance is easier.

5. Smart Planning

Accountants help with budgets and forecasts. You can make better choices for growth.

6. Modern Technology

They use the latest software and tools. Reports are faster, accurate, and secure.

7. Flexibility

Services can grow or shrink with your business. No hiring or training hassles are needed.

How to Choose the Right Accounting Outsourcing Company

A good accounting outsourcing company should be easy to talk to, know a lot, and help you save time and money.

Know Your Business Needs

Start by making a list of what help you want. Do you only want tax help? Or do you also need payroll, reports, and help with bills? Pick a team that gives the types of accounting consulting services you need.

Check Their Skills

The team should know your country’s tax rules. They must also know how to use tools like Xero or QuickBooks. These tools help with bills, tax forms, and reports.

Look at the Cost

Some firms charge by the hour. Others ask for a fee each month. Choose one that fits your budget but still gives good help.

Ask About Tools

Ask what software they use. It should be safe, easy to use, and work on a phone or laptop. A good accounting outsourcing company uses cloud tools that save time and let you check reports from anywhere.

See Their Reviews

Read what other people say about the company. If the reviews are good, it means they do great work and are easy to trust.

Ask About Support

Find out if the company gives help when you need it. Can you call or message them fast? Good service is just as key as smart math.

Check Their Work Style

Some teams work fast and send reports each week. Others work slowly or send updates once a month. Choose the accounting outsourcing company that matches how you like to work.

Tips for a Smooth Transition to an Outsourced Accounting Model

Set Clear Expectations

Write down tasks, deadlines, and report formats. Clear goals help both sides know their work and stop mistakes.

Communicate Often

Talk by call, email, or chat to solve issues fast. Regular talks keep everyone in sync and reduce delays.

Give Full Access

Let the team reach the data, software, and systems they need. This ensures work is done right and on time.

Train Your Staff

Show in-house staff how to work with the outsourced team. Training lowers friction and makes daily work easy.

Check Performance

Look at reports and results often. This helps spot problems and improve how work is done.

Make a Transition Plan

Set a clear plan with steps and key dates. A plan cuts confusion and keeps the move smooth.

Build Teamwork

Encourage open talks, feedback, and joint work. Good teamwork builds trust and better results.

Keep Improving

Review tasks and processes often. Small changes keep the system strong as your firm grows.

Common Mistakes to Avoid When Choosing an Accounting Outsourcing Company

When picking an accounting outsourcing company, watch out for these errors:

- Ignoring Service Scope: Make sure the company offers all the services you need.

- Overlooking Experience: Pick a company with proven skills and a good track record.

- Neglecting Technology: Use firms that work with modern software to save time and avoid errors.

- Not Checking Security: Your financial data must be safe. Always check their security measures.

- Focusing Only on Cost: Cheap options may lower quality. Balance cost with value and expertise.

To grow your business, you need clear and correct financial records. You don’t have to do it alone. Partner with Meru Accounting. We handle bookkeeping, taxes, and give smart advice.

Pick a partner who offers the types of accounting consulting services you need. Choose skilled staff, modern tools, and fair prices.

With Meru Accounting by your side, accounting is simple and stress-free. You can focus on what you do best, running and growing your business, while we take care of your finances.

FAQs

1. What does an accounting outsourcing company do?

They help you manage your money tasks like bookkeeping, payroll, taxes, and reports from outside your office.

2. Is outsourcing good for small businesses?

Yes! It saves money, gives expert help, and lets you focus on your work.

3. What are the most common types of accounting consulting services?

Bookkeeping, payroll, tax help, bank checks, reports, and planning for the future.

4. How do I know which accounting outsourcing company is right for me?

Pick one that offers the services you need, fits your budget, and has good reviews.

5. Can Meru Accounting help with all types of services?

Yes, Meru Accounting offers many types of accounting consulting services and helps businesses from all over the world.