Home » Navigating US Tax Deductions for Self-Employed Professionals.

Navigating US Tax Deductions for Self-Employed Professionals

If you run your own business, know your tax deductions. They help you pay less tax, save cash, and grow your business. Many self-employed people miss key tax deductions for self-employed and end up paying more tax than they should. You can deduct costs for office supplies, home office, travel, car use, health insurance, and retirement. Track all costs each month to claim your exemptions and avoid tax-time shocks.

Plan ahead and keep clear records. This lowers taxable income and keeps more cash in your pocket. It also helps you invest back in your business. Know the rules for each deduction. From home office to work meals, following limits helps you save. Good tax planning also helps you plan costs and manage cash flow.

What Are Tax Deductions for Self-Employed Professionals?

Definition

Tax deductions for self-employed workers are costs that cut taxable income. With less income taxed, you pay less.

Purpose

The goal of deductions is to save money. By cutting income that is taxed, you keep more cash in hand.

Eligibility

You must run a business, freelance, or earn as an independent worker to claim these. Regular employees cannot claim the same set of deductions.

Examples of Tax Deductions

Common costs you can deduct include:

- Office Supplies – pens, paper, printers, or small tools for work.

- Internet and Phone Bills – the part used for business needs.

- Business Travel – flights, hotels, and meals for client work.

- Professional Software – tools like accounting apps or design programs.

Using these deductions well can maximize tax savings for self-employed professionals.

Understanding Self-Employed Tax Exemption

The IRS allows self-employed tax exemption rules that help cut your tax bill:

Self-Employment Tax Deduction

You can claim half of your self-employment tax as a write-off. This cuts your income that gets taxed.

Health Insurance Premiums

Pay for your own health plan? You can deduct those costs. The rule also covers your spouse and kids.

Retirement Savings

Money you add to a SEP IRA or Solo 401(k) reduces your tax bill and grows your future fund.

Home Office Deduction

Use a room at home only for work? You can write off a share of rent, light, and internet costs.

Tools and Supplies

Laptops, tools, and other gear you need for work can be claimed in full or in part.

Learning and Growth

Course fees, workshops, and trade skill classes are tax-deductible. They help you grow while you save.

These rules are made to give self-employed professionals a fair chance at self-employed tax exemption and more savings.

Top Tax Deductions for Self-Employed Professionals

Home Office Deduction

Deduct part of your rent or mortgage if a room is used only for work. Include utilities and maintenance.

Vehicle Expenses

Deduct car costs for business trips. Track miles and fuel.

Health Insurance Premiums

Deduct premiums for yourself, spouse, and kids as part of a self-employed tax exemption allowed by the IRS.

Retirement Contributions

Contribute to SEP IRA, Solo 401(k), or SIMPLE IRA. Contributions grow tax-free until you withdraw.

Office Supplies and Equipment

Deduct computers, printers, stationery, software, and furniture.

Travel and Meals

Deduct business travel. Meals are 50% deductible if related to business.

Marketing and Ads

Costs for online ads, business cards, or social media campaigns are deductible.

Professional Services

Fees for accountants, consultants, or lawyers are deductible.

Internet and Phone

Deduct the business portion of your bills. Keep clear records.

Education and Training

Deduct courses, webinars, and books that improve skills.

Software Subscriptions

Tools like Photoshop, Zoom, or project apps can be deducted.

Business Insurance

Premiums for liability or business insurance are deductible.

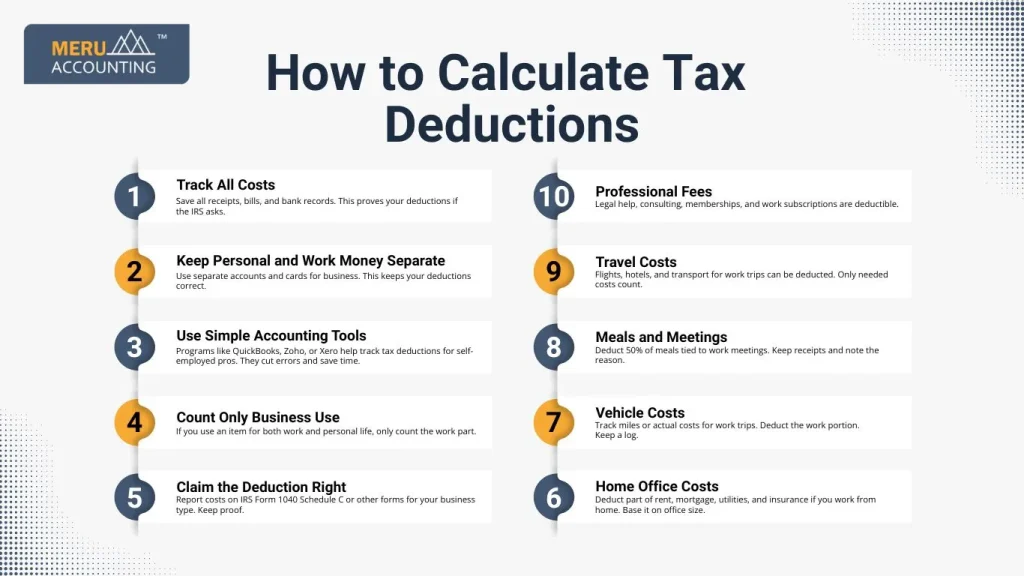

How to Calculate Tax Deductions

1. Track All Costs

Save all receipts, bills, and bank records. This proves your deductions if the IRS asks.

2. Keep Personal and Work Money Separate

Use separate accounts and cards for business. This keeps your deductions correct.

3. Use Simple Accounting Tools

Programs like QuickBooks, Zoho, or Xero help track tax deductions for self-employed pros. They cut errors and save time.

4. Count Only Business Use

If you use an item for both work and personal life, only count the work part.

5. Claim the Deduction Right

Report costs on IRS Form 1040 Schedule C or other forms for your business type. Keep proof.

6. Home Office Costs

Deduct part of rent, mortgage, utilities, and insurance if you work from home. Base it on office size.

7. Vehicle Costs

Track miles or actual costs for work trips. Deduct the work portion. Keep a log.

8. Meals and Meetings

Deduct 50% of meals tied to work meetings. Keep receipts and note the reason.

9. Travel Costs

Flights, hotels, and transport for work trips can be deducted. Only needed costs count.

10. Professional Fees

Legal help, consulting, memberships, and work subscriptions are deductible.

Key Self-Employed Tax Breaks

1. Self-Employment Tax Deduction

Deduct half of the self-employment tax to lower taxable income.

2. Qualified Business Income Deduction

You may deduct up to 20% of your business income under certain self-employed tax exemption rules

3. Health Insurance Deduction

Deduct premiums for health, dental, and long-term care for you, spouse, and kids.

4. Retirement Savings

Contributions to SEP IRA, Solo 401(k), or SIMPLE IRA reduce taxable income.

5. Training and Work Courses

Costs for workshops, courses, or certificates that help your work may be deducted.

6. Depreciation

Deduct wear and tear on tools, furniture, or gear over time.

7. Start-Up Costs

New business costs like legal fees, licenses, or marketing can be deducted.

8. Business Insurance

Deduct liability, property, or workers’ comp premiums.

9. Loan Interest

Interest on loans used for business can be deducted.

Common Mistakes to Avoid

Mixing Personal and Business Expenses

When personal and business costs mix, records become messy and deductions get unclear. Use separate bank and credit accounts to keep things clean.

Not Keeping Receipts

Receipts are proof of business spend. If you lose them, the IRS may reject your claims. Store them in digital form for easy access.

Ignoring Mileage Logs

Business travel miles are often missed. Without a log, you may lose one of the easiest tax deductions. Use apps or a notebook to track each trip.

Overestimating Deductions

Claiming more than you should may raise red flags. Stick to real business costs you can prove and avoid guesswork.

Missing Available Exemptions

Many miss tax deductions for self-employed work that they qualify for. Stay informed so you do not overpay.

Failing to Track Inventory or Supplies

Supplies and small tools may look minor, but they add up fast. Not tracking them means losing a fair share of deductions.

Tips to Maximize Tax Savings

Keep Detailed Records of All Expenses

Track each expense and keep proof. Clean records help you claim the right amount and avoid errors.

Contribute to Retirement Accounts

Save in a SEP IRA or Solo 401(k) to cut taxable income while building future wealth.

Use Accounting Software

Cloud tools like QuickBooks or Zoho help track tax deductions for self-employed costs, create reports, and stay audit-ready.

Review IRS Guidelines

The IRS updates rules often. Reviewing them keeps you safe and helps you use all possible breaks.

Keep Separate Business Accounts

Never mix money. A separate account makes bookkeeping simple and tax filing smooth.

Track Mileage with Apps

Mileage tracking apps record trips in real time. This makes sure you never miss out on travel deductions.

Keep Receipts Digitally

Scan or click a photo of each receipt. Digital records are easy to store, sort, and show during audits.

Utilize Health Savings Accounts (HSA)

If eligible, use an HSA. It reduces taxable income and helps pay for medical costs.

Review Home Office Deductions

If you work from home, claim the part of rent, power, and internet tied to your office space.

Examples of Tax Savings

- Freelance writers: Deduct home office, internet, writing software

- Consultants: Deduct travel, meals, and professional services

- Designers: Deduct software, ads, and office furniture

- Online sellers: Deduct shipping, supplies, website hosting

Every self-employed professional can lower taxable income and increase tax savings.

Tax Deductions for Self-Employed pros can save you a lot of cash and boost tax savings for self-employed workers. Knowing self-employed exemptions and keeping track of costs helps you pay just what you must. Use this guide to claim all allowed deductions and plan for a safe financial future. Smart tax planning keeps more cash in your pocket and helps your business grow.

At Meru Accounting, we help you claim every eligible tax deduction for self-employed individuals, maximize your self-employed tax exemption, and improve tax savings for self-employed professionals. Our team tracks your costs and keeps you in line with IRS rules, so you do not miss a deduction. With clear tax plans, we boost your self-employed tax exemptions and improve tax savings for self-employed pros. Work with us for less stress, more clarity, and extra funds to grow your business.

FAQs

Q1: What counts as a tax deduction?

A: Expenses tied to your business, like office supplies, travel, and services.

Q2: Can I deduct home office costs?

A: Yes, if used only for work.

Q3: What is a self-employed tax exemption?

A: Certain costs, like health premiums and retirement contributions, reduce taxable income.

Q4: How can I save taxes?

A: Claim deductions, use exemptions, and contribute to retirement plans.

Q5: Are business meals deductible?

A: Yes, 50% if linked to business.

Q6: Can I deduct education expenses?

A: Yes, if it helps your business skills.

Q7: Can software subscriptions be deducted?

A: Yes, for work tools like Zoom or Photoshop.