What is the IRS Tax Return Form 1040-V US?

When you file your federal income tax in the USA, there are many forms to know. One important form is Form 1040-V. It helps you send payments to the IRS if you owe money. In this blog, we explain all you need to know about Form 1040-V and how to use Form 1040-V online for your tax payment. IRS Form 1040-V is a payment slip. It helps the IRS link your tax return to your tax file. If you owe tax when filing Form 1040, 1040-SR, or 1040-NR, and you pay by check or money order, use Form 1040-V. It acts like a payment slip that you send with your paper check. This form is not needed if you choose to pay online or use other electronic ways to pay.

What is IRS Form 1040?

Form 1040 is the main form used by people to file income tax returns in the USA. The IRS uses this form to know:

• The IRS uses this form to determine how much income you earned.

• It also shows what deductions you can claim.

• The form helps identify which tax credits you qualify for.

• Additionally, it calculates how much tax you owe or if you are due a refund.

You can download Form 1040 for free from the official IRS website.

Who Should File Form 1040?

The IRS says every U.S. citizen or resident must file if their income is above the set limit. This applies to people:

• Living in the U.S. or abroad

• With wages, business income, or passive income

• With foreign income (U.S. taxes on global income)

If you’re not sure whether you need to file, you should still check. Penalties may apply if you don’t file when you should.

What Are Forms 1040EZ and 1040A?

1. Form 1040EZ

This is a short, simple version of Form 1040. It was used before 2018 but is now no longer available. It was meant for:

• People who are single or married without kids

• Earn less than $100,000

• Have no claims like itemized deductions or credits

2. Form 1040A

This was also a shorter form than the 1040. It was for people who:

• Don’t own a business

• Earn less than $100,000

• Don’t itemize deductions

Now, all taxpayers use Form 1040, and extra schedules are added for complex income and claims.

Where and How to File Form 1040?

There are two main ways to file your Form 1040:

• Mail: You print and send it to the IRS. The address depends on where you live.

• E-File: You can file online using tax software or through a tax professional, and then make your payment through 1040-V Online options if you prefer.

E-filing is fast and gives you proof of submission. Refunds also come faster this way.

Can I Fix Errors After Filing Form 1040?

Yes. If you find a mistake, you can file Form 1040-X to change:

• Filing status

• Income or deductions

• Tax credits

The IRS often fixes small math errors on its own, but if something major is wrong, you should file Form 1040-X. This helps avoid audits or fines later.

What is Form 1040-V Used For?

Form 1040-V is used to send a payment by mail when:

• You owe tax after filing your return

• You are not paying online or through your bank

This form helps the IRS apply your payment to the correct account. It is a one-page slip that you send with your check or money order. If you don’t include Form 1040-V, the IRS might take longer to process your payment.

What Details Should I Include on Form 1040-V?

To fill the 1040-V form, you will need:

• Your full name

• Social Security Number (SSN)

• Spouse’s SSN (if joint return)

• Street address

• The amount you are paying

Write your SSN and the tax year on your check or money order. Make it payable to:

“United States Treasury”

How Can I Pay Form 1040-V Online?

While Form 1040-V is for mail payments, many people prefer using 1040-V Online alternatives for faster and secure tax payments. Here’s how:

1. IRS Direct Pay

Use this free service to pay from a savings or checking account. You can schedule payment up to 30 days in advance.

2. Debit or Credit Card

The IRS allows card payments through third-party providers. They may charge:

• Flat fee for debit cards

• Percentage fee for credit cards

3. EFTPS (Electronic Federal Tax Payment System)

This system is great for people who pay taxes often or run a business.

Note: If you pay online, you do not need to send Form 1040-V.

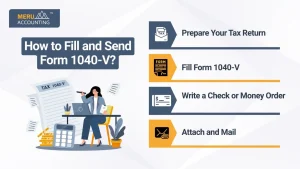

How to Fill and Send Form 1040-V?

Here’s a step-by-step guide to fill and send the form by mail:

Step 1: Prepare Your Tax Return

Complete Form 1040 and calculate the tax due.

Step 2: Fill Form 1040-V

Add your:

• Name

• SSN

• Address

• Payment amount

Step 3: Write a Check or Money Order

Make it payable to “United States Treasury.”

On your check, write:

• Your name

• SSN

• Tax year

• Form number (1040)

Step 4: Attach and Mail

Detach the payment slip from the bottom of the 1040-V form. Do not staple or paperclip it. Include your check and send both to the correct IRS mailing address.

Where to Mail Form 1040-V?

Mailing addresses differ based on:

• The state you live in

• Whether you are including a payment

• Whether you’re using a private courier

You can check the IRS mailing address on the IRS instructions page.

Make sure:

• You use the right envelope

• You send it to the correct address

• You send it before the tax deadline

Where to Get Form 1040-V?

You can get IRS Form 1040-V in the following ways:

• Download it from the IRS website

• Use tax filing software

• Pick it up from a local IRS office

It is often included when you use e-file software but choose to pay by mail.

Why Form 1040-V Matters

Form 1040-V helps ensure that your check or money order is matched with your tax file. If not used properly, your payment may be delayed or misapplied.

Using it right means:

• Your payment is processed fast

• You avoid IRS notices

• Your record stays clean

Tips for Using Form 1040-V

Form 1040-V is a payment slip used when you pay federal taxes by check or money order. Using it the right way helps make sure your money is linked to your tax return without delay.

Follow these easy tips:

1. Double-Check the Amount

Before you pay, be sure the amount you enter on the form matches what you owe.

Even small errors can cause delays or lead to a letter from the IRS. Use your tax return to find the right number.

2. Match Your Name and SSN

The IRS uses your name and Social Security Number (SSN) to link your payment to your file.

Write both exactly as they appear on your tax return. Spelling or number errors can slow things down.

3. Write the Check the Right Way

Make the check or money order payable to:

“United States Treasury”

• Do not use short names or spelling errors

• On the memo line, write:

• Your SSN

• Your phone number

• The tax year (like “2024”)

4. Use the Correct Mailing Address

IRS payment addresses are not the same for all states.

They also change if you send a payment with or without your full tax return.

To avoid delays:

• Check the latest IRS mailing list online

• Or read the back of Form 1040-V for your correct address

5. Keep a Copy for Your Records

Once you send your form and check:

• Take a photo or scan of the filled Form 1040-V

• Make a copy of your check or money order

This gives you proof in case:

• The IRS says they didn’t get it

• You need to fix a problem later

Common Mistakes to Avoid

Many people make simple mistakes when sending payments with Form 1040-V. Avoid these to make sure your payment gets processed fast and right:

- Not Including Form 1040-V

If you send a check without the slip, the IRS might not match it to your tax file. This can cause delays or errors. Always send Form 1040-V with your check. - Wrong Payment Amount

Make sure the amount is right. If you pay less, the IRS may charge late fees or interest. If you pay more, you may wait long for a refund. - Unsigned checks or forms: An unsigned check or form can be rejected. Sign your check and fill out all needed parts on Form 1040-V.

- Wrong mailing address: The IRS has many addresses for payments. Sending it to the wrong one can slow or lose your payment. Check the right address before you mail.

- Late mailing: The IRS must get your payment by the tax deadline to avoid penalties. Mail your payment early or pay online to make sure it arrives on time.

How the IRS Processes Form 1040-V

When the IRS gets your Form 1040-V and payment, they use the form to match the amount with your tax file. This helps stop delays or errors. Here’s how it works, step-by-step:

1. Receipt – The IRS gets your mail at the correct tax office.

2. Check – A team or tool checks if your Form 1040-V is filled in right and matches your return.

3. Apply Payment – Your money is added to your tax file. It lowers what you owe or adds to your refund.

4. Confirm – You can track the payment online. It may take 7 to 10 business days to show.

Can You Use Form 1040-V for Estimated Tax Payments?

No. Form 1040-V is only for payments sent with your yearly tax return.

It is not for estimated tax payments made during the year.

To pay estimated tax, you must use Form 1040-ES.

It has four payment slips—one for each quarter. These slips help the IRS know which time your payment covers.

If you send an estimated tax payment without the right slip:

• The IRS might not match it fast

• It can lead to errors or delays

What Happens If You Don’t Use Form 1040-V?

If you send a payment without Form 1040-V:

• The IRS may take longer to match your payment

• You may get IRS letters asking for proof or more details

• You might face penalties or interest if your payment is not posted on time

• Refunds can also get delayed or show the wrong amount

Using Form 1040-V helps stop these issues by giving the IRS the info needed to link your payment.

How to Pay Without Using Form 1040-V

Mailing a payment with Form 1040-V is the usual way, but you can pay your taxes other ways too:

• Online payment

• EFTPS

• Phone payments

• Credit or debit card

If you mail a check, do not skip Form 1040-V. Leaving it out can slow how the IRS applies your payment.

Handling taxes can be tough. Whether you’re mailing or using 104-V Online payment tools, expert help can ensure accuracy. At Meru Accounting, we help you:

• Prepare Form 1040 and all schedules

• Calculate taxes due

• Pay online or by check

• Use Form 1040-V the right way

FAQs

Q1. Can I file Form 1040-V online?

No. You use Form 1040-V only when you send a check or money order by mail. It is not used for online tax payments.

Q2. Is Form 1040-V needed if I pay online?

No. If you pay online, the IRS system tracks your payment. You do not need this form.

Q3. Can I pay by credit card using Form 1040-V?

No. Form 1040-V is for checks or money orders only. You cannot use it for card payments.

Q4. Where do I mail Form 1040-V?

Use the IRS address from the form’s guide. The address depends on your state and if you add a payment.

Q5. What if I send the wrong amount with Form 1040-V?

The IRS will post what you send. If it’s short, you’ll owe more. If it’s too much, you may get a refund.

Q6. Can I use Form 1040-V for state taxes?

No. Form 1040-V is only for U.S. federal tax payments. Use your state’s form to pay state tax.

Q7. How fast does the IRS process payments with Form 1040-V?

It may take a few days or weeks. Time depends on how much mail the IRS gets.