Home » How bookkeeping helps for restaurant?

How bookkeeping helps for restaurant?

Operating a successful restaurant in the evolving cultural world of the United States entails more than just creating delectable food. A restaurant’s financial health is just as important as the flavors it offers, which is where smart bookkeeping comes into play.

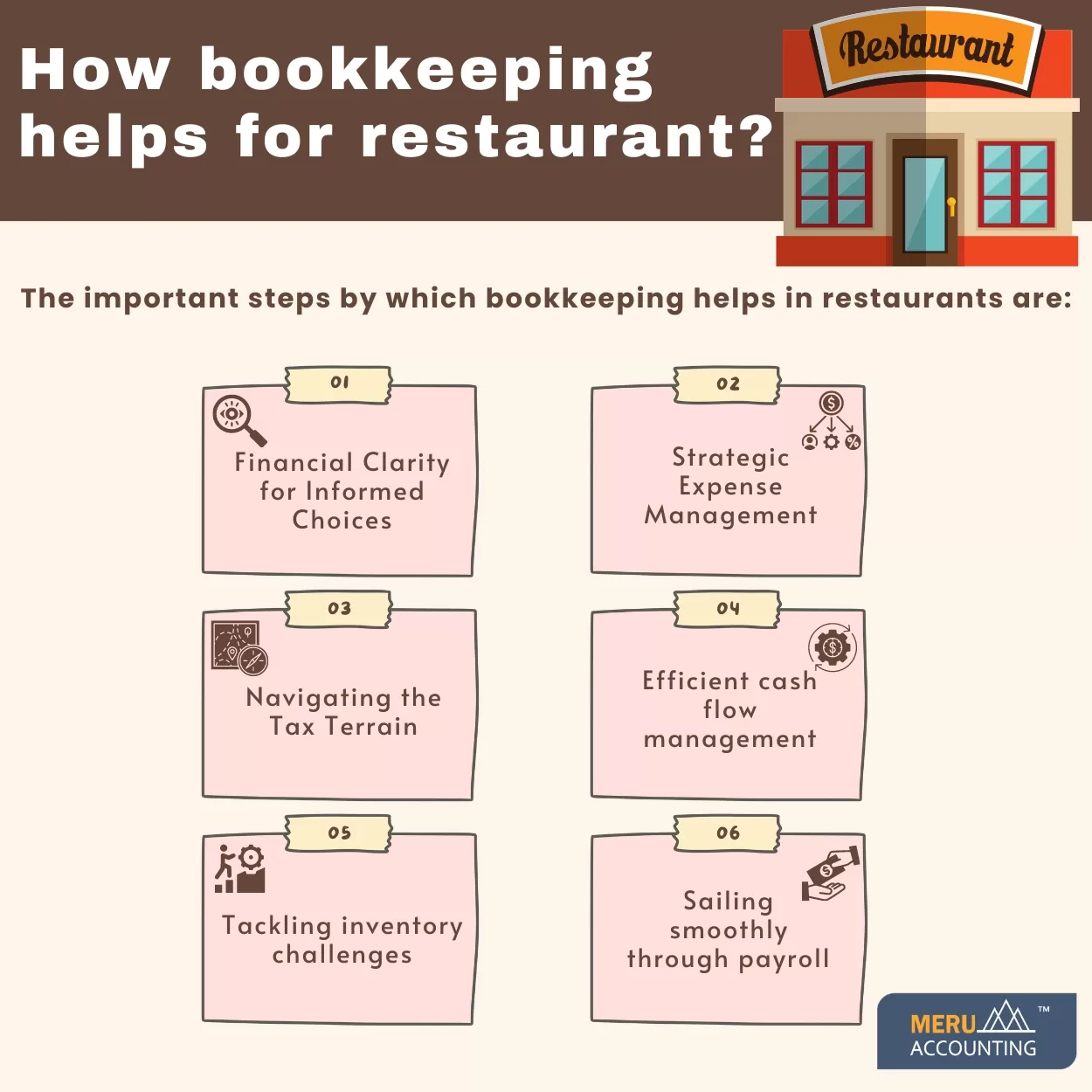

Let’s look at how bookkeeping helps restaurants in the USA as well as other parts of the world:

Financial Clarity for Informed Choices

The restaurant bookkeeping service serves as a compass for restaurant owners as they navigate financial complexity. By diligently collecting income, managing expenses, and calculating earnings, owners obtain a clear picture of their financial situation. This transparency enables educated decisions about menu changes, marketing initiatives, and operational upgrades.

Strategic Expense Management

The restaurant bookkeeping service has a wide range of charges, from ingredient costs to operational overheads. The bookkeeping for restaurants categorizes and tracks these expenses, resulting in a complete analysis. This granular knowledge enables managers to uncover cost-cutting opportunities without affecting service or food quality.

Navigating the Tax Terrain

The tax system in the United States is complex, and compliance is not optional. Precise bookkeeping guarantees that all income and spending are properly documented, which simplifies the tax filing process. This approach enables restaurant operators to optimize tax planning tactics and increase profits.

Efficient cash flow management

Restaurant cash flow fluctuates frequently, owing to seasonal trends and market dynamics. Regular bookkeeping provides a bird’s-eye view of income and spending trends. With this knowledge, entrepreneurs may plan to weather lean months while ensuring sustainability and expansion during good ones.

Tackling inventory challenges

Maintaining appropriate inventory levels is an ongoing concern for restaurants. The bookkeeping for restaurants takes on a guardian role here, assisting in tracking inventory turnover, identifying slow-moving commodities, and minimizing overstocking or shortages. This guarantees that menus are consistent and waste is reduced.

Sailing smoothly through payroll

Payroll management can be difficult when dealing with a variety of employee responsibilities and variable workforce levels. The bookkeeping for restaurants ensures that employees are paid correctly and on time, reducing errors and avoiding potential disputes caused by payroll disparities.

Building trust with stakeholders

Transparency is the basis of trust in business. Bookkeeping generates clear financial accounts that demonstrate a restaurant’s trustworthiness. When working with investors, lenders, or partners, these remarks instill confidence and boost the restaurant’s credibility, opening the path for future investments and partnerships.

Strategic budgeting and forecasting

Restaurants, like all businesses, require a long-term strategy. The restaurant bookkeeping service is essential for creating realistic budgets and forecasts. Analyzing historical financial data allows owners to forecast trends, create attainable financial goals, and make improvements to their strategy for long-term success.

Meru Accounting is a CPA firm that not only provides certified bookkeepers but also a variety of other accounting services that can help you establish and grow your business with competent bookkeepers and accountants.