Home » Can I file a Form 1041 online?

Can I file a Form 1041 online?

IRS form 1041 is the income tax return filed by the fiduciary of living trust or estate in the USA. Here, proper reporting of the capital gains, income, deductions, and losses are made. The tax rules here are different than that for the living individuals. If you reside in the US, then you need to File 1041 online when the death happened in the past two years or if it happened currently. The basic return for the trust or estate is done with Business Program of TaxSlayer Pro. Here, we will look more about filing this form.

Who must file IRS form 1041?

This form is typically filed by estates and trusts that have certain types of income or meet specific criteria.

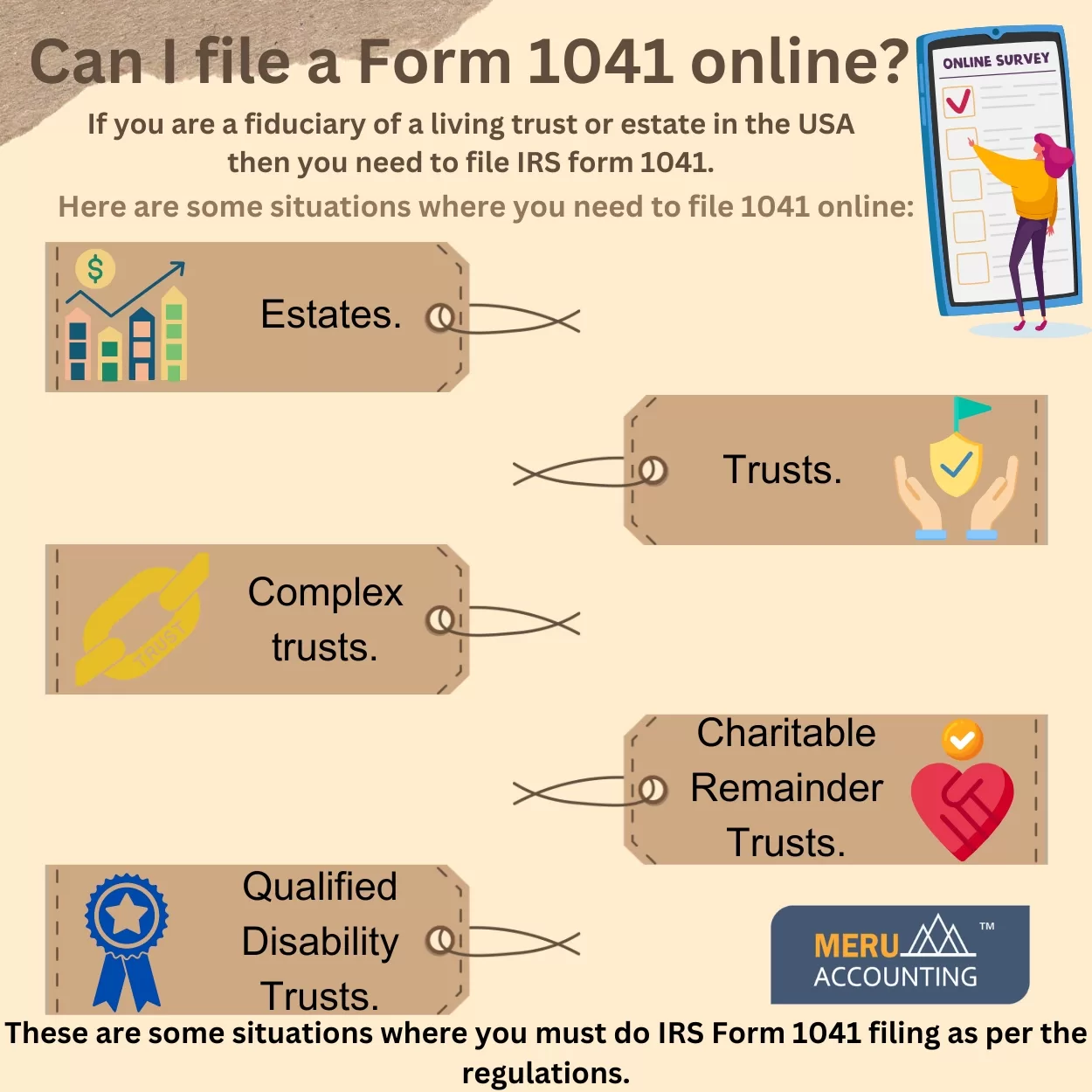

Here are some important situations where one needs to file 1041 online:

Estates

Form 1041 is required for estates that have a gross income of $600 or more during the tax year. An estate is established when someone passes away, and it continues to exist until the estate’s assets are distributed to the beneficiaries or heirs.

Trusts

Trusts that have taxable income, or that distribute income to beneficiaries, must file IRS form 1041. This includes revocable living trusts, irrevocable trusts, charitable trusts, and other types of trusts.

Complex Trusts

Complex trusts, which are trusts that retain income rather than distribute it to beneficiaries, must file Form 1041, regardless of the amount of income they generate.

Charitable Remainder Trusts

Charitable remainder trusts that have gross income or make distributions to beneficiaries must file Form 1041.

Qualified Disability Trusts

Qualified disability trusts may also need to file Form 1041 if they have taxable income.

What are the steps to file 1041 online?

Here are some general steps to file your IRS form 1041:

- Gather necessary information like taxpayer identification number (TIN) for the estate or trust, which is typically an Employer Identification Number (EIN) or Social Security Number (SSN).

- Determine the filing requirement of Estates and trusts.

- Prepare Form 1041 by downloading the latest version of Form 1041.

- Complete the necessary schedules and forms.

- Calculate taxable income.

- Pay any taxes due where you can use IRS Form 1041-V, Payment Voucher, to submit a payment if required.

- File the return.

- Include beneficiary information.

- Maintain records.

- Determine due dates and the due date for filing Form 1041 can vary depending on the type of estate or trust.

- Request an extension (if necessary).

- File an amended return (if necessary) and this can be done if you need to make changes to a previously filed Form 1041, use Form 1041-X, Amended U.S.

These are some general steps when you file 1041 online in the USA. If you find it difficult to file this form then you can take the help of the experts. They will file 1041 online on your behalf to ensure that it is done as per the regulations.

Meru Accounting provides IRS form 1041 filing services in the USA. They have good knowledge and experience in filing this form which makes it a better choice to outsource the filing of Form 1041. They will follow the proper steps when they file 1041 online for you. Meru Accounting is a proficient accounting service providing agency in the USA.

FAQs

- Can I file Form 1041 online for a trust or estate?

Yes, Form 1041 can be filed online using the Business Program in TaxSlayer Pro. - Who needs to file IRS Form 1041 after a death?

Estates must file if gross income is $600 or more in a year following the death. - Do trusts need to file Form 1041 if income is shared?

Yes, if a trust earns income or pays it to others, it must file the form. - What is a complex trust for IRS filing?

A complex trust keeps income instead of paying it, and must file Form 1041. - What does a charitable remainder trust file with the IRS?

It must file Form 1041 if it earns income or gives payments to anyone. - What is the first step before filing Form 1041 online?

Get the EIN or SSN for the trust or estate and check if filing is required. - What forms are used to update or fix a filed 1041?

Use Form 1041-X to correct a return. Use 1041-V to make a payment if needed. - Can experts help with online filing of Form 1041?

Yes, Meru Accounting handles the full filing process as per IRS steps.