Track and Review Your Tax Return Status

Filing taxes is not just about sending forms on time. It is also about making sure the IRS has received your return. You also need to confirm that it is being processed in the right way. Once you file, the next step is to track your tax return status. Doing this gives you clarity and peace of mind. You will know where your return stands and when to expect a refund.

Many taxpayers are not sure how to check tax return status with the IRS. At first, the process may sound complex. But in truth, it is quite simple if you follow the right steps. In this guide, we will show you easy ways to check your tax return status. We will also explain what different status messages mean and share tips to help you avoid delays.

Why Check Your Tax Return Status?

- To confirm that the IRS has received your return. Knowing how to check tax return status ensures your return has entered the system without errors.

- To know if your return is still under review. It helps you stay aware of possible issues.

- To track when you will get your refund. This helps in planning your personal budget.

- To avoid delays or missed updates. Regular tracking saves you from last-minute surprises.

- To fix errors if any issue comes up. The sooner you know, the faster you can correct mistakes.

How the IRS Handles Your Return

- IRS first receives your return electronically or by mail. Once received, they record it in their system.

- They check basic details like name, SSN, and income. A mismatch here can delay the process.

- Next, they verify deductions and credits. Each entry is checked to ensure accuracy.

- If all is correct, they approve and release the refund. Direct deposits are issued faster.

- If there are issues, they may request more info. This is usually done through a letter or notice.

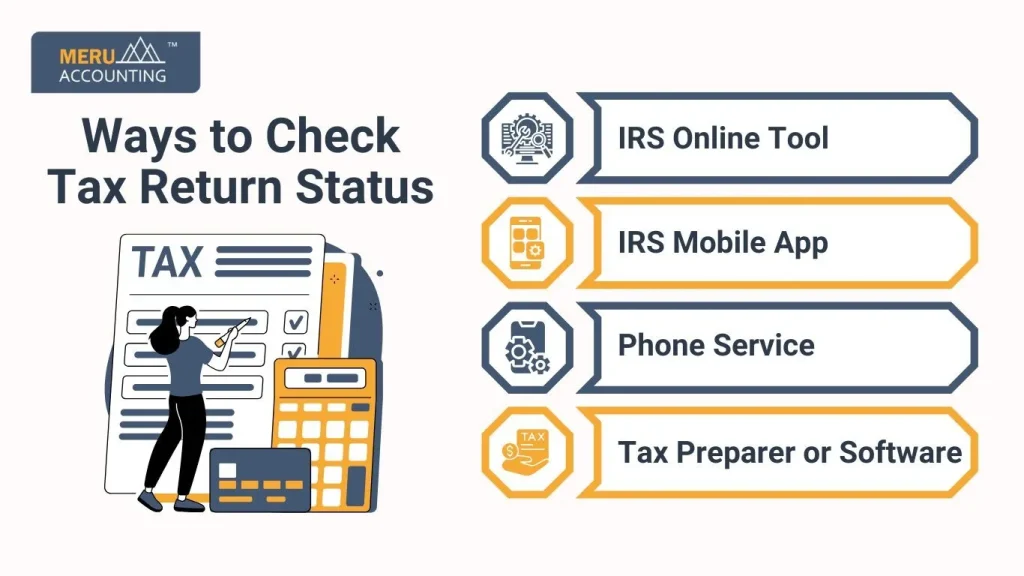

Ways to Check Tax Return Status

There are several ways to check tax return status and stay updated.

1. IRS Online Tool

- Use “Where’s My Refund?” on IRS.gov. It is the most reliable method.

- Enter SSN, filing status, and refund amount. Details must match exactly.

- Get live updates on your IRS tax return status. The tool is updated daily.

2. IRS Mobile App

- Download the IRS2Go app. It is free and safe to use.

- Works like the online tool. You can track the status anytime.

- Check refund status on your phone. If you are unsure how to check tax return status, the IRS2Go app makes the process quick and simple.

3. Phone Service

- Call the IRS helpline. Numbers are available on IRS.gov.

- Use an automated system to check the status. Have your details ready before calling.

- You may need to wait if calling during peak season. Learning how to check tax return status online first can save you from long phone delays.

4. Tax Preparer or Software

- If you filed with a tax service, they may give updates. They often sync with IRS data.

- Many software tools show IRS updates in your account. This saves you from visiting the website.

- Always use trusted tax preparers or software. Fake services can misuse your details.

How to Check Tax Return Status Online

- Visit the IRS website. Only use the official IRS.gov site.

- Go to the “Where’s My Refund?” section. The page is simple and easy to use.

- Provide Social Security Number. Enter carefully without mistakes.

- Select your filing status. Options include single, married, or head of household.

- Enter refund amount. Use the exact figure from your tax return.

- Submit and check results. You will see one of the three status updates.

Stages of IRS Tax Return Status

When you check the IRS tax return status, you may see these stages:

1. Return Received

- IRS confirms receipt of your return. This means your return has entered the system.

- You must wait until it is reviewed further. No refund is issued at this stage.

2. Return Approved

- IRS has processed and accepted your return. This shows there are no major issues.

- You will also see the expected refund date. The amount will also be confirmed.

3. Refund Sent

- Refund has been sent to your bank or mailed as a check. This is the final stage of status.

- It may take a few days for funds to reach your account. Mailed checks may take longer.

Common Delays in Tax Return Status

- Errors in SSN or personal details. These cause system rejections.

- Wrong bank account details for direct deposit. Refund may bounce back to the IRS.

- Missing forms like W-2 or 1099 can cause delays. If you know how to check tax return status, you can spot these issues early and respond faster.

- Claiming wrong deductions or credits. These trigger alerts and extra checks.

- Manual review triggered by mismatched data. Reviews take more time to complete.

Tips to Avoid Refund Delays

- Double-check your personal info before filing. Correct details reduce the chances of rejection.

- Use the correct bank account details. Always confirm routing and account numbers.

- File early to avoid the IRS backlog. Early filers usually get refunds faster.

- Keep all W-2 and 1099 forms ready. Missing forms are a common reason for delays.

- Use e-file instead of paper filing for faster updates. E-filing is also more secure.

IRS Tax Return Status for E-File vs Paper Filing

- E-File: Faster updates, usually within 24–48 hours. This is the preferred method.

- Paper Filing: May take 3–4 weeks to show on the IRS system. Paper returns move more slowly.

- Direct deposit refund is faster than a mailed check. Choose a deposit for quick access.

How Long Does It Take to Get a Refund?

- E-file with direct deposit: 2–3 weeks. If you know how to check tax return status, you can see updates on your refund almost daily.

- Paper file with mailed check: 6–8 weeks. Paper checks take longer to print and mail.

- Delays possible if return needs extra review. Reviews can extend wait times.

What If IRS Tax Return Status Shows an Error?

- IRS may ask you to send more documents. Respond quickly to avoid further delay.

- You may need to correct mistakes and re-file. Some errors can be fixed with an amendment.

- If the refund is delayed, the IRS system will display the reason. Always check updates online.

- Always respond quickly to IRS letters. Ignoring notices can lead to penalties.

How to Check Tax Return Status Without Internet

- Use the IRS phone service at 1-800-829-1040. Calls are answered by automated systems.

- Provide SSN, filing status, and refund amount. This helps the system pull your record.

- The automated voice will tell you your refund status. If needed, you may connect to a live agent.

Security While Checking Your Status

- Always use the official IRS website. Anyone searching for how to check tax return status should avoid fake websites that may steal personal details.

- Do not share your SSN on other sites. Keep your data private.

- Avoid emails or texts claiming IRS updates. These are common scams.

- IRS will not ask for a card or banking details by email. Always stay alert.

Benefits of Tracking Your IRS Tax Return Status

- Peace of mind knowing the return is in process. You stay informed at all times.

- Faster resolution of problems. Issues are solved early when spotted.

- Helps plan your finances around a refund. You know when funds will arrive.

- Prevents missed IRS notices. You will not ignore important messages.

Key Points to Remember

- Always track your tax return status after filing. Never ignore this step.

- Use the official IRS website or the IRS2Go app. These are safe and quick.

- Keep your SSN and filing info ready. Small errors can block access.

- Refunds are faster with e-file and direct deposit. Choose this option when possible.

- Respond fast if the IRS needs more documents. This keeps your return moving.

Tracking your IRS tax return status is an important step after filing. It gives you clarity, avoids delays, and ensures your refund reaches you on time. Using online tools, mobile apps, or phone services, you can easily check where your return stands. Always use official IRS channels and never share details with unverified platforms.

At Meru Accounting, we help taxpayers manage the entire filing and tracking process smoothly. Our experts guide you on how to file correctly and track your return without confusion. We make sure you avoid errors that can cause IRS delays. From e-filing assistance to refund tracking, we handle it all for you. With Meru Accounting, you can relax knowing your tax return is in safe hands and your finances are managed with care.

FAQs

- How soon can I check my tax return status after filing?

You can check after 24 hours for e-file and after 4 weeks for paper filing. This ensures the IRS has updated records. - What information do I need to check the IRS tax return status?

You need SSN, filing status, and the exact refund amount. These details must match your return. - Can I check tax return status by phone?

Yes, call the IRS helpline or use their automated phone system. Phone service works without internet. - What does “Return Received” mean?

It means the IRS has received your tax return but has not yet approved it. Processing is still in progress. - How long does it take to get a refund after approval?

Usually, within 2–3 weeks for e-file with direct deposit. Mailed checks take longer. - Why does my tax return status show a delay?

Delays may be due to errors, missing forms, or IRS manual review. Always check for IRS notices. - Is IRS2Go safe for checking tax return status?

Yes, IRS2Go is the official mobile app by the IRS and is secure. It gives real-time updates.