Home » What Features Should I Look for in a Cloud-Based Accounting Software?

What Features Should I Look for in a Cloud-Based Accounting Software?

Fast, clear, and simple tools help business owners work better every day. Many now use cloud-based accounting software to track cash, manage bills, and send reports with ease. These tools cut stress and save time by keeping your work in one place. You can view your accounts from anywhere, sync apps, and manage tasks live. Smart features make it easy to stay on top of your goals. This blog shows the top features of cloud-based accounting software and helps you choose the right tool for your business.

Why Choose Cloud-Based Accounting Software?

Cloud tools change how small businesses handle their money. You no longer need to sit at one desk to check your accounts. With cloud-based accounting software, your team can access records anytime. This brings speed, ease, and better control to your work.

The shift to cloud systems offers many gains. It cuts setup costs, gives fast updates, and lowers tech issues. These tools also grow with your business and offer more safety.

Key Benefits of Using Cloud-Based Accounting Tools

Work from Anywhere

Cloud software lets you manage your accounts from any device. Whether you are in the office, on a trip, or at home, access is always available. This keeps your team in sync and working well. You can log in from home, office, or on the road. This makes teamwork easy and smooth.

Save Time with Auto Features

Smart tools fill in entries, send alerts, and track due bills. Spend less time on numbers and more on growing your business. It fills in data, sends reminders, and tracks due dates.

No More Software Installs

There is no need to install or update anything. Just sign in using your app or browser. This saves time, cuts setup issues, and keeps your software always current. You don’t need CDs or files.

Secure and Backed Up

Your data stays safe with encrypted servers and regular backups. Even if a device breaks or gets lost, your records are safe and easy to restore at any time. Cloud tools store your data in secure servers. They save your files right away as you work.

Real-Time Numbers

Live updates show your income, spending, and profits as they happen. This helps you track business health and make smart choices based on real numbers, not old reports. You can view all your reports live. It keeps your info fresh and easy to use.

Share with Your Team

Cloud tools let many users work at once. You can set roles and rights to keep control. This supports teamwork and helps tasks move without delays. You can set roles and share the tool with your team. This cuts delays and boosts trust.

Lower Costs Over Time

You don’t pay for servers, IT staff, or updates. You pay monthly or yearly, based on what you need. This keeps costs low and more predictable as you grow, with big setup fees or updates. You pay as needed, often each month or year.

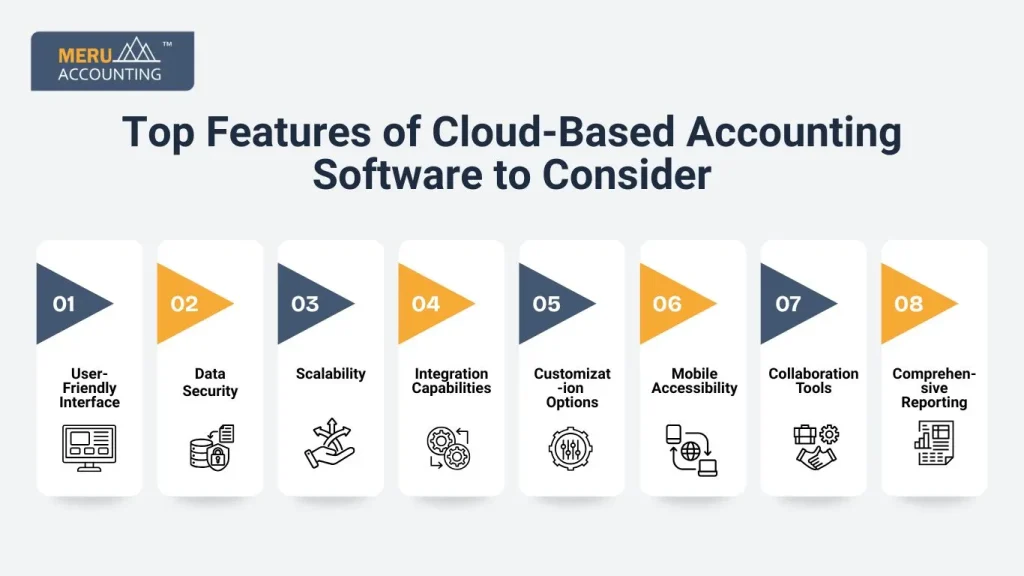

Top Features of Cloud-Based Accounting Software to Consider

To get the best use, you must look for the right features of cloud-based accounting software. Let’s break down what you should check before you buy.

1. User-Friendly Interface:

- The tool must be easy to use for both experts and beginners. It should have simple menus, clean screens, and steps that make sense. A clear layout means faster use and fewer mistakes. This helps your team work better from the start.

2. Data Security:

- Security is a must when handling your business’s financial records. The software must use strong methods like encryption, two-factor login, and cloud backups. Good safety keeps your data private and stops illegal access or leaks.

3. Scalability:

- A growing business needs flexible tools. The software should grow with your team, handle more records, and support extra users. It must stay smooth even when your business grows fast or adds new services.

4. Integration Capabilities:

- Your software must link well with tools you already use, like CRM, payroll, or tax apps. This makes sure your data moves smoothly and saves time by cutting down on double entries.

5. Customization Options:

- Every firm has distinct accounting requirements and workflows. Choose a cloud-based accounting solution with customization capabilities to personalize the software to your individual needs.

- Custom reports, unique dashboards, and changeable settings enable you to adapt the software to your business procedures and preferences.

6. Mobile Accessibility:

- Being able to check your accounts from a phone or tablet helps you stay in charge. You can track sales, send bills, or view reports from anywhere, even when you’re away from the office.

7. Collaboration Tools:

- Effective cooperation is critical for accounting teams, particularly in remote or distant work environments. Choose software that has collaboration options, including shared access, user permissions, and real-time collaboration capabilities.

- These tools improve communication and collaboration among team members, allowing them to work more efficiently and effectively.

8. Comprehensive Reporting:

- Robust reporting tools are vital for understanding your company’s financial health and success. Look for accounting software that provides a variety of adjustable reports, such as profit and loss statements, balance sheets, and cash flow predictions.

- Generating accurate and timely reports allows you to make more educated decisions and promote business success.

How to Pick the Best Cloud Accounting Tool for Your Business

Know Your Needs

Start by listing your needs. What tasks eat up your time? What tools do you already use?

Test the Interface

The look and feel of the tool must be simple. Test the dashboard and check if it suits your skills.

Check for Mobile Access

Pick a tool that has a phone app. You may need to use it while away from your desk.

Read Real Reviews

User reviews give a clear view. Learn what people like or hate about the tool.

Ask About Support

Support matters. Ask if they offer chat, phone, or mail support. Be sure to check the hours and how long you may wait.

Compare the Costs

Cost can vary. Some tools charge per user. Others charge per task. Pick what fits your cash flow.

Free Trials Are a Must

Try the software for a few days. This helps you spot limits before you pay.

Common Mistakes to Avoid When Selecting Cloud Accounting Solutions

Ignoring Team Input

Don’t choose alone. Ask for feedback from the people who will use it. Their view helps a lot.

Skipping Training Needs

If your staff can’t use it well, it’s a waste. Make sure training is easy and quick.

Choosing Features You Don’t Need

Extra tools may look good, but they can slow you down. Pick only what you’ll use.

Not Checking Data Limits

Some tools limit file size or number of entries. Make sure these limits don’t block your work.

Forgetting About Security

Make sure the tool has two-step logins and SSL. It must also comply with local rules.

Overlooking Local Tax Rules

Your software must fit your tax laws. Pick one that suits your region.

Failing to Plan for Growth

Think long-term. Your tool should work now and in five years.

Future Trends in Cloud Accounting Software

- AI-Powered Bookkeeping– Smart tools can sort your bills and bank logs. This will cut your manual tasks.

- Chat-Based Support- Live chat and bots will help solve user issues fast.

- More Data Insights- You’ll get smart tips from the tool based on your past actions.

- Real-Time Tax Filing– Some tools now file tax reports on time and with no help.

- Full Mobile Access- More tools are going mobile-first. Soon, most tasks can be done on phones.

- Better Cash Flow Tools- You’ll get tools that predict and show cash flow issues before they hit.

- Deeper Integrations- Your accounting tool will work with even more apps, making all work seamless.

When it comes to the best features of cloud-based accounting software, Meru Accounting leads with smart, user-friendly tools. We guide you to the right choice for your needs. We match tools to your needs. You won’t pay for what you don’t use.

FAQs

- What is cloud-based accounting software?

Cloud accounting software stores business records online. You use it to track income, check spending, and send bills. It works from any place using a phone or a laptop. - Is cloud accounting software secure?

Yes. Cloud tools use two-step logins, backups, and encryption. These keep your records safe and stop fraud. You can rely on these tools for strong protection. - How can I access my accounts using cloud software?

Log in using your browser or mobile app. You can send bills, check reports, and track money from home, office, or on the go. This helps you stay in control every day. - Does cloud accounting software reduce manual work?

Yes, many tools offer auto features like billing, bank feeds, and data sync. These save time and reduce errors caused by manual entry. - Can cloud accounting software work with my other business tools?

Most cloud tools support integration with CRMs, payroll systems, tax apps, and more. It lets you handle all key tasks from one spot.