Most Common Mistakes to Avoid While Filing Federal Taxes

Filing Federal Taxes is an important yearly duty for everyone. It may look simple, but many people make avoidable errors. These errors may cost time, money, and peace of mind. A small mistake can delay refunds or bring IRS issues. Planning ahead helps you avoid stress and file on time.

When you understand the steps for Filing Federal Taxes and know the IRS rules, the process gets easier. You need to know what income to report and which forms to file. Federal tax return mistakes can be avoided by careful review. Filing with accuracy not only ensures peace but also saves money. With the right care, you can finish this process smoothly.

Why Errors Happen in Federal Tax Filing

- People often rush near the deadline when Filing Federal Taxes and miss key steps. Always start early to stay calm and reduce errors.

- Some filers are not aware of the latest IRS rules. Check updates every year before you start your return.

- Many people do not organize forms or receipts on time. A little planning can avoid large filing mistakes.

- Filing without review causes simple errors that could be avoided. Reviewing once more helps avoid these issues.

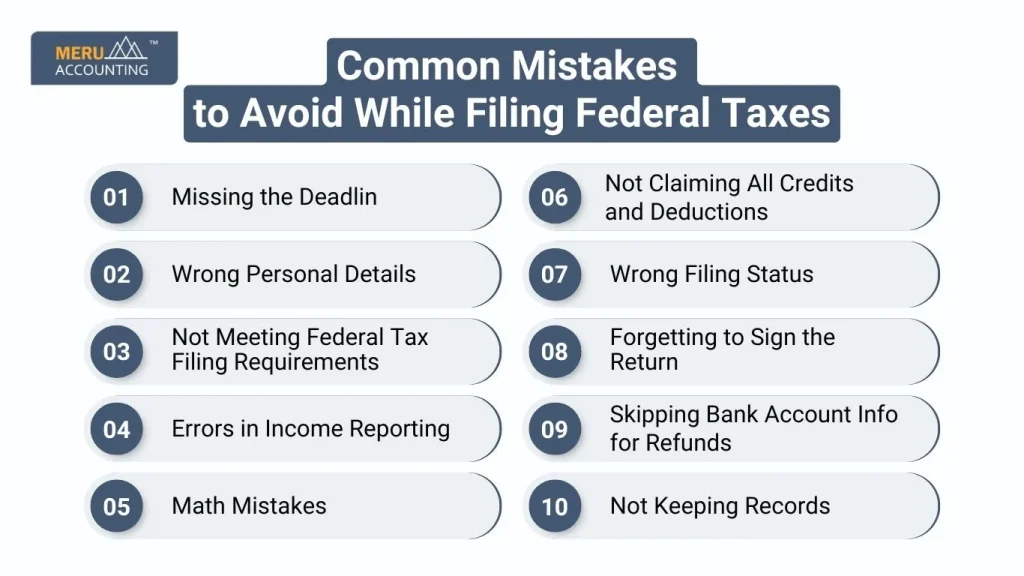

Common Mistakes to Avoid While Filing Federal Taxes

1. Missing the Deadline

- Always check the last date for tax filing. Late filing can bring fines and extra charges from the IRS.

- Mark the date on your calendar early and stay ready. Filing Federal Taxes early also gives more time to fix errors.

2. Wrong Personal Details

- Wrong Social Security Numbers or names may cause rejection. IRS checks personal details before processing your return.

- Double-check every detail before submitting to avoid delay. Keep documents near you when filling in details to stay accurate.

3. Not Meeting Federal Tax Filing Requirements

- Some think they do not need to file with low income. But rules depend on age, status, and other conditions.

- Confirm your federal tax filing requirements every year with the IRS. A quick check saves penalties and missing refunds.

4. Errors in Income Reporting

- Many forget side jobs, freelance pay, or gig income. These earnings are also taxable and must be reported.

- Report all 1099s, W-2s, and extra sources of pay. Skipping any income may cause notices and penalties later.

5. Math Mistakes

- Wrong math can lead to wrong refunds or dues. Small math errors often create confusion and refund delays.

- Use tax software or calculators to be error-free. Federal tax return mistakes can be avoided with smart tools.

6. Not Claiming All Credits and Deductions

- Some miss credits like the education or child tax credit. Missing credits means paying more than you actually should.

- When Filing Federal Taxes, always check IRS lists of credits and deductions each year. Filing Federal Taxes correctly saves money when benefits are claimed.

7. Wrong Filing Status

- Single, married, and head of household have different rules. Picking the wrong one may increase your final tax.

- Read the IRS guide to choose your correct status. Federal tax return mistakes can be avoided by checking your status early.

8. Forgetting to Sign the Return

- Unsigned returns are not valid and get rejected. IRS treats unsigned returns as if never filed at all.

- When e-filing, always use your secure IRS PIN. Double-check signing before sending to avoid late problems.

9. Skipping Bank Account Info for Refunds

- If you want a direct deposit, enter the correct details. Wrong account numbers may delay your refund for weeks.

- Federal tax return mistakes can be avoided by double-checking. Direct deposit is faster and safer than mailed checks.

10. Not Keeping Records

- Keep all W-2s, 1099s, and receipts for later proof. Records help if the IRS asks for supporting evidence in the future.

- Proper record keeping helps you plan next year’s filing. Stay safe and organized by keeping copies in one file.

Tips to Make Filing Federal Taxes Easy

Stay Organized

- Collect all income forms before starting your return. Missing even one form may cause serious filing errors.

- Sort receipts and bills in clearly labeled folders. Staying neat saves time and avoids future tax issues.

Use Tax Software or a Preparer

- Software checks for small errors and quick updates. Many tools also guide you through deductions step by step.

- Preparers know the rules and save you money legally. Federal tax return mistakes can be avoided with expert help.

Review Before Submitting

- Double-check names, numbers, and all income figures. Reviewing helps ensure the IRS accepts your return smoothly.

- A few minutes of checking saves weeks of delay. Always review credits and deductions before pressing submit.

File Early

- Early filing gives time to fix any mistakes. Filing earlier also reduces the risk of identity theft.

- Do not wait until the last week for filing. Federal tax filing requirements are easier when handled on time.

Importance of Meeting Federal Tax Filing Requirements

- Filing Federal Taxes ensures compliance and helps you avoid IRS penalties. Meeting deadlines gives peace and protects financial standing.

- Even with low income, filing builds a legal record. Refunds and credits are often missed by non-filers.

- Federal tax filing requirements change based on many factors. Always confirm requirements for your personal situation yearly.

Federal Tax Return Mistakes Can Be Avoided By Following These Rules

- Stay updated with IRS notices and yearly tax changes. Following new updates ensures accuracy during federal tax filing.

- File on or before the deadline to avoid fines. Never wait until the last moment for safe filing.

- Report all income, including side jobs and gig pay. Hidden income often causes IRS letters and stress.

- Claim every deduction and credit that you qualify for. This reduces tax and improves your refund amount quickly.

- Keep safe records for future checks and references. Federal tax return mistakes can be avoided by taking simple steps.

Common IRS Notices Linked with Federal Tax Errors

Identity Verification Notice

IRS may ask you to confirm your ID. This happens if your details do not match the records. Always use correct names, SSNs, and addresses when filing.

Math Error Notice

Small math mistakes may trigger notices. IRS fixes numbers but delays refunds. Careful filing helps avoid this.

Missing Information Notice

IRS may send letters if forms are missing. Lost W-2s or 1099s often cause this. Keep all forms safe for smooth filing.

Adjustment Notice

IRS may adjust your return after review. This happens if credits or deductions are wrong. Double-check all claims before final submission.

Benefits of Filing Federal Taxes Correctly

Avoid Penalties

Correct filing avoids fines for late or wrong returns. Penalties grow if you ignore them.

Build Trust with IRS

Accurate filing keeps you in good standing. Trust lowers audit risk.

Gain Access to Future Credits

Some credits need past filing history. Good records ensure you qualify.

Protect from Legal Issues

Errors while Filing Federal Taxes may cause legal action. Correct filing protects you.

Role of Digital Tools in Tax Filing

Guided Filing Process

Software guides each step. This reduces errors and makes filing easy.

Automatic Updates

Tax tools update with IRS rule changes. You always file with the latest laws.

File Storage and Backup

Most tools save returns securely. Past returns are easy to access.

Easy Access Anywhere

Cloud tools let you file from any device. Filing online saves time and effort.

How Early Planning Helps Avoid Tax Mistakes

Budgeting for Taxes

Planning lets you save for payments. This reduces stress during tax time.

Professional Consultation

Early planning gives time to ask experts. Their advice lowers mistakes.

Tracking Yearly Income

Track income during the year to avoid errors. Stay aware of tax needs.

Avoiding Last-Minute Rush

Planning removes deadline stress. Calm filing gives accurate results.

Risks of Ignoring Federal Tax Filing Requirements

Wage Garnishment

IRS may take part of your paycheck if taxes go unpaid.

Seized Refunds

Future refunds may be held until dues are cleared.

Damaged Credit Score

Unpaid taxes may hurt your credit history. Loans then get harder to secure.

Legal Actions

Serious non-compliance may cause legal trouble. IRS can take strict steps.

How Professional Help Can Improve Accuracy

Updated Knowledge

Professionals know the new IRS rules. This prevents errors.

Handling Complex Cases

Experts manage returns with many income sources. Each source is filed correctly.

Audit Support

Professionals can speak for you in audits. This reduces stress.

Tailored Advice

Experts suggest deductions for your case. This saves money within the law.

Impact of Filing Status on Your Taxes

Qualifying Widow(er) Status

This status applies to those with kids. It offers benefits like joint filing.

Separate Filing Downsides

Married filing separately removes some credits. Couples often pay more.

Impact on Standard Deduction

Filing status sets the deduction size. The wrong choice may cut savings.

Eligibility for Credits

Some credits depend on status. Example: Earned Income Credit.

Why Keeping Records is a Long-Term Benefit

Avoiding Duplicate Reporting

Good records stop double entry of income.

Proof of Charitable Donations

Receipts prove your claims. Without proof, the IRS may deny them.

Support During Business Growth

Self-employed? Records show trends for tax planning.

Easy Audit Response

With records ready, audits move faster and with less stress.

How Refund Delays Happen from Small Mistakes

Wrong Address

Refund checks fail if the address is wrong.

Multiple Bank Accounts

Using many accounts may confuse IRS systems.

Incomplete Forms

Missing info means review and delay.

Data Entry Errors

One wrong digit can slow refunds. Always review before filing.

Filing Federal Taxes can be simple when done with care. Most errors are common and easy to prevent. Knowing your federal tax filing requirements helps you plan better. Federal tax return mistakes can be avoided by small, careful actions. With the right planning, tax filing becomes smooth and stress-free.

At Meru Accounting, we help clients with accurate tax filing. Our experts review every detail to avoid costly mistakes. We ensure all federal tax filing requirements are met on time. Federal tax return mistakes can be avoided by trusting skilled professionals. With our support, you can focus on life and leave taxes to us.

FAQs

- What happens if I miss the deadline for Filing Federal Taxes?

You may face IRS penalties along with added interest charges. - How do I know my federal tax filing requirements?

Check IRS charts for income, age, and filing status. - Can math errors delay my refund?

Yes, math mistakes often slow down refund processing. - What if I forget to sign my return?

Unsigned returns are rejected and must be resubmitted. - How can I make sure my federal tax return mistakes can be avoided by planning?

Stay organized, use tools, and review details carefully. - Do I need to keep records after filing?

Yes, the IRS may ask for proof during later audits. - Is it better to e-file or mail my return?

E-filing is quicker, safer, and less error-prone.