How to Get Cost-Effective Offshore Bookkeeping Services?

Managing books can take up too much time, especially for growing firms. Offshore bookkeeping services help reduce cost and free up time. But finding the right service at the right cost is not always simple. This blog explains how to make it work without cutting corners.

What Are Offshore Bookkeeping Services?

Offshore bookkeeping services mean hiring a third-party firm in another country to handle your books. These tasks may include recording transactions, reconciling bank accounts, preparing reports, and managing payables.

They often use cloud tools like QuickBooks, Xero, or Zoho Books to work remotely. You can track their work in real time and maintain control.

Most offshore teams work from places with lower living costs. This means they can offer the same work at a lower rate than local firms.

Why Firms Choose Offshore Bookkeeping Services

Small and mid-sized businesses use offshore bookkeeping services for these main reasons:

- To cut labor costs without lowering output

- To focus on core business instead of daily entries

- To avoid hiring full-time staff for part-time needs

- To get access to skilled bookkeepers at lower rates

These services help firms stay lean and still keep strong financial records.

Challenges You May Face

Offshore services are useful, but not perfect. Some common issues include:

- Time zone gaps

- Language clarity

- Data privacy concerns

- Lack of industry knowledge

Planning and the right vendor can reduce or avoid most of these issues.

How to Find the Right Offshore Bookkeeping Partner

1. Check Their Experience

Look for firms that have served businesses like yours. Check how long they’ve worked with offshore clients.

2. Ask About Tools They Use

Do they work with tools you use already? Can they manage backups? Do they know your accounting software?

3. Review Their Process

Ask how they handle day-to-day work. Do they have review checks? Do they follow a checklist? You want them to be organized.

4. Check References or Reviews

Ask for client references. Read reviews. Ask for proof of their results.

5. Discuss Security Steps

Data must be safe. Ask about their security controls. Do they follow data protection rules? Do they use secure login and file sharing tools?

How to Keep Costs Low Without Losing Quality

Cost is key. But lower price should not mean poor quality. Here’s how to save while keeping your books in order:

1. Choose a Clear Scope of Work

Decide what the offshore team will handle. It can be basic tasks like data entry or full reports. Clear scope avoids confusion and waste.

2. Use Standard Tools

Use cloud tools both sides can access. This keeps work smooth and avoids setup cost. QuickBooks, Xero, and Zoho are good picks.

3. Work With a Fixed Price Model

Hourly billing can add up fast. Ask for fixed price packages. This keeps your cost known and stable.

4. Build a Long-Term Relationship

Long-term deals help reduce your rate. Vendors often give better terms to long clients.

5. Keep Work Simple

Avoid tasks that need too much custom work. Standard steps cost less and are easier to track.

Best Countries for Offshore Bookkeeping Services

Many countries offer offshore services. Here are a few common ones:

- India – Known for trained staff and strong English skills. Offers a wide range of services.

- Philippines – Offers good English support. Works well for firms needing real-time updates.

- Mexico – Works well for firms in North America due to time zone match.

- Vietnam – Lower cost and trained staff. Suitable for basic bookkeeping.

Always check vendor skills, not just location.

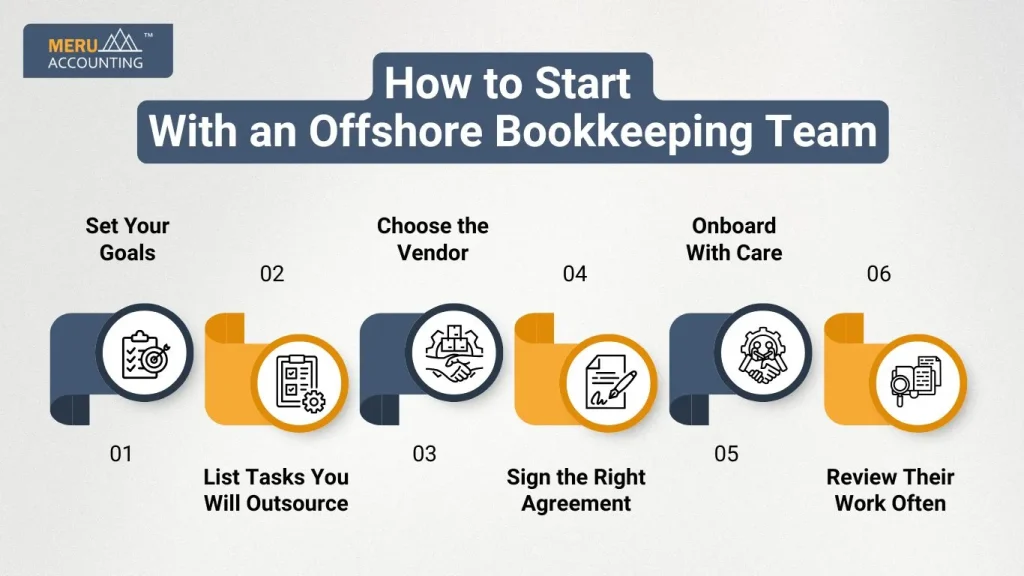

How to Start With an Offshore Bookkeeping Team

Step 1: Set Your Goals

Know why you want offshore help. Is it to cut cost, save time, or get better reports?

Step 2: List Tasks You Will Outsource

This may include:

- Daily transactions

- Bank reconciliation

- Payroll reports

- Payable and receivable tracking

- Budget tracking

Step 3: Choose the Vendor

Shortlist firms. Ask for trial work. Compare prices, tools, and reviews.

Step 4: Sign the Right Agreement

Your contract must cover scope, tools, rates, delivery time, support, and exit terms.

Step 5: Onboard With Care

Give them clear instructions. Share samples. Walk them through your process. Good training saves time later.

Step 6: Review Their Work Often

Set weekly or monthly review meets. Ask for regular reports. Give feedback early.

How to Avoid Common Mistakes

1. Not Defining Tasks Clearly

You must tell what you want in clear terms. Vague tasks lead to delays and extra cost.

2. Ignoring Data Security

Use encrypted tools. Avoid email for files. Make sure they use strong passwords and backups.

3. No Clear Point of Contact

You need one person on their side who owns the work. Don’t work with a team where nobody is accountable.

4. Skipping Reviews

Bookkeeping needs regular checks. If you don’t review, you may miss issues until tax season.

5. Hiring Based Only on Price

Low price is good but not at the cost of errors. Always check for skill and process.

Signs of a Good Offshore Bookkeeping Firm

- Replies fast and clearly

- Uses secure tools

- Follows process steps

- Gives clear reports

- Understands your industry

If they ask the right questions, it shows they care about doing it right. At Meru Accounting, we make sure all our clients are satisfied with our offshore bookkeeping process.

Offshore Bookkeeping for Different Businesses

- For E-commerce Firms – They track orders, fees, returns, and taxes from marketplaces.

- For Real Estate – They manage rent income, vendor bills, and bank records.

- For Law Firms – They keep trust accounts and billable hours.

- For Startups – They build clean books from day one, which helps with fundraising.

- For CPA Firms – They act as back office teams that manage all client books.

Key Questions to Ask Your Offshore Bookkeeping Firm

- How do you handle time zone gaps?

- What’s your review process?

- Do you follow GAAP or IFRS rules?

- How do you keep data secure?

- Can I get daily or weekly updates?

These help check if they can work long term with you.

What to Expect After You Hire Them

Once onboarded, expect:

- A checklist of tasks each week

- Reports by due date

- Quick answers to your queries

- No surprise fees

- Easy tracking of past entries

A good team will feel like an extension of your in-house staff.

Long-Term Value of Offshore Bookkeeping Services

When you choose the right team, offshore bookkeeping services do more than save cost. They help you stay on top of your numbers without hiring extra staff. They can help during audits or tax filing. And they help you plan cash and growth.

How Offshore Bookkeeping Helps with Compliance and Tax

Offshore bookkeeping teams often assist with compliance tasks. They track tax deadlines, prepare schedules, and flag missing receipts. This helps reduce costly fines and audits. Many firms stay updated on tax laws in your country. This knowledge ensures your books match government rules.

Some services offer tax filing support or work alongside your tax advisor. This connection saves time during tax season and prevents surprises.

Improving Business Decisions with Offshore Bookkeeping

Regular reports from offshore teams provide clear views of your finances. You can spot trends, track cash flow, and plan budgets. When you get timely data, decisions about buying, hiring, or investing become easier.

Some providers offer custom dashboards or reports. These tools give quick insights without waiting for manual updates.

Tips to Work Smoothly with Offshore Bookkeepers

- Use video calls for training and monthly reviews to build trust.

- Document your processes clearly and share updates.

- Agree on communication methods like email, chat apps, or phone.

- Set realistic deadlines considering time zone differences.

- Encourage questions. A good bookkeeper will ask when unsure.

Why Transparency Matters

Choose a partner who shares their progress openly. Transparency builds trust and helps avoid misunderstandings.

Ask for:

- Access to software anytime

- Regular status reports

- Clear invoices with no hidden fees

This openness helps keep your bookkeeping accurate and your budget intact.

Offshore bookkeeping services are useful if planned well. Define tasks, check skills, and review work often. Choose value over just low rates. A strong offshore team can help your books stay clean, your time stay free, and your costs stay low.

By following these steps, you’ll find cost-effective offshore bookkeeping services that support your business growth without surprises or delays.

Meru Accounting has proven expertise and a client-focused approach. We specialize in offshore bookkeeping for industries like real estate, construction, restaurant and many other professional services. With strong communication, secure processes, and transparent pricing, Meru Accounting helps businesses reduce costs without sacrificing quality. Get a trusted extension of your finance department that keeps your books accurate and your operations running smoothly.

FAQs

- Can offshore bookkeeping work with my current software?

Yes. Offshore teams use the same software you have. They handle QuickBooks, Xero, or NetSuite smoothly. - Will I lose control if I outsource bookkeeping?

No. You keep control. They do daily tasks while you review reports and updates. - Is offshore bookkeeping good for small businesses?

Yes. It saves money and time. Small firms can avoid hiring extra staff. - How do I see the work done offshore?

You get access through cloud software. You can watch progress and get updates anytime. - Is it safe to share my financial data offshore?

Yes. Trusted firms protect your data with secure systems and agreements. - Why choose Meru Accounting for offshore bookkeeping?

Meru Accounting offers trained teams. They use your tools and keep your books accurate and current.