What Are the Costs and Time Involved in Becoming a Xero Certified Bookkeeper?

Xero is one of the most popular accounting software platforms. Becoming a Xero Certified Bookkeeper can open doors to better jobs and clients. The certification shows that you know how to use Xero for real business tasks. It is free, online, and beginner-friendly. Xero certification is valued by both employers and clients. It adds real strength to your resume. The course teaches key tools like invoicing, bank feeds, and reports. You can learn at your own speed, which suits busy work lives. Once you pass, you also get access to Xero HQ and tools to help grow your firm.

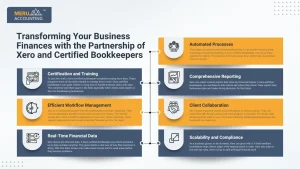

Transforming Your Business Finances with the Partnership of Xero and Certified Bookkeepers

Xero is a powerful cloud tool that helps small and mid-size firms with their books. Bookkeepers who gain Xero certification learn how to use the software well. They can help clients save time, cut errors, and get a clear view of their business. Let’s explore the key points that cover what a Xero-certified bookkeeper does and the time and cost involved in becoming certified.

Certification and Training

To use Xero well, a Xero-certified bookkeeper completes training from Xero. These programs teach all the skills needed to manage Xero’s tools. Once certified, bookkeepers can guide clients in using Xero to handle business tasks with ease. This credential sets them apart in the field, especially when clients seek experts in Xero for bookkeeping businesses.

Efficient Workflow Management

Xero is a cloud-based system that lets bookkeepers work from anywhere. They can manage books, handle invoices, and run payroll on the go. This remote access lets a Xero-certified bookkeeper act fast when clients need help. Quick support means better service and smoother financial work for the client.

Real-Time Financial Data

Xero shows live financial data. A Xero-certified bookkeeper can check and share up-to-date numbers anytime. This gives clients a real view of how their business is doing. With this data, owners can make smart moves and fix weak areas before they become problems.

Automated Processes

Xero helps cut manual work by automating tasks. It can handle invoicing, bank matching, and expense tracking. A Xero-certified bookkeeper can set up these systems for clients. This reduces errors and saves time, which helps businesses focus on growth.

Comprehensive Reporting

Xero can create custom reports that show key financial trends. A Xero-certified bookkeeper can use these to help clients see where they stand. Clear reports help businesses plan and make strong decisions for the future.

Client Collaboration

Xero makes it easy for clients and bookkeepers to work as a team. They can share files, talk through issues, and track progress in real time. This builds trust and keeps both sides in sync. For those in Xero for bookkeeping businesses, this teamwork is a major win.

Scalability and Compliance

As a business grows, so do its needs. Xero can grow with it. A Xero-certified bookkeeper helps clients adapt while keeping books in order. Xero also stays in line with tax rules, which is key to safe and legal financial work.

How to Hire a Xero Certified Bookkeeper?

Bookkeeping is one of the most vital parts of any business. Hiring a Xero-certified bookkeeper can be a smart move, but not always easy. There are many things to check before making the hire. A certified bookkeeper brings more than just skills. They bring clear, reliable records and help you better understand how your numbers work. If you hire someone with the right training and a strong past record, it can give your business a real edge.

What Xero Bookkeepers Do for Your Business

As mentioned above, Xero bookkeeping is a method of cloud-based bookkeeping. That means the financial data is not stored in physical books or on a single device, but online. A Xero-certified bookkeeper uses this system to track all financial entries.

Here’s how they help:

- Every cash inflow and outflow is recorded in Xero

- Entries are grouped under the right heads—like sales, salary, rent, etc.

- Based on those records, reports like Profit & Loss, balance sheets, and bank reconciliations are created

- They make sure your records are up to date and compliant with tax rules

- You can see the state of your business in real time

This setup saves time and cuts errors. It also lets business owners see the big picture and make smart decisions.

How to Hire a Xero Certified Bookkeeper?

Now to the main point—how to hire the right person for the job. Here are some steps to help you choose a skilled Xero-certified bookkeeper:

1. Check Their Certificate

Start by checking if they are really Xero certified. Ask for their badge or ID from Xero. This confirms they’ve passed the right courses and know how to use the software well.

2. Review Their Work Record

Go through their past work. What type of clients have they worked with? Do they have experience in your industry? A strong work history can give you peace of mind.

3. Ask for Referrals

Talk to other businesses they’ve worked for. Ask how they handled the job, how they solved issues, and if they were easy to work with.

4. Test Their Software Skills

Xero is more than just data entry. A good Xero bookkeeper knows how to set up reports, use add-ons, automate entries, and link with other apps. Make sure they can use all the key features.

5. Check Their Communication Style

They should be able to explain numbers in simple words. If you don’t understand reports, the bookkeeper must guide you. Clear talks are just as key as correct numbers.

Why It Matters

A Xero-certified bookkeeper is more than a record keeper. They give you:

- Better control over cash flow

- Help with tax filing and audits

- Clear financial reports

- Time to focus on business growth

They can be a true partner in the growth of your company. So take your time, check their skills, and hire the best fit.

Certification and Training

To start, a bookkeeper must finish a certification course by Xero. This is a full guide on how to use all the tools Xero offers. These tools include invoicing, payroll, and bank feeds. Once trained, the Xero-certified bookkeeper knows how to help clients use the system for better results.

Average Time to Complete: About 6–8 hours, though this depends on the mode and skill level.

Learning Formats Available

Xero gives three ways to learn:

- Self-paced Online Courses

Go at your speed. Best for people with work or other tasks. - Live Webinars

These let you ask questions live with Xero experts. - Fast-track Assessments

Skip basic lessons and get certified fast if you already know the system.

Each option is clear and gives all you need to use Xero well.

What the Certification Covers

The course goes through each part of the system. These are the core skills learned:

- Set up client accounts

- Create and send invoices

- Do bank recs

- Handle payroll

- Build reports

After the course, you take a test. It includes tasks and questions to make sure you understand how to use the tools.

Cost of Getting Xero Certified

Xero certification is free if you’re a bookkeeper, CPA, or work in finance and serve clients. This makes it a smart choice for growing your firm.

No fees. No hidden charges. Just your time and effort.

Extra Perks After Certification

When you pass, Xero gives you:

- Access to Xero HQ

A pro dashboard to manage clients and tasks. - Free Xero Software Access

Use Xero for your own practice at no extra cost.

Comparison: Xero Certification vs. Other Software Certifications

Software | Certification Cost | Time to Complete | Renewal | Free Demo Account |

Xero | Free | 6–8 Hours | Yearly | Yes |

QuickBooks Online | Paid | 8–10 Hours | Yearly | Yes |

Zoho Books | Free | 5–7 Hours | No | Yes |

Sage Accounting | Paid | Varies | Varies | No |

Xero Certification is one of the most flexible and accessible options.

Certification for Global Users

- Xero is used in countries like the USA, UK, Australia, New Zealand, Canada, and more.

- Xero’s certification and training are adjusted to local rules (like tax systems and payroll).

- The certification is relevant whether you work with local or international clients.

While the training is free, you may lose some billable hours while you study. But the skills you gain make up for it by letting you charge more and work smarter. Getting Xero certified is free, simple, and valuable. In under 8 hours, you can become an Xero Certified Bookkeeper. It boosts your career in bookkeeping, freelancing, or accounting. No large cost, no long time – just commitment and practice. At Meru Accounting, we have a skilled team of Xero Certified Bookkeepers. We use Xero to give smart, fast, and clear bookkeeping services. Our team knows the software well and helps clients with smooth and clean records. With strong skills and the right tools, we make bookkeeping easy for your business.

FAQs

1. Is Xero certification free?

Yes, it is 100% free to join and complete.

2. How long does it take to get certified?

Most people finish the course in 6 to 8 hours.

3. Do I need a finance background?

No, it’s made for all, even if you’re new to finance.

4. Can I call myself a Xero Certified Bookkeeper after this?

Yes, once you pass, you can use that title.

5. Do I get a certificate after completion?

Yes, Xero gives you a digital certificate.

6. Do I need to renew the certification?

Yes, each year you must do a short refresher.

7. Can I add Xero certification to my resume?

Yes, and it can boost your job profile too.