Home » The True Cost of DIY QuickBooks Bookkeeping vs. Hiring a Bookkeeper

The True Cost of DIY QuickBooks Bookkeeping vs. Hiring a Bookkeeper

Many small business owners choose DIY QuickBooks Bookkeeping in the early stages. It seems simple and cost-effective. The software handles tasks like invoicing, expense tracking, and reporting. But as the business grows, things can get more complex. Managing books alone takes time and effort. Errors become harder to fix. Missed deadlines and compliance issues can lead to fines. While QuickBooks provides helpful tools, it does not replace the value of experience. Hiring a bookkeeper brings accuracy, insights, and peace of mind to business owners.

What Is DIY QuickBooks Bookkeeping?

DIY QuickBooks Bookkeeping refers to handling your business’s financial records on your own using QuickBooks software. This section outlines what this approach involves and explains how it suits various business types.

Easy-to-Use Interface for Starters

QuickBooks gives users a clean and easy dashboard. It helps beginners understand where their money comes from and where it goes. This tool suits those with little or no background in accounts.

Control Over All Business Expenses

With DIY QuickBooks Bookkeeping, you can manage your expenses by yourself. You see what you earn and spend daily. It gives a full picture of how money moves.

Cloud Access from Anywhere

The software works on the cloud. That means you can access it from your office, home, or on the road. You only need a device and the internet to use it.

Invoicing Made Simple

You can send bills to clients using QuickBooks. It keeps track of who paid, who didn’t, and when. This makes billing and follow-ups much easier for small firms.

Automatic Bank Feeds and Syncing

QuickBooks connects with your bank and pulls in transactions. This saves time and avoids mistakes. It updates records without the need for manual entries.

Ideal for Freelancers or Solo Entrepreneurs

If you’re a freelancer or running a small one-person business, this tool may be enough. But as the business grows, the system may not meet all new needs.

Breaking Down QuickBooks Bookkeeping Pricing

When looking at QuickBooks bookkeeping pricing, things are not always clear. However, hidden costs and the time required to manage it can make the total expense more complex than expected.

Basic Plan May Seem Cheap

The low-cost plan attracts many business owners. It looks budget-friendly at first glance. But it covers only basic features and has limits for add-ons.

Extra Features Raise the Price

The more tools you add, the more it costs. Payroll, advanced reporting, and extra users all add fees. It’s no longer cheap once you need more support.

Cost Varies Based on Business Type

A small retail shop and a medium-sized agency have different bookkeeping needs. As those needs grow, QuickBooks bookkeeping pricing rises to reflect the additional features required.

Paying for Unused Features

Some features in high-tier plans may go unused. You pay for things you don’t even need. This leads to a waste of money every month.

Training Time Adds Hidden Cost

Learning to use QuickBooks takes time. That time could be spent on serving clients or growing sales. These lost hours can cost more than you think.

Fixing Errors May Require Expert Help

If you mess up, fixing errors may cost a lot. You might even end up hiring an accountant later, beating the point of doing it yourself.

Challenges of DIY QuickBooks Bookkeeping

DIY QuickBooks Bookkeeping may look simple, but it comes with risks. Time, stress, and costly mistakes often go unseen until it’s too late. Let’s break down the common hurdles.

Long Learning Curve for First-Timers

QuickBooks isn’t hard, but it’s not foolproof either. First-time users need weeks to understand terms and tools. This learning curve takes effort and energy.

Small Mistakes Turn Costly Fast

A small entry error can affect your whole report. You might miss tax credits or file incorrect returns. That mistake could bring penalties later.

Constant Software Updates

QuickBooks updates its platform often. With every update, the layout may change. Users must keep learning new things to stay updated.

Poor Reporting Leads to Wrong Choices

Bad data leads to bad business decisions. If the books are wrong, you may undercharge or overspend. You can’t grow with messy books.

Managing Multiple Roles Adds Pressure

As an owner, you already handle sales, staff, and more. Adding bookkeeping to your list creates stress. It may reduce your focus on core work.

Lacks Human Advice in Complex Cases

Software cannot understand your full picture. It won’t guide you through loans, taxes, or audit risks. That’s where human help wins.

Hiring a Professional Bookkeeper: What to Expect

Hiring a bookkeeper may cost more upfront, but it saves money and stress later. Compared to DIY QuickBooks Bookkeeping, it offers deeper insight, fewer errors, and real peace of mind.

Personal Attention to Your Business

A bookkeeper sees your records and knows your goals. They give insights made just for your business. You get help that fits your needs.

Timely Reports for Smart Planning

You’ll get reports on time, every week or month. These reports help track cash flow and growth. You’ll know where to cut costs or invest more.

No Need to Learn Complex Software

Bookkeepers already know QuickBooks or other tools. You don’t need to learn it all. You can focus on your business while they manage the books.

Helps with Tax Preparation and Filing

They keep all records clean for tax season. Your CPA can file faster and with fewer errors. You may even save on taxes with better tracking.

They Scale with Your Growth

As you grow, they adjust. Whether you add a new service or hire more staff, they will change the reports and budgets as needed.

Saves You Time Every Week

No more spending evenings on bookkeeping. A bookkeeper gives you back hours. You can use those hours to grow or relax.

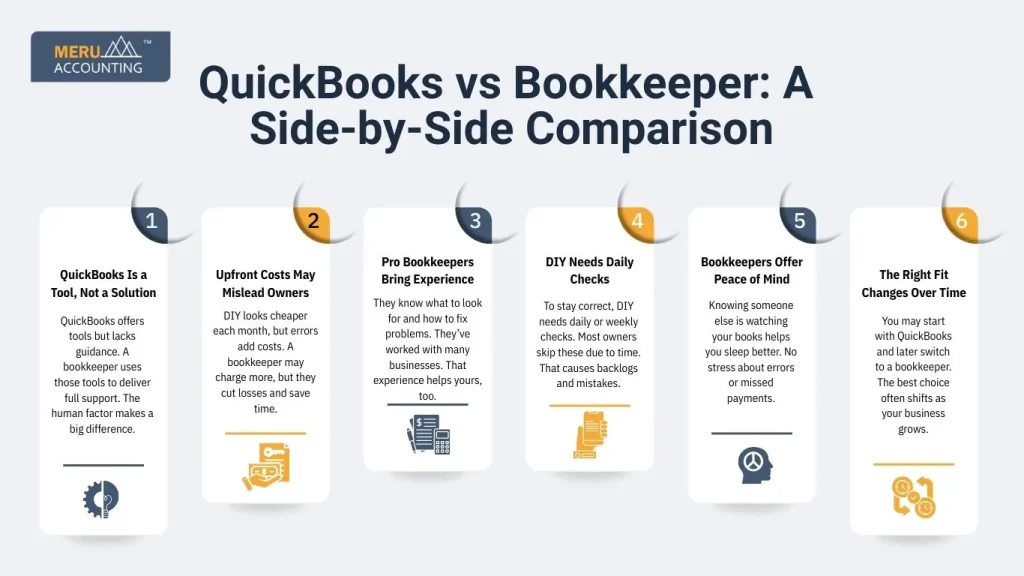

QuickBooks vs Bookkeeper: A Side-by-Side Comparison

Choosing between QuickBooks vs Bookkeeper isn’t easy. Each option has its own cost, effort, and support level. A true side-by-side view shows where each wins and falls short.

QuickBooks Is a Tool, Not a Solution

QuickBooks offers tools but lacks guidance. A bookkeeper uses those tools to deliver full support. The human factor makes a big difference.

Upfront Costs May Mislead Owners

DIY looks cheaper each month, but errors add costs. A bookkeeper may charge more, but they cut losses and save time.

Pro Bookkeepers Bring Experience

They know what to look for and how to fix problems. They’ve worked with many businesses. That experience helps yours, too.

DIY Needs Daily Checks

To stay correct, DIY needs daily or weekly checks. Most owners skip these due to time. That causes backlogs and mistakes.

Bookkeepers Offer Peace of Mind

Knowing someone else is watching your books helps you sleep better. No stress about errors or missed payments.

The Right Fit Changes Over Time

You may start with QuickBooks and later switch to a bookkeeper. The best choice often shifts as your business grows.

As you grow, your needs shift. QuickBooks vs bookkeeper isn’t just a cost question; it’s a growth and strategy choice that evolves with your business goals

How to Decide What’s Right for Your Business

The choice depends on your time, growth stage, and goals. Here’s how to choose smart for your setup.

Check Your Current Stage of Growth

If you’re just starting, QuickBooks may work. But if you’re growing fast, hiring help saves stress and time.

Evaluate the Time You Can Spend

If you only have a few hours each week, DIY may not work. Bookkeeping needs time to do right.

Think About Error Risk

If your records must be perfect, like during funding or audits, go pro. One small mistake can hurt your chances.

Consider Business Complexity

If your business has many products, staff, or rules, QuickBooks alone may not be enough. You’ll need expert help.

Ask How Fast You Want to Scale

Want to double your growth? You need time to lead. Bookkeepers free you up for bigger goals.

Set Budget with Value in Mind

Hiring a bookkeeper is an investment. Their work pays back through saved time, fewer errors, and tax savings.

At Meru, we build plans that suit your size, goals, and tools. Your books stay in sync with your growth. You get clear, simple pricing. We handle QuickBooks every day. We fix errors, speed up tasks, and keep everything in order. We stay updated on your state and industry tax laws. Contact us to get advice that fits your region and business type.

FAQs

- Is DIY QuickBooks Bookkeeping enough for a small business?

It might work for very small firms, but once your needs grow, you risk errors. A bookkeeper ensures your books stay clean.

- How much does QuickBooks cost each month?

QuickBooks bookkeeping pricing starts around $30, but with added tools, you could pay $100 or more monthly.

- Can a bookkeeper use QuickBooks on my behalf?

Yes. Many bookkeepers work with QuickBooks. They know the software well and can help you use it better.

- What if I have already made mistakes in QuickBooks?

A bookkeeper can fix past errors and clean your records. This saves you from future issues during tax time or audits.

- Do I lose control by hiring a bookkeeper?

Not at all. You stay in charge while we handle the busy work. We keep you informed and involved.