Outsourcing Bookkeeping for Doctors: A Path to Efficiency and Cost Savings

Managing money is key for every medical expert. But it often takes time, effort, and special skills. Doctor bookkeeping needs care to stay legal, clear, and stress-free.

Outsourcing bookkeeping for doctors brings many gains—more free time, cost cuts, and fewer errors. It also helps doctors focus more on patient care, not paperwork.

Bookkeeping for doctors is vital to keep medical practices running well. Its needs change based on the size of the practice. A small clinic and a large hospital will face different tasks due to the number of patients, how they work, and the rules they must follow.

Good doctor bookkeeping helps clinics and hospitals handle money matters with ease. It also ensures they follow laws and stay in good financial shape. Bookkeeping for doctors means tracking the money that comes in and goes out of the practice.

Unlike basic bookkeeping, doctor bookkeeping deals with rules and issues unique to health care. Regular bookkeeping doesn’t meet these special needs. That’s why a tailored approach works better.

To solve these issues, many health centers pick doctor bookkeeping systems built for their field. These tools include things like auto-billing, rule checks, and links to medical software. This setup helps the clinic stay on top of its money and lets doctors give more time to their patients.

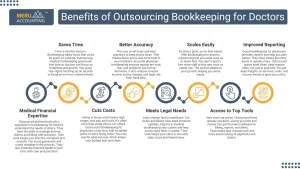

Benefits of Outsourcing Bookkeeping for Doctors

1. Medical Financial Expertise

Outsourced professionals who specialize in bookkeeping for doctors understand the needs of clinics. They have the skills to manage income, claims, and billing with precision. Their work keeps your practice compliant and smooth. You avoid guesswork and costly mistakes in the process. They also track the financial health of your clinic with care and precision.

2. Saves Time

Time is vital for doctors. Bookkeeping takes hours that could be spent on patients. Outsourcing medical bookkeeping gives back that time so doctors can focus on treatment and growth. You avoid late nights catching up on records or fixing errors from rushed entries.

3. Cuts Costs

Hiring in-house staff means high wages, sick pay, and tools. It’s often more than small clinics can afford.

Outsourced bookkeeping for physicians costs less, with no added perks or extra hiring costs. You only pay for what you use, which keeps your budget lean and clean.

4. Better Accuracy

Pros use smart tools and best practices to keep books clean. That means fewer errors and more trust in your numbers. Accurate physician bookkeeping ensures reports are neat, fast, and simple to use for big decisions. It also reduces missed income, wrong charges, and legal risk from false data.

5. Meets Legal Needs

Laws change fast in healthcare. Tax codes and billing rules need constant updates. Experts in medical bookkeeping stay current and help avoid costly fines or audits. Their work keeps your clinic in line with state, local, and federal laws.

6. Scales Easily

As clinics grow, so do their needs. With bookkeeping for doctors, outsourcing lets you scale work up or down fast. You don’t need to hire more staff or buy new tools as needs rise. The service adapts to your growth, helping you avoid waste.

7. Access to Top Tools

New tools are pricey. Outsourced firms already use them, saving you time and money.

You get the latest software for billing, reports, and alerts.

That means less manual work and more auto-tracking of payments and claims.

8. Improved Reporting

Good bookkeeping for physicians provides reports that help you plan better. They show where the clinic earns or spends more. Outsourced teams send clean, clear reports often, not just at year-end. You get deep insights on services, costs, and income trends to grow your clinic.

Bookkeeping Differs for Small vs. Large Medical Clinics

1. Accounting Style

- Small Clinics: Use cash basis—track money when paid. This physician bookkeeping method is easy and fits low-volume clinics. It suits solo doctors or small teams with few patients. It helps keep things simple and clear.

- Large Clinics: Use an accrual basis—track income when earned. It fits busy practices with many claims.

It shows long-term gains and helps plan future growth based on delayed payments.

2. Revenue Handling

- Small Clinics: Handle billing with simple tools, often in-house. With fewer patients, this is easy to manage. Fewer claim errors happen, and medical bookkeeping tracks payments with care.

- Large Clinics: Deal with many claims and firms. They need smart software and trained staff.

These tools cut down claim errors and speed up cash flow.

3. Tracking Costs

- Small Clinics: Track costs by hand or with basic software. Owners often do this on their own. This works well for small-scale bookkeeping for doctors, where spending is low and steady.

- Large Clinics: Spend more on staff, rent, and tools. Advanced systems help track and plan costs.

They also help set smart budgets and reduce waste.

4. Reports and Planning

- Small Clinics: Use simple reports, like income and costs. These physician bookkeeping reports help track daily money needs. They’re fine for short-term goals and tax time.

- Large Clinics: Use deep reports with cash flow, margins, and cost per service.

This helps spot trends and guide smart growth plans.

5. Law and Rules

- Small Clinics: Face fewer rules but still must comply. Good books help them meet all tax and health rules.

It keeps their practice legal and safe from fines. - Large Clinics: Must follow more complex laws. A full-time compliance expert may be needed.

Outsourced bookkeepers help meet state, local, and federal rules.

6. Tech and Software

- Small Clinics: Use low-cost tools for records and billing. These meet basic needs.

Many use QuickBooks or simple EHR links. - Large Clinics: Need linked tools for EHR, books, and billing. Outsourced firms often provide these links.

This improves speed, reduces manual tasks, and saves hours.

Why Bookkeeping for Doctors Matters

1. Money Health

Just like your health, clinic money must stay in shape. You need funds to pay staff, buy tools, and run your office. Bookkeeping for doctors shows if costs rise or fall—and where to cut waste. This lets you plan smart and avoid money stress.

2. Tax Compliance

Doctors must pay taxes like all others. Missed records cause audits and big fines. Good books show what you owe and help file returns with ease. This saves time and keeps you safe from legal stress.

3. Cash Flow Watch

Money in and out must be tracked to avoid shortages. This helps with bills, pay, and savings. Bookkeeping shows trends, like high or low cash months. Medical bookkeeping helps you plan ahead and avoid missed bills or missed pay.

4. Billing and Pay

Doctors bill patients and firms like Medicare. If bills aren’t tracked, pay can be late or lost. Bookkeeping for physicians helps send bills fast and track payments right. This speeds up cash flow and helps keep the clinic strong.

5. Legal Compliance

Health firms follow strict rules. Doctors must store patient and money data with care. Physician bookkeeping helps meet HIPAA and billing rules with accurate data handling. Bad records can lead to fines or even lawsuits.

6. Financial Planning

Doctors may want to grow, buy gear, or save more. Books show what’s earned and what’s owed. You can plan when to spend, save, or invest. Accurate medical bookkeeping supports smart planning, leading to less stress and more gains.

7. Avoid Costly Errors

Missing data, wrong charges, or lost bills cost money. Books catch and fix these fast. They lower risk and boost profit. Accurate records also help avoid fraud and waste.

Where Traditional Doctor Bookkeeping Falls Short

1. Complex Billing

Health billing is not easy. Each firm has its own codes and steps. Traditional bookkeeping for doctors often misses claims or delays payment. This hurts your bottom line. Bookkeepers fix this with tools built for clinics.

2. Tough Legal Rules

Health law is strict. You must follow tax, HIPAA, and billing rules. Old books can’t track all this. Errors lead to fines or loss of license. Outsourced physician bookkeeping teams are trained to handle these challenges.

3. Revenue Cycle Gaps

From visit to pay, many steps happen. Errors or delays hurt cash flow. Old systems can’t track it all. That means more unpaid bills. Experts in bookkeeping for physicians track claims, pay, and reports to fix this.

4. Need for Custom Reports

Doctors need more than basic numbers. They must see what earns the most or costs too much. Old tools lack deep views. You may miss key trends or waste money. Modern medical bookkeeping systems give smart reports for each service.

5. Poor Software Link

Clinics use EHR and billing tools. If books don’t link, staff must enter data twice. This wastes time and causes more errors. Linked bookkeeping for doctors systems save time, reduce mistakes, and work faster.

Outsourcing bookkeeping for doctors saves time, cuts costs, and improves care. It keeps records clear and ready for tax season. You get expert support, smart tools, and peace of mind. No more late bills, bad reports, or surprise audits. No matter your size, outsourcing helps you grow. Meru Accounting gives smart and simple bookkeeping for doctors. We know the needs of clinics and health pros. Our team keeps records right, meets rules, and sends reports on time. With online tools and expert help, physician bookkeeping is fast and smooth. Trust Meru to manage your books, so you can care for your patients.

FAQs

Q1. What is bookkeeping for doctors?

It means tracking money in, money out, and all clinic records.

Q2. Why should doctors outsource bookkeeping?

It saves time, cuts down on mistakes, and brings expert help.

Q3. Is medical bookkeeping different from regular bookkeeping?

Yes, it deals with patient bills, claims, and health rules.

Q4. Can outsourced bookkeepers help with taxes?

Yes, they make tax-ready reports and keep records in order.

Q5. Is my data safe with outsourced bookkeeping?

Trusted firms use strong tools and follow HIPAA rules.

Q6. How much does it cost to outsource physician bookkeeping?

It varies, but it’s often less than hiring full-time staff.

Q7. Can I access my financial reports anytime?

Yes, with cloud tools, your books are always within reach.