E-commerce Bookkeeping: What Are the Hidden Costs of Neglecting Proper Management?

E-commerce bookkeeping plays a vital role in ensuring that financial transactions are accurately recorded, expenses are tracked, and profits are calculated correctly. Ignoring this aspect can lead to hidden costs that undermine profitability and business growth. By choosing to outsource bookkeeping services or adopting efficient e-commerce bookkeeping practices, businesses can avoid these pitfalls and keep their financial health in check.

Table of Contents

- Introduction

- Hidden Costs of Neglecting Proper E-commerce Bookkeeping

- Key Benefits of Proper E-commerce Bookkeeping

- FAQs

- Conclusion

Introduction

E-commerce bookkeeping is an essential part of any online business, as it involves the accurate recording and tracking of financial transactions. From sales and returns to inventory management and taxes, keeping financial records up-to-date is crucial for understanding a business’s financial health. Despite its importance, many e-commerce business owners fail to prioritize bookkeeping, leading to hidden costs that can harm their bottom line. By recognizing the hidden costs of neglecting bookkeeping and choosing to outsource bookkeeping services, e-commerce businesses can ensure smooth financial operations and avoid unnecessary setbacks.

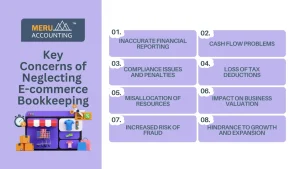

Hidden Costs of Neglecting Proper E-commerce Bookkeeping

Neglecting ecommerce bookkeeping can lead to serious financial and operational challenges.

- Inaccurate Financial Reporting

Failing to maintain accurate and up-to-date financial records makes it difficult to understand your business’s financial performance.

- Without clear reports, you may make poor decisions regarding investments or resource allocation.

- It becomes challenging to identify profitable products or services, causing missed business opportunities.

- Inaccurate records can also hinder your ability to secure loans or attract investors, as they rely on reliable financial data.

- Cash Flow Problems

Proper cash flow management is crucial for ecommerce businesses, but poor bookkeeping can lead to:

- Late payments to suppliers, resulting in strained relationships and potential delays in stock replenishment.

- Missed recurring expenses, such as subscriptions for software or marketing tools, which can disrupt operations.

- An inability to predict financial shortfalls or surpluses, making it hard to capitalize on opportunities or handle emergencies.

- Compliance Issues and Penalties

Ecommerce businesses are subject to various tax laws and regulations that require accurate bookkeeping.

- Without proper records, you may unintentionally fail to file taxes correctly or on time, leading to penalties and fines.

- Improper financial documentation can increase the risk of a tax audit, diverting resources away from core business activities.

- Non-compliance can damage your reputation, making customers and partners wary of working with you.

- Loss of Tax Deductions

Bookkeeping ensures you don’t overlook eligible tax deductions and credits. Without accurate records:

- You might miss deductions for expenses such as software subscriptions, shipping fees, or marketing costs, which could save you money.

- Missing out on these deductions increases your tax liability, reducing your profitability and cash reserves.

- Misallocation of Resources

Neglecting proper bookkeeping often leads to:

- Overestimating profits, causing you to overspend on unnecessary investments or expansions.

- Underestimating expenses, leaving critical areas like inventory, marketing, or customer service underfunded.

- Misguided strategies due to a lack of clarity about where your money is going and how it’s performing.

- Impact on Business Valuation

Accurate bookkeeping is essential when determining your business’s worth, especially if you plan to sell or merge in the future.

- Poor records can undervalue your business, leading to unfavorable terms in sales or financing negotiations.

- Investors and potential buyers rely on clear financial records to assess profitability and growth potential. Without these, they may lose confidence in your business.

- Increased Risk of Fraud

Without proper documentation and oversight, your ecommerce business is at a higher risk of fraudulent activities.

- Discrepancies in financial records may go unnoticed, allowing theft or unauthorized transactions to occur.

- Lack of accountability in financial processes can create vulnerabilities that harm your business financially and operationally.

- Hindrance to Growth and Expansion

Neglected bookkeeping creates obstacles that limit your ability to grow or expand your ecommerce business.

- Inaccurate records make it difficult to secure funding or attract investors, as they need confidence in your financial stability.

- Poor financial management hinders your ability to capitalize on market opportunities or invest in new product lines.

- A weak financial foundation slows down long-term business development.

Key Benefits of Proper E-commerce Bookkeeping

- Improved Financial Visibility: Proper e-commerce bookkeeping provides a clear picture of a business’s financial health. By tracking sales, expenses, and profits, business owners can make more informed decisions and avoid financial mismanagement.

- Better Cash Flow Management: With accurate financial records, e-commerce businesses can better manage their cash flow. This includes ensuring that payments to suppliers are made on time, as well as having a clear understanding of receivables and payables.

- Optimized Tax Filings: E-commerce bookkeeping ensures that tax filings are accurate and up-to-date. By keeping financial records organized, businesses can take advantage of tax deductions, avoid penalties, and ensure compliance with tax regulations.

- Scalability and Growth: With the right financial data, businesses can make strategic decisions about scaling. Proper e-commerce bookkeeping helps businesses assess profitability, understand trends, and optimize their operations for growth.

- Reduced Risk of Errors and Fraud: Accurate bookkeeping reduces the risk of errors and fraud. Properly tracking transactions and reconciling accounts ensures that all financial records are correct and protected from unauthorized activity.

Conclusion

By understanding the importance of accurate financial tracking and opting to outsource bookkeeping services, businesses can avoid these pitfalls and focus on scaling. Meru Accounting offers specialized ecommerce bookkeeping and outsource bookkeeping services, ensuring accuracy, compliance, and efficiency. With Meru Accounting’s support, your business can thrive and grow with confidence. With proper e-commerce bookkeeping, your business can thrive and grow with confidence.

FAQs

1. How can outsource bookkeeping services help my e-commerce business?

- Outsource bookkeeping services can help manage your financial records accurately, ensuring you avoid costly mistakes and comply with tax regulations.

2. What are the risks of neglecting e-commerce bookkeeping?

- Neglecting e-commerce bookkeeping can lead to inaccurate financial reporting, cash flow issues, tax penalties, and missed opportunities for growth.

3. Can outsourcing bookkeeping services improve my business’s efficiency?

- Yes, outsourcing bookkeeping services can save time and reduce errors, allowing you to focus on growing your business while experts handle the financial details.

4. Is e-commerce bookkeeping difficult?

- While e-commerce bookkeeping can be complex, outsourcing the task to professionals can ensure it’s done accurately and efficiently.

5. How does Meru Accounting help e-commerce businesses?

- Meru Accounting offers expert ecommerce bookkeeping services, ensuring accurate records, tax compliance, and seamless integration with e-commerce platforms.

6. Why choose Meru Accounting for outsourced bookkeeping?

- Meru Accounting provides reliable and affordable outsource bookkeeping services, saving you time and improving efficiency while you focus on growing your business.