E-commerce Bookkeeping: Why Your Online Store Needs a Specialized Approach

E-commerce bookkeeping is of importance when managing the finances of an online store. E-commerce stores operate a wide range of transactions that occur, are subjected to different gateways for payments, and incur various taxes in a global economy. A professional approach guarantees that financial tracking is done appropriately. This will give businesses the ease of checking their sales, expenses, and profits. Many owners of online stores outsource the bookkeeping service to experts in understanding the intricacies of e-commerce. Outsourcing bookkeeping services saves time, reduces errors, and ensures tax compliance. It also gives real-time insights into financial health, enabling businesses to make informed decisions. Proper e-commerce bookkeeping allows store owners to focus on growth while professionals handle financial records seamlessly.

Introduction

E-commerce bookkeeping is responsible for the accounts of the online store. It reports and keeps track of all sales, expenses, taxes, and profits. There are several payment and currency options present with the online stores; therefore, there is proper management of funds through bookkeeping. A substantial number of business owners outsource bookkeeping services or professional accountants for their stores to ensure proper record management. It saves time, reduces errors, and keeps businesses in compliance with tax regulations. Expert e-commerce bookkeeping for online store owners frees up precious hours for additional revenue generation by letting a professional manage your finances.

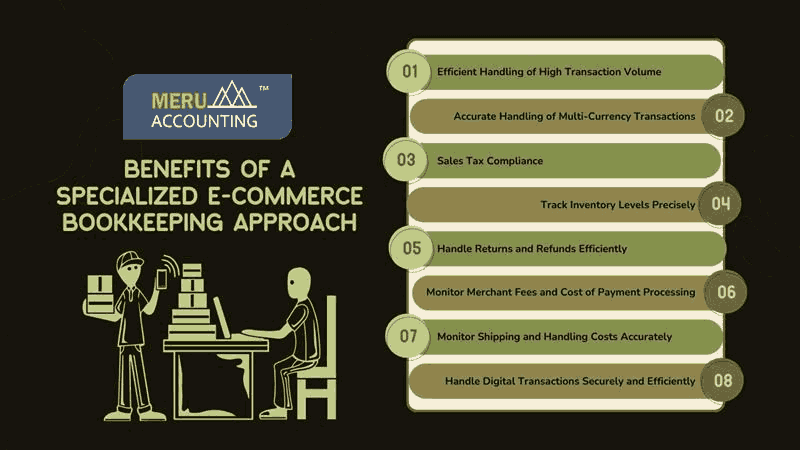

Benefits of a Specialized E-commerce Bookkeeping Approach

- Efficient Handling of High Transaction Volume: E-commerce companies generate hundreds of thousands of sales, returns, and chargebacks daily. If the e-commerce bookkeeping is not proper, the income and expenses of the company cannot be traced properly. Hence, through proper record-keeping, the company avoids mistakes, finds inconsistencies, and has smooth financial transactions.

- Accurate Handling of Multi-Currency Transactions: If your e-commerce stores sell internationally, you deal in different currencies. Proper accounting will mean that all the transactions are made based on correct exchange rates and currency conversions. This way, financial miscalculations are avoided and the reporting of sales is transparent.

- Sales Tax Compliance: Sales tax laws differ by country, state, and even city. For e-commerce businesses, they must calculate, collect, and remit taxes properly to avoid legal issues. Bookkeeping helps the store owner keep track of their tax liabilities and be compliant with tax regulations. Without proper e-commerce bookkeeping, businesses may face penalties for incorrect tax filings.

- Track Inventory Levels Precisely: Online stores must maintain accurate inventory records to avoid stockouts or overstocking. Proper bookkeeping tracks inventory costs, sales, and restocking needs. It ensures businesses manage their supply efficiently and prevent losses due to mismanaged stock.

- Handle Returns and Refunds Efficiently: E-commerce business deals with returns and refunds every day. Unorganized bookkeeping can cause revenues to be understated or overstated, hence causing financial ambiguity. An organized e-commerce bookkeeping system ensures all returns and refunds are reflected correctly in the financial statements so that revenue records remain accurate.

- Monitor Merchant Fees and Cost of Payment Processing Multiple payment gateways including PayPal, Stripe, and credit card processors can be used through e-commerce stores. Each will charge different kinds of transaction fees. Proper bookkeeping helps trace the costs such that businesses would know how much they spend for the payment process and can determine whether to readjust their price strategy.

- Monitor Shipping and Handling Costs Accurately: Shipping costs can be a significant profit killer. An organized bookkeeping system captures all shipping and handling expenses, which enables businesses to optimize shipping methods, reduce costs, and ensure accurate financial reporting.

- Handle Digital Transactions Securely and Efficiently: Unlike traditional businesses, e-commerce transactions occur digitally. Store owners must integrate specialized bookkeeping software to track income and expenses seamlessly. Outsourced bookkeeping services help automate data entry, reduce human errors, and improve financial management.

Best Tools and Software for E-commerce Bookkeeping

Some of the best tools and software for e-commerce bookkeeping and bookkeeping outsourcing are given below:

- Xero: Perfect tool for growing teams, it has real-time financial reporting, easy bank reconciliation, and an efficient invoice manager. It integrates easily with popular e-commerce platforms like Shopify and WooCommerce.

- QuickBooks Online: it is a detailed and structured accounting feature appropriate for small businesses. Reporting is a strong feature, and easy to use for those businesses requiring clear financial records.

- Zoho Books: It is a multilingual accounting software managing sales, expenses, and inventory. Thus, it is ideal for those businesses requiring a versatile and global solution.

- FreshBooks: Extremely user-friendly software for a freelancer or owner of a small business and provides an easy account system with any individual having simple invoice-making and cost-tracking but also capable of team collaboration.

- A2X: Connects e-commerce to accounting. They have an automation for tracking sales and inventory reports. For bookkeeping outsourcing services, A2X will do so since you do not have time for such.

- Wave: Wave is free, and user-friendly for small businesses, with simple accounting functionalities like invoicing, expense tracking, and receipt scanning.

- Sage 50 cloud: Sage 50 cloud provides both desktop and cloud-based accounting with full-fledged financial management capabilities, such as payroll and inventory control.

- NetSuite ERP: This would be ideal for larger companies. NetSuite ERP enables real-time tracking, multi-currency support, and comprehensive customization for complex financial management.

- Bench: Bench provides full-service bookkeeping and tax filings. The service is appropriate for any kind of business that needs to outsource bookkeeping services so that they can focus on other important business matters.

Conclusion

E-commerce bookkeeping is essential for conducting your online shop without any challenges. It guides you on running transactions, inventory, taxation, and most other financial matters. You get to ensure perfect records and fulfill all the bookkeeping requirements with ease, adhering to the rules and regulations. If simplifying your bookkeeping is what’s on your wishlist, consider using outsourced bookkeeping services. Meru Accounting offers professional e-commerce bookkeeping and outsourced bookkeeping services, allowing online businesses to ensure proper financial records, observe tax regulations, and enhance their financial management. This gives you ample time to focus on growing your business since the professionals at Meru Accounting will be taking care of the financials.

FAQs

1. Why should I outsource bookkeeping services for my online store?

- Ans: Outsourcing bookkeeping services means you let experts handle your financial records while you focus on growing the business. It saves time, reduces errors, and gets you tax compliance.

2. How can Meru Accounting help my e-commerce business?

- Ans: Meru Accounting also offers bookkeeping for an e-commerce business. That ensures the accuracy of financial books, helps you maintain compliance with tax compliance, and pushes you to be better at improving your financial health.

3. What tools do I need for bookkeeping on e-commerce?

- Ans: The tools assist in tracking sales, managing inventory, and undertaking expenses. Some of the popular ones are Xero, QuickBooks Online, and FreshBooks. Such a tool might make bookkeeping a little more efficient and accurate.

4. How does e-commerce bookkeeping help in tax compliance?

- Ans: E-commerce bookkeeping accounts for all your sales and expenses. This way, you can ensure accurate computation and declaration of taxes in order to avoid penalties and fines.

5. Can Meru Accounting process my e-commerce store returns and refunds?

- Ans: Yes, an accounting firm handles returns and refunds for e-commerce. We will make sure all the transactions are properly documented to avoid misstatement of revenues and that your financial reports will remain accurate.