Effective Accounts Payable Management for Your Business

Managing money matters is a key task for every company. One of the most vital parts of this process is accounts payable management. It helps a business handle its bills, maintain vendor ties, and keep cash flow in check. When you improve how you deal with accounts payable, you cut errors, save time, and improve your bottom line. This blog shares all you need to know about accounts payable management and how it can help your business.

What is Effective accounts payable management?

Accounts payable management is a core function that ensures all company bills are tracked and paid on time. Below, we discuss its meaning, importance, and benefits.

The management of accounts payable involves tracking all unpaid bills, due dates, and vendor payment duties. It helps businesses stay organized and avoid late fees or missed payments. It helps businesses stay organized and avoid unnecessary late fees or missed payments.

The management of accounts payable is one of the core processes that help keep a company’s bills in order. The accounts payable process is the amount that the entity has to pay to its suppliers or vendors on the account of goods and services. It means that after giving instructions for goods and services by the unit, the firm should evidence a legal responsibility in its books of accounts on the basis of the invoice amount previous to making the payment. So this legal responsibility of the unit over its dealer or vendor is known as the accounts payable department. After the payment has been completed to the seller or the dealer, the amount is deducted from the accounts payable balance. Account Payable vs Accounts Receivable.

Importance of Business Stability

A proper system ensures timely payments, improves supplier relationships, and creates a strong base for financial growth. Without it, businesses face constant cash flow disruptions.

Impact on Financial Planning

Effective management provides a clear view of upcoming expenses, helping companies plan and budget better while maintaining healthy cash reserves.

Reduction of Errors

A structured process reduces duplicate or incorrect payments, keeping records clean and reducing the risks of financial disputes with suppliers.

Improved Vendor Relationships

Paying suppliers on time builds trust. This helps set long-term ties, win better deals, and get good service from vendors.

Contribution to Growth

A smooth payables process keeps cash steady. It helps fund growth plans and lets the firm scale with ease.

The Role of Accounts Payable in Business Growth

Accounts payable management impacts every stage of business growth. A well-managed system ensures the smooth flow of operations and finances.

Cash Flow Optimization

Quick, planned pay keeps money free. This helps meet new goals or face urgent needs fast.

Strong Supplier Networks

Good payables build firm ties with suppliers. This makes sure the supply stays strong with top service.

Avoidance of Penalties

Paying on time stops late fees and extra costs. Saved money can fund new growth work.

Access to Discounts

Early pay can bring price cuts. This saves costs and lifts profit for the firm.

Better Negotiation Power

Vendors like fast payers. This may lead to good terms, low rates, or quick service.

Long-term Financial Health

Good payables keep credit scores high. This makes it easy to get loans or good bank terms.

Key Challenges in Managing Accounts Payable

Businesses often face issues that slow down or complicate the management of accounts payable. Knowing these challenges helps in building solutions.

Manual Errors

Mistakes can cause wrong or double pay. This hurts money records and adds risk.

Late Payments

Missed dates harm vendor trust and add fees. This can hurt the firm’s good name.

Poor Tracking Systems

With no live check, unpaid bills pile up. This leads to mix-ups and weak vendor ties.

Approval Bottlenecks

Slow sign-offs hold payback. This delays invoices and hurts vendor trust.

Lack of Automation

Manual steps waste time and cause errors. This adds cost and slows down cash flow.

Fraud Risks

Weak checks make fraud easy. This can cause a big loss of money.

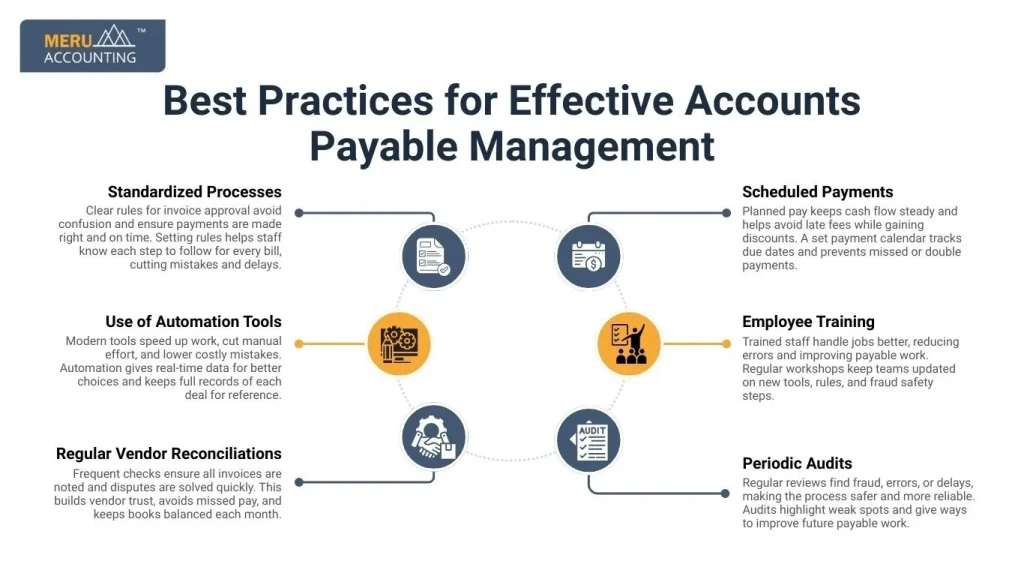

Best Practices for Effective Accounts Payable Management

Following proven steps can make tasks smooth, precise, and cost-saving.

Standardized Processes

Clear rules for invoice approval avoid confusion and ensure payments are made right and on time. Setting rules helps staff know each step to follow for every bill, cutting mistakes and delays.

Use of Automation Tools

Modern tools speed up work, cut manual effort, and lower costly mistakes. Automation gives real-time data for better choices and keeps full records of each deal for reference.

Regular Vendor Reconciliations

Frequent checks ensure all invoices are noted and disputes are solved quickly. This builds vendor trust, avoids missed pay, and keeps books balanced each month.

Scheduled Payments

Planned pay keeps cash flow steady and helps avoid late fees while gaining discounts. A set payment calendar tracks due dates and prevents missed or double payments.

Employee Training

Trained staff handle jobs better, reducing errors and improving payable work. Regular workshops keep teams updated on new tools, rules, and fraud safety steps.

Periodic Audits

Regular reviews find fraud, errors, or delays, making the process safer and more reliable. Audits highlight weak spots and give ways to improve future payable work.

Technology and Tools for Effective Management of Accounts Payable

Tech makes payable tasks faster, safer, and more efficient. Below are key tools to improve flow and save team time.

Cloud-Based Platforms

Cloud systems give quick access to invoices, schedules, and vendor data from anywhere. They help teams share info, track changes live, and ensure no payments are missed.

Automated Invoice Matching

This tool matches purchase orders with bills and delivery notes. It cuts manual checks, reduces errors, and speeds approval, making the flow smooth and precise.

Digital Record Keeping

Storing payment records online allows quick data access, better law compliance, and easy checks during audits. It cuts paper use and keeps documents safe and neat.

AI-Powered Validation Tools

AI flags duplicate, wrong, or fake invoices before pay is sent. This prevents loss, reduces human error, and builds strong controls to stop fraud or wrong transfers.

Accounting System Integration

Linking payable tools with your main accounts system ensures smooth data flow across teams. It removes manual entries, saves time, and gives accurate reports for plans and budgets.

Mobile Approval Apps

Mobile apps let managers review and approve bills on the go. This removes delays from physical signs, keeps payments on track, and allows quick action even if key staff are out.

Compliance and Risk Control in Accounts Payable Management

Strong compliance is a key part of accounts payable management. It makes sure that all payments follow tax laws, rules, and vendor terms. Without it, a firm risks fines, audits, and damage to vendor trust. The management of accounts payable is not just about paying bills; it is also about keeping the process safe and in line with set rules.

Legal and Tax Duties

Firms must keep records of each bill, payment, and tax entry. Wrong or late filing can cause high costs. Good AP systems track due dates, create full logs, and cut the chance of tax errors.

Fraud Control

AP is often a target for fraud. Fake bills, false vendors, or duplicate entries can harm cash flow. A good accounts payable management system should have strong checks, vendor proof steps, and set approval paths.

Internal Controls

Rules for who checks, signs, and pays bills make the process safe. Firms can split tasks so no one person handles all steps. This lowers risk and builds trust.

Vendor Terms

Paying on time shows respect for vendor deals. It avoids disputes and helps firms gain better terms in the future.

By adding compliance and risk checks into daily work, firms make the management of accounts payable safer, steadier, and ready to grow.

Measuring and Improving Accounts Payable Performance

Regular checks of payable steps help improve speed and save costs.

Invoice Processing Time

Track how long it takes to process invoices to find and fix slow points in the system.

Payment Accuracy Rates

Measure pay errors to suppliers and make changes to improve accuracy and avoid disputes.

On-Time Payment Ratio

Check late or missed payments to boost vendor ties and avoid extra costs from delays.

Supplier Feedback Analysis

Regularly gather supplier input on payment practices to identify gaps and areas for improvement.

Compliance Checks

Assess how well payment practices align with contract terms and industry standards for financial management.

Cost Savings from Discounts

Track benefits gained from early payment discounts to evaluate if opportunities are being maximized effectively.

At Meru Accounting, we customize accounts payable solutions to suit your company’s size, needs, and industry-specific requirements for maximum efficiency. Our tools reduce manual workloads, speeding up the entire payment cycle while ensuring accuracy and transparency.

FAQs

1. What is accounts payable management?

It is the process of tracking, recording, and paying a firm’s bills on time. It helps with cash flow, avoids late fees, and keeps vendors happy.

2. Why is the management of accounts payable important?

It keeps costs in line, builds vendor trust, helps plan budgets, and keeps the firm strong in the long run.

3. How can automation help accounts payable?

Automation cuts hand slips, speeds up tasks, ensures bills are paid on time, and gives quick data on cash flow.

4. What are common issues in managing accounts payable?

Late pay, human slips, weak track tools, slow sign-offs, and fraud risks can hurt vendor trust and firm health.

5. How does good accounts payable impact cash flow?

By planning and tracking pay well, firms avoid cash gaps, spend smart, and keep money flow steady.

6. What tools can improve accounts payable?

Cloud apps, match tools, AI checks, and mobile sign-off apps help speed work, cut slips, and make pay safe.

7. How often should accounts payable be audited?

A check every three months helps catch errors, block fraud, and keep the process fast and safe.