What Every Small Business Should Know About the W-2 Form

If you run a small business, you must know what is Form W-2, a key tax statement for you and your staff. It is a key tax form for both you and your staff. This tax statement shows how much you paid them and how much tax you took out. You must send this form each year to your staff and the IRS. Filing it on time and with the right facts is not just good practice—it is the law. Knowing what is Form W-2, how to file it, and how to read a W-2 form helps you stay on track. This guide will show what the form holds, who must file it, and when to send it. With the right steps, you can avoid mistakes and meet tax rules.

What Is Form W-2: Wage and Tax Statement?

Form W-2 is a tax form used in the U.S. It shows how much a worker earned and how much tax was taken out. Employers must send this form each year to both the worker and the IRS. It helps track pay and tax details.

If you are a W-2 worker, your boss takes taxes from your pay. This includes income tax, Social Security, and Medicare. The money is sent to the tax office. At the end of the year, you get a copy of your W-2 to file your tax return.

The W-2 form shows your name, address, and Social Security Number. It also shows total pay, tax paid, and amounts for Social Security and Medicare. It gives a full record of your yearly income and tax.

The IRS uses the W-2 to match your tax return. It helps check if the right tax was paid. That’s why it’s key to file this form right and on time.

Who Must File Form W-2?

If you run a firm and have staff on your books, you must give them a W-2 each year. This rule applies to full-time and part-time staff. You do not give a W-2 to freelance or gig workers. These workers get a Form 1099-NEC.

You must file a W-2 if:

- You paid a worker $600 or more

- You withheld any tax from their pay

- You gave them other types of wage-based income

Even if no tax was withheld, you may still need to file a W-2 based on how and what you paid.

The deadline to send W-2 forms is January 31 of the next year. That gives your staff enough time to file taxes by April 15. You must also send the form to the Social Security Administration (SSA) and keep a copy for your firm’s records.

What Information Does Form W-2 Include?

This tax statement follows a set format that includes employer and employee details. It shows:

- Your firm’s name, address, EIN, and state ID

- The staff member’s name, address, and SSN

- Pay earned and tax held during the year

Knowing what’s on the form helps you fill it right and lets your staff report their pay with no mix-ups.

How to Fill Out a W-2 Form?

Filling out a W-2 Form is a key task for any boss. It shows how much you paid your staff and the tax you took out. Here are the parts you need to fill in:

1. Employer Information

Write your business name and address. Add your Employer ID Number (EIN). Check that all the info is true and matches IRS records.

2. Employee Information

Put down the full name of the worker. List their home address and Social Security Number (SSN). Make sure the SSN is right.

3. Wages and Taxes

List the full wages, tips, and any bonuses paid for the year. Add the amount of federal tax you took out. Show the Social Security and Medicare tax you withheld.

4. Other Data

Write if the worker is part of a retirement plan. Add health plan details if you gave one. Note any other pay taken out, like union dues or wage cuts.

How to Read Form W-2: Wage and Tax Statement

How to read a W-2 form involves understanding the boxes marked with letters and numbers. Each box gives key info:

Boxes A to F

These show:

- Staff name and address

- Social Security Number

- Employer name, address, EIN, and state ID

Boxes 1 and 2

- Box 1: Shows all taxable pay (wages, tips, bonuses)

- Box 2: Shows total federal tax held

Boxes 3 and 4

- Box 3: Shows pay taxed under Social Security

- Box 4: Social Security tax held

Boxes 5 and 6

- Box 5: Shows pay taxed under Medicare

- Box 6: Medicare tax held (usually 1.45%

Boxes 7 and 8

- Box 7: Tips the worker told you about

- Box 8: Tips the boss split with staff

Box 9

This is left blank. It was for a tax break that no longer applies.

Box 10

Shows what the boss paid for care of the worker’s child or loved ones.

Box 11

Shows income held or paid from a non-qualified plan.

Box 12

Lists extra pay or perks like 401(k) amounts. Each has a code. For instance, Code D means a 401(k) plan. The IRS guide has the full list.

What Are the Key Deadlines for Filing W-2 Forms?

Keep these key dates in mind:

- January 1 to December 31 – Tax year

- January 31 – Last day to give W-2 to workers

- February 28 or 29 – Last day to file Copy A by paper

- March 31 – Last day to file Copy A online on the SSA portal

If you miss these dates, you might pay a fine or face IRS issues. So, start early and double-check each W-2.

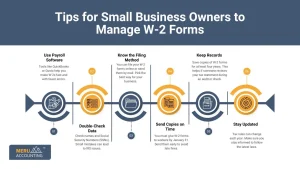

Tips for Small Business Owners to Manage W-2 Forms

Managing W-2 forms can be simple if you stay on top of the key steps. Here are some tips to help you:

1. Use Payroll Software

Tools like QuickBooks or Gusto help you make W-2s fast and with fewer errors.

2. Double-Check Data

Check names and Social Security Numbers (SSNs). Small mistakes can lead to IRS issues.

3. Know the Filing Method

You can file your W-2 forms online or send them by mail. Pick the best way for your business.

4. Send Copies on Time

You must give W-2 forms to workers by January 31. Send them early to avoid late fines.

5. Keep Records

Save copies of W-2 forms for at least four years. This helps if someone reviews your tax statement during an audit or check.

6. Stay Updated

Tax rules can change each year. Make sure you stay informed to follow the latest laws.

Common Mistakes Small Business Owners Make

W-2 forms must be filled with care. Many small business owners make simple mistakes that can cause big problems. Below are some of the most common errors in filling out this key tax statement to avoid.

1. Filing Late

Some owners miss the deadline to file W-2 forms. This can lead to fines and issues with the IRS. Always file early or on time.

2. Missing Employee Details

If you leave out names, Social Security Numbers, or addresses, the form is not complete. Always check that each W-2 has full and correct details.

3. Wrong Amounts in Boxes

Putting the wrong wage or tax numbers in the form can cause errors. Make sure all pay, tax, and benefits are listed correctly.

4. Not Sending It to the IRS

Some owners send W-2s to staff but forget the IRS. You must send copies to both your workers and the IRS.

5. Not Updating Employee Records

If staff move or change names, and you do not update their records, the W-2 form may be wrong. Keep your files up to date.

Difference Between W-2 and 1099

W-2 Form | 1099 Form |

For employees | For freelancers or contractors |

Taxes are withheld | Taxes are not withheld |

The employer handles tax filing | Contractor handles their own tax |

Used for payroll staff | Used for non-payroll staff |

Electronic vs Paper Filing of W-2

When filing W-2 forms, small business owners can choose between electronic and paper filing. Both options have their pros and cons.

Electronic Filing

Filing W-2s online is fast and more accurate. It helps lower the chance of mistakes. The Social Security Administration (SSA) suggests this method. It saves both time and effort.

Paper Filing

Filing by paper is slow and takes more work. Since it is done by hand, there is a greater chance of mistakes. It also takes the SSA longer to handle paper forms.

Filing Rule for Small Businesses

If your business files more than 10 W-2 forms in a year, you must file them online. This rule helps avoid errors and saves paper.

What Is the Difference Between W-2 Copy A, B, C, D, 1, and 2?

Each copy of this tax statement serves a different use, such as federal filing, employee records, or employer files.

- Copy A – This copy is sent to the Social Security Administration (SSA).

- Copy B – This copy goes to the employee to use when filing their federal tax return.

- Copy C – The employee keeps this copy for their personal records.

- Copy D – This copy stays with the employer for their records.

- Copy 1 – If required, this copy is sent to the state, city, or local tax office.

- Copy 2 – The employee uses this copy to file their state or local tax return.

Knowing what each copy is for helps ensure you file and give out the forms the right way.

How to Verify Employee Information Before Filing W-2

Before you file any W-2 forms, take time to check the details of each employee. Make sure:

- The names are spelled correctly.

- The Social Security Numbers (SSNs) are valid.

- The home addresses are up to date.

- The wage and benefit info is correct.

If you keep your records up to date during the year, you can avoid W-2 mistakes at tax time.

For every small business owner, knowing the W-2 Form is a must. This tax form helps your business follow IRS rules. Learning what Form W-2 is, how to read it, and how to file it correctly is key to running a smooth business. At Meru Accounting, we help small business owners prepare and file W-2 Forms with care. Our skilled team makes sure your payroll and tax forms meet IRS rules, so you can run your business without stress.

FAQs

- What is Form W-2 used for?

It reports wages paid and taxes withheld for an employee. - When should I give W-2 Forms to employees?

By January 31 every year. - What if I make a mistake on a W-2?

File a corrected form called W-2c. - Can I file W-2 Forms online?

Yes, you can file electronically through the SSA. - Who needs to file a W-2 Form?

Any business that pays employees, including small businesses. - How do I read a W-2 form easily?

Check each box: wages, taxes withheld, and employer details. - What happens if I don’t file W-2 Forms?

You may face IRS penalties and unhappy employees.