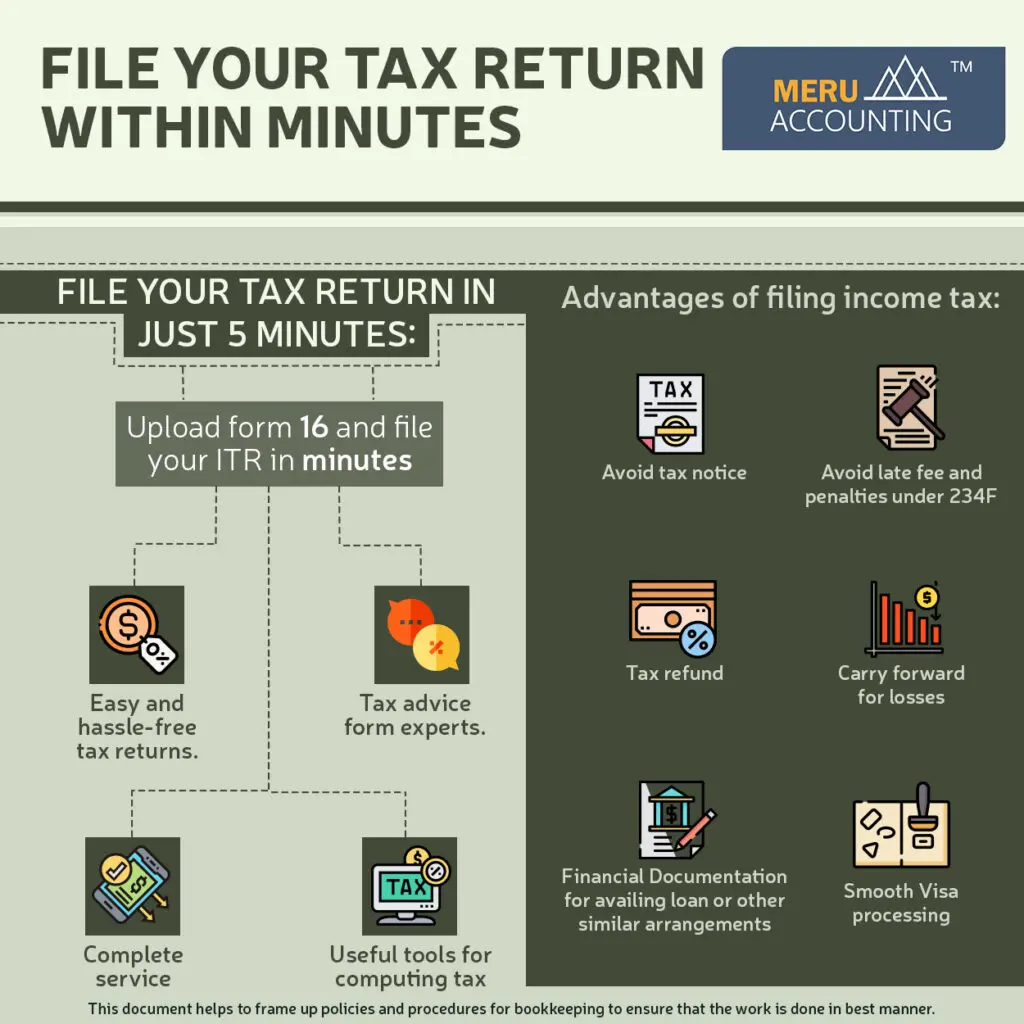

File your tax return within minutes.

Filing your tax return is no more a time consuming and lengthy procedure. With electronic filing or e-filing, it has become just a matter of a few minutes.

How can I file my tax return?

You can file your income tax return in two ways- Offline and Online mode.

Offline mode of filing an ITR takes more time. You need to download the required ITR form and fill it offline. After that, you need to save and generate an XML file then upload it to the site. To file ITR in the upload XML method, you must have either excel utility or Java utility.

Online mode or e-filing is the fastest method of filing the tax return with a few minutes. You can upload Form 16 and file the return yourself or hire our Tax experts. At Meru accounting, you get complete service of the tax return under one roof.

How does Meru accounting work?

We know the tax accountability is different for income under various income heads. We provide customized tax service to serve their tax filing requirements. We also have an income tax calculator to determine your tax liability.

Our Income tax filing process:

Salary income, business income, foreign income, NRI’s and capital Gain.

You either upload the documents through our online portal or email us.

You get a call from our experts to answer all your queries and doubts.

We assign tax experts who process your e-return. Our experts also re-checks the return filed by you.

After e-filing, our expert will ask you to verify your tax return

Why choose us?

I. Professionally Qualified Expert: At Meru accounting, you get tax advice from our professionals and experienced group of individuals qualified as CAs, CPA and accountants. Hiring us to do your taxes makes your return filing easy and compliant.

II. Affordable: All our tax-related services are provided in a budget-friendly package. We provide affordable and quality service. We charge hourly rates for our service.

III. Experience: Meru accounting tax experts make your tax filing and business registration quick and smooth. With their experiences, they help in claiming maximum deduction in your tax liability.

IV. E-filing services: Our experts help in the relevant selection of ITR forms and process toward e-filing. We make e-filing quick by determining the adjustment for losses.

V. Data Security: We keep our clients’ data safe and confidential. Clients’ data security is our top concern. We have an end to end data encryption and firewall protection.

VI. Remote access: We provide remote tax service anytime through cloud accounting. You can access your tax information from anywhere.

Details we need to process your return:

We need the following details to start filing your return:

I. Basic Information: PAN, Aadhar card and current address.

II. Bank Details: All the details of your bank account in the relevant financial year is mandatory.

III. Income proofs: Current salary details, business income, income from investments such as FD’s, saving bank account etc.

IV. Deduction Claimed: All the deduction claimed under sec 80 of the Income-tax Act.

V. Tax payment made- TDS and advance tax payments.