Brief Explanation for Form 1065: What Is Form 1065 and How to File It Online for Free

If you run a business with partners, you may need to file Form 1065 online for free to meet IRS rules. It is the U.S. Return of Partnership Income. The IRS requires this form to report your partnership’s income, losses, and deductions. This blog will help you understand what is form 1065, who must file it, and how to file Form 1065 for free with trusted tools. We will also cover who must file it and the steps to file it properly.

What Is Form 1065?

Wondering what is form 1065? It’s the U.S. Return of Partnership Income used to report your partnership’s finances. It is a tax return used by the IRS to review your partnership’s profit, loss, tax breaks, and credits. Each partner also gets a Schedule K-1, which shows their share of the firm’s income. The IRS uses Form 1065 to see your firm’s money flow for the year. Partners pay tax on their income share, even if the firm did not send them a check.

Partnership tax return 1065

Partnership tax return 1065 is a U.S. tax form used by the IRS to record the financial details of a partnership. It is used to report the firm’s profit, loss, deductions, and tax credits. No tax is paid with Form 1065. Instead, the tax duty moves to the partners, who must show their share on Schedule K-1 and pay taxes on their own return. Each partner must pay income tax on their share, even if the income was not paid out.

Who has to file the Partnership Tax Return Form 1065?

- All LLCs are classified as domestic partnerships and headquarters in the US

- Foreign Partnership with income in the US.

- Nonprofit religious organization.

- Multi-member LLC not elected to be taxed as a Corporation or S Corporation.

What documents are necessary to report Partnership Taxes?

To file Form 1065, you need key year-end financial reports. These include the income statement, balance sheet, and a list of all tax-deductible costs. The start balance on this year’s balance sheet must match the end balance from last year.

Before you meet a tax preparer for a partnership return, have the following ready:

- Basic info about the firm, like the Employer ID number, business code (NAICS code), and the date it was set up.

- The accounting method used—cash or accrual. This shows when to record income and costs.

- A full list of gross sales, returns, and perks, like markdowns or free items or services.

How to Send Form 1065?

You can mail Form 1065 or file 1065 online using IRS-approved tools.. For the paper, go to the IRS site, download the form, print it, and send it by mail. But if your partnership has more than 100 partners, you must file 1065 online for free or through an IRS e-file provider, along with Schedule K-1 and all related forms. Form 1065 is due by the 15th day of the third month after your tax year ends. If this day falls on a weekend or a public holiday, the next workday becomes the due date.

What Info Does Schedule K-1 Include?

Schedule K-1 tells the IRS and each partner about:

- Passive income

- Capital gains

- Real estate income

- Dividends

- Other credits

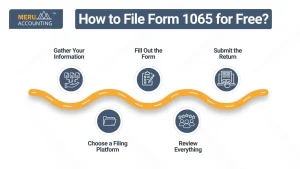

How to File Form 1065 for Free?

Here’s how to file Form 1065 for free in easy steps:

1. Gather Your Information

- Collect your financials.

- Get each partner’s info (name, SSN/EIN, share).

2. Choose a Filing Platform

You can file 1065 online for free using IRS Free File or other services.

Look for trusted platforms that offer a no-cost version.

3. Fill Out the Form

- Input income, expenses, and deductions.

- Fill Schedule B and Schedule K.

- Create Schedule K-1s for each partner.

4. Review Everything

- Double-check numbers and partner info.

- Review financial data before submission.

5. Submit the Return

- Use a free e-file provider or the IRS system.

- Save a copy of the confirmation for records.

Key Schedules in Form 1065

- Schedule L: This shows your balance sheets at the start and end of the tax year. It lists all assets, debts, and owner’s capital.

- Schedule M-1: This shows items not on the tax return. It explains the gap between your net income and the IRS view of taxable income.

This is common, but ask your tax expert if unsure. - Schedule M-2: This tracks changes in partners’ capital. This includes profits kept in the firm or moved out, and non-cash changes.

- Schedule K-1: Each partner must get one. It shows their share of the firm’s profits, tax breaks, and credits.

This form includes data like rental income, foreign deals, capital gains, and more.

Where Can You File Form 1065 Online?

You can now file Form 1065 online for free, which is faster and easier than mailing.

It also gives you tools to track your filing. Some top tax tools help you file Form 1065 online for free with ease and speed.

- CCH Axcess – Easy to use, full of helpful features

- Intuit Tax Online – Trusted by many firms, great support for Form 1065

- Thomson Reuters Tax & Accounting – Good for all sizes of firms, works well with other tools

- Wolters Kluwer CCH Tagetik – Made for large firms with complex tax needs

There are two main ways to file Form 1065 online

1. IRS-Authorized E-File Providers: Your Gateway to Secure and Reliable Online Filing

Recognizing the growing preference for online filing, the IRS has established a network of authorized e-file providers. These providers, adhering to stringent IRS standards, offer a secure and reliable platform for submitting Form 1065 electronically. They ensure the integrity and confidentiality of your partnership’s financial data, providing peace of mind throughout the filing process.

Some popular IRS-authorized e-file providers include:

- CCH Axcess:

Known for its easy-to-use tools and strong features, CCH Axcess helps partnerships file Form 1065 online with ease. It’s a top pick for many tax pros. - Intuit Tax Online:

Used by a wide range of firms, Intuit Tax Online supports many tax forms, including Form 1065. It gives users a smooth and trusted filing process. - Thomson Reuters Tax & Accounting:

This tool works well for all types of firms, big or small. It blends with current finance tools and supports Form 1065 filing with ease. - Wolters Kluwer CCH Tagetik:

This platform helps large firms handle tough tax needs. It comes with high-end tools that help with Form 1065 and more complex tasks.

To find an IRS-authorized e-file provider that meets your needs, you can visit the IRS website.

2. Use the IRS Free File program:

If your income is low or mid-range, you may file Form 1065 online for free through the IRS Free File program. This program is backed by the IRS and run by trusted tax software firms. You can check the list of these providers on the IRS site.

E-Filing Procedure:

Once you have chosen an e-file provider, you will need to create an account and provide your partnership’s information. You will then be able to upload your completed Form 1065 and any other required forms or attachments. The e-file provider will then submit your return to the IRS electronically.

Best Software to File Form 1065 Online Free

1. IRS Free File Program

- Some approved software providers support Form 1065.

- Income limits apply.

2. TaxAct or FreeTaxUSA

- Sometimes offer free trials or reduced fees.

- Basic partnerships may qualify for free options.

3. Drake Tax or TaxSlayer

- Good for small firms.

- May include free e-filing in packages.

Who Should Not Use Form 1065?

Not all businesses need to file Form 1065. This form is only for partnerships and some multi-member LLCs. If your business fits into one of the groups below, you should not use Form 1065:

1. Sole Proprietorships

If you run your business alone, you are a sole proprietor. You must report your income and costs using Schedule C, filed with your personal tax return (Form 1040). You do not need Form 1065.

2. Single-Member LLCs

A single-member LLC is treated like a sole proprietorship for tax purposes. It is a “disregarded entity” in the eyes of the IRS. You must file Schedule C, not Form 1065.

3. Corporations

If your business is a corporation, you must file a different form.

- C Corporations file Form 1120.

- S Corporations file Form 1120-S.

Only true partnerships and LLCs with two or more members are required to file Form 1065. Before you file, make sure you know your business type.

Can a Partnership Use the Cash Method?

Yes, most partnerships can use the cash method of accounting. It’s simple and works well for small businesses.

What is the cash method?

- You report income when you receive it.

- You report expenses when you pay them.

It tracks real cash going in and out. Many small firms like this method because it’s easy to follow.

When you file Form 1065 online free, you must choose a method—cash or accrual. You can choose cash unless:

- You are a tax shelter, or

- Your average yearly income is more than $27 million (for 2024 and later).

If you meet these rules, you can use the cash method with no issue.

State Filing Requirements for Partnerships

Filing Form 1065 is a federal rule. But many states have their own tax return rules for partnerships. Even if you file Form 1065 online free with the IRS, you might need to send a state form too.

A few examples:

- California – Must file Form 565 with the California Franchise Tax Board.

- New York – Must file Form IT-204 with the New York State Department of Taxation.

- Texas – No income tax, but may require a Franchise Tax Report.

Each state has its own forms, deadlines, and rules. Some may charge fees or want more info from partners. Make sure to check your local state tax office so you stay compliant.

If you run a partnership, it’s key to know what Form 1065 is and why you need to file it. The good news is that you can now file Form 1065 online for free with many simple tools. This saves time, stress, and cost while showing you how to file Form 1065 for free with simple steps. Just be sure to file it right and on time. If it feels hard, get help from a tax pro. Whether you’re new or just need a guide, you now know how to file 1065 online the easy way.

Trying to file 1065 online for free? Meru Accounting makes it smooth and stress-free. Our skilled tax team helps you file online with care. We make sure your partnership’s tax data is sent right and safely to the IRS. With Meru Accounting, you can be sure that your tax tasks are done right and on time. This gives you more time to grow your business.

FAQs

Q1: What is Form 1065 used for?

It tells the IRS about a partnership’s income and costs.

Q2: Can I file Form 1065 online for free?

Yes, use IRS Free File or free tools like FreeTaxUSA.

Q3: What is the deadline to file Form 1065?

It’s March 15, unless you ask for more time.

Q4: What is Schedule K-1?

It lists each partner’s share of income, loss, or credits.

Q5: Do single-member LLCs file Form 1065?

No. They use Schedule C with their 1040 form.

Q6: What happens if I file late?

You may owe a $220 fine per partner each month.

Q7: Can I amend Form 1065 if I make a mistake?

Yes. Use Form 1065X to fix errors.