What is Form 1120-F?

Form 1120-F is used by foreign companies to report income and pay US tax. Companies with ties to US trade or business must file it. Tax is paid at the corporate rate, not the individual rate.

The form covers income, gains, losses, deductions, and credits. It also includes schedules for dividends, tax calculations, and the balance sheet. US tax rules under Effectively Connected Income (ECI) apply.

Companies can use this form to claim refunds, report other foreign taxes, check branch profits, or calculate extra tax on interest.

Who needs to file Form 1120-F?

The parties who are required to file the Form:

A corporation is treated as doing business in the US if it has a trade or business there, even if it earns no income or the income is tax-free under a treaty.

- An entity that was not engaged in a connection with any trade or business in the US, but had earned an income from a U.S. source.

- A branch executive of QDD.

- A foreign corporation may claim a refund for any tax overpayment made during the fiscal year.

- A International corporation that claims the benefit of any deductions or credits made to the corporation.

- A foreign corporation claiming treaty benefits or modified tax rules must disclose related income on Form 8833.

In all these cases, filing the correct Income Tax Return ensures compliance with IRS rules and helps avoid penalties.

When to file the Form?

A foreign corporation with U.S.-connected income files Form 1120-F by the 15th day of the fourth month. However, an extension can be granted to file the return for six months through the Form 7004 extension request form. A International corporation that has no connection or fixed place of business in the U.S. must file by the 15th of June; the grant of extension can be requested through Form 7004.

Where to file Form 1120-F? An option for e-filing is available.

The foreign corporation can file the Form 1120-F through the following address:

Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409.

Why does the foreign corporation need to comply?

In any case, if the corporation fails to file the Form, the corporation will face heavy penalties. The regulation for penalties is the same as the Form 1120-C. An accurate disclosure of the statement is a must to comply with these regulations to avoid the chance of the IRS rejecting the Income Tax Return.

Requirements to file the Form:

The overseas corporation must fulfill the requirements of the Form:

- Documental proof of withholding tax (Form 1042-S).

- On what ground was the refund claimed?.

- Important tax certifications (Form W-8BEN-E).

- Any additional documentation to support the claim?

- Refund of backup withholding tax.

- Refunds of US withholding.

Exception made by the IRS:

- A International corporation is exempt from filing Form 1120-F only if neither it nor its branches is a QDD.

- The international corporation was not engaged in a U.S. trade or business during the year.

- The US tax amount was withheld at the source.

- U.S. source income of that overseas entity is exempted from U.S. taxation as stated under section 881(c) or (d).

- Owns a beneficiary of an estate, has a trust engaged in a U.S. trade or business. However, this may not require the taxpayer to file the form.

Common Mistakes to Avoid with Form 1120-F

Filing Form 1120-F can be hard for a foreign corporation if care is not taken. A wrong step may cause tax loss, fines, or loss of treaty rights. To keep your Income Tax Return safe, here are the most seen errors and how to avoid them.

Late Filing

Many firms file late or miss the due date. This leads to IRS fees and loss of key tax rights. Plan and file on time.

Missing Data

A big error is to skip key facts, like the EIN, U.S. trade link, or tax treaty proof. Always check that each field is done.

Wrong Income Report

Some firms fail to list all U.S. sales or gains. Others list gross, not net. A full and true report is a must to avoid tax audits.

Missed Deductions or Credits

A foreign corporation may miss claims for costs like rent, pay, or loan interest. This raises tax owed. Check all rules for credits and cuts.

No Schedules

Form 1120-F needs extra forms like Schedules H or I. If these are not sent, the IRS may hold or deny the return.

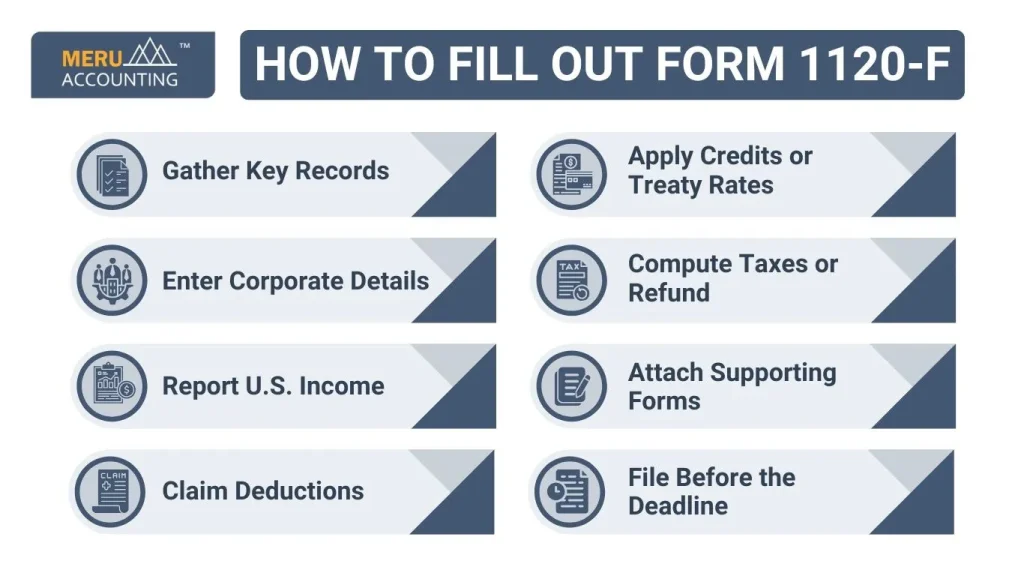

How to Fill Out Form 1120-F

Filing Form 1120-F is key for foreign firms that earn money in the U.S. This tax form lets the IRS see how much you made and what tax you must pay. A correct filing helps you avoid fines, interest, and tax issues later.

This section shows how to fill out the Form step by step. It lists what to write, what papers to attach, due dates, and tips for an error-free return. Proper filing of the Income Tax Return also ensures treaty benefits are not lost.

Key Sections of Form:

1. Company Information

You must provide essential identification details, including:

- Company Name: Enter the exact legal name of the overseas corporation.

- Address: Include the principal office location (foreign address) and U.S. office, if applicable.

- Employer Identification Number (EIN): A valid EIN is required for tax reporting.

Providing incorrect or incomplete information here may delay processing or lead to IRS inquiries.

2. Income Section

This section reports all effectively connected income (ECI) earned in the United States. This includes:

- Sales revenue from U.S. operations.

- Service income connected to U.S. business activities.

- Rental or royalty income is effectively connected.

Accurate reporting ensures proper tax calculations and minimizes the risk of audits.

3. Deductions and Credits

Foreign corporations can claim deductions to reduce taxable income, such as:

- Business operating expenses (wages, rent, supplies).

- Interest payments on business loans.

- Depreciation on U.S.-based assets.

Tax credits, including those under applicable tax treaties, can also lower the final tax liability.

4. Calculate Tax Liability

Once income and deductions are reported:

- Apply current corporate tax rates as per IRS guidelines.

- Use tax treaty provisions to claim reduced rates or exemptions (must attach supporting documentation).

This calculation determines how much tax is owed or whether a refund is due.

5. Attach Required Schedules

Schedules provide detailed breakdowns of specific income or deductions, including:

- Schedule H for deductions and expenses.

- Schedule I for interest and dividend income.

- Form 8833 if claiming treaty-based return positions.

Failing to attach necessary schedules may delay return processing or result in treaty benefit denials.

6. Sign and Submit

An authorized officer of the corporation must sign the form before submission. Unsigned returns are considered incomplete and may lead to penalties or IRS follow-up notices.

Step-by-Step Filing Process

Step 1: Gather Key Records

Prepare:

- U.S. and foreign financial statements.

- Receipts and invoices for deductible costs.

- Any prior-year tax returns and treaty papers.

Step 2: Enter Corporate Details

Fill in:

- Legal name and foreign address.

- U.S. agent or office details if available.

EIN or apply for one if missing.

Step 3: Report U.S. Income

List:

- Sales made in the U.S.

- Fees from U.S.-based services.

- Gains from U.S. asset sales.

Step 4: Claim Deductions

Write down:

- Wages, rent, and supplies are linked to U.S. work.

- Depreciation on local property.

- Interest on U.S. loans.

Step 5: Apply Credits or Treaty Rates

If your home country has a tax treaty with the U.S.:

- Claim lower rates under treaty rules.

- Attach Form 8833 with proof.

Step 6: Compute Taxes or Refund

- Subtract deductions and credits.

- Apply tax rate.

- Show final tax owed or refund due.

Step 7: Attach Supporting Forms

Include:

- Schedules H and I.

- Other IRS forms are tied to credits or deductions.

- Proof for any treaty claims.

Step 8: File Before the Deadline

File:

- Online with IRS e-file for speed.

- Or by mail to the address in the IRS instructions.

Late returns risk penalties and loss of treaty benefits.

Penalties for Late or Wrong Filing

Failing to file correctly can lead to:

- Late filing fees and interest.

- Loss of tax treaty rights.

- Higher chance of IRS audits in the future.

Tips for Easy and Accurate Filing

- Keep complete records of U.S. transactions.

- Follow the IRS instructions line by line.

- Hire a tax expert for complex cases.

- File early to fix errors before the due date.

- Attach all schedules and support papers.

FAQs

- Who must file the 1120-F form?

Any foreign company with U.S. trade or one claiming treaty benefits must file, even if no tax is owed. Filing ensures the proper recording of the Income Tax Return.

- When is Form 1120-F due?

It’s due on the 15th day of the 6th month after the tax year ends. You may request more time by filing Form 7004.

- Do I need to file if there is no U.S. income?

Yes, you should file a protective return to keep treaty rights and avoid IRS disputes later.

- What if I file late?

You may face penalties, interest, and loss of treaty benefits. The IRS may also audit your business.

- Can I e-file this Form?

Yes, IRS-approved providers allow secure e-filing, which is faster than mailing paper returns.

- What documents should I attach?

Attach all schedules, Form 8833 for treaty claims, and proof of deductions to support your filing.