Form 8865: Return of US Persons For Certain Foreign Partnerships

Any US person who has control of any of the foreign partnerships is liable for the filing of Form 8865. The foreign partnership is considered when there is more than 50 percent interest through direct and indirect ownership in the firm. The control can be indirect or direct, which can be either through profit, loss, capital, or any deductions. So, any of the USA individuals who have some foreign partnerships must get information about the Return of US Persons Concerning Certain Foreign Partnerships. The filing requirements will explain all the income statements, schedules, as per the category, and other information. The category in which you are eligible requires the required submissions.

Understanding Form 8865

Form 8865 is a tax form for U.S. people who own part of a business outside the U.S. If you are in a foreign partnership, you may need to file it with the IRS. If you are a partner in such a business, you may need to file this foreign partnership tax return. The form reports your share of income, expenses, and other details about the partnership to the IRS.

What is Form 8865?

Form 8865 is used by U.S. taxpayers to report their share in certain foreign partnerships. It shows your ownership, income, losses, and other key financial details. The form also tells the IRS how the partnership is set up and where it is based. This helps the IRS track foreign business activity.

Filing Form 8865 is needed to follow U.S. tax rules. It helps you avoid fines for not reporting foreign partnerships. The form lists profits, losses, contributions, and payouts. By giving this information, the IRS can track your share and make sure taxes are correct.

Why is Form Important?

Filing IRS Form 8865 ensures that US taxpayers declare all their foreign income. The IRS uses this form to prevent tax avoidance through offshore businesses.

- If you don’t file, you may pay up to $10,000 in fines.

- Filing on time keeps you safe from extra charges.

- It makes your tax record clear and correct.

In short, these form keeps you safe and show the IRS your share in a foreign business.

Who needs to file Form 8865?

Not all U.S. people with a foreign partnership must file the Form. The IRS sets rules based on how much you own or control. Below are the main cases:

Category 1 – Full Control: If you own over 50% of a foreign partnership, you must file this form.

Category 2 – Big Share: If you own 10% or more in a partnership that U.S. people mostly own, you need to file.

Category 3 – Property Given to a Partnership: If you give property or assets to a foreign partnership and get a share in return, you must report it.

Category 4 – Special Deals: Some large deals or trades with a foreign partnership must be reported, even if you own less than 10%.

Why File on Time?

Filing IRS Form 8865 is not optional. Missing this foreign partnership tax return can lead to fines of $10,000 or more. Knowing what is Form 8865 and filing it on time protects you from penalties and keeps your tax record clear.

Information required for filing it:

A similar type of information is necessary as that of the foreign corporation Form 5471 and Form 1065. All the capital gains details, profits, balance sheet, capital accounts of the partner, and all other related entities of the partnership firm must be given. The form also requires the address name, the taxpayer ID, the transfer of property with the partnership’s detailed information, and ownership interest changes with the partner. Along with it, the person must provide all the relevant information as laid down by the tax department.

Deadline for the Form :

As per the income tax return of every partner, the form must be filed accordingly. It also includes the extension applicable while filing the form. Most of the taxpayers will have the due date of April 15. In case there is an extension, it must be filed as per the new date.

Where to file it?

The eligible US person with a foreign partnership must file Form 8865 with the IRS center. You can also do the online filing of this Form.

Why do you need to comply?

A US person who holds that 10% partnership interest in a foreign partnership firm and does not file the Form will be subject to a penalty. The penalty can go up to $10,000 per year. In case the contribution is made through the property and there is a non-disclosure of the transfer, then the penalty will go up to 10% of $100,000. So, it is very important to file Form 8865 within the given duration. Also, the amount of penalty varies as per the category in which you are applying.

Those involved in the foreign partnership must provide all the vital information. It includes acquisition, transfer, income-related aspects, and other important information while filing the return of US persons concerning certain foreign partnerships. As per the category in which they fall, al; concern formalities must be completed.

Key Details Needed for Filing Form:

You must give clear and correct information about your foreign partnership. The IRS needs this to know your role in the business. Filing IRS Form 8865 requires clear information about your partnership. You need:

1 – Partnership Name and Address

Write the name of the partnership and its full address, including the country.

2 – Your Share of Income, Losses, and Capital

Show how much profit, loss, and capital belong to you in the partnership.

3 – Property You Gave to the Partnership

List any money, goods, or other assets you added to the business.

4 – Deals with Related Parties

Report transactions or exchanges you had with people or companies linked to the partnership.

5 – Balance Sheet and Profit-Loss Reports

Include the financial details of the business, such as assets, debts, income, and costs.

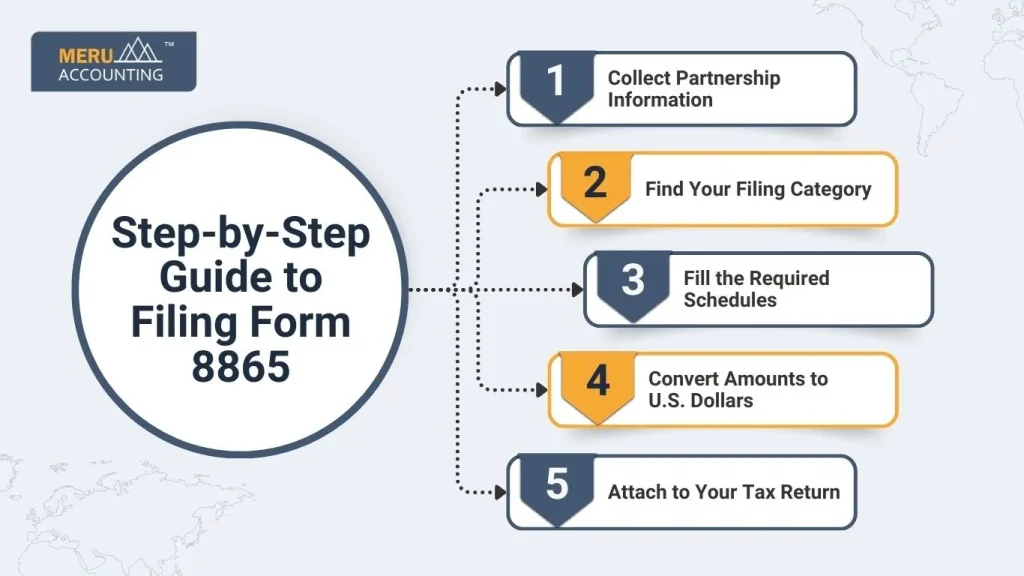

Step-by-Step Guide to Filing Form 8865

Form 8865 may look hard, but you can do it step by step. Follow this guide to make it simple and avoid mistakes.

Step 1 – Collect Partnership Information

Start by gathering details about the foreign partnership. This includes:

- The name of the business.

- The country where it is set up

- The type of business it runs.

Step 2 – Find Your Filing Category

The IRS has four main categories for Form filers. You must know which one fits you because it decides what parts of the form you need to fill out.

Step 3 – Fill the Required Schedules

Form has different schedules to report:

- Income and expenses.

- Capital and shares you own.

- Transactions or property transfers.

- Only complete the schedules that match your case.

Step 4 – Convert Amounts to U.S. Dollars

All numbers on the form must be in U.S. dollars. Use the official exchange rate for the tax year to make sure your report is correct.

Step 5 – Attach to Your Tax Return

When your form is ready, submit IRS Form 8865 with your federal income tax return by the due date.

- Attach it to your federal tax return.

- Send it by the IRS due date.

Filing this way keeps you safe from big fines and makes sure the IRS has the right info about your foreign business.

Common Mistakes to Avoid

- Missing deadlines or filing late.

- Leaving required fields blank.

- Using the wrong exchange rates.

- Not reporting transactions with related parties.

- Failing to file when you meet the ownership threshold.

Avoiding these errors saves you from heavy IRS penalties.

Detailed Schedules Explanation for Form 8865

Form has different schedules. Each one gives the IRS specific info about your foreign partnership. Filling them right helps you stay clear of errors and fines.

Schedule A – Ownership Details

This schedule shows:

- Who owns the partnership?

- How much share each partner has.

Schedule B – Income and Costs

This part lists:

- Money earned by the business.

- Expenses and other activities of the partnership.

Schedule G – Deals with Related Parties

Here you report:

Any trade or transaction done with people or companies linked to the partnership.

Schedule K-1 – Partner’s Share

This schedule shows:

- You’re part of the income or credits from the partnership.

- It tells the IRS what belongs to you.

Schedule L – Balance Sheet

This part gives:

- Assets, debts, and equity of the foreign partnership.

- A clear picture of its finances.

Schedule M – Transactions with the Filer

Here you list:

- Money, property, or services are moved between you and the partnership.

Filing foreign partnership tax returns can be complex, especially when dealing with multiple schedules and strict IRS rules. Meru Accounting makes the process easier by offering:

- Expert Guidance: We know all IRS rules for foreign partnerships and will help you file correctly.

- Accurate Filing: Our team ensures all figures and schedules are complete and correct.

- On-Time Submission: We help you meet every deadline to avoid penalties.

- Full Support: From data collection to filing, we manage the process for you.

With Meru Accounting, you can handle your IRS Form 8865 filing stress-free and stay compliant with US tax laws.

FAQs

- Do I need to file if I own a small part of a foreign partnership?

Yes. If you own 10% or more, or do certain deals with the partnership, you must file this form.

- What happens if I miss the deadline?

You may get a $10,000 fine for each late form. If you wait longer, extra fines can add up fast.

- Does the form change my US tax bill?

Not always. The form helps you follow IRS rules on foreign income. But not filing can still bring big fines.

- Can I file these forms by myself?

Yes, but the form is hard to fill out. Many people make mistakes. Tax experts like Meru Accounting can help you do it right.

- Can I fix my form after filing?

Yes. If you made mistakes or forgot info, you can send a corrected form later.