What is the Future of Amazon Bookkeeping?

Amazon bookkeeping is changing fast with new tools, trends, and seller needs.

As Amazon grows, sellers need to keep better track of income, expenses, and taxes.

Good bookkeeping helps sellers make smart decisions, avoid tax issues, and grow profits.

This blog explores the future of Amazon bookkeeping and key Bookkeeping Tips for sellers.

Efficient bookkeeping is a key part of Amazon’s e-commerce success. The future of Amazon bookkeeping lies in keeping up with fast trends and tech tools. In 2025 and beyond, accurate and smart bookkeeping is more than just numbers; it’s a tool for growth. As a seller, staying on top of your books helps you stay clear of rules and taxes. It also helps you plan for profit and avoid common traps. Modern tools and expert help can turn your books from a chore into a growth plan.

What is Amazon Bookkeeping?

Amazon is a strong and growing place for online sales. With lots of sellers and buyers, it’s vital to know your cash flow. Amazon bookkeeping, or Amazon FBA bookkeeping, is the way to track and handle all money tasks linked to your store. This includes income, costs, fees, and stock updates.

Using smart Bookkeeping Tips helps sellers stay clear, cut losses, and plan better. In this post, we will break down how tools, trends, and good habits shape the future of Amazon bookkeeping.

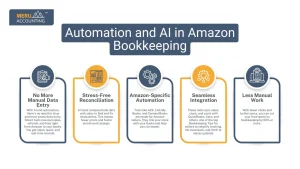

Automation and AI in Amazon Bookkeeping

No More Manual Data Entry

With AI and automation, there’s no need for slow and error-prone data entry. Smart tools now pull sales, refunds, and fees right from Amazon to your books. You get clean, quick, and real-time records.

Stress-Free Reconciliation

AI tools compare bank data with sales to find and fix mismatches. This means fewer errors and faster month-end closings.

Amazon-Specific Automation

Tools like A2X, Link My Books, and ConnectBooks are made for Amazon sellers. They link your store with your books and help you run leaner.

Seamless Integration

These tools sync sales, stock, and costs with QuickBooks, Xero, and others, one of the top Bookkeeping Tips for sellers to simplify tracking. No more back-and-forth or messy uploads.

Less Manual Work

With fewer clicks and better syncs, you can cut your time spent on bookkeeping by 50% or more.

Cloud-Based Solutions

Increased Adoption

Most Amazon sellers now use cloud tools like QuickBooks Online or Xero. These give real-time access to data and work from any place, any time.

Handling Multiple Currencies

Cloud tools help you work in many currencies. One of the best Bookkeeping Tips is to use software that manages exchange rates smoothly. If you sell in the US, UK, EU, and more, these tools help you stay on track.

Inventory Tracking

Real-time stock levels help avoid lost sales or extra costs. Cloud systems help you track what’s in, what’s out, and what’s slow to move.

Personalized Insights

AI and Data Analysis

Smart tools now look at your trends and tell you what works. You get forecasts, not just past records.

Tailored Recommendations

Some tools even tell you which products are worth keeping or dropping. This saves time and helps boost sales.

Operational Optimization

Data insights help improve price points, ad spends, and product lines — all while watching the bottom line.

Focus on Compliance and Tax Regulations

Complex Tax Rules

Selling on Amazon means dealing with tax laws across states or countries. It’s easy to miss a rule and get fined.

Handle Taxes Confidently

Amazon bookkeeping software helps you keep track of tax rates, sales tax due, and when to file, one of the must-know Bookkeeping Tips for sellers. This helps you avoid tax stress.

Outsourced Amazon Bookkeeping Services

Expertises Guide

Amazon sellers don’t need to do it all alone. Firms that know e-commerce can help you avoid costly errors.

Save Money, Gain Quality

Hiring full-time staff is costly. Outsourcing gives you pro help at less cost, often with better results.

Renowned Firms

Choosing a firm with a strong record gives you peace of mind. They use tested tools and safe systems.

Enhanced Data Security & Privacy

Protect Your Data

All your info — sales, bank, tax — lives online. Good software should use encryption, backups, and safe logins.

Look for the Best

Choose tools with multi-layer safety, like two-factor logins and secure cloud storage.

Be Proactive

Be alert and audit your system. Safety today means fewer problems later.

Understanding Amazon Bookkeeping Software

1. Financial Tracking

Track every dollar, sales, returns, fees, ads, and more. This gives you a true view of your profit and growth.

2. Amazon FBA

With FBA, stock and shipping costs add a new layer. Good tools help you avoid stock-outs or overstock risks.

The Importance of Amazon Bookkeeping Software

1. Tax Compliance

Good books mean fewer tax errors. When the IRS or GST asks, you’re ready.

2. Profitability Analysis

Know what sells, what doesn’t, and why. One of the top Bookkeeping Tips for sellers is to act on these reports monthly.

3. Business Growth

Clean books show where to grow, be it new products, better prices, or fresh markets.

Effective Amazon Bookkeeping

Dedicated Accounts

Use separate bank and credit cards for your Amazon business. This makes tracking easy and audit-ready.

Accounting Software

Pick software that links to Amazon. Tools like QuickBooks, Xero, A2X, or SellerZen make your job easier.

Regular Reconciliation

Each month, match your bank and Amazon reports. Fix issues early.

Expense Tracking

Record all costs — ads, stock, shipping, refunds, and Amazon fees. Don’t leave money on the table.

Inventory Management

Track items you sell, what’s in storage, and what needs reordering. This avoids stock-outs or dead stock.

Cash Flow Analysis

See when cash comes in and when bills are due. Simple Bookkeeping Tips like these help avoid shortfalls.

Consistent Record Keeping

Store all receipts, invoices, and files. Digital or paper, but sorted. It saves time and stress later.

Outsourcing Amazon Bookkeeping

Professional Assistance

Experts know the tools, tax rules, and Bookkeeping Tips for sellers that help you grow faster and stay compliant.

Time and Resource Savings

Outsource the books and focus on sourcing, selling, and scaling.

Data Security

Pro firms use top safety tools and processes to protect your data.

Top 10 Bookkeeping Tips Every Seller Needs to Know

Separate Business and Personal Finances

Always keep business cash separate. Use a business bank and card to track true earnings.

Track Every Expense

Even small costs count. Log each cost with Amazon bookkeeping software.

Use Accounting Software

Use trusted tools that sync with Amazon. Save time, cut errors.

Regularly Reconcile Your Accounts

Match books to bank statements. Do this monthly to catch gaps fast.

Maintain Accurate Inventory Records

Use inventory tools to track sales, stock, and restocks in real time.

Set Aside Money for Taxes

Each month, save for taxes. This avoids stress at year-end.

Understand and Track Cash Flow

Track what you earn and spend. Use software to get real cash flow reports.

Keep Up with Receivables

Follow up on late payments. Use tools that send auto alerts or reminders.

Consult with a Professional

Ask an expert to review your books. Get help with taxes, growth, and goals.

Review Financial Statements Regularly

Check reports each month — profit, loss, and balance. This shows your real health and future path.

Benefits of Outsourcing Bookkeeping

1. Saves Time and Money

Outsourcing bookkeeping saves time and lowers costs. You avoid hiring full-time staff and reduce hours spent on accounts. Trained bookkeepers work fast and keep records correct. This allows you to focus on key areas of your business.

2. Experts Handle Tax Rules Better

Bookkeeping experts know tax laws and stay updated with rule changes. They handle forms, due dates, and filings with care. This lowers the risk of errors and helps avoid fines or late fees.

3. Keeps Your Records Audit-Ready

Outsourced bookkeepers keep records clear and up to date. Your books stay well-prepared in case of an audit or review. This saves time and helps reduce stress during checks.

4. Helps with Planning and Growth

Clean records give a clear view of your business. Reports show profit, costs, and cash flow. This helps you plan, set goals, and grow with better control.

5. You Focus on Sales and Products

With your books managed by experts, you can spend more time on sales and product work. This helps improve results and supports business growth

Top Amazon Bookkeeping Mistakes and How to Avoid Them

Failure to Separate Personal and Corporate Money

Mistake: Mixing funds makes tax time hard and books messy.

Solution: Open business-only accounts and cards.

Neglecting Regular Reconciliation

Mistake: Skipping this leads to errors and missed money.

Solution: Reconcile monthly. Use software that flags gaps.

Ignoring Inventory Management

Mistake: Running out of stock or overstocking drains profits.

Solution: Link your books to inventory tools and track in real-time.

Ignoring All Expenses

Mistake: Skipped costs hurt your tax deductions.

Solution: Log every cost in your bookkeeping system.

Mistakenly Identified Transactions

Mistake: Wrong categories distort your tax and profits.

Solution: Use preset rules in your software and review reports often.

Not Keeping Up with Tax Legislation

Mistake: You could get fined or audited.

Solution: Stay current or work with pros who are.

Ignoring Sales Tax Collection

Mistake: Unpaid tax leads to legal issues.

Solution: Use tools to auto-calculate and file sales tax.

Relying Only on Amazon Reports

Mistake: Amazon reports don’t show the full picture.

Solution: Combine Amazon data with software like QuickBooks for full insights.

Amazon bookkeeping is no longer a manual job. It is now driven by tools, automation, and insights. Sellers who use smart Bookkeeping Tips and tools will grow faster. Good bookkeeping makes taxes easy, keeps cash flowing, and boosts profits. The future is all about cloud, AI, and smart reports. Adapt early and stay ahead. At Meru Accounting, we help Amazon sellers with simple, smart bookkeeping. We use cloud tools to track sales, costs, and cash in real time. Our team keeps your books clean, tax-ready, and clear. With us, you stay on track and grow with ease.

FAQs

- What is Amazon bookkeeping?

It’s the process of tracking income, fees, and expenses from selling on Amazon. - Why is bookkeeping important for Amazon sellers?

It helps with taxes, profits, and keeps your business organized. - Can I do Amazon bookkeeping myself?

Yes, but using tools or a bookkeeper makes it easier. - What software is good for Amazon bookkeeping?

A2X, QuickBooks Online, and Xero are good options. - How often should I update my books?

Every week or at least once a month. - Can I automate my Amazon bookkeeping?

Yes, many tools now allow you to automate most tasks. - What are the top Bookkeeping Tips for sellers?

Separate accounts, track expenses, and review reports regularly.