How to Get a Loan Against Tax Refund: A Simple Guide

Getting fast cash can be tough when you have sudden expenses. Many people do not know that they can take a personal loan against their income tax return. This option lets you borrow money using your tax refund as security. In this blog, we explain how you can get a loan against a tax refund, its benefits, risks, and how experts can help you make the process simple.

What is a Personal Loan Against Income Tax Return?

A personal loan against income tax return allows you to borrow money using your tax return papers as proof of income. Instead of waiting weeks or months for your refund, you can get funds quickly. Once the IRS releases your refund, the lender takes the amount you borrowed from it.

How Does It Work?

- You apply for the loan with proof of your tax return.

- The lender checks your eligibility.

- You receive the money before your refund arrives.

- The refund pays off the loan when processed by the IRS.

Example Case

If your refund is $2,000 and you need urgent cash, you can apply for a loan of $1,500. When your refund arrives, the lender takes $1,500 plus fees directly from it.

What is a tax advance loan?

The refund loans are not given by the IRS; they are given by third parties. These third parties charge specific fees, and some of the interest rates on this loan. Depending on the tax refund, the loan with the tax return. Once the IRS accepts the return, you can easily and quickly access the refund. One basic thing must be noted: it is not the actual refund of the amount you get here; it is only the loan given to you, and after the refund is made by the IRS, the amount is directly repaid from the refund received.

How can you get a tax advance loan?

The loan with tax return refund is provided by the tax preparation companies. These tax preparation companies will also include one that does e-filing. The first step for getting a loan here is to use the services of these companies before the due date. After making the related calculations through the income tax return calculator, these companies can give the loan through the partnered financial institutions. To qualify easily for this loan, your credit card history and overall credit score must be good.

How long will the loan for the tax return refund need?

Generally, the direct deposit of the amount will take a minimum of six days to process, and for the prepaid card, it will take around 24 hours. In the case of the e-filing service, the physical card will take around eleven days to receive.

Eligibility Criteria for a Loan Against Tax Refund

Not everyone can get a loan against a tax refund. Lenders check certain factors before approving it.

Basic Requirements:

- You must have filed your income tax return.

- You should have a confirmed refund amount.

- A valid ID and bank account are needed.

- Some lenders may check your credit score.

Other Considerations

Some lenders may require your last year’s tax records or proof of steady income. This increases their trust that you can repay the loan easily.

Meeting these points improves your chances of getting approval for a personal loan against income tax return.

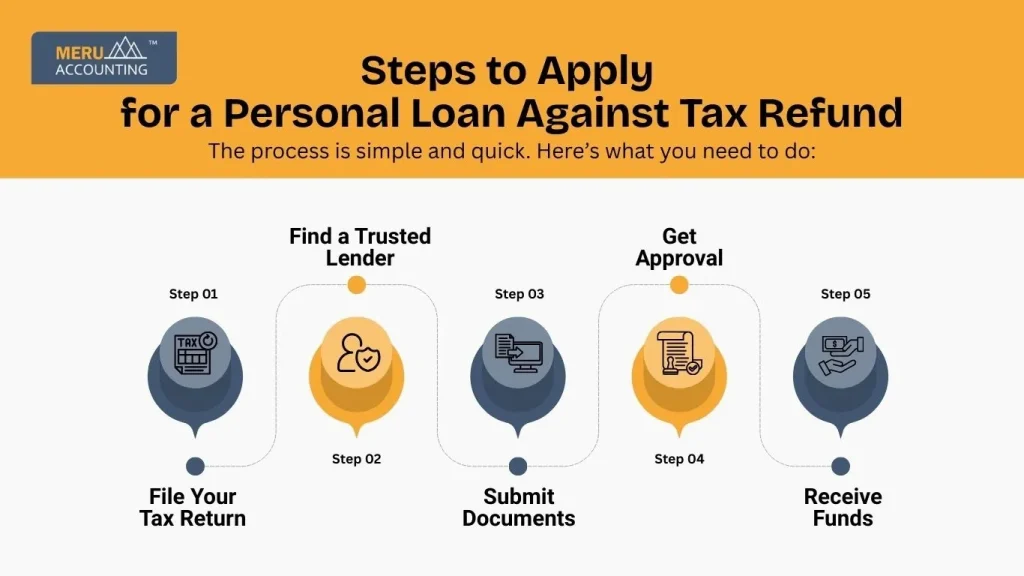

Steps to Apply for a Personal Loan Against Tax Refund

The process is simple and quick. Here’s what you need to do:

Step 1: File Your Tax Return

Without filing your ITR, you cannot get a personal loan against income tax return. Make sure your tax return is accurate and submitted on time, as errors can delay loan approval.

Step 2: Find a Trusted Lender

Look for banks or financial firms that offer a loan against tax refund services. Compare their interest rates, fees, and terms to avoid high costs later.

Step 3: Submit Documents

Provide the following:

- Filed tax return proof

- ID and bank details

- Any extra forms the lender asks for. This step helps lenders verify your refund details and ensures quick approval.

Step 4: Get Approval

Lenders check your refund details and credit history. If all looks fine, they approve your loan against tax refund within a few days or even hours in some cases.

Step 5: Receive Funds

Once approved, funds are sent to your bank account before your tax refund arrives. You can use this money for emergencies or planned expenses.

Personal Loan Against Income Tax Return Online: A Quick Guide

Applying online makes the process even faster.

How to Apply Online:

- Go to the lender’s website.

- Fill out the online form.

- Upload tax return proof and ID.

- Wait for approval and get money directly into your account.

Why Online is Better

Online applications save time, avoid long queues, and allow you to compare multiple lenders easily. Many prefer a personal loan against income tax return online for its speed and convenience.

Benefits of Taking a Loan Against Your Tax Refund

There are several reasons why people choose this loan option:

Quick Access to Money

This loan option gives you funds in advance, helping you meet sudden expenses without waiting weeks for the IRS refund process. It is a quick solution when you need urgent money.

No Collateral Needed

You do not need to risk your property or assets. Only your expected tax refund acts as security, making approval simpler and safer for you.

Simple Process

With fewer documents and quick checks, applying for a loan against a tax refund is easy. The steps are short and easy to understand, making the process smooth.

Online Convenience

You can apply from home using your phone or computer. The online option saves time, avoids bank visits, and makes getting a loan simple and fast.

Flexible Usage of Funds

You can use the loan for any personal need, such as paying bills, handling emergencies, or making important purchases, without restrictions.

Helps Build Credit History

Timely repayment of your loan can help improve your credit score, making it easier to get future loans.

Taking a loan against a tax refund is a good choice when you need urgent cash and know you have a refund coming.

Risks and Things to Consider Before Applying

While this loan is helpful, you must be careful.

Possible Risks:

High Fees or Charges

Some lenders charge high fees, reducing the final amount you receive. Always check charges before signing.

Refund Shortfalls

If your refund ends up lower than expected, you might still owe the difference to the lender.

Eligibility Restrictions

Not every tax return qualifies. Certain cases may not meet lender rules, delaying approval.

Potential Debt Cycle

Borrowing too often against refunds can lead to a cycle of debt if not managed wisely.

Impact on Future Tax Planning

Taking loans on your refunds often can affect how you plan your taxes in the future, reducing savings opportunities.

Make sure you read the loan terms before you take a personal loan against your tax refund.

Tips to Get the Most from a Loan Against a Tax Refund

To make the most of a personal loan against tax refund, follow these tips:

- Know Your Refund: Check your refund amount before you apply. Borrow only what you can pay back.

- Pick the Best Lender: Look at fees, rates, and terms. Choose the one that costs less.

- Use Money Wisely: Spend the loan on urgent needs, not on things you want.

- Pay Back on Time: Make sure your refund is enough to cover the loan and fees.

- Keep Your Records: Save your loan and refund papers for future use.

These steps help you use a personal loan against your income tax return online safely and fast.

At Meru Accounting, we help you file your tax return correctly to ensure you have a confirmed refund amount that lenders accept. Our experts guide you step by step to ensure you get funds quickly and avoid errors in your application.

FAQs

- Can I get a personal loan against a tax refund before filing my return?

No. You must file your tax return first and have a confirmed refund amount to apply for a personal loan against your tax refund.

- How long does it take to get money from a loan against a tax refund?

Most lenders approve and transfer funds in 1–3 days once they check your documents.

- Is it possible to get a personal loan against an income tax return online?

Yes. Many lenders offer personal loans against income tax returns online services. You can apply using their website or app from home.

- Is my credit score important for getting a loan against my tax refund?

Some lenders check your credit score. A good score can help you get quick approval and lower fees.

- What happens if my tax refund is lower than expected?

If your refund is less than the loan amount, you must pay the extra money back to the lender directly.

- Do loans against tax refunds cost a lot?

Some lenders may ask for high fees or interest. Check and compare many lenders to find the cheapest one.

- Can I spend my loan money on anything?

Yes. A personal loan against tax refund lets you use the money for bills, health costs, or any quick need.