Gusto vs QuickBooks Payroll: A Complete 2025 Comparison

Managing payroll is key for any small or mid-size firm. Choosing the right tool can save time, cut mistakes, and make the workflow smooth. Both tools are strong in payroll, but when comparing Gusto vs QuickBooks Payroll, they serve firms in different ways. Gusto is praised for its clean setup, clear design, and HR extras like staff benefits. QuickBooks Payroll, on the other hand, links well with QuickBooks Accounting. For firms already in that system, it helps track pay, tax, and books in one place. In this guide, we compare Gusto vs QuickBooks Payroll, their features, ease of use, cost, support, and more. You will learn which fits your firm best.

Understanding the Basics

Before comparing these two payroll platforms, it’s important to understand what they are and what they offer.

What is Gusto Payroll?

Gusto is a cloud tool for payroll. It helps firms pay staff, file taxes, and run HR tasks. Gusto is known for its clean design and simple steps. Many small firms like it for ease of use.

What is QuickBooks Payroll?

QuickBooks Payroll works with QuickBooks accounting. It helps pay staff, track hours, and file taxes. It is strong for firms that already use QuickBooks, as it links payroll with accounts well.

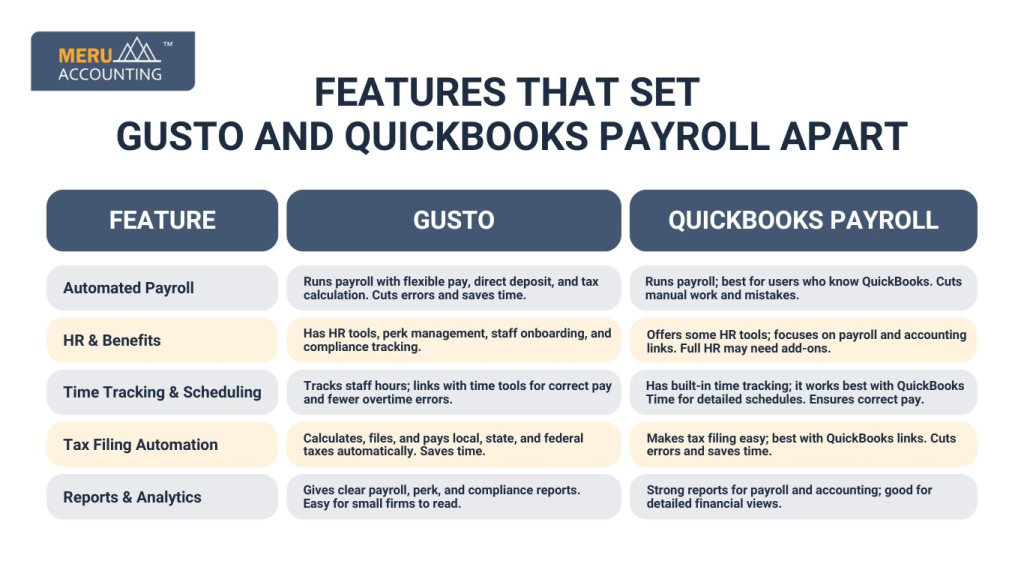

Features That Set Gusto and QuickBooks Payroll Apart

Both platforms have useful tools, but some key differences make Gusto vs QuickBooks Payroll unique.

Feature | Gusto | QuickBooks Payroll |

Automated Payroll | Runs payroll with flexible pay, direct deposit, and tax calculation. Cuts errors and saves time. | Runs payroll; best for users who know QuickBooks. Cuts manual work and mistakes. |

HR & Benefits | Has HR tools, perk management, staff onboarding, and compliance tracking. | Offers some HR tools; focuses on payroll and accounting links. Full HR may need add-ons. |

Time Tracking & Scheduling | Tracks staff hours; links with time tools for correct pay and fewer overtime errors. | Has built-in time tracking; it works best with QuickBooks Time for detailed schedules. Ensures correct pay. |

Tax Filing Automation | Calculates, files, and pays local, state, and federal taxes automatically. Saves time. | Makes tax filing easy; best with QuickBooks links. Cuts errors and saves time. |

Reports & Analytics | Gives clear payroll, perk, and compliance reports. Easy for small firms to read. | Strong reports for payroll and accounting; good for detailed financial views. |

Pricing and Plans in 2025

Pricing is always a major factor when selecting a payroll platform. Comparing Gusto vs QuickBooks Payroll helps small firms see which offers better value for money.

Gusto Pricing

Three plans: Core, Complete, Concierge. Core suits small firms; Complete adds HR tools; Concierge gives full HR help. Fees start low, plus a per-staff cost.

QuickBooks Payroll Pricing

Three plans: Core, Premium, Elite. Core is basic; Premium adds fast pay and HR; Elite covers tax mistakes. Costs more than Gusto for small teams.

If your firm needs simple payroll with strong HR tools, the Gusto vs QuickBooks Payroll comparison shows that Gusto gives more value for small teams. QuickBooks Payroll is best if you use QuickBooks and want smooth accounting links.

Ease of Use: Navigating Payroll Without Hassle

Onboarding & Setup Process

Gusto makes setup easy. Add staff, set perks, and start pay in a few steps. QuickBooks Payroll setup is a bit harder, but it is clear to users of QuickBooks.

Dashboard and User Experience

Gusto has a clean, neat dashboard. Navigation is smooth. QuickBooks Payroll works well, but it may feel packed if you do not use other QuickBooks tools. Both give fast access to pay and reports.

Integrations & Ecosystem: Connecting Payroll to Your Tools

Compatible Apps & Tools for Gusto

Gusto links with many accounting tools, time apps, and HR tools. Syncing data is easy and fast.

Compatible Apps & Tools for QuickBooks Payroll

Gusto vs QuickBooks Payroll: QuickBooks Payroll works best with QuickBooks products. It also links with time apps and some HR tools. Firms that use QuickBooks get smooth data flow.

Customer Support & Service Quality: Assistance When You Need It

Support Options and Response Times

Gusto gives email, phone, and chat support. Teams respond fast and help well. QuickBooks Payroll offers phone and chat support, with long hours for top plans.

User Satisfaction and Reviews

Gusto users like the clean design and fast support. QuickBooks Payroll users like the link with accounts and strong tax help. Both score high; the choice depends on your needs.

Pros and Cons of Gusto vs QuickBooks Payroll

Gusto Pros

- Easy Dashboard: Gusto has a neat dashboard. Users can run payroll, check reports, and handle staff fast. Even new users find it clear.

- Strong HR Tools: Gusto has HR tools like staff onboarding, perks, and time logs. This keeps work smooth and cuts errors.

- Auto Tax Filing: Gusto calculates, files, and pays tax. Users avoid mistakes and fines.

- Flexible Pay Schedule: Supports weekly, bi-weekly, semi-monthly, or monthly pay. Firms can match staff needs or cash flow.

- Self-Service Options: Staff can view pay stubs, tax forms, and perks online. HR workload drops.

- Fast Support Team: Phone, chat, and email help. Users get quick fixes, keeping pay smooth.

- Links to Apps: Gusto links to accounting, time, and HR apps. Data sync is smooth.

Gusto Cons

- Weak Accounting Link: Gusto works with many tools but lacks deep links with big accounting apps. Users may need manual updates or extra connectors.

- Strong HR Tools: Gusto has HR tools like staff onboarding, perk management, and time logs. These tools let small firms run HR in one place, cut errors, and keep work smooth.

- Automated Tax Filing: Gusto figures, files, and pays taxes on its own. Users can skip mistakes and fines, as it handles local, state, and federal taxes fast.

- Employee Self-Service Options: Staff can see pay stubs, tax forms, and perks online. This cuts HR load and lets workers manage their info safely.

- Responsive Support Team: Gusto gives phone, chat, and email help. Users get fast, useful answers, keeping pay smooth and easy.

QuickBooks Payroll Pros

- Strong Accounting Integration: QuickBooks Payroll links seamlessly with QuickBooks accounting software. This reduces data entry, prevents errors, and provides a clear financial picture.

- Robust Reporting: The platform provides detailed payroll, tax, and financial reports. Users can generate insights quickly, which helps with planning, auditing, and compliance.

- Tax Penalty Protection in Elite Plan: The Elite plan covers errors in tax filing, reducing the risk of penalties. Businesses gain peace of mind knowing taxes are handled accurately.

- Flexible Payroll Options: QuickBooks Payroll supports different pay schedules, including weekly, bi-weekly, and semi-monthly. This flexibility helps businesses match payroll to employee needs.

- Employee Self-Service: Employees can access pay stubs, W-2s, and benefits information online. This reduces HR workload and gives staff secure control over their information.

QuickBooks Payroll Cons

- Best Suited for Existing QuickBooks Users: Businesses not already using QuickBooks accounting may not fully benefit from the integration. Standalone use may feel limited compared to Gusto.

- Higher Costs for Elite Features: Advanced payroll and tax protection features come with higher-tier plans. Small teams may find these costs steep compared to Gusto.

- Some Reports Can Be Complex: While reports are detailed, they can overwhelm users who need only basic payroll summaries. Learning the system may take extra time.

- Limited HR Tools in Base Plan: QuickBooks Payroll focuses more on payroll than HR. Businesses needing robust HR support may need add-ons or additional software.

- Less Intuitive Dashboard for Non-Accountants: The dashboard is optimized for accounting users. Owners without accounting experience may face a learning curve navigating financial details.

- Customer Support Varies by Plan: Support quality improves with higher-tier plans. Base plan users may face slower responses or limited access to advanced guidance.

Who Should Choose Which in 2025?

When deciding between Gusto vs QuickBooks Payroll, picking the right tool depends on your firm’s size, workflow, and goals.

Best for Startups & Small Businesses

Startups and small firms that need an easy-to-use, full-featured payroll tool may prefer Gusto. Its HR tools and simple automation fit teams with few resources.

Best for Growing Enterprises

Firms that use QuickBooks or need strong accounting links may choose QuickBooks Payroll. It is good for reports, tax tasks, and works well with existing finance workflows.

Managing payroll can be time-consuming and complex. Meru Accounting helps businesses handle payroll efficiently using platforms like Gusto and QuickBooks Payroll. Our team ensures accurate tax filing, smooth payroll processing, and compliance with local regulations. We can help you choose the right platform, set it up, and manage it so you can focus on growing your

Business.

FAQs

- Which is easier for small businesses to use?

Comparing Gusto vs QuickBooks Payroll shows that Gusto is easier for small teams, while QuickBooks Payroll works well if you already use QuickBooks accounting. - Can I file taxes automatically?

Yes. Both platforms handle federal, state, and local taxes. Gusto does this for all plans, while QuickBooks offers penalty protection in the Elite plan. - Do employees get self-service access?

Yes. Both platforms allow employees to view pay stubs, W-2s, and benefits online. This reduces HR work and improves transparency. - Which software has better HR tools?

Gusto provides more HR features, such as onboarding, benefits, and time tracking. QuickBooks Payroll has limited HR tools in lower-tier plans. - Can I track employee hours?

Yes. Gusto offers basic tracking, with add-ons for advanced needs. QuickBooks integrates with QuickBooks Time for accurate hour logging. - Which one is better for reporting?

QuickBooks Payroll offers detailed reports, ideal for accounting. Gusto has simpler, clearer reports, which work well for small teams.