How Are Virtual Bookkeeping Services Transforming the Way We Handle Finances?

Efficient financial management is crucial for businesses to stay on track and ensure sustainability. Traditional bookkeeping methods have long been the norm, but the rise of technology has shifted the landscape. Virtual bookkeeping services are now transforming how businesses handle their finances, offering a more flexible and efficient approach to managing books. By adopting remote bookkeeping services, businesses can streamline their financial processes while maintaining accuracy and transparency. This innovative solution not only saves time but also provides access to professional expertise without the need for physical presence.

Table of Contents

- Introduction

- How Virtual Bookkeeping Services Work

- Common Myths About Virtual Bookkeeping Services

- FAQs

- Conclusion

Introduction

Remote bookkeeping services, also known as virtual bookkeeping services, refer to the practice of managing a company’s financial records and accounting tasks online from a remote location. This service includes tasks such as tracking expenses, managing accounts payable and receivable, reconciling bank statements, and preparing financial reports, all handled through secure cloud-based platforms. These services provide businesses with remote access to bookkeeping professionals who handle everything from data entry to financial reporting. As businesses continue to embrace technology, the shift from traditional in-house accounting departments to virtual bookkeeping services has become more widespread. These services offer various advantages, such as improved efficiency, cost savings, and greater flexibility.

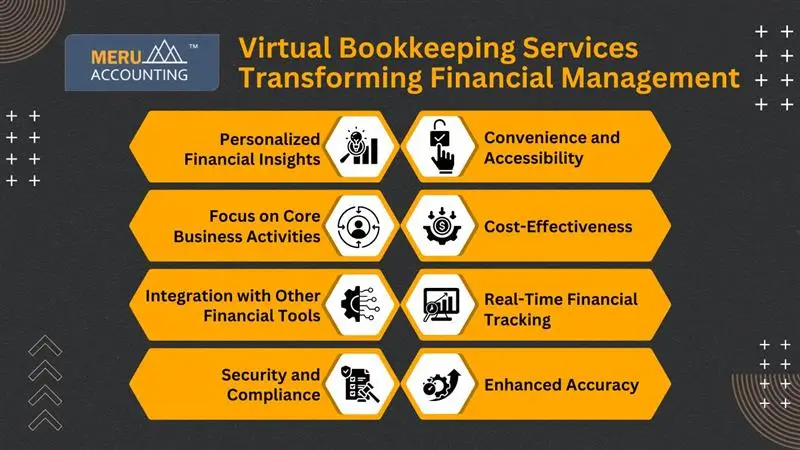

Virtual Bookkeeping Services Transforming Financial Management

- Convenience and Accessibility

- With virtual bookkeeping services, you can access your financial information anytime, anywhere, as long as you have an internet connection.

- Remote bookkeeping services eliminate the need to be tied to traditional office hours or locations, offering great flexibility for busy business owners and individuals.

- Cost-Effectiveness

- Virtual bookkeeping services reduce the expenses tied to hiring in-house staff, such as salaries, benefits, and office space.

- Many remote bookkeeping services offer scalable pricing plans, so you only pay for the services you need.

- Real-Time Financial Tracking

- Remote bookkeeping services offer real-time financial tracking, allowing you to see your financial health at any moment.

- Timely updates help in making informed decisions and avoid potential financial setbacks.

- Enhanced Accuracy

- Virtual bookkeeping services integrate automated systems and professional expertise to minimize errors.

- Integration with your bank accounts and financial tools reduces the chances of manual entry mistakes.

- Security and Compliance

- Reputable remote bookkeeping services prioritize the security of your financial data with robust protection measures.

- These services ensure compliance with the latest tax laws and financial regulations, keeping your business safe.

- Integration with Other Financial Tools

- Virtual bookkeeping services seamlessly integrate with accounting software, CRM systems, and other financial tools.

- This integration streamlines financial operations, reducing redundancy and ensuring consistency across your business.

- Focus on Core Business Activities

- Outsourcing bookkeeping tasks to remote bookkeeping services allows you to focus on core business activities.

- With more time for strategic planning and customer service, your business can experience improved productivity and growth.

- Personalized Financial Insights

- Virtual bookkeeping services offer tailored financial reports and insights to suit your business or personal needs.

- This customization helps you better understand your financial position and make informed decisions.

Common Myths About Virtual Bookkeeping Services

- It’s Only for Large Businesses: Some people believe that virtual bookkeeping services are only suitable for large companies with complex financial needs. However, remote bookkeeping services are just as beneficial for small businesses and freelancers, providing them with affordable, professional support without the overhead of hiring full-time employees.

- It’s Too Complicated to Set Up: Another myth is that transitioning to virtual bookkeeping services requires complicated setup processes. In reality, virtual bookkeepers often work with businesses to ensure a smooth transition. With user-friendly platforms and cloud-based tools, businesses can quickly adapt to a virtual bookkeeping system.

- Virtual Bookkeepers Are Less Reliable: Some may think that remote bookkeeping services lack the reliability of in-house teams, but this isn’t the case. Virtual bookkeeping professionals are highly skilled and committed to maintaining high standards of service. They use secure platforms to manage financial data, ensuring that businesses’ financial information is protected.

Conclusion

Virtual bookkeeping services are transforming the way businesses manage their finances. With the ability to automate tasks, offer flexibility, and provide expert support, remote bookkeeping services have become an essential tool for businesses of all sizes. These services not only help streamline financial processes but also improve accuracy, reduce costs, and enhance overall efficiency. Meru Accounting offers comprehensive virtual bookkeeping solutions, ensuring businesses stay on top of their financial health while optimizing their operations. By adopting virtual bookkeeping services, businesses can focus on growth and success while leaving the complex financial tasks to trusted professionals.

FAQs

1. How do virtual bookkeeping services save time?

- Virtual bookkeeping services automate many bookkeeping tasks and eliminate the need for manual data entry. This reduces time spent on repetitive tasks and ensures quicker, more accurate financial reporting.

2. Can virtual bookkeeping services help with tax preparation?

- Yes, virtual bookkeeping services can assist with tax preparation by keeping accurate and up-to-date financial records. These records can then be used for tax filing purposes, ensuring compliance and minimizing errors.

3. Are virtual bookkeeping services secure?

- Virtual bookkeeping services use secure cloud-based platforms that encrypt financial data, making it safe from unauthorized access. Bookkeepers adhere to strict confidentiality agreements to protect sensitive business information.

4. How should I select the best virtual bookkeeping service for my business?

- Consider factors such as your business’s size, budget, and specific needs. It’s also essential to choose a provider with experience in your industry and proficiency with accounting software that meets your business’s requirements.

5. How can Meru Accounting help with my business’s virtual bookkeeping needs?

- Meru Accounting provides tailored virtual bookkeeping services, keeping your financial records accurate and up-to-date, so you can focus on growing your business.

6. What makes Meru Accounting special for virtual bookkeeping services?

- Meru Accounting offers personalized, secure, and cloud-based bookkeeping solutions, ensuring accurate financial records and helping your business thrive.