How Much Does Payroll Outsourcing Cost?

Every business wants to save time, avoid errors, and stay on top of staff payments. One major concern for growing companies is the outsourcing cost. It affects how firms plan, budget, and manage their teams. This blog explains what drives the payroll outsourcing cost, the average rates for different business sizes, and how to choose the right provider. It also shows how smart planning can reduce costs while improving results.

What is Payroll Outsourcing?

Payroll outsourcing means you hire another company to handle your payroll tasks. This can include:

- Calculating pay and taxes

- Sending out pay slips

- Filing payroll tax returns

- Keeping up with laws and deadlines

By handing over this work, you can focus more on your core business.

Why More Companies Choose Payroll Outsourcing

Cuts Errors

Outsourcing payroll helps avoid mistakes in pay, tax deductions, and reports. Correct payroll means staff get paid right and on time, which builds trust and morale.

Avoids Fines

Payroll experts follow tax rules and labor laws. They file on time and correctly, which lowers the risk of fines and legal trouble.

Saves Time

Handling payroll in-house takes a lot of time. Outsourcing lets managers and HR focus on running the business, not on admin work.

Reduces Costs

Small firms may not need a full payroll team. Large firms can save on salaries, benefits, and training for in-house staff.

Expert Help and Tech

Payroll firms use good software and know the rules well. This ensures payroll is fast, right, and smooth.

Easy to Grow

As a company grows, payroll gets more complex. Outsourcing makes it easy to handle more staff without hiring more people or buying new systems.

Improves Security

Payroll data is sensitive. Outsourcing to trusted providers keeps staff and company data safe with secure systems.

Better Reporting

Payroll services give clear reports on salaries, taxes, and costs. This helps management make smart business decisions.

Key Factors That Influence Payroll Outsourcing Cost

The payroll outsourcing cost can rise or fall based on several factors. Let’s look at the main ones that affect how much you’ll pay.

Business Size and Complexity

The number of employees matters. More staff means more data and more work, which often means higher costs. Also, firms with hourly workers, freelancers, or people in many states may pay more.

Frequency of Payroll Processing

Do you pay your team weekly, biweekly, or monthly? The more often you run payroll, the more you might pay the service provider.

Services Included

Some providers just run payroll. Others include:

- Tax filings

- Time tracking

- Direct deposit

- Reports and audits

The more services you want, the higher the cost may be.

Geographic Location and Rules

Different states and countries have different tax laws. If your team is spread out or overseas, it may cost more to stay compliant.

Average Payroll Outsourcing Cost by Business Type

While costs vary, we can give some ballpark numbers for each type of firm.

Small Businesses

For small firms with under 10 staff, the cost is often low. You might pay $50 to $100 per month plus $3–$10 per employee per month. A flat fee per pay run is also common.

Medium-Sized Enterprises

If you have 20 to 100 workers, the cost can be $200 to $500 per month, with added fees based on the features you use. Custom reports and HR tools may raise the total.

Large Corporations

Big firms may need full HR support, advanced reporting, and tight compliance help. In these cases, the cost can rise to $1,000 or more monthly. But the value in time saved and lower risk can make it worth it.

Cost Comparison: In-House Payroll vs. Outsourced Payroll

Let’s break down the price difference.

Type | Estimated Cost per Month | Pros | Cons |

In-House Payroll | $500–$3,000 (staff + software + training) | Full control, in-house team | Costly, time-consuming, and risk of errors |

Outsourced Payroll | $100–$1,000 (based on size & needs) | Saves time, reduces errors, ensures compliance | Less control, monthly fee |

The payroll outsourcing cost is often less than hiring full-time staff. Plus, you gain expert support and fewer payroll headaches.

How Payroll Outsourcing Cost Affects Business Growth

The outsourcing of payroll costs is not just a number. It can change how your business grows. When you know what you spend each month, you can plan better. You can hire new staff, buy tools, or train your team. Small firms can avoid cash flow problems by keeping the payroll costs low and clear.

Outsourcing payroll also frees your staff. Your HR or finance team can do work that helps the business grow. They can focus on plans, staff, and sales instead of pay runs. This makes your team work more and spend less time on routine tasks.

A smart payroll service also helps you avoid fines. Mistakes in pay or taxes can cost a lot. By knowing your outsourcing cost, you save money and keep staff happy. You also make sure all reports and pay slips are correct on time.

As your business grows, the right payroll partner can help. They can handle more staff, new sites, and extra pay runs. This keeps the cost fair and stable. You get help without needing to hire more people in-house.

In short, planning for payroll outsourcing costs helps you save time, cut risk, and grow your business fast. You stay in control of money and can focus on tasks that matter most.

Hidden Costs to Watch Out for in Payroll Outsourcing

Not all payroll providers share full pricing upfront. These hidden costs can catch you off guard. Make sure to review each one carefully before you sign a contract or agree to a plan.

Setup Fees

Some providers charge a one-time setup fee when you first start. This fee may cover data entry, system setup, or initial support. Be sure to ask if this is included in your plan.

Extra Payroll Runs

If you need to process extra payments like bonuses or off-cycle runs, you may face added costs. These extra runs are not always part of the standard package and can raise your total bill.

Year-End Tax Services

Many providers charge extra for year-end tax tasks. This can include filing W-2s, 1099s, or summary reports. These charges often come as a surprise if not discussed at the start.

Integration Fees

If you want to link your payroll with accounting or time-tracking software, expect possible charges. Some providers treat software connections as premium features and bill separately for setup or use.

Ask for a full fee list upfront to avoid surprises later.

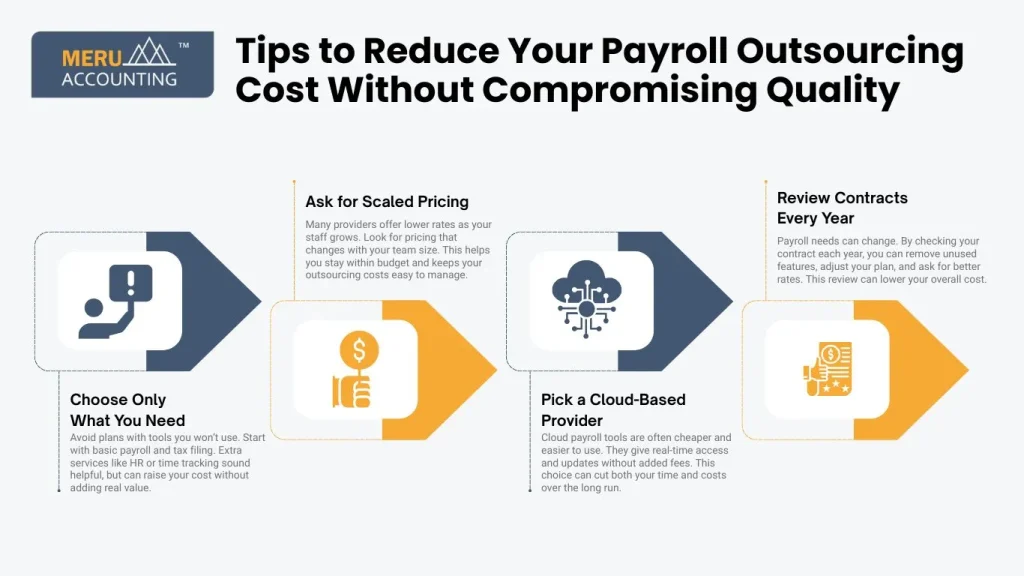

Tips to Reduce Your Payroll Outsourcing Cost Without Compromising Quality

You don’t have to spend a lot to get good payroll services. Here are a few smart ways to cut your payroll outsourcing cost while keeping the quality and support your business needs.

Choose Only What You Need

Avoid plans with tools you won’t use. Start with basic payroll and tax filing. Extra services like HR or time tracking sound helpful, but can raise your cost without adding real value.

Ask for Scaled Pricing

Many providers offer lower rates as your staff grows. Look for pricing that changes with your team size. This helps you stay within budget and keeps your outsourcing costs easy to manage.

Pick a Cloud-Based Provider

Cloud payroll tools are often cheaper and easier to use. They give real-time access and updates without added fees. This choice can cut both your time and costs over the long run.

Review Contracts Every Year

Payroll needs can change. By checking your contract each year, you can remove unused features, adjust your plan, and ask for better rates. This review can lower your overall cost.

Choosing the Right Payroll Provider for Your Budget

Picking the right partner helps you save money, reduce stress, and stay on track. Here’s what to look for to make sure your provider is a good fit for your needs and budget.

Check Experience and Client Reviews

A good track record is a strong sign. Look for providers with proven payroll experience and good client reviews. This ensures you’re not overpaying for low service and keeps your payroll costs in check.

Look for Flexible Plans

The best providers offer flexible plans that fit your budget. Whether you need simple payroll or more tools, the plan should match your size and avoid raising your cost for no reason.

Ask About Support Access

You’ll need help now and then. Make sure the provider offers easy access to live support without charging extra. Quick support saves time and helps you stay in control of your payroll process.

Check for Growth Support

Your provider should grow with your team. Ask if they can handle more staff, more features, or new states when needed. This avoids switching providers and keeps your payroll cost stable as you grow.

The best choice is a provider that understands your business and can offer good value at a fair price.

At Meru Accounting, we understand how tricky payroll can be. That’s why we offer a smooth, clear, and cost-friendly solution. Our plans fit businesses of all sizes. Whether you have 5 staff or 500, we give you:

- Easy payroll runs

- Timely tax filings

- Expert support

- Full reports

We believe the payroll cost should be fair. No hidden fees. Just clear pricing and real value.

FAQs

- What is included in payroll outsourcing?

It covers pay runs, tax filing, direct deposits, and pay slips. Some plans add reports, compliance help, and year-end filings. - Does cost rise for larger teams?

Yes. More staff means higher cost. Teams across states or countries add more tax and rule checks, which can raise cost. - Can outsourcing save money vs in-house payroll?

Yes. It costs less than hiring payroll staff or buying in-house software. You also save time and lower the risk of fines. - Are there hidden fees?

Sometimes. Extra fees may apply for setup, bonus runs, year-end reports, or software links. Always ask for a full fee list. - How can small businesses cut costs?

Choose a basic plan, pay monthly or quarterly, and skip services you don’t need. Providers like Meru Accounting offer cost-friendly options.