Home » How Smart Bookkeeping Can Save Your Medical Practice

How Smart Bookkeeping for Medical Practices Can Save Your Business

Running a medical office is not just about helping people stay healthy. It’s also about keeping the business side strong. If the bills are not paid, the staff is not paid, or the records are not clear, the whole practice can suffer. That’s why smart bookkeeping for medical practices is so important.

Bookkeeping is how you keep track of the money that comes in and goes out. It helps you know if your business is doing well or not. Just like a doctor needs to check a patient’s health, bookkeeping for medical needs to check its financial health too.

In this guide, we will talk about what medical bookkeeping is, how it helps, and why cash flow matters.

What Is Bookkeeping for Medical Practices?

Bookkeeping for medical practices is the process of keeping clear and organized records of money. It includes:

- Keeping track of patient payments

- Recording money from insurance companies

- Paying bills on time

- Managing staff pay and taxes

- Making sure money is used the right way

When bookkeeping is done right, it helps a medical office stay strong. It shows where money is going, what costs too much, and where savings can happen.

Why Bookkeeping for Medical Is Different

Medical offices have special needs. They deal with insurance claims, co-pays, government rules, and many staff members. A missed payment or billing mistake can cause problems.

Here are some simple points that show why bookkeeping for medical practices is not like other types of bookkeeping:

Deals with Patient Payments

Medical offices get money from patients and also from insurance. This makes bookkeeping for medical offices more tricky than in other fields.

Insurance Claims Are Hard

A lot of the money comes from health insurance. If claims are wrong or late, the office may not get paid. That’s why medical bookkeeping needs extra care.

Health Rules Must Be Followed

Medical offices must follow rules like HIPAA. These rules help keep patient info safe. So, bookkeeping for medical practices must protect both money and private data.

Many Small Bills to Track

There are co-pays, tests, and treatments. That means lots of small payments to keep in order. Bookkeeping for medical offices needs to keep all these clear and correct.

Different Types of Staff Pay

Medical offices may have doctors, nurses, assistants, and office staff. Each may be paid in a different way. Medical bookkeeping must track all of these accurately.

Special Software Is Needed

Medical offices use special tools to handle billing, patient records, and money. A good bookkeeper for medical practices knows how to use these tools.

Late Payments Can Hurt

If money from insurance or patients comes in late, it can hurt cash flow. That’s why bookkeeping for medical offices must be done quickly and correctly.

Taxes Are Complicated

Medical offices have many tax rules to follow. Medical bookkeeping must ensure everything is in order when tax time comes.

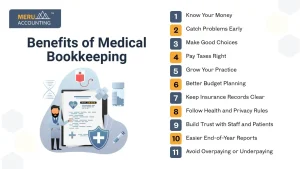

Benefits of Medical Bookkeeping

Bookkeeping for medical practices helps your clinic stay strong. Just like doctors help people stay healthy, medical bookkeeping helps the business stay healthy. It keeps track of your money, helps you plan better, and protects your office from mistakes. Here are some clear and simple benefits of medical bookkeeping:

Know Your Money

You will always know how much money is coming in and going out.

Bookkeeping for medical practices means you don’t have to guess—you’ll know exactly what you earn and what you spend.

Catch Problems Early

If something is wrong, like a late payment or a bill that’s too high, you’ll spot it fast.

Medical bookkeeping helps you fix problems before they get out of hand.

Make Good Choices

When you understand your numbers, it’s easier to make smart decisions.

You can decide when to buy new equipment, give staff a raise, or add new services.

Pay Taxes Right

With clear records, you won’t miss tax deadlines or make costly mistakes.

Bookkeeping for medical offices helps you avoid late fees and keeps your taxes accurate.

Grow Your Practice

When your books are in order, you can plan for the future.

You might open a new location, hire more staff, or expand your services.

Better Budget Planning

Medical bookkeeping helps you create a solid budget.

You’ll know how much to spend on rent, payroll, tools, and other expenses—without running out of money.

Keep Insurance Records Clear

Medical offices handle many insurance claims.

Good bookkeeping keeps these records clean and correct so you don’t lose out on payments.

Follow Health and Privacy Rules

Patient data must stay secure.

Medical bookkeeping helps protect both financial records and private health information, following rules like HIPAA.

Build Trust with Staff and Patients

When money is managed well, staff feel secure and patients trust your practice.

It shows the office is professional and well-run.

Easier End-of-Year Reports

At year-end, you need to know how your business performed.

Medical bookkeeping helps you prepare reports that clearly show your income and expenses.

Avoid Overpaying or Underpaying

If your records are off, you could pay a bill twice—or forget to pay at all.

Bookkeeping for medical practices keeps everything accurate and up to date.

Challenges in Medical Bookkeeping

Even though bookkeeping for medical practices is very helpful, it also comes with some hard part. Here are the main challenges of medical bookkeeping in simple words:

Hard to Understand Insurance Payments

Medical offices get paid by insurance companies, but payments are often slow or confusing.

This makes bookkeeping for medical practices harder to manage.

Lots of Small Payments to Track

Patients may pay by cash, card, or in parts over time.

Keeping track of each payment accurately is a challenge in medical bookkeeping.

Changing Health Rules

There are many rules in the healthcare field, and they change often.

Bookkeeping for medical practices must stay up to date and follow these regulations closely.

Protecting Patient Information

Financial records often include patient details.

Keeping this information private is a critical part of medical bookkeeping.

Many Staff and Different Pay

Doctors, nurses, assistants, and office staff may all be paid differently.

Tracking various pay structures adds complexity to medical bookkeeping.

Keeping Up with Tax Rules

Medical offices must follow specific tax laws and regulations.

If these are misunderstood or ignored, bookkeeping can quickly go off track.

Late Payments from Insurance

Insurance companies often delay payments.

This affects cash flow and increases the stress of managing finances in a medical office.

Using Complex Software

Medical practices rely on software to manage billing, patient info, and payments.

Learning and using these tools correctly is a major part of medical bookkeeping.

Fixing Past Mistakes

If past records have errors, fixing them can be difficult and time-consuming.

That’s why accuracy in medical bookkeeping is crucial every single day.

Time-Consuming Work

Bookkeeping takes time and close attention to detail.

Since medical staff are already busy, bookkeeping can become an overwhelming task.

Medical bookkeeping is more than just numbers. It’s the heartbeat of your practice. Without good records, a medical office can run into serious trouble. With smart bookkeeping for medical practices, you can stay strong, grow, and serve patients better.

Cash flow management is part of this too. It keeps your practice running smoothly every day. Bookkeeping helps you make smart choices and avoid money stress.

Let Meru Accounting handle your bookkeeping for medical. Our team knows what to do, and they do it well. We keep your money matters safe, simple, and strong.

FAQs

- What makes bookkeeping for medical practices different from other businesses?

Medical bookkeeping deals with patient records, insurance billing, and health laws. It needs special care and tools. - Why is cash flow so important in a medical office?

If cash flow is weak, you might not have enough to pay staff, rent, or buy supplies. Strong cash flow keeps the office running. - Can I do the bookkeeping myself?

You can, but it’s risky. Bookkeeping takes time, skill, and knowledge of laws. A mistake can cost you money. It’s better to let pros like Meru Accounting help. - How often should I check my books?

Every week is the best. At least once a month is a must. This keeps problems from growing. - How does Meru Accounting help with taxes?

We track income and costs all year. When tax time comes, your records are ready. We file taxes right and on time.