How to Integrate Amazon Bookkeeping Software with Other Financial Tools

Amazon sellers deal with complex tasks daily. Sales, fees, returns, and taxes need to be tracked in real-time. Choosing the best Amazon bookkeeping software becomes essential at this point the right software is so important. Integration plays a big role in making your process simple. It connects your Amazon data to accounting, tax, and inventory systems. When done right, you save time and cut errors. This blog will guide you on how to sync Amazon accounting software with other tools to build a strong and smooth workflow. With smart connections, your Amazon business can grow faster and stay on top of finances.

Why Integrate Amazon Bookkeeping Software?

Integrating Amazon bookkeeping software with other financial tools allows seamless communication between platforms, keeping data consistent and current. Here are the top benefits for Amazon sellers:

- Better Accuracy: It cuts down manual errors by syncing your data on its own.

- More Efficiency: It saves time by updating records across platforms.

- Deeper Insights: It brings all your data together, giving a clear view of your business.

Steps to Set Up Integrations

Connecting Amazon accounting software with your other tools helps keep your data clean and current. It makes your business smoother and saves you time. Follow these simple steps to get started:

1. Identify What You Need

Look at your business setup. List the tools you use, like accounting software, stock control, or payment systems. Decide which data you want to sync—sales, stock levels, or payment details.

2. Pick the Right Tools

Once you know your needs, choose tools that fit. Options like Zapier or Make work well for most users. If you need more control, go for a custom API built for your software.

3. Set Up the Connection

Now link your software to the other tools. Map data fields like sales or payments to match. Set how often the data should sync, daily, hourly, or real-time.

4. Test the Setup

Don’t skip testing. Check if the data syncs correctly and if all fields are matched. Fix any issues before using the integration full-time.

5. Keep It Running Smooth

Even after setup, keep checking the integration. Watch for errors, missing records, or any sync issues. Update the settings as your needs change.

Choosing Integration Tools

Several platforms help you connect Amazon accounting software with other systems. Popular options include:

- Zapier: Connects various apps to automate workflows, improving efficiency

- Make (formerly Integromat): Offers advanced integration features for creating complex workflows

- API Integrations: APIs enable custom connections between Amazon and other tools, though some technical skills are needed

Integrating with Accounting Software

- Linking Amazon accounting software with accounting platforms like QuickBooks, Xero, or Zoho Books simplifies accounting. Key benefits include:

- Automated Syncing: Transfers sales, expenses, and fees from Amazon to accounting software

- Simplified Reconciliation: Automates bank statement matching with Amazon transactions

- Tax Compliance: Consolidated financial data for easier tax reporting

Integrating with Inventory Management Systems

Managing inventory is crucial for Amazon sellers. Integrating your inventory system with Amazon software helps keep stock data accurate and operations smooth:

- Real-Time Sync: Updates inventory levels and sales data between Amazon and your inventory management system

- Automated Reordering: Sets triggers for reordering stock based on inventory levels

Integrating with Payment Processors

Payment tools like PayPal, Stripe, and Square are key for Amazon sellers. Linking them with your Amazon software helps in many ways.

- Consolidated Data: It pulls payment details into one place. This keeps your records clean and easy to track.

- Fee Management: It logs all processing fees and matches them to each sale. This gives you full control over profit tracking.

- Comprehensive Reporting: It builds clear reports with both sales and payment data. You see the full picture of your business finances.

Top Financial Tools to Integrate with Amazon Bookkeeping Software

Your Amazon bookkeeping software works best when it connects with the right tools. These tools make sure your books stay clear, updated, and complete. Here are the top ones to use.

1. Xero and QuickBooks Online

These tools manage full business accounts with ease. You can sync Amazon sales as invoices or journal entries. They track income, expenses, and reports in one place. With clean data, it’s easier to make smart business choices.

2. Inventory Management Software

Tools like Zoho Inventory help you track stock, update levels, and match each sale to your items. You can avoid stockouts or extra stock with real-time updates. This link keeps your sales and stock always aligned.

3. Tax Software

Linking to tools like Avalara or TaxJar helps calculate taxes and file returns on time. These tools reduce the stress of tracking tax across many regions. They also help you stay compliant and avoid fines.

4. Payment Platforms

Platforms like PayPal or Stripe record disbursements, fees, and refunds from Amazon. These entries flow into your books right away. You’ll always know where your money is and how it moves.

5. Payroll Tools

Tools like Gusto handle staff pay and sync that data into your software. They track payroll taxes, deductions, and payments. With this link, all staff costs stay up-to-date in your books.

Integration lets your Amazon accounting software become a complete financial dashboard.

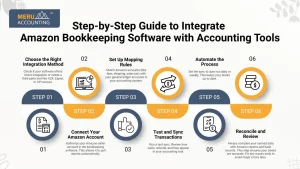

Step-by-Step Guide to Integrate Amazon Bookkeeping Software with Accounting Tools

Let’s now walk through how to connect your Amazon bookkeeping software with tools like Xero or QuickBooks.

Step 1: Choose the Right Integration Method

Check if your software offers direct integration or needs a third-party tool like A2X, Zapier, or API access.

Step 2: Connect Your Amazon Account

Authorize your Amazon seller account in the bookkeeping software. This allows it to pull reports automatically.

Step 3: Set Up Mapping Rules

Match Amazon accounts (like fees, shipping, sales tax) with your general ledger accounts in your accounting system.

Step 4: Test and Sync Transactions

Run a test sync. Review how sales, refunds, and fees appear in your accounting tool.

Step 5: Automate the Process

Set the sync to auto-run daily or weekly. This keeps your books up to date.

Step 6: Reconcile and Review

Always compare your synced data with Amazon reports and bank records. This step ensures your books are accurate. Fix any issues early to avoid major errors later.

Common Challenges in Integration and How to Overcome Them

While linking Amazon bookkeeping software with other tools saves time, it can bring some hurdles. Here’s how to handle them.

1. Duplicate Entries

Set clear sync rules. Use unique IDs for each invoice to stop double entries. Duplicate data can confuse your records. Fix it early to keep your books clean.

2. Wrong Tax Mapping

Review local tax rules often. Make sure your tax settings match in both platforms. Wrong tax entries may lead to compliance issues. Always stay updated with your local tax laws.

3. Currency Conversion Errors

Use the multi-currency tools in your Amazon software. Always apply the latest exchange rates. Incorrect conversion can affect profit reports. Always check the exchange rate settings for accuracy.

4. Inventory Sync Fails

Use a tool that supports SKU matching. It keeps your stock levels correct across all systems. Missing or wrong stock numbers affect sales. Choose tools that track stock in real-time.

5. Weak Support from Tool Providers

Choose tools that offer great support. Or work with trusted experts like Meru Accounting to avoid these problems.

Good support helps you fix issues fast. Meru Accounting offers expert help to keep your systems running smoothly.

At Meru Accounting, we know what Amazon sellers need to stay ahead. Our team helps you get the best results from your Amazon bookkeeping software.

We handle complete setup and support for Xero and QuickBooks. We also manage tax rules, GST setup, inventory sync, and payroll tool links.

With Meru, you get clear books, smooth workflows, and expert help every step of the way. Let us simplify your Amazon accounting so you can focus on growing your business.

FAQs

- What tools can sync Amazon bookkeeping software with accounting platforms?

You can use tools like Zapier, Make, or custom APIs. They help Amazon software connect with Xero, QuickBooks, or Zoho Books. These tools move your sales, fees, and expenses with no manual work. - How does integrating Amazon bookkeeping with payment processors help?

It lets you pull payment data from PayPal, Stripe, or Square right into your books. This gives you clear records of each sale, refund, and fee. Your reports stay accurate and up to date. - Can Amazon accounting software connect with inventory systems?

Yes, it can link with tools like Zoho Inventory or DEAR Systems. This keeps your stock levels synced in real time. It also helps stop stockouts and overstock problems. - What should I check before finalizing an integration with Amazon bookkeeping?

Test all synced fields for accuracy before going live. Check that each platform sends and gets the right data. Fix any errors early to avoid later issues. - Why is ongoing monitoring needed after integrating Amazon bookkeeping?

Even after setup, problems can still happen. Regular checks help you spot missed data, sync failures, or outdated settings. Fixing these fast keeps your records clean.