How to do payroll in Xero: A guide to set up payroll in Xero

Managing payroll can become a time-heavy task for businesses of all sizes. Every company must keep records of payroll taxes, no matter how many employees they have. It is important to have a clear and simple payroll system in place. You may wonder how to set up payroll in Xero. To begin with Xero payroll training, you should first learn how a payroll system works. This will help you understand how to do payroll using Xero.

A payroll system ensures that staff are paid on time and that the business follows legal rules. You must also keep steady records of key details, such as salaries, tax withheld, Social Security, and Federal Unemployment Tax.

These records are needed to meet federal rules and to help with daily staff tasks. They include a list of all staff who are paid for their work or services done for the company.

Xero offers a built-in payroll system that helps small business owners run payroll with ease. Thanks to its smart tools, you won’t need to spend all your time on payroll work.

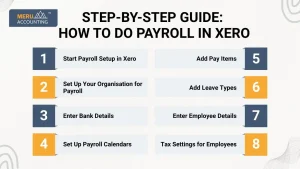

Step-by-Step Guide: How to Do Payroll in Xero

1. Start Payroll Setup in Xero

- Log in to your Xero account

- Click on the Payroll tab.

- Choose Payroll Settings

- Fill out the business and contact details.

2. Set Up Your Organisation for Payroll

Under Payroll Settings:

- Add your business name and ABN (for Australia)

- Choose your country and tax region.

- Select your payday schedule.

- Add business location and address.

3. Enter Bank Details

- Go to the Payment Settings tab.

- Add your business bank account.

- Ensure the bank details match your real account.

- This helps when you pay employees.

4. Set Up Payroll Calendars

- Click on Payroll Calendars

- Choose the pay cycle: Weekly, Fortnightly, or Monthly.

- Add the start date and first pay period.

- This helps to automate pays

5. Add Pay Items

Go to Pay Items in Settings:

- Click on Earnings to add wage types

- Add salary, hourly rate, commission, etc.

- You can also add Deductions and Reimbursements.

- Keep track of bonuses, travel, and other payments

6. Add Leave Types

- Click on Leave under Pay Items

- Add annual leave, sick leave, and unpaid leave.

- Set rules for leave accrual

- Xero will track and update leave balances

7. Enter Employee Details

- Go to the Payroll tab

- Click Add Employee

- Fill in basic info: name, tax details, contact info.

- Add salary or hourly pa.y

- Set their working hours and leave entitlement

8. Tax Settings for Employees

- Add each employee’s tax file number

- Choose tax rate and deductions (as per country laws)

- This ensures proper tax is withheld.

- Helps with end-of-year reporting

How to set up your payroll?

It is vital to collect your payroll information and update all of your business information. This information includes:

- Bank account details of your business

- Your wages payable and expense account details

- A list of all the necessary pay items, such as earnings, deductions, reimbursements, and the corresponding expense account

- Super details for each employee

- Business pay calendars

You’ll then need to gather your employee information. This covers:

- Personal details, contact details, and bank details

- Employment details, including tax file number, salary, super, and leave

- Current pay balance for the financial year, up to when you start using Xero

Set up payroll accounts and tracking

Before you start with the setting up of payroll accounts, you will have to set up the bank accounts and non-bank accounts through which you will pay your employees.

If you’re unsure about which account to set up or select, speak with your accountant or bookkeeper.

- Go to your Xero account, click on your organization name, click on Settings, and then go to Payroll settings.

- In the Organisation tab, click on Bank account, then select the account that you will use to pay your employees.

- (Optional) You can choose to use the default wages, PAYG, and superannuation accounts, or choose from the other accounts.

- (Optional) You can track payroll expenditure by keeping tabs on the Employee Groups or Timesheet Categories. You can add payroll tracking in the settings once you have set up your payroll.

- Click on Save.

Setting up your payroll calendar

To adopt a well-defined payroll, you must update your payroll calendar so that it corresponds with your day-to-day pay run.

- Go to your Xero account, click on your organization name, click on Settings, and then go to Payroll settings.

- Select Calendars and then click Add.

- Set the Pay period, Start date, and First payment date.

- Click on Add, and now your pay calendar is all set up.

Setting up payslip options and company logo

Through your payslips, you can choose to show or hide your employee’s annual salary or employment basis as and when required. Added to that, you can also add your company logo:

1. Go to Organization Name > Settings > Payroll settings.

2. From the Organisation tab, go under the Payslip Options and select:

- Show the Annual Salary checkbox for full-time and part-time employees to see their annual salary on their payslips.

- Show Employment Basis checkbox to show whether works full-time, part-time, casual, labor-hire, or is working under the superannuation labor stream.

3. (Optional) Under Company Logo, click on Upload Logo to add a logo to your profile.

4. Click on Save.

Create your pay templates for your employees:

- Click on the Payroll menu, select Employees, and then enter the employee’s name. This will open up the concerned employee’s details.

- Click on the Pay Template tab. Set and adjust your employee’s earnings, deductions, superannuation, and reimbursements as per your astute judgment.

- Click on Save. The employee pay templates can be edited at any time after finishing the process of your setup.

How to post your pay run?

Go to your pay run menu in Xero, click on Post Pay Run, and then click on Yes to confirm the posting of your pay run.

However, there may be times when troubleshooting begins in your pay run.

These troubleshooting errors can be:

- Exceeding employee limit: There is an employee limit under your pricing plan that allows you to process pay runs only for a set number of employees in your Xero account.

- Account type no longer active error message: This error message notifies you only when a chart of a particular account has been overwritten or is underachieved. To fix this error, update the pay items to activate accounts or restore the account code.

How to email your employees their payslips?

- Go to your Payroll menu, click on Pay employees, and select the pay run period to email.

- Go to Pay Run Options > Email Payslips, choose the employees you want to send it to, and then click on Email Payslips.

OR choose the historical payslips process:

- Go to the Payroll menu > Employees and select the employee for whom you have to provide the payslip.

- Go to the Payslips tab and then click on Payslip History.

- Download any historical payslips, save these payslips as PDFs, and send them directly to your employees.

How to do payroll in Xero: Reconcile with your payroll payment system

Once your payroll process is completed and the payment to your employees has been made, you must reconcile your payroll system. A statement line of your current payroll run will be stated in your bank account in Xero. You will be required to add through the spend money transaction tab.

- To reconcile with your payroll payment, go to the Accounting menu, click on Bank Accounts, and select the Reconcile items for the bank account through which your payroll payment was made.

- Search for the statement line that accurately represents the particular payroll payment concerned.

- Click on the Create tab and create a spend money transaction. Enter the transaction details. The code of your payroll transaction must match the one selected in your payroll settings.

- Click OK, and now you have reconciled your payroll payment.

Benefits of Using Payroll in Xero

1. Simple Payroll Process

- Clear steps from setup to payslip

- Easy even for non-experts

2. Accurate Tax and Leave Calculations

- Xero updates tax rules regularly

- It keeps your payroll correct.

3. Payslips and Reports in One Place

- Send payslips with one click.

- Access old payslips anytime

4. Cloud-Based and Safe

- Access payroll anytime, anywhere

- Bank-level data security

5. Auto Superannuation (AU)

- Super payments can be paid with one click

- Saves time and avoids errors

Tips for Managing Payroll in Xero

1. Keep Employee Info Updated

- Update tax file numbers, contact info

- Add new bank details when needed.

2. Review Pay Runs Regularly

- Check amounts, tax, and leave before finalizing.

- Avoids errors and penalties

3. Use Templates for Faster Setup

- Create templates for roles.

- Helps when hiring multiple staff

4. Stay Compliant with Local Laws

- Review the tax and labor rules.

- Adjust payroll settings as needed.

5. Train Your Staff

- Show the team how to enter timesheets.

- Helps in getting hours right

Common Mistakes to Avoid in Xero Payroll

1. Skipping Tax Settings

- Always set the right tax rate

- Or you may underpay or overpay tax.

2. Wrong Pay Period

- Always check the calendar and pay cycle.

- Mismatch confuses pay

3. Ignoring Leave Balances

- Leaving not tracked can cause issues later.

- Xero can auto-track if set properly.

4. Not Reconciling Payments

- Unmatched payroll entries lead to errors in reports.

- Always reconcile your bank statement.s

5. Missing STP Filing (AU)

- You must report each payment to the tax office

- Xero makes it easy with direct filing.

Using Payroll in Xero makes it simple to manage pay, tax, leave, and compliance. Once set up right, it can save hours of manual work. If you’re wondering how to do payroll in Xero, follow these simple steps and avoid common errors. With clear records, auto reports, and cloud access, Xero is a smart payroll solution.

At Meru Accounting, we help businesses streamline their payroll using Xero. From setup to ongoing payroll processing, our expert team ensures everything runs smoothly and stays compliant. Let us handle your payroll so you can focus on growing your business with peace of mind.

FAQs

1. Can I run payroll for part-time staff in Xero?

Yes, Xero supports full-time, part-time, and casual workers.

2. How do I edit a payroll calendar?

Go to Payroll Settings > Payroll Calendars and click edit.

3. Can I stop a pay run once it is processed?

Yes, you can revert a pay run if not yet been filed or paid.

4. Does Xero calculate leave automatically?

Yes, once leave rules are set, Xero tracks and updates leave.

5. How secure is payroll data in Xero?

Xero uses bank-level encryption to keep data safe.

6. Can I file payroll with the IRS or ATO using Xero?

Yes, Xero files directly via STP (in Australia) and integrates with US payroll partners.

7. Is there a mobile app to run payroll in Xero?

You can use the Xero Me app to manage payslips and timesheets.