In-House vs. Outsourced Bookkeeping: Which One Should You Choose?

Choosing how to handle your books is a big step for any business. Many owners face the same question: Outsourcing vs. In-House Accounting — which is the better option?

Both choices offer benefits and pose challenges. Some prefer in-house staff for control and easy chats. Others go for outsourcing to save time, reduce costs, and get expert support.

In this blog, we’ll break down both paths. We’ll also look at the cost of outsourcing accounting services, so you can make a smart decision that fits your needs and budget.

What is In-House Bookkeeping?

In-house bookkeeping means that your bookkeeper is part of your company. They work in your office or remotely but are hired by you. This person or team handles all your day-to-day finance tasks.

Key Features of In-House Bookkeeping:

- Full-time or part-time team member

- Direct contact and fast updates

- Full access to your files, tools, and systems

- Familiar with your business’s inner workings

What is Outsourced Bookkeeping?

Outsourced bookkeeping means that you hire someone outside your business to do the job. It can be a freelancer or a full firm. They work off-site and use cloud tools to manage your books.

Key Features of Outsourced Bookkeeping:

- No need to hire or train staff

- Uses cloud software for access and updates

- Usually more cost-effective

- Flexible contracts based on your needs

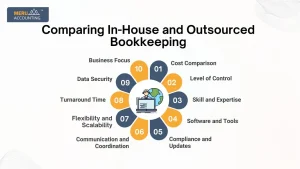

Comparing In-House and Outsourced Bookkeeping

Accounting.

1. Cost Comparison

In-House Bookkeeping:

- You need to pay wages, taxes, and staff benefits.

- You must also cover the cost of software, training, and office space.

- This option is often more costly for small businesses.

Outsourced Bookkeeping:

- You only pay for the services you use.

- There are no added costs for tools, training, or benefits.

- The cost of outsourcing accounting services is often much lower than hiring full-time staff.

2. Level of Control

In-House Bookkeeping:

- You can make quick changes and give direct instructions.

- You get hands-on access to all financial records.

- This works well for firms with complex daily tasks.

Outsourced Bookkeeping:

- Communication is planned and more formal.

- You share control through reports and dashboards.

- Even so, you stay informed and in charge of your accounts.

3. Skill and Expertise

In-House Bookkeeping:

- The skill level depends on the person you hire.

- Your team may need time to adjust to rule changes.

- During busy times, they may lack the support they need.

Outsourced Bookkeeping:

- You get access to skilled and trained experts.

- These professionals stay updated on new tax rules.

- They offer strong support and deep insights when needed.

4. Software and Tools

In-House Bookkeeping:

- You must choose and pay for the software.

- You are also in charge of data safety and backups.

- You might not have access to advanced tools.

Outsourced Bookkeeping:

- The service often includes modern tools.

- Cloud-based software allows access anytime.

- Data is well protected and backed up often.

5. Flexibility and Scalability

In-House Bookkeeping:

- To grow, you need to hire and train more staff.

- Layoffs during quiet times can be costly and hard.

- Scaling takes time and effort.

Outsourced Bookkeeping:

- You can add or cut services as needed.

- It’s easy to grow as your firm expands.

- It adjusts well during both busy and slow periods.

6. Communication and Coordination

In-House Bookkeeping:

- You can talk face-to-face for quick updates.

- Fixes happen fast, and the team works closely.

- Trust builds with daily teamwork.

Outsourced Bookkeeping:

- Workflows are clear and done online.

- Reply times can vary by service.

- Good planning and tools are key for updates.

7. Data Security

In-House Bookkeeping:

- You manage your own servers and access.

- Risk control and rules must be handled in-house.

- This may need extra spending on tools and staff.

Outsourced Bookkeeping:

- Trusted firms use secure and encrypted systems.

- Your data is backed up on a regular basis.

- They follow top global safety and data rules.

8. Turnaround Time

In-House Bookkeeping:

- Tasks are done during office hours only.

- Speed depends on a few people’s pace.

- It can slow down if staff are out or busy.

Outsourced Bookkeeping:

- Most firms work across time zones and stay active.

- Large teams help deliver work on time.

- They meet strict deadlines even in peak times.

9. Compliance and Updates

In-House Bookkeeping:

- You must train staff to keep up with rule changes.

- If updates are missed, risks go up.

- You’re fully responsible for staying compliant.

Outsourced Bookkeeping:

- Experts keep up with tax and law updates.

- They help ensure that you stay compliant.

- It lowers your risk of legal issues.

10. Business Focus

In-House Bookkeeping:

- You spend time managing the finance team.

- You also handle HR tasks like payroll and hiring.

- It adds stress and reduces focus on core tasks.

Outsourced Bookkeeping:

- You free up time by handing off the work.

- You avoid the burden of managing a team.

- This lets you focus more on growth and service.

When to Choose In-House Bookkeeping

In-house bookkeeping works well when your firm needs close watch and daily access to records. Choose this method if:

You need someone on-site each day:

If your team speaks with the bookkeeper often or needs fast help, having them in-office helps fix issues quick and stay on track.

Your firm handles complex tasks:

If your work needs job-based billing, cost splits, or strict rules, an in-house team can focus more and handle the steps with care.

You want full control over records:

With in-house staff, you set rules, check work, and keep data safe. This helps if you deal with private files or must meet strict rules.

You have strong HR and tools in place:

If your firm has space, tools, and trained staff to hire and guide a bookkeeper, in-house can work well for long-term plans.

To sum up:

In-house bookkeeping works best in the Outsourcing vs. In-House Accounting debate when control and daily support matter most.

When to Choose Outsourced Bookkeeping

Outsourcing bookkeeping is a smart choice for many firms. Below are the main reasons why it may be right for your business:

1. You Need to Cut Costs

If you want to lower costs, outsourcing can help. It removes the need to pay full-time staff, buy software, or provide office space and benefits.

2. You Want Experts Without Full-Time Hires

Outsourcing gives you access to skilled people without hiring them. You do not need to train or manage them. You get expert work without a long-term job offer.

3. You Need Flexible Services

Outsourced services can change as your needs grow. Whether you want weekly reports or monthly checks, you can scale the service up or down.

4. You Use Simple, Routine Transactions

If your business has basic tasks like sales and bills, outsourcing works well. It handles simple work with less effort from your team.

Cost of Outsourcing Accounting Services

The cost of outsourced services will change based on many things. Below are the main factors:

1. Volume of Work and Number of Entries

More entries mean more time and more cost. If your books are busy, expect to pay more.

2. Type of Reports You Need

Simple reports like income and spending cost less. Custom reports and tax reports may cost more.

3. Level of Service Required

Basic bookkeeping is low cost. But if you need full services—like payroll or tax filing—the price goes up.

4. Size of Your Business and Frequency of Updates

A large firm with lots of changes and tasks will pay more than a small firm with fewer updates.

Sample Price Ranges

To understand the cost of outsourcing accounting services, here’s what you may pay based on firm size and needs.

- Small Firms: $200–$750 per month

- Medium Firms: $750–$2,500 per month

- One-Time Jobs: Clean-ups or year-end work may cost more

Outsourcing vs. In-House Accounting

Feature | In-House Accounting | Outsourced Accounting |

Cost | High | Lower |

Control | Full | Shared |

Flexibility | Low | High |

Skill & Expertise | Limited | Wide Range |

Scalability | Hard | Easy |

Software Cost | Paid by Business | Often Included |

Communication | Direct | Online |

Compliance Updates | Manual | Expert-Managed |

Ideal for | Large/Complex Firms | Startups & Growing Firms |

When comparing Outsourcing vs. In-House Accounting, think about your business size, goals, and budget. If you need full control and someone onsite each day, in-house may suit you best. But if your goal is to cut costs, speed up work, and tap into expert help, outsourcing is the smart choice.

The cost of outsourcing accounting services is often much lower than hiring and training full-time staff. With the right team, you can keep your books in shape, meet rules, and use your time to grow the business.

Meru Accounting helps you decide between Outsourcing vs. In-House Accounting by offering smart, low-cost services that fit your needs. Our skilled team uses top tools and follows clear steps to give you fast, correct results. With over 10 years of real-world work in many fields, we help you grow with less stress. Choose Meru Accounting for help you can trust at a fair price.

FAQs

- Is outsourcing bookkeeping cheaper than in-house?

Yes. The cost of outsourcing accounting services is often much lower, especially for small firms. - Can I outsource just part of my accounting?

Yes. You can choose only what you need—like payroll, tax filing, or bills. - Is my data safe with outsourced firms?

Yes. Trusted firms use secure tools, encrypted files, and strong access control. - What tools do outsourced services use?

They use cloud tools like QuickBooks, Xero, Zoho Books, and FreshBooks. - How fast are outsourced services?

Work is often done in 1–3 days, based on the task and load. - Can outsourced bookkeepers work with my CPA?

Yes. They often work with your CPA to help with tax prep and audits. - Do I lose control by outsourcing?

No. You keep full access, get reports, and approve key tasks.