Home » Industry Expertise » Bookkeeping For Gems and Jewelry Exporters

Experience Hassle-Free

Bookkeeping for Gems and Jewelry Exporters

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping for Gems and Jewelry Industry

- Running a gems and jewelry exporting business can be both exciting and challenging. While the glittering gems may catch your eye, the importance of bookkeeping cannot be overstated. Bookkeeping is essential for any business to keep track of their finances accurately, including recording all transactions such as invoices and receipts. But how does bookkeeping work? What are its benefits? And most importantly, why is it crucial for gems and jewelry exporters? Join us as we dive into the world of bookkeeping for this industry and uncover tips on keeping accurate records that will help you make informed financial decisions!

- The Gems and Jewellery sector is one of the most vibrant industries in India. It is also one of the most complex, with a large number of businesses involved in the trade. As a result, accounting and bookkeeping in this sector can be very challenging. There are a few things that you need to keep in mind when it comes to accounting and bookkeeping in the Gems and Jewellery sector

- First of all, you need to have a clear understanding of the nature of the business. This includes understanding the various types of transactions that take place, as well as the different types of products that are traded. You also need to be aware of the various taxes that are applicable in this sector. GST is one of the most important taxes that you need to be aware of, as it is levied on all transactions in this sector. In addition, there are other taxes such as excise duty and import duty which are also applicable. It is also important to maintain accurate records of all transactions

- This includes both sales and purchases. You need to keep track of inventory levels, as well as receivables and payables. In addition, you also need to maintain records of expenses incurred in running the business .With all these factors in mind, you can see that accounting and bookkeeping in the Gems and Jewellery sector can be quite challenging. However, if you keep these points in mind, you will be able to manage your finances effectively and ensure compliance with all.

Different types of bookkeeping and accounting methods used for gems and jewelry business:

- Different types of accounting methods used in gems and jewelry business:

Single-entry

accounting

Double-entry accounting

Accrual basis accounting

Cash basis accounting

The importance of bookkeeping for gems and jewelry Exporters:

For gems and jewelry exporters, bookkeeping is crucial to the success of their business. Keeping accurate records allows them to have a clear understanding of their financial situation at all times. Having proper bookkeeping practices in place can help these businesses identify areas where they can cut costs and improve profitability. It also helps ensure that they are properly managing taxes and complying with regulations. Moreover, bookkeeping provides critical information for decision-making as it gives insights into which products or services are performing well and which ones need improvement. Without this data, it’s challenging to make informed decisions about investments or expansion plans.

In addition, precise bookkeeping ensures transparency between the exporter and its customers or suppliers. When there is a dispute over an invoice or payment history, having accurate records makes resolving the issue much easier. For a gems and jewelry exporter to remain competitive in today’s market requires careful attention be given to maintaining complete books of accounts, invoices, and receipts. By doing so not only will they safeguard against financial mismanagement but boost profits while ensuring compliance with industry rules and regulations.

How Does Meru Accounting Help In Maintaining A Book Of Accounts?

Gems and jewelry export industry is very huge. So, a wide range of risks like foreign taxes, gold prices, credit risk, currency fluctuation risk, etc affects it. We at Meru Accounting believe in providing an all-in-one solution to all these complexions and cover accounting related to all the stated matters and much more.

This industry has a very large exposure and the risk associated with it is huge too. So, it’s very important to update the books of accounts regularly. It is advisable to update books of accounts every fortnight so that receivables can be tracked and chased timely. Then only a company can have a proper look at its business and profitability.

The gems and jewelry export industry deals with many clients and too being situated in different countries. This makes the invoicing process a bit tricky and requires being meticulous. For that recurring invoices should be set up so that the invoices are automatically created in the accounting system and are matched with the receipts, and we have expertise in handling the same for our clients.

Receivables Management for Gems And Jewelry Business:

- In the gems and jewelry industry, receivables management involves keeping track of invoices sent out to clients, following up on overdue payments, and ensuring timely collections. This helps businesses maintain cash flow, reduce bad debt losses, and improve overall financial stability.

- Implementing effective receivables management practices require clear communication with clients regarding payment terms and deadlines. It also involves establishing processes for invoicing regularly, sending reminders for upcoming payments, addressing disputes promptly, and pursuing legal action if necessary.

- Proper record-keeping is crucial in receivables management since it enables businesses to monitor past due accounts accurately. By staying organized through accurate bookkeeping practices – firms can identify trends in late payments from specific customers or product lines—ultimately helping prevent future issues down the road.

- Maintaining healthy cash flow through efficient receivables management is critical for gems and jewelry businesses’ long-term success.

Receivables Management Considering Gold Prices:

The gems and jewellery industry has to deal with the changing prices of Gold in the international commodity markets. As the price changes, it affects the export business as well, and that makes it hard to manage receivables due to complex calculations. We at Meru Accounting carry out the accounting tasks related to it in a timely manner and with that managing receivables also become easy.

Inventory Management

Inventory management is very essential and that too becomes a very serious task when inventory costs a mammoth amount. Understanding this need, we keep regular track of inventory and trade deals with our experienced team using the best accounting software that is suitable for our client’s business.

Manage Capital Cost

Capital cost is the major contributor to a company’s profit. Gems and Jewellery businesses are generally highly profitable businesses given only if one adequately amortizes the capital cost against the receipts. Accounting for Gems and jewellery Business, We have expert professionals to look after this requirement so that any kind of error can be avoide

Increase Profit

Tax advisors are knowledgeable about various tax incentives, deductions, and credits available to businesses. They can identify opportunities for businesses to optimize their tax positions and take advantage of fiscal benefits. By carefully analyzing the business's financial situation and tax laws, tax advisors can provide guidance on maximizing deductions, claiming applicable credits, and structuring transactions to minimize tax liabilities.

Best Practices For Receivables Management In The Gems And Jewelry Business

Best practices for receivables management in the gems and jewelry business involve implementing effective strategies to ensure timely payment from customers. One of the most important steps is to establish clear payment terms with customers before any transactions take place. Additionally, it’s essential to have a robust invoicing process that includes accurate billing details, due dates, and accepted forms of payment. Providing multiple payment options such as credit card payments or online transfers can also make it easier for customers to pay their bills on time. Another best practice is to maintain open communication with clients and follow up regularly on outstanding payments. This helps build relationships based on trust and transparency while also ensuring that your business receives its dues promptly.

It’s equally crucial to track accounts receivable closely and act quickly if there are any issues with late payments or non-payment. Establishing a collection policy can help streamline this process by outlining procedures for pursuing delinquent accounts.

Investing in software tools such as accounting systems or customer relationship management programs can simplify receivables management tasks further while providing real-time insights into the financial health of your gems and jewelry business.

However, it’s important to note that there are challenges associated with receivables management as well. From dealing with late payments to managing disputes over invoices, businesses need to be proactive in addressing these issues and finding solutions.

A strong focus on effective receivables management can help gems and jewelry businesses not only improve their financial health but also enhance customer relationships through clear communication and efficient payment processes. By adopting best practices tailored to their specific needs, companies can successfully navigate this critical aspect of running a successful business.

Conclusion

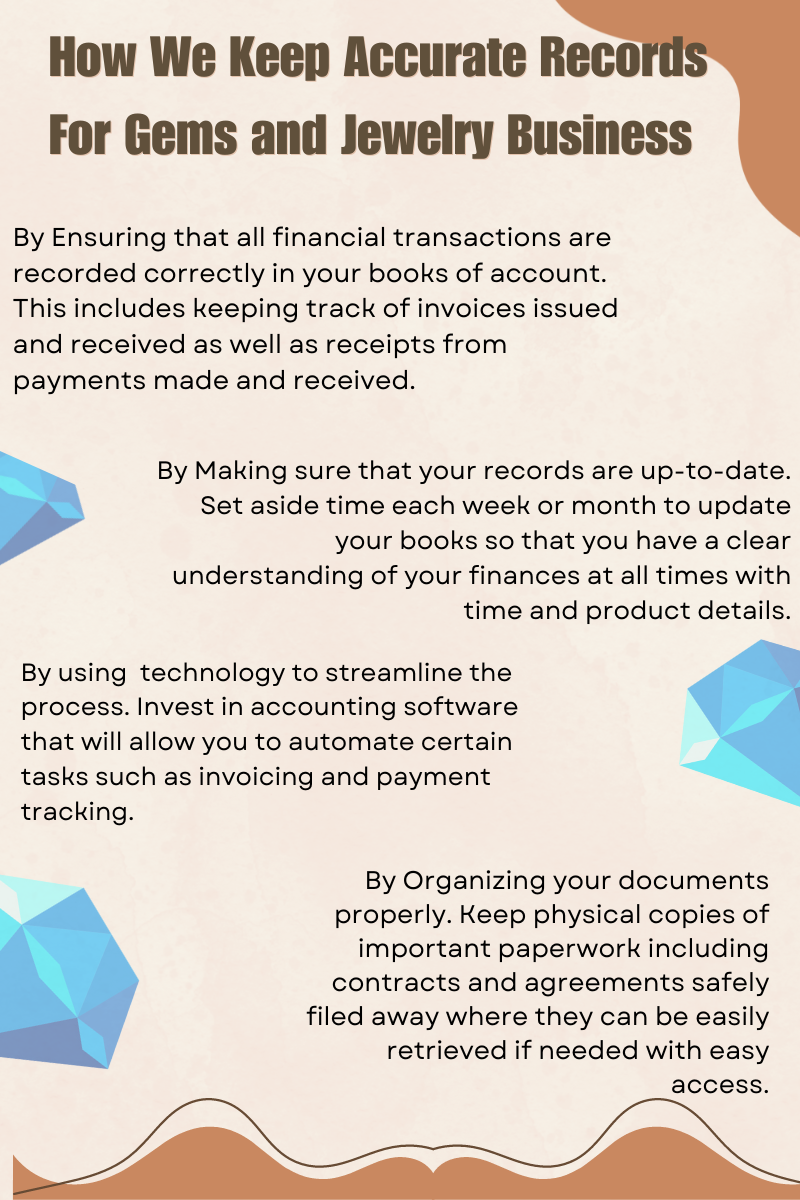

Bookkeeping is an essential aspect of any business operation. As a gem and jewelry exporter, it is crucial to keep accurate records of all financial transactions such as invoices, receipts, and other important documents. By doing so, you can easily track your expenses and profits while ensuring that you comply with tax laws. Hiring a professional bookkeeper can help ensure that your books are kept up-to-date and accurate while allowing you to focus on running your business. Additionally, by keeping organized records, you will be able to make informed decisions about the future direction of your company. Remember that the success of any business depends on proper planning and execution. Therefore, always prioritize maintaining accurate books of accounts in order to achieve long-term success in the gems and jewelry export industry.

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS