Home » Industry Expertise » Bookkeeping For Online business

Experience Hassle-Free

Bookkeeping For Online business

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping for the E-commerce sector in the US.

Online bookkeeping for e-commerce in the US refers to using digital tools and software to manage and track financial transactions, records, and reporting for e-commerce businesses. With the increasing popularity of online shopping and the growth of e-commerce, utilizing online bookkeeping solutions has become essential for efficient financial management. Here’s an introduction to online bookkeeping for e-commerce in the US.

Digital Tools

Online bookkeeping platforms and software, such as QuickBooks Online, Xero, or specialized e-commerce accounting software, provide e-commerce businesses with streamlined bookkeeping processes. These tools automate various tasks, including data entry, transaction categorisation, financial reporting, and inventory management.

Integration With E-Commerce Platforms

It integrates seamlessly with popular e-commerce platforms like Shopify, Woo Commerce, or Amazon Seller Central. This integration allows for direct syncing of sales data, fees, and expenses, saving time and reducing the risk of manual errors.

Real-Time Data

It provides real-time access to financial data, enabling e-commerce businesses to stay updated on their revenue, expenses, and profitability. This visibility helps make informed decisions and quickly identify economic trends or issues.

Automation And Efficiency

It automates repetitive tasks, such as transaction categorisation, bank reconciliation, and financial report generation. This automation saves time, reduces manual errors, and improves overall efficiency in managing the financial aspects of an e-commerce business.

Sales Tax Compliance

These platforms often include features to handle sales tax management. They can automatically calculate sales tax based on customer locations, generate sales tax reports, and even assist in filing sales tax returns, ensuring compliance with US tax regulations.

Financial Reporting

The software generates financial statements, such as income statements (profit and loss statements), balance sheets, and cash flow statements. These reports provide insights into the financial health of the e-commerce business, aiding in decision-making, budgeting, and investor or lender communications.

Collaboration And Accessibility

It allows multiple users, such as business owners, accountants, or bookkeepers, to access and collaborate on financial records from anywhere with an internet connection. This flexibility improves communication and ensures everyone involved has the most up-to-date information.

Data Security

Reputable online bookkeeping platforms prioritise data security and employ measures such as encryption, secure data centres, and regular backups. This helps protect sensitive financial information from unauthorised access or loss.

Scalability

Its solutions can accommodate the growth of e-commerce businesses. They can handle increasing transaction volumes, expanding product lines, and multiple sales channels, adapting to the company's changing needs.

Different Types Of Bookkeeping In E-Commerce In The US?

In the e-commerce industry in the US, various types of bookkeeping methods can be employed based on the specific needs and complexity of the business. Here are some common types of bookkeeping used in e-commerce:

Cash Basis Bookkeeping

This method records transactions when cash is received or disbursed. It is straightforward and suitable for smaller e-commerce businesses with simple financial operations. Cash basis bookkeeping focuses on tracking actual cash flow and provides a clear view of available funds.

Hybrid Bookkeeping

Accrual basis bookkeeping records transactions when they occur, regardless of when cash is received or paid. It provides a more accurate representation of a business's financial position and performance by matching revenue and expenses to the period in which they are earned or incurred. Accrual basis bookkeeping is commonly recommended for huge or growing e-commerce businesses.

Hybrid Bookkeeping

Hybrid bookkeeping combines elements of both cash basis and accrual basis methods. It records certain transactions on a cash basis (such as cash receipts and payments) and other transactions on an accrual basis (such as inventory and accounts payable/receivable). Hybrid bookkeeping can benefit e-commerce businesses that want the simplicity of a cash basis for some transactions while still capturing a more accurate financial picture with an accrual basis for others.

Single-Entry Bookkeeping

Single-entry bookkeeping is a primary method where transactions are recorded in a simple journal, typically with minimal detail. This method is commonly used by small e-commerce businesses with uncomplicated financial operations. However, single-entry bookkeeping may need more points for comprehensive financial reporting and analysis.

Double-Entry Bookkeeping

Double-entry bookkeeping is a more comprehensive method that records each transaction with a debit and a credit entry. It follows the fundamental accounting equation (Assets = Liabilities + Equity) to balance the books. Double-entry bookkeeping provides a complete and accurate picture of a business's financial transactions and is suitable for e-commerce businesses of all sizes.

Outsourced Bookkeeping

Some e-commerce businesses outsource tasks to external professionals or accounting firms. Outsourced bookkeeping services handle various aspects of financial record-keeping, including data entry, reconciliation, financial reporting, and tax compliance. This option allows e-commerce businesses to focus on core operations while leveraging the expertise of bookkeeping professionals.

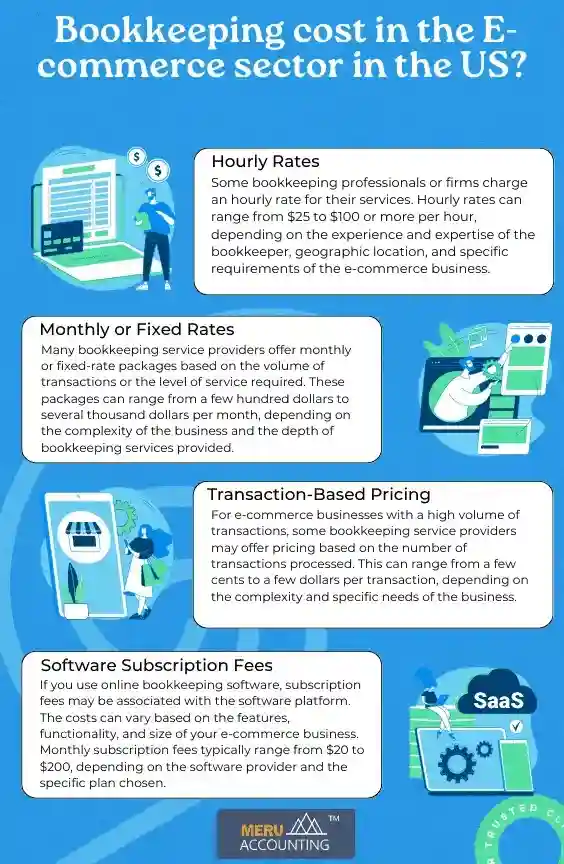

Bookkeeping Cost In The E-Commerce Sector In The US?

The cost of bookkeeping services for the e-commerce sector in the US can vary depending on several factors, such as the complexity of the business, the volume of transactions, the scope of services required, and the chosen service provider. Here are some standard pricing models and cost ranges to consider:

How Does E-Commerce Business Accounting Differ From General Accounting?

In the e-commerce industry in the US, various types of bookkeeping methods can be employed based on the specific needs and complexity of the business. Here are some common types of bookkeeping used in e-commerce:

- We help you integrate your online website with accounting software, which helps in the smooth import of data into online platforms to the accounting system.

- We specialise in working on various online business platforms like eBay and Amazon.

- When using a payment gateway like PayPal, Eway, stripe, Trans First, Square N, we pay, etc.; we help you ensure that you receive timely payment.

- Meru Accounting has vast experience maintaining accounts for leading online companies and start-ups.

- We use software like the Shopping cart to help you create a platform for your online business and carry out further business operations. This software handles your sales, bank transactions, paid and unpaid orders, and customers.

- We at Meru Accounting manage accounting payables and receivables with the help of various add-ons. These add-ons help us track and receive & pay the due amount. So, you need not worry about getting into the cash-flow trap.

- We help you switch from your regular traditional accounting software to some leading software like Xero and Quickbooks and ensure that all your data is synced correctly. We allow our clients to run their online business smoothly.

- We specialise in many online platforms and payment getaways, which benefit our clients to boost their profitability. Analysing highly profitable items can help you focus more on which items to sell, ultimately increasing overall profitability.

Welcome To Meru Accounting: Your E-Commerce Financial Partner

Meru Accounting is your trusted partner in navigating the complex financial landscape of the thriving e-commerce sector. We understand the unique challenges faced by e-commerce businesses in the United States, and our dedicated team of experts is here to provide comprehensive accounting solutions tailored to your specific needs. With our industry expertise and innovative approach, we empower e-commerce entrepreneurs to stay financially sound and achieve sustainable growth

Why Choose Meru Accounting?

In the e-commerce industry in the US, various types of bookkeeping methods can be employed based on the specific needs and complexity of the business. Here are some common types of bookkeeping used in e-commerce:

E-Commerce Industry Specialists

- We specialise in serving the e-commerce sector, working with businesses of all sizes, from startups to established online retailers. Our deep understanding of the industry allows us to provide proactive and strategic financial guidance.

Comprehensive Accounting Services

- We offer a wide range of accounting services designed to address the specific needs of e-commerce businesses. From bookkeeping and financial reporting to tax planning and compliance, we've got you covered.

Tax Optimization

- Our team of tax experts stays up-to-date with the ever-changing tax regulations and deductions relevant to the e-commerce industry. We work diligently to optimise your tax position, minimise liabilities, and ensure compliance with federal, state, and local tax laws.

Inventory Management

- Effectively managing inventory is crucial for e-commerce success. We can help you implement inventory tracking systems, calculate the cost of goods sold (COGS), and provide valuable insights into inventory turnover and profitability.

Financial Analysis And Forecasting

- Make informed decisions and plan for the future with our comprehensive financial analysis and forecasting services. We'll help you understand key performance indicators (KPIs), identify trends, and develop strategies for sustainable growth.

E-Commerce Software Integration

- We are well-versed in popular e-commerce platforms and accounting software, allowing us to integrate your financial data and streamline your processes seamlessly. This integration saves you time and gives you real-time access to critical financial information.

Collaboration And Accessibility

- It allows multiple users, such as business owners, accountants, or bookkeepers, to access and collaborate on financial records from anywhere with an internet connection. This flexibility improves communication and ensures everyone involved has the most up-to-date information.

Partner With Meru Accounting Today

Focus on growing your e-commerce business while leaving the financial complexities to us. At Meru Accounting, we are passionate about helping e-commerce entrepreneurs achieve their goals and reach new heights of success. Our commitment to exceptional customer service, industry expertise, and innovative solutions sets us apart as your trusted financial partner.

Contact us today to schedule a consultation and discover how our tailored accounting services can empower your e-commerce business to thrive in the competitive online marketplace. Let’s embark on this journey together and unlock the full potential of your e-commerce enterprise.

In Conclusion

Online bookkeeping is crucial to running an online business in the US. It helps you track your finances and make informed decisions about your business operations. Companies can easily manage their financial records by using one of the various online bookkeeping services available, such as Amazon or offshore providers.

When setting up online bookkeeping for your business, it is essential to consider factors like cost, security features, and compatibility with payment gateways like PayPal. Choosing a reliable service provider that meets all these requirements will help you run your business efficiently while maintaining accurate financial records.

Investing in good quality online bookkeeping services will save time and prevent potential risks associated with inaccurate accounting. With the right tools and knowledge, managing your books has never been easier!

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS