Home » Industry Expertise » Outsource Offshore Bookkeeping Services

Experience Hassle-Free

Outsource Offshore Bookkeeping Services

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Outsource Offshore Bookkeeping Services

What Is Offshore Bookkeeping?

Offshore bookkeeping refers to the practice of outsourcing financial tasks, such as maintaining and managing accounts, recording transactions, and preparing financial statements, to a third-party company located in a different country. This offshore service provider specializes in handling accounting and bookkeeping functions for businesses from different parts of the world.

Why Is It Required?

With the increasing globalization of businesses and advancements in technology, companies are no longer restricted by geographical boundaries. They can expand their operations beyond their home countries and tap into international markets. However, this expansion also brings along various challenges related to managing finances across multiple locations.

- Access To Local Tax Experts: Offshore bookkeeping, provides access to skilled professionals with deep knowledge of local tax laws, ensuring accurate financial reporting and compliance with international accounting standards.

- Cost Reduction Benefits: Offshore bookkeeping offers cost savings by eliminating overheads associated with in-house teams, such as salaries, office space, equipment, and training programs. Businesses pay only for the services provided.

- Focus On Core Activities: Partnering with an efficient offshore bookkeeping service allows business owners to concentrate on core activities, redirecting valuable resources towards strategic initiatives for business growth.

- Essential For Modern Businesses: Offshore bookkeeping is essential for modern businesses, addressing the need for accurate financial management across borders. It provides cost-effective solutions, ensures global standards compliance, and has become a crucial tool for efficiency, savings, and scalability.

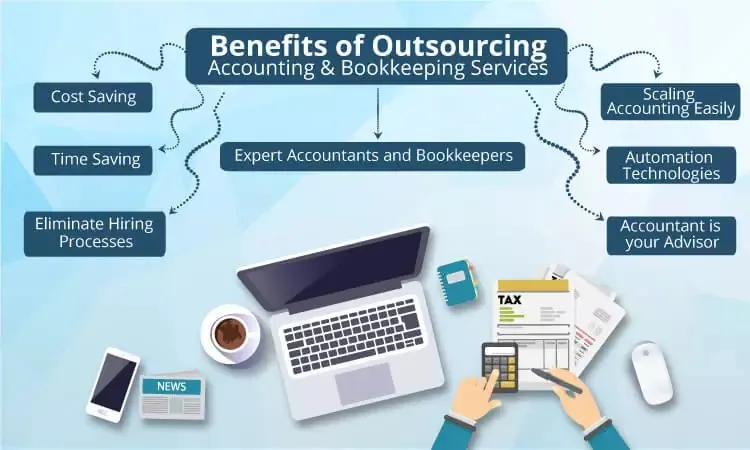

Benefits Of Offshore Outsourcing Bookkeeping

There are numerous benefits and advantages of outsourcing bookkeeping services offshore. One of the main benefits of offshore outsourcing bookkeeping is cost reduction. By outsourcing, companies can save a significant amount of money on hiring in-house bookkeepers, providing them with office space, equipment, and benefits.

Advantages Of Offshore Accounting Outsourcing:

- Skilled Accountants for Accuracy: Offshore bookkeeping services often employ highly trained accountants, specializing in tax preparation, financial reporting, and payroll management, ensuring accurate and up-to-date books.

- Focus on Core Competencies: Outsourcing offshore allows businesses to concentrate on core competencies. Instead of managing financial records, owners can dedicate time to growing their company and enhancing customer satisfaction.

- Flexibility in Scalability: Outsourcing offers flexibility in scalability. Businesses can easily adjust the level of service provided by the offshore bookkeeping company to meet changing needs, whether due to growth or seasonal fluctuations.

- Access to Advanced Technology: Working with an offshore partner grants access to advanced technology and software without heavy infrastructure investments. This streamlines processes, enhancing overall efficiency.

Choose The Correct Partner For Offshore Outsourcing Bookkeeping

Choosing the right offshore bookkeeping company is a crucial decision for any business. There are many options available, which makes it hard to choose.

Here are some steps you can follow to ensure you find the best fit for your needs.

- Conduct comprehensive research on offshore bookkeeping companies, focusing on industry experience, reputation, and client testimonials to assess track record and reliability.

- Consider your specific needs and create a list of requirements from an offshore bookkeeping service provider. Clarify whether you need assistance with tax compliance, financial reporting, or other specific tasks to narrow down choices.

- Shortlist potential companies and schedule consultations or meetings to evaluate communication skills, responsiveness, and expertise. Assess how well they handle businesses similar to yours.

- During meetings, inquire about their processes and technology infrastructure. Understand how they handle data security and confidentiality, especially when outsourcing sensitive financial information.

By following these steps carefully, finding the right offshore bookkeeping company becomes less challenging. It ensures that your business receives reliable support while enjoying all the benefits of offshoring without compromising on quality or security measures.

Who Can Take These Services?

Any business that requires efficient and cost-effective financial management must go for offshore bookkeeping services. These services are beneficial for businesses of all sizes and industries seeking efficient and cost-effective financial management. Whether you’re a small startup, a mid-sized company expanding globally, or a large corporation, outsourcing bookkeeping tasks to trusted and professional firms like Meru Accounting ensures accurate reporting without the need for full-time in-house accountants. This flexible solution caters to diverse business needs, providing expertise for accurate financial reporting and allowing companies to concentrate on their core operations.

Why Should You Choose Meru Accounting?

At Meru Accounting, we offer a wide range of offshore bookkeeping services to meet the needs of businesses across various industries. Our team of experienced professionals is dedicated to providing accurate and timely financial information while ensuring strict adherence to confidentiality and data security protocols.

- Outsourcing to Meru Accounting enables significant cost reduction by saving on overheads like office space, equipment, software licenses, and employee salaries.

- Partnering with Meru Accounting provides access to a highly skilled team proficient in accounting software and industry best practices, ensuring accurate and efficient financial record maintenance.

- Meru Accounting’s streamlined processes guarantee quick turnaround times for assigned tasks, acknowledging the importance of timely financial reporting in informed decision-making.

- Choosing Meru Accounting for offshore bookkeeping allows businesses to concentrate on core activities rather than administrative tasks. Outsourcing to Meru frees up valuable time and resources for business growth.

By following these steps carefully, finding the right offshore bookkeeping company becomes less challenging. It ensures that your business receives reliable support while enjoying all the benefits of offshoring without compromising on quality or security measures.

Conclusion

Offshore outsourcing bookkeeping by Meru Accounting provides significant benefits for businesses of all sizes. It allows organizations to cut costs, streamline processes, and focus on core business activities, enhancing overall efficiency.

With our comprehensive and customized services, we ensure accurate records and insightful financial reports. Our experienced professionals manage all aspects of financial management, providing cost-effective solutions and quality service delivery. Contact us now if you are searching for quality offshore bookkeeping services.

FAQs

Outsourcing bookkeeping saves time, reduces costs, provides expertise on demand, and offers scalability for your growing firm

Absolutely. Meru Accounting employs advanced security measures to ensure the confidentiality and compliance of your client’s financial information.

Yes, Meru Accounting ensures seamless integration with your firm’s existing systems.

Yes, Meru Accounting understands that every CPA firm is unique. We offer customizable solutions to align with your practice’s goals.

Meru Accounting brings a wealth of experience, a proven track record, and a client-centric approach, ensuring your firm’s success.

Meru Accounting utilizes industry-leading tools such as QuickBooks, Xero, and Sage Intacct to enhance efficiency and accuracy in bookkeeping for CPA firms.

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS

Please book a call, by selecting your suitable time zone to speak to one of our great accountant meru