Home » Industry Expertise » remote bookkeeper

Experience Hassle-Free

Remote Bookkeeper

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Outsource Remote Bookkeeper and Elevate your Financial Management

- Having a remote bookkeeper has become essential in today’s changing business environment for organizations looking for effective financial management free from the limitations of physical closeness. The demand for a remote bookkeeper wanted is increasing every day. A remote bookkeeper is a proficient specialist who can manage various financial responsibilities from any location.

- They use technology and accounting software to keep precise records. Their duties include managing accounts payable and receivable, tracking expenses, reconciling bank statements, and making sure tax laws are followed. The advantages of opting for a remote bookkeeper are manifold, including cost-effectiveness through outsourcing, flexibility in working hours, and the efficiency gained from cloud-based systems that enable real-time collaboration and secure data sharing.

- The remote bookkeeper plays a crucial part in the financial well-being of firms by recording transactions, monitoring spending, and handling accounts payable and receivable with exacting attention to detail. In addition to these fundamental duties, they are essential in producing financial reports that provide insightful information about a business’s performance and facilitate decision-making. To succeed in this position, particularly when working remotely, one must possess good organizational abilities, proficiency with accounting software, and effective communication skills. In order to find a qualified and trustworthy remote bookkeeper, businesses must first evaluate their specific needs, then use online talent acquisition platforms, network within professional forums, ask for referrals, and perform in-depth interviews.

What Is A Remote Bookkeeper?

A remote bookkeeper is a professional who performs all the essential financial tasks for a business but does so remotely. Unlike traditional in-house bookkeepers who work on-site, remote bookkeepers can handle their duties from anywhere in the world, provided they have access to the necessary technology and software.

Their responsibilities often include managing accounts payable and receivable, reconciling bank statements, tracking expenses, preparing financial reports, and ensuring compliance with tax regulations. They are skilled in utilizing various accounting software platforms to streamline processes and maintain accurate records.

One of the main advantages of hiring a remote bookkeeper is cost-effectiveness. By outsourcing this role, businesses can save money on office space and equipment while still benefiting from expert financial management. Remote bookkeepers also offer flexibility as they can adapt their working hours to fit your business’s needs.

Furthermore, remote bookkeepers bring efficiency by leveraging cloud-based systems that allow secure data sharing and collaboration with other team members or stakeholders. This eliminates the need for physical paperwork and enables real-time monitoring of financial activities.

Their responsibilities often include managing accounts payable and receivable, reconciling bank statements, tracking expenses, preparing financial reports, and ensuring compliance with tax regulations. They are skilled in utilizing various accounting software platforms to streamline processes and maintain accurate records. One of the main advantages of hiring a remote bookkeeper is cost-effectiveness. By outsourcing this role, businesses can save money on office space and equipment while still benefiting from expert financial management. Remote bookkeepers also offer flexibility as they can adapt their working hours to fit your business’s needs. Furthermore, remote bookkeepers bring efficiency by leveraging cloud-based systems that allow secure data sharing and collaboration with other team members or stakeholders. This eliminates the need for physical paperwork and enables real-time monitoring of financial activities.

Role Of A Remote Bookkeeper

The role of a remote bookkeeper is crucial in maintaining the financial health of businesses. A remote bookkeeper plays a vital role in ensuring accurate and up-to-date bookkeeping records for clients, regardless of their location.

- Manage and maintain accurate financial records for clients.

- Keep detailed records of income, expenses, and transactions.

- Conduct regular bank reconciliations to ensure accuracy between financial records and bank statements.

- Identify and resolve discrepancies promptly.

- Track and categorize expenses to provide a clear overview of spending patterns.

- Help clients make informed financial decisions based on expense analysis

- Generate and send invoices to clients or customers

- Monitor and follow up on overdue payments to maintain healthy cash flow.

- Prepare regular financial reports, including profit and loss statements and balance sheets.

- Provide insights into financial performance and trends.

- Stay updated on tax laws and regulations to ensure compliance.

- Assist in the preparation of tax documents and filings.

- Prepare regular financial reports, including profit and loss statements and balance sheets.

- Provide insights into financial performance and trends.

- Stay updated on tax laws and regulations to ensure compliance.

- Assist in the preparation of tax documents and filings.

- Collaborate with clients to create and manage budgets.

- Offer recommendations for cost-saving measures and financial efficiency.

- Maintain regular communication with clients to address queries and provide financial updates.

- Collaborate with other team members or departments as necessary.

- Implement and follow strict security measures to protect sensitive financial information.

- Use secure and reliable technology for data storage and transmission.

- Offer financial advice and insights to help clients make informed business decisions.

- Act as a strategic partner in achieving financial goals.

- Possess expertise in using accounting software and other relevant tools.

- Stay updated on the latest technological advancements in bookkeeping.

- Demonstrate efficient time management skills to handle multiple clients and tasks simultaneously.

- Meet deadlines for financial reporting and other deliverables.

- Educate clients on financial best practices and provide guidance on optimizing financial processes.

- Offer training on the use of accounting software if necessary.

- Quickly identify and address financial discrepancies or issues.

- Propose effective solutions to improve financial processes.

- Utilize remote collaboration tools effectively for seamless communication and workflow.

- Ensure accessibility to financial data while maintaining security.

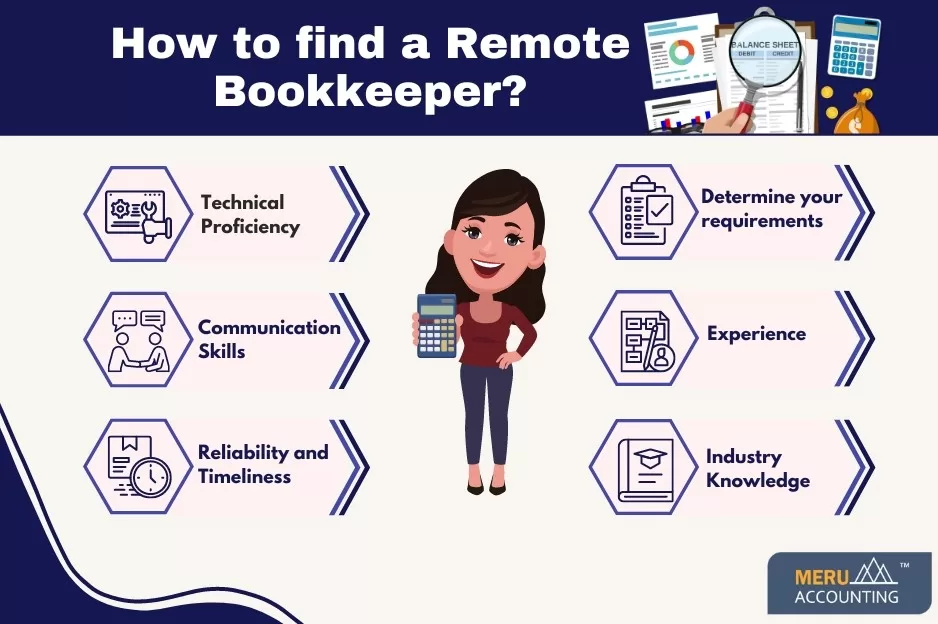

How To Find A Remote Bookkeeper?

Finding a remote bookkeeper that meets your business needs can be a challenging task. However, with the right approach and resources, you can streamline the process and find the perfect fit for your company.

- Determine your requirements : Before searching for a remote bookkeeper, it’s important to identify what specific tasks and qualifications you need them to have. Consider factors such as their level of experience, software proficiency, industry knowledge, and any other specific requirements unique to your business.

- Experience : Prioritize candidates with experience in remote bookkeeping and a proven track record of managing financial tasks similar to those in your business.

- Industry Knowledge : Consider a remote bookkeeper who has experience in your industry. Familiarity with industry-specific practices and regulations can be advantageous.

- Technical Proficiency : Ensure that the firm is proficient in using accounting software commonly used in your industry, such as QuickBooks, Xero, or others.

- Communication Skills : Effective communication is crucial for remote work. Look for a bookkeeping firm who can clearly articulate financial information and is responsive to inquiries.

- Reliability and Timeliness : Assess the ability to meet deadlines and deliver accurate financial reports in a timely manner. Reliability is crucial for remote collaboration.

Remember that finding the right remote bookkeeping firm takes time and effort but investing time in this search will ultimately lead to more efficient financial management for your business.

Why Choose Meru Accounting As Your Remote Bookkeeper?

- Comprised of highly skilled and experienced remote bookkeepers.

- Understanding the importance of accurate financial records.

- Striving to provide impeccable services tailored to each client’s unique needs.

- Prioritizing the security and confidentiality of your financial information.

- Robust systems are in place to ensure data protection.

- Compliance with industry standards to safeguard sensitive data.

- Offering flexible pricing options to make services accessible for businesses of all sizes.

- Customized packages based on specific requirements.

- Ensuring clients only pay for the services they need.

- Responsive, proactive, and dedicated customer service.

- Building long-term relationships with clients.

- Providing personalized support and timely assistance as needed.

At Meru Accounting, we offer exceptional outsourcing services for every Industry in the US. Our remote bookkeepers possess all the knowledge and expertise you need for your business. Contact us now and find the best remote bookkeeper that aligns with your business requirements.

Remote bookkeepers offer flexibility, cost savings, and expertise without the need for on-site presence.

Our remote bookkeepers use secure channels and encryption, following industry best practices for data security.

We use various tools like email, video calls, and project management software for transparent and efficient communication.

Our bookkeepers often have experience in various industries, providing customized financial support.

The cost of hiring a remote bookkeeper can vary depending on factors such as experience level, location, and specific needs. It is best to discuss pricing options with potential candidates or outsourcing companies.

Yes, when working with reputable outsourcing companies like Meru Accounting that prioritize data security and confidentiality. We use secure servers and encryption methods to protect sensitive financial information.

Absolutely! With modern advancements in technology, communication has become seamless regardless of geographical distance. Our remote bookkeepers use communication channels such as email, phone calls, video conferencing tools, etc., ensuring you stay connected throughout the process.

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS